Sustainable Capital in Flux: Seizing Private Market Opportunities Amid Volatility

Sustainable investing is evolving. In public and private markets, we believe investors are adopting a more practical approach to sustainability that is performance oriented. We think the underlying secular themes driving the transition to a low-carbon economy are resilient, with enduring fundamentals that will continue to create opportunities for investors who know where to look.

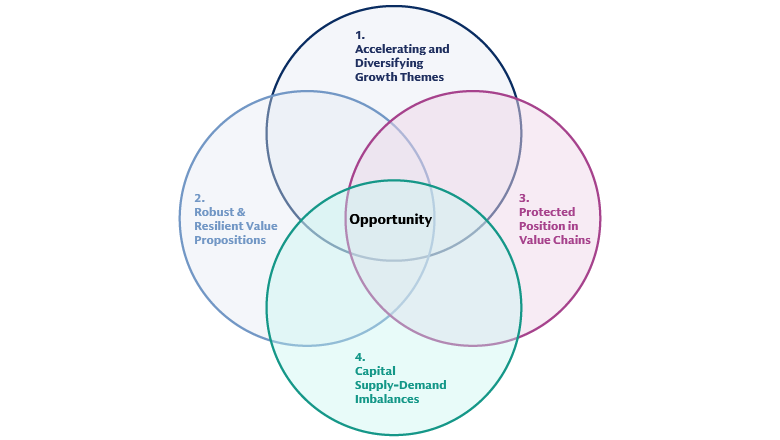

In a volatile policy and macroeconomic environment, we think investors should look beyond the headlines for opportunities that combine conviction and a margin of safety at the intersection of four key areas:

- Accelerating “in-the-money” growth themes within broader growth trends

- Companies that offer robust value propositions instead of relying on “green premiums” or government subsidies

- Companies that provide a critical link in a value chain

- Being able to take advantage of imbalances in the supply of and demand for capital

Based on these factors, we see attractive opportunity sets in asset classes where sustainability thematic opportunities are structurally advantaged, including private credit, value-add infrastructure, middle-market private equity and continuation vehicles.

The Reset: Lessons from Sustainable Investing 1.0

Lesson 1: Pragmatism and complexity over idealism and linearity

Recent headlines often paint a picture of a “green retreat” by government, corporates, and investors. Yet we view it as a healthy, necessary reset for the sustainable investing agenda, which is maturing in three key ways:

- Focusing on substance over form: The initial rush for headline climate targets and portfolio carbon reductions is evolving. Investors and corporates are now shifting from aspirational goal-setting to performance-oriented investing, prioritizing risk-adjusted returns.

- Beyond “climate-first” idealism: A “climate-first” perspective has given way to a more grounded and practical approach. Decarbonization now balances emissions reduction with critical considerations such as energy affordability, reliability, accessibility, economic competitiveness, and security.

- Embracing complexity over linearity: The energy transition is not a smooth, linear progression. It is a dynamic process marked by periods of acceleration and deceleration, influenced by a complex interplay of economic, geopolitical, and technological factors. The reality of inherent complexity of how the energy transition will unfold, over linear hopes of progress, must be embraced.

Lesson 2: Long-term secular trend continues with enduring fundamentals

Amid the shifts and complexity, energy transition remains a viable long-term secular trend. While it is true that traditional energy sources will remain a critical part of the energy system and the global economy for a long time to come, renewables are becoming “too cheap to contain and too big to ignore.”1 They account for 90% of total power expansion globally, growing at a record rate of 15.1% from 2023 to 2024.2 The amount of global investment in renewables and associated technologies is now double the investment in fossil fuels.3 The underlying drivers – falling costs, rapid deployment, and geopolitical imperatives – remain robust and underpin its long-term trajectory.

