Cutting Through the Noise: Navigating Fed Easing

Historical and Theoretical Market Responses

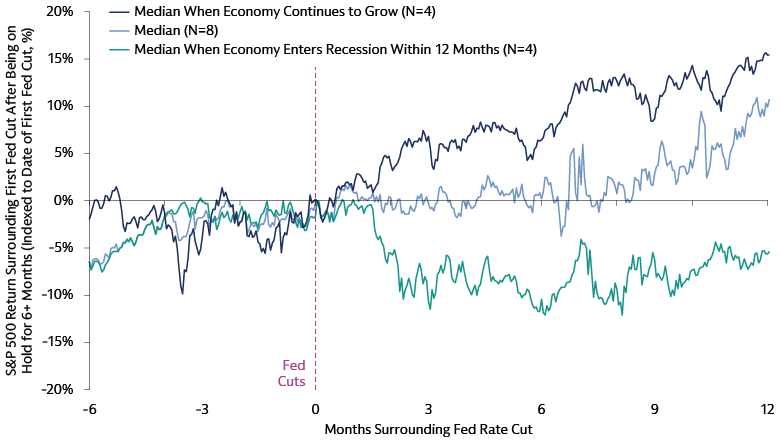

The impact of Fed easing on financial assets depends on the reasons for rate cuts and the broader investment environment. When the Fed cuts rates to prevent a recession and achieve a soft landing, markets have historically responded positively, expecting lower borrowing costs to boost economic activity and corporate earnings. We believe this is the scenario we are in today, with continued economic expansion expected over the next year, driven by reduced tariff impacts, emerging fiscal support, and ongoing easy financial conditions.

Assets that may benefit in a soft landing:

- US Treasuries, particularly at the front-end of the curve, have generally performed well across rate-cutting cycles, rallying both before and after rate adjustments.

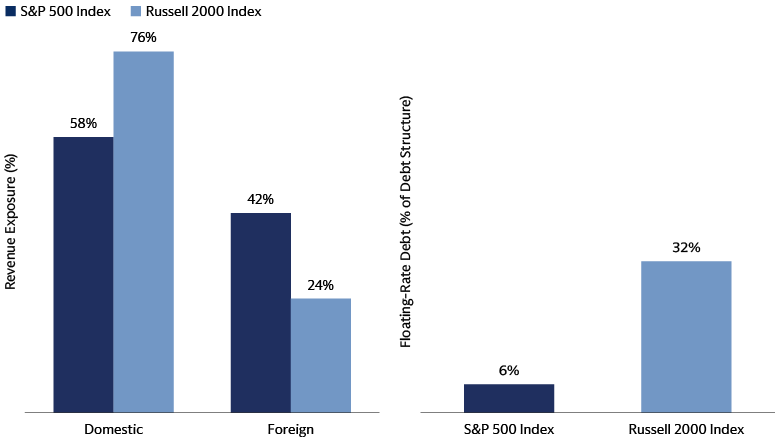

- US equities historically tend to perform strongly. We expect small-cap stocks which generate a high percentage of revenue from the US relative to large-cap stocks and often carry a higher proportion of floating-rate debt to benefit more directly from reduced interest rates. We think dividend-paying stocks can also gain favor among income-focused investors adjusting to diminished fixed income yields.

Left: Source: Goldman Sachs Asset Management. As of August 31, 2025

Right: Goldman Sachs Global Investment Research, Bloomberg. As of January 16, 2025.

- Commercial and residential real estate can experience renewed construction activity, increased property demand, and improved profitability on rental income amid lower financing costs.

- Private equity assets may benefit from reduced debt burdens, as they are largely financed with floating-rate debt.

Assets with inconsistent patterns or potential weakening in a soft landing:

- Cash and money market funds may see outflows as investors seek higher-yielding alternatives such as short-duration strategies and core fixed income. However, investors prioritizing stability and liquidity may find it potentially advantageous to keep their cash in Money Market Funds, given they typically adjust their yields downward with a delay compared to the Fed funds rate.

- US dollar performance has been mixed amid Fed cutting cycles, as the trend is largely dependent on the broader economic and global policy actions; coordinated global easing tends to support dollar strength, while uncoordinated cycles often result in dollar weakness or neutral performance.1 That said, historically, the dollar tends to rally or move sideways if the Fed cuts rates and no recession follows. This is due to inflows into US equities, which can support the dollar despite lower yields.

- Oil shows no consistent trend, with supply and demand dynamics and geopolitical events primarily driving prices.

- Private credit is an increasingly diverse investment universe, and so lower rates will have varying effects on different private credit strategies. The largest segment of the market, floating-rate senior direct lending, may experience declining yields, though this may be partially offset by lower distress rates, and may lead to a more normalized spread environment.

- Gold historically tends to perform better in recessionary rate-cutting cycles, while underperforming in non-recessionary environments.