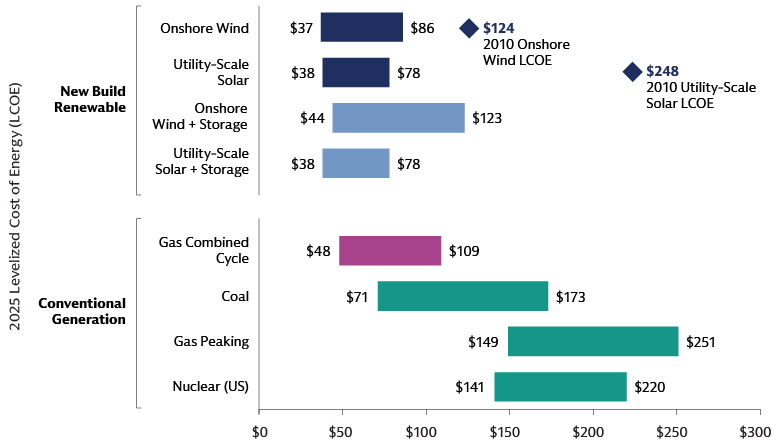

- Falling costs: After decades of cost innovation, clean energy’s economic advantage is increasingly clear. For the first time, we no longer face trade-offs on costs. For example, lithium-ion battery-pack prices plummeted by 86% to $115/kWh in 2024 from $806/kWh in 2013.4 A further reduction projecting further reductions to $80/kWh is forecast by 2026.5 In contrast, combined cycle capex costs increased from close to $800/kW to $2,400/kW from 2022 to 2025.6

Source: Lazard – Levelized Cost of Energy. Goldman Sachs Asset Management. As of June 2025.

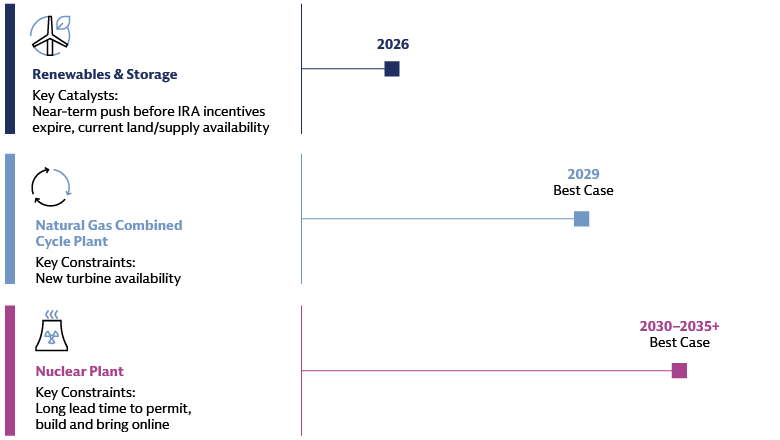

- Rapid deployment: Renewables are the quickest generation source to deploy. As technology companies and hyperscalers race to deploy artificial intelligence (AI), “speed to power” is paramount. This imperative is most constructive for renewables in the near term, because competing power-generation sources such as natural gas and nuclear are facing more immediate supply chain and logistical constraints.7

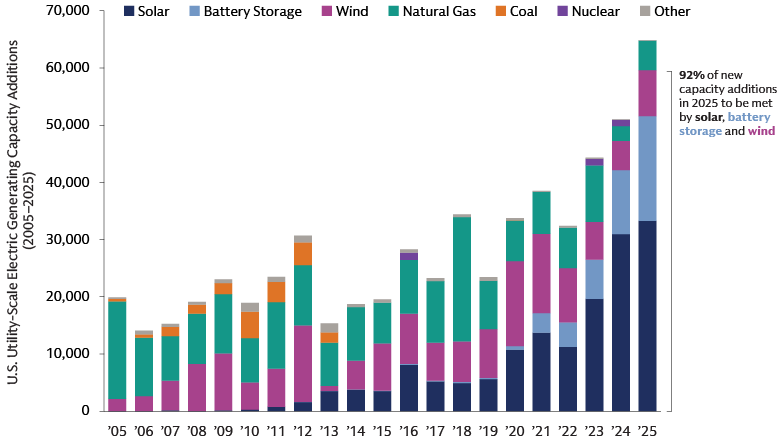

Source: Goldman Sachs Global Investment Research. As of August 2025.

- Energy security as a driver: Responses to boost energy security vary according to context. For some, it may mean more liquified natural gas (LNG) imports and infrastructure; for others, it may mean more domestic sources. For many countries that are heavily dependent on fossil fuel imports, energy security increasingly drives, rather than deters, energy-transition investing. Approximately 70% of clean energy investments originate from net fossil fuel importers.8 Geopolitical pressures to reduce dependence on fossil fuel imports are accelerating the shift to home-grown energy sources. Globally, electricity investments are now 50% higher than fossil fuels, a stark reversal from a decade ago when they were 30% lower.9 This is particularly evident in emerging markets, which we believe are leapfrogging traditional fossil fuel models by deploying renewables and its associated technological solutions at scale. Countries like China are becoming "electro-states," leveraging leadership in renewables and electrification for strategic advantage,10 India reached 50% of its total installed power capacity from non-fossil fuel sources by July 2025, five years ahead of schedule.11 In certain developed markets like Europe, Russia’s invasion of Ukraine accelerated Europe’s energy transition, with Europe now spending 10 times more investing in clean energy than in fossil fuels.12

Lesson 3: Macro matters

We have noticed in the last few years have brought new appreciation that the macro environment is not merely a backdrop but a fundamental driver of capital allocation, business models, and ultimately investment performance.

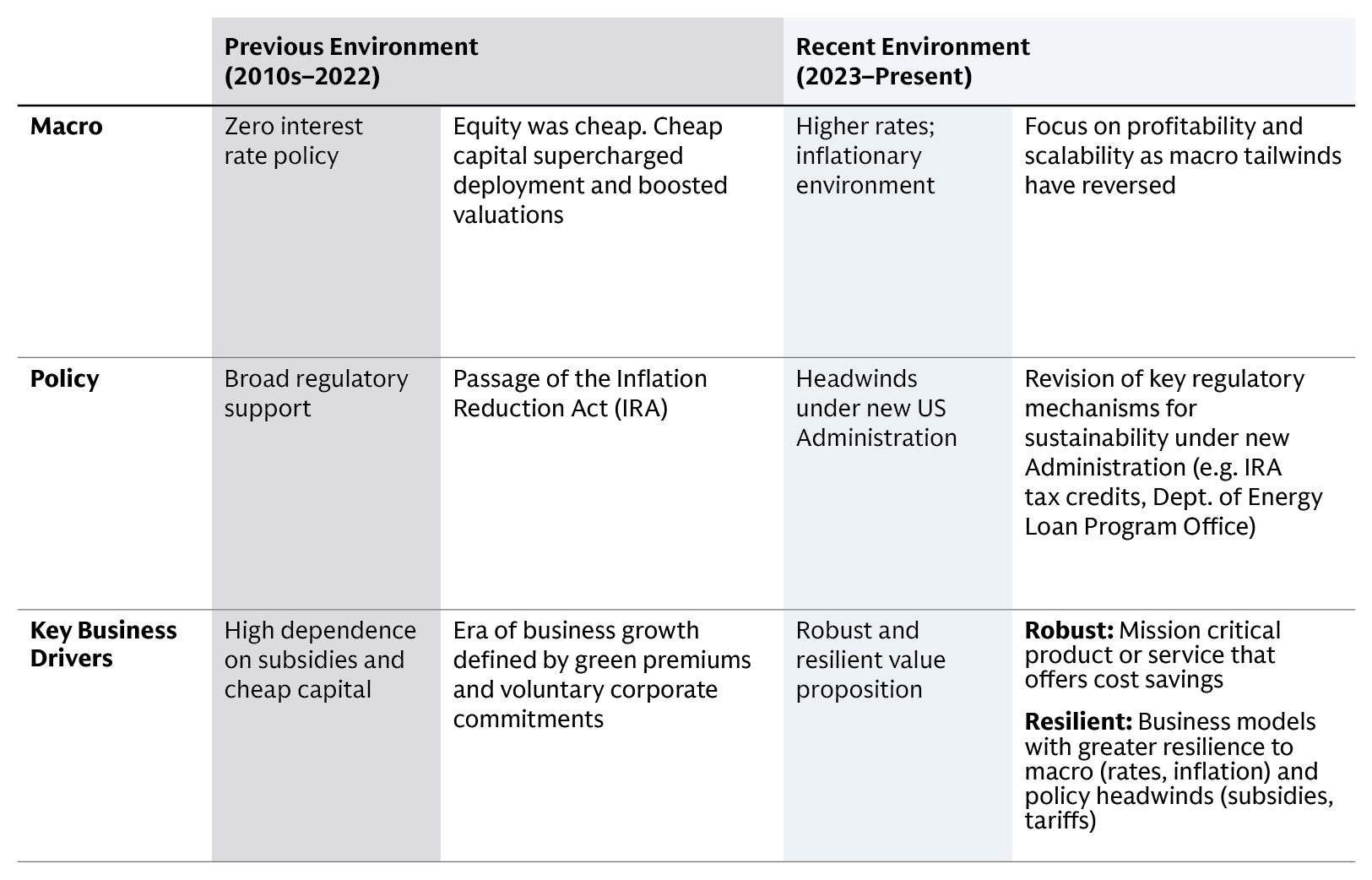

In our view, clean energy is far more dependent on interest rates than fossil fuels due to its capital-intensive business model. Clean energy projects often rely heavily on debt financing, given their high up-front capital costs (capex) and relatively low ongoing operational costs (opex) once built, and generally fixed revenue stream. In contrast, much of the necessary fossil fuel infrastructure already exists and the primary cost driver is fuel cost and operational expenses.13 The past decade, characterized by a zero-interest-rate policy, fostered cheap capital-supercharged deployment that boosted valuations across the clean energy sector.14 We believe this macro environment, coupled with broad regulatory support including the passage of the Inflation Reduction Act (IRA), allowed for business growth heavily dependent on subsidies, “green premiums,” and voluntary corporate commitments. These tailwinds in a way allowed for optimism that the transition would be simpler and more linear.

However, we believe the recent shift in policy, higher interest rates and an inflationary environment have reversed these macro tailwinds, demanding a renewed focus on profitability, scalability, and business resilience across economic cycles. Consequently, it is our belief that success in this macro environment necessitates businesses with robust value propositions that alleviate mission-critical customer pain points and deliver significant cost savings. These benefits tend to be driven by economic fundamentals and market discipline, rather than by idealism or policy alone. This environment also necessitates a strategic shift for private market investors – as the era of inexpensive leverage and broad multiple expansion recedes, operational value creation, focused on driving revenue growth and margin expansion, becomes critical.

Source: Goldman Sachs Asset Management, As of October 2025.

Lesson 4: Go beyond the headlines

We have engaged in over 100 investor conversations this year on navigating the current state of energy-transition investing, and we often observe a tendency to focus too much on the headlines.

- Renewable vs. fossil fuel debate: 90% of conversation vs. 10% of opportunity: The debate between renewable and fossil fuels frequently dominates public discourse and investor conversations, yet disproportionately overshadows the substantial and growing opportunities within the broader climate transition theme.

- Near-term changes, and especially US federal policy reversal, tend to dominate investor conversation: Despite US policy reversal, renewables still made up 92% of the 22.6 GW of new capacity added in the first 5 months of 2025.15

To capitalize on the vast energy transition opportunity set, it matters how and where you invest.