Unique Dynamics of the Current Cycle

No two easing cycles are alike, and the current one presents distinct considerations for investors. Notably, the Fed paused its easing cycle for eight months, during which markets were influenced by several key developments:

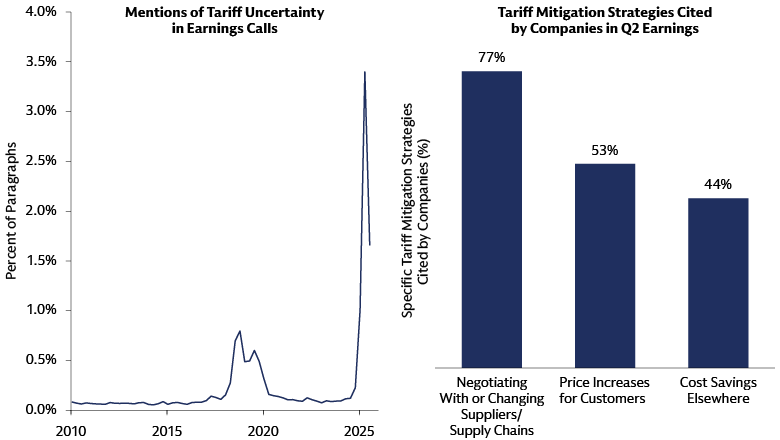

- The rise and fall of tariff uncertainty: Initial market declines from the "Liberation Day" tariff announcements in April 2025 have reversed as investors, companies, and households shifted from fearing further tariffs to actively managing their real-world impact.

Left: Source: Department of the Treasury, Goldman Sachs Global Investment Research Earnings Season Takeaways: Adjusting to the New Environment (August 25, 2025). * Mean across Russell 3000 earnings calls.

Right: Source: Goldman Sachs Global Investment Research US Economics Analyst Earnings Season Takeaways: Adjusting to the New Environment (August 25, 2025).

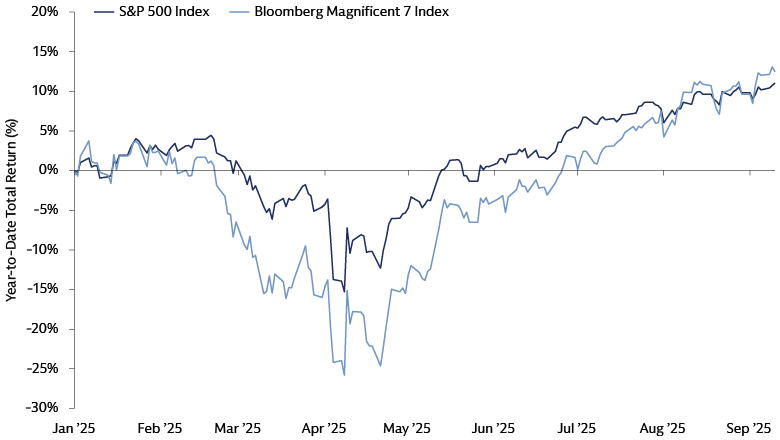

- AI Innovation: Despite competitive pressures from new, cost-effective Chinese AI models, US big-tech companies have reaffirmed AI investment commitments and delivered solid earnings, driving a rebound in "Magnificent 7" stock performance.

Source: Macrobond, Bloomberg, Goldman Sachs Asset Management. As of September 10, 2025. Past performance does not predict future returns and does not guarantee future results, which may vary.

- Geopolitical volatility: Escalating tensions in the Middle East have caused temporary rather than persistent "risk-off" reactions, highlighting persistent geopolitical risks.

- Fiscal & monetary concerns: Rising concerns over Fed independence and fiscal dominance have contributed to higher inflation expectations, a steepening yield curve, and dollar weakness.

- European fiscal expansion: Germany's historic fiscal stimulus has attracted capital flows, strengthening European equities and the euro.

- Elevated market valuations: Continued economic expansion, AI optimism, and less severe impacts from tariffs and geopolitics have propelled the S&P 500 to all-time highs and pushed credit spreads close to historical lows.

What We Think This Means for Investors

1. Embrace the easing cycle: In our view, the Fed's rate-cutting cycle will continue into 2026, supporting economic expansion. We believe this should benefit fixed income, including front-end US Treasuries, and investment-grade credit, where the rate component of yields is higher than in the past, meaning total returns benefit from falling rates. We also expect equities, especially small-cap stocks, to perform well despite high starting valuations.

Source: Goldman Sachs Goldman Investment Research. US Weekly Kickstart US equity playbook into year-end (September 5, 2025). Past performance does not predict future returns and does not guarantee future results, which may vary.