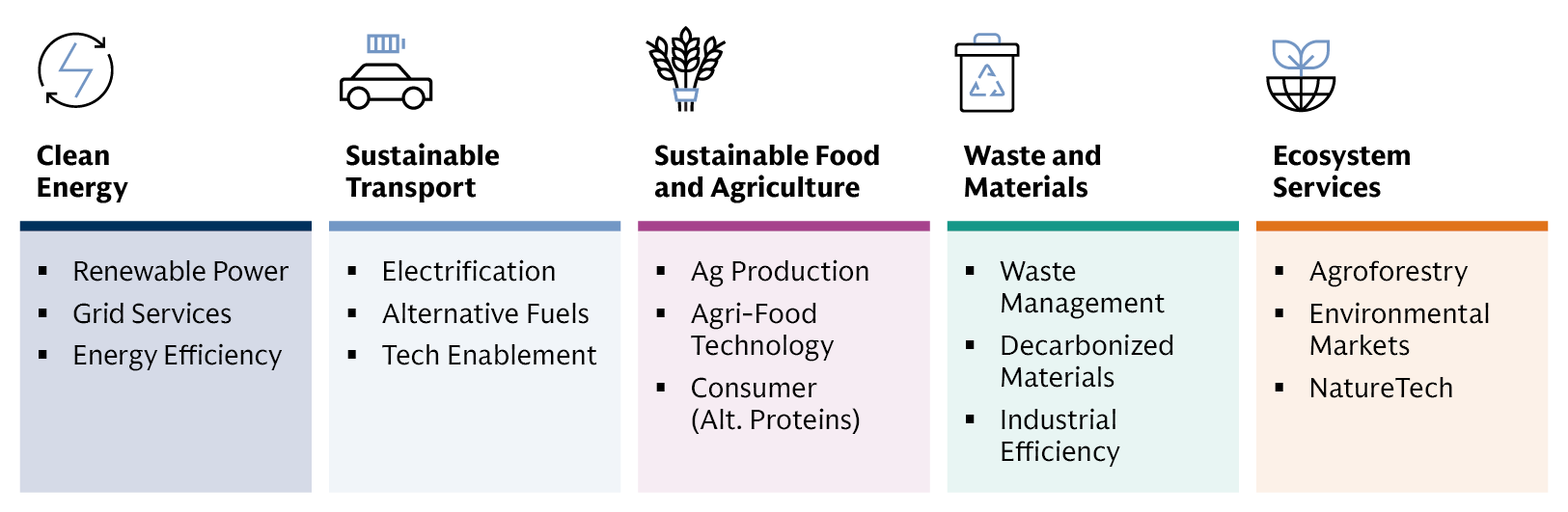

1. Go beyond renewables and approach the energy transition holistically: Investors should look beyond just renewable energy companies to diversify and access a broader range of growth opportunities. For example, circular economy business models offer distinct economic resilience by lowering input costs and limiting inflation pressures from price volatility. Circular economy investment opportunities also exist across sectors such as waste management, consumer goods and packaging, and the built environment.

Source: Goldman Sachs Asset Management. For illustrative purposes only. As of September 2025.

2. Focus on emerging innovations that are reshaping power demand and supply. Innovations around data center large load flexibility and curtailment practices from hyperscalers, states, utilities, regulators, and regional transmission organizations have implications on how we can achieve AI ambitions without power availability bottlenecks and impact on residential rates.

Source: U.S. Energy Information Administration. Goldman Sachs Asset Management. As of August 2025.

Drawing from these four lessons, we believe it is not just about which theme, but more importantly, how to play the theme and the type of capital structure to deploy.

The Way Forward: Find Opportunities with Conviction and A Margin of Safety

We believe that the underlying secular themes driving the low-carbon transition will be persistent and resilient. There will be ebbs and flows, but the direction of travel is clear. In a volatile policy and macro environment, we look for opportunities with conviction and a margin of safety at the intersection of four areas:

- Focus on accelerating “in-the-money” themes within broader growth trends: Within the broader trend of growing investment in the climate transition theme, we are increasingly seeing a divergence of sub-themes. In more mature areas (e.g. renewable energy, grids, energy storage) investment increased by14.7% from 2023 to 2024, while less mature areas (e.g. hydrogen, carbon capture) saw a decline of 22.6%.16 This divergence further emphasizes investor appetite in scale and unit economics.

- Find companies that have robust value proposition and drive operational value creation: The sustainable investment landscape has undergone a significant shift, moving away from an era when cheap capital and broad regulatory support fostered growth heavily reliant on subsidies and a perceived "green premium." The shift to higher interest rates and inflation has reversed these macro tailwinds, compelling a renewed focus on profitability, scalability, and business resilience across cycles. In this new macro environment, both investors and companies have adapted. Investors are now evaluating opportunities differently, prioritizing demonstrable profitability and robust financial performance in the present, rather than solely on long-term future potential. The investor value-creation playbook is also shifting to focus more on operational execution to drive revenue growth and margin expansion. That could look like technological and data transformation, operational improvement and cost reduction, sustainability uplifts on material drivers of risks/opportunities, talent and organization strategy, or scaling revenue growth, among others. Consequently, companies can no longer rely on a "green premium" or broad regulatory support to drive growth; instead, they must offer robust value propositions that solve mission-critical pain points for their customers or deliver significant cost savings. This necessitates a clear path to profitability and tangible benefits, ensuring that sustainable solutions are economically compelling on their own merits.

- Find companies that provide a critical link in a value chain: Certain end markets (e.g. solar panels) have become highly commoditized. Businesses face intense competition and compressed profit margins. Rather than focusing on these commoditized “downstream” products, investors may find greater opportunities in “pick-and shovel” companies that supply essential tools, specialized components, or services needed for the broader energy transition infrastructure. These could include manufacturers of advanced materials, specialized equipment for renewable energy production, or companies providing critical services like grid upgrades. Focusing on companies with a technological or scale advantage can lead to better financial outcomes. By focusing on companies with a technological or scale advantage in these less commoditized segments, investors can potentially achieve greater market share and better margins, mitigating the pressures faced by businesses directly exposed to intense competition and volatility in the end market.

- Be in a position to take advantage of imbalances in the supply of and demand for capital: In real assets and infrastructure for example, we see significant capital pools from asset managers and owners focused on the core and core-plus segments, compressing returns. In the value-add space, by contrast, you can potentially build and grow assets to sell to those pools of capital rather than compete with them. Private credit offers another good example that can benefit significantly from the pronounced supply-demand imbalance for capital. Since 2014, $781 billion has been raised in sustainable private equity, but only $61 billion raised for sustainable private debt.17 We think this imbalance is particularly significant given first, equity capital drives further demand for debt to grow projects and companies, and second, given the direct, bespoke nature of this market, there are significant barriers to entry for lenders lacking experience and structuring expertise. The negative headlines on policy may spur further dislocation as investor sentiment on renewables dips, which may generate additional opportunities for those with robust origination channels and expertise navigating complex regulations.