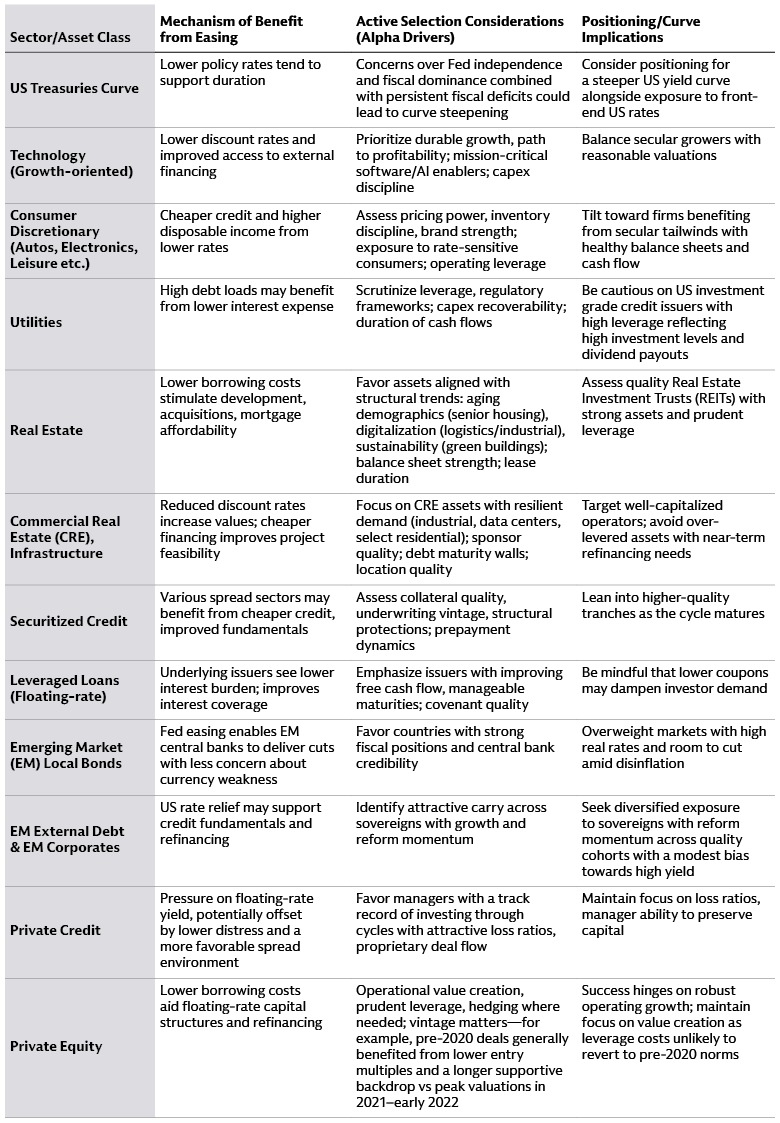

2. Focus on alpha over beta: While Fed easing without recession risks may provide a broad market tailwind, we believe alpha generation lies in security and sector selection rather than passive exposures. Investors should consider an active approach that assesses structural trends, balance sheet quality, and cash flow resilience within the broader market context as detailed below.

3. Stay dynamic. History is a helpful guide but not a precise map for navigating today's unique cycle. A dynamic approach that considers a range of macro, market, and valuation factors is essential. Our current investment playbook emphasizes positioning for broadening equity market gains and seeking to generate income across bond and equity markets, reflecting a comprehensive assessment of cyclical and structural forces. It’s important to continuously verify outlooks and adjust investment exposures accordingly.

Source: Goldman Sachs Asset Management. These views are as of September 11, 2025 and provided for informational purposes only and subject to change. This information should not be construed as investment advice or constitute a recommendation by Goldman Sachs Asset Management to buy, sell or hold any security.

For more on our views on CRE explore Finding Firmer Footing: The Case for Commercial Real Estate

What We’re Watching:

- Policy proof points: The market anticipates another two Fed rate cuts this year, in line with the median projection featured in the Fed’s dot plot, with further easing in 2026. There is a risk of disappointment if the Fed adopts a slower pace of easing. In Europe, we are monitoring Germany’s fiscal stimulus delivery and evidence of increased region-wide defense spending. In China, better-than-expected export growth, high-tech development, and equity market gains have reduced pressure for major stimulus, but we remain alert for any fiscal easing to address weak domestic demand, a weak property market, and deflation.

- Consumer spending resilience: The US consumer has shown resilience post-pandemic, but with no stimulus checks and a weakening job market, the sustainability of spending is uncertain. Insights from the Goldman Sachs Annual Global Retail Conference and our research analysts indicate a resilient consumer. However, tariff cost pass-throughs may squeeze disposable incomes and slow spending.

- AI’s path to profitability: The Magnificent-7 companies delivered strong earnings in 2Q, outpacing the broader S&P 500 Index. Big-tech players have revised higher capex guidance, indicating a long-term investment trend. However, key questions remain about the broader productivity gains and returns from the AI capex boom.

- Fiscal risks: High debt levels and spending needs in areas such as defense, decarbonization, digitization, and healthcare are straining government budgets. Political fragmentation further complicates addressing fiscal deficits. This is evident in developed market bond markets, where long-term bond yields have risen significantly in 2025, despite declining short-term yields. We remain vigilant about fiscal sustainability and its impact on bond yields and risk sentiment.

- Fed independence: Ongoing pressure from the White House on the Fed to reduce rates could unsettle markets, lift inflation expectations, steepen the curve, and weigh on the dollar. While Fed Chair Powell’s term ends in May 2026, announcements on the potential new Chair nominee could come sooner.

1 Source: Goldman Sachs Global Investment Research Global Markets Daily: The Dollar After the First Cut (September 10, 2024).