Source: Goldman Sachs Asset Management. For illustrative purposes only. As of October 2025.

Where to Play: The "Sustainable Thematic Opportunity Set" Differs by Asset Class

We leverage insights from our direct investing business and open architecture platform that allocate to third-party managers to develop views on how the four dynamics mentioned above play out in the market. Importantly, investors execute investment opportunities in an asset class. Asset-class-specific dynamics of key return drivers in the current market environment provide crucial context and shape how robust and attractive the “sustainable thematic opportunity set” is by asset class. These dynamics influence the volume of deals, relative attractiveness, and potential scale to deploy capital. We see attractive opportunity sets for sustainable themes in four areas:

- Private Credit: Demonstrates strong relative value and attractive risk-adjusted returns, especially in bespoke strategies, driven by a scarcity of capital for sustainable investments and increasing demand from maturing companies.

- Value-Add Infrastructure: Presents a significantly growing opportunity set with strong market fundamentals, benefiting from a less crowded deployment environment and the increasing importance of sustainable features and resilience in asset valuation.

- Middle-Market Private Equity: Offers a strong balance of asset stability and the ability for GPs to influence company trajectories, with a growing number of profitable sustainable businesses making it an appealing segment for dedicated thematic funds.

- Continuation Vehicles: Provide attractive entry valuation points by addressing liquidity needs in a market with limited exits, representing a nascent but growing opportunity.

Navigating Sustainable Capital in Private Markets: A Pragmatic Path Forward

The sustainable investing landscape is undergoing a pragmatic reset, shifting from idealism to a focus on substance, resilience, and economic fundamentals. While the long-term secular trend of energy transition remains robust, driven by falling costs, rapid deployment, and energy security, success in the current volatile macro and policy environment demands a renewed emphasis on profitability, scalability, and robust value propositions. By looking beyond headlines and identifying accelerating “in-the-money" themes, critical value chain links, and capital imbalances, investors can find conviction and margin of safety across asset classes, particularly in private credit, value-add infrastructure, and lower middle market private equity, and continuation vehicles.

1Ember. “The Electrotech Revolution.” September 2025.

2International Renewable Energy Agency (2025), Renewable Capacity Statistics 2025. https://www.irena.org/News/pressreleases/2025/Mar/Record-Breaking-Annual-Growth-in-Renewable-Power-Capacity

3International Energy Agency. World Energy Investment 2025. https://www.iea.org/topics/investment

4BloombergNEF: Lithium-Ion Battery Pack Prices See Largest Drop Since 2017, Falling to $115 per Kilowatt-Hour. Dec-2024.

5S&P Global: CERAWEEK: Renewables ready to go, labor and parts delays gas plants: NextEra CEO. Mar, 2025.

6Gas Outlook. “Costs to build gas plants triple, says CEO of NextEra Energy.” Oct 7, 2025.

7S&P Global, US gas-fired turbine wait times as much as seven years; costs up sharply. May 2025.

8International Energy Agency (IEA): World Energy Investment Report 2025

9International Energy Agency (IEA): World Energy Investment Report 2025

10McKinsey Global Energy Perspectives 2025: China has the largest electricity demand today, in part because of its high level of electrification China is projected to have more than 90 percent low-carbon power by 2050.

11Reuters. “India hits 50% non-fossil power milestone ahead of 2030 clean energy target.” July 14, 2025

12European Investment Bank. “The only way forward.” October 15, 2024.

13International Energy Agency (2024), Who is investing in energy around the world, and who is financing it? OECD Environment Working Paper No. 245 (2024)

14Wood Mackenzie (2024) Conflicts of interest: The cost of investing in the energy transition in a high interest-rate era

15U.S. Energy Information Administration, as of August 2025.

16BNEF 2024 Clean Energy Investment Trends.

17Sustainable strategies include Pitchbook categories: Agriculture; Air; Biodiversity & Ecosystems; Climate; Energy; Infrastructure; Land; Oceans and Coastal Zones; Pollution; Waste; Water. Private equity funds include private equity, venture capital, and infrastructure.