Taking Control of Hidden Risks in Passive Sustainable Equity Strategies

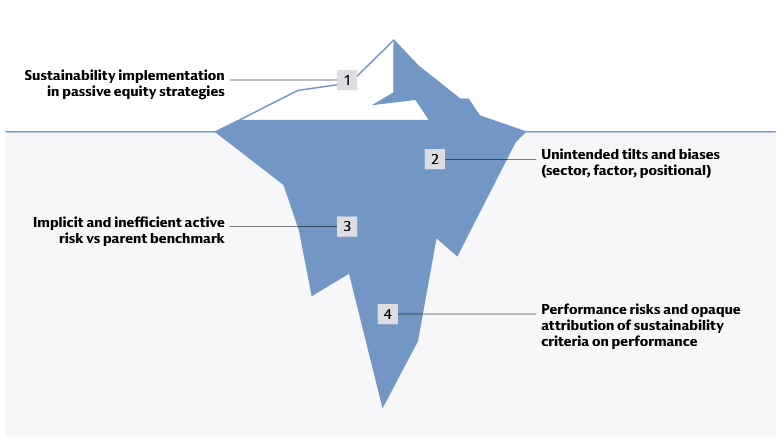

Passive strategies have long been an important part of sustainable investors’ core portfolio allocations. In Europe, by far the world’s largest sustainable fund market, passive strategies account for nearly a third of total assets and have seen consistent inflows in recent years.1 Yet we believe there are no truly passive strategies in sustainable investing. The incorporation of investment criteria such as exclusions in an off-the-shelf sustainable index or a bespoke sustainable overlay on a conventional index leads to divergence from the underlying market portfolio. As a result of this divergence, sustainable passive strategies can acquire unintended style and sector tilts that have implications for portfolio performance, particularly if they are left unmanaged.

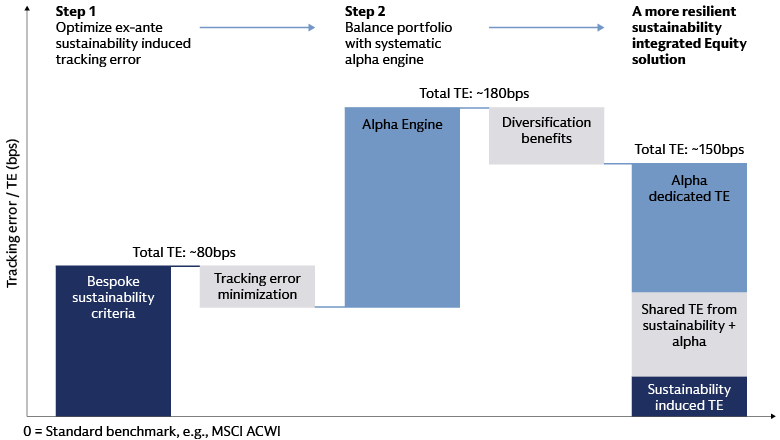

Source: Goldman Sachs Asset Management. As of September 2025. For illustrative purposes only.

In our view, the fluctuations in sustainable investment performance in recent years were often driven more by the tilts and biases built into sustainable strategies than by anything intrinsic to sustainability itself. In the years 2019 through 2021, for example, sustainable funds tended to outperform traditional funds largely because they were overweight growth stocks in a market environment that supported this style of investing.2 In 2022 and 2023, by contrast, the growth tilt of sustainable funds weighed on returns as the market shifted and value stocks began to dominate. The tendency of sustainable strategies to limit or exclude traditional energy companies also weighed on returns as the performance of the energy sector surged during this period.

Looking forward, we think investors are increasingly looking for solutions to mitigate the impact of sustainability-related portfolio tilts and enhance returns across market cycles. In core equity allocations, quantitative strategies could help to reduce short-term performance volatility while longer-term sustainability themes develop. Specifically, an Alpha Enhanced approach that combines the transparency of passive investing with the risk management and alpha potential of active strategies could help investors take control of sustainability-related risks.

We believe a two-step Alpha Enhanced approach can address two key risks inherent in passive sustainable investing: performance volatility and reduced transparency. The first step is to minimize the tracking error introduced by sustainable-investing criteria, either hidden in a ready-made sustainable index or in a customized overlay placed on a conventional index. Next, a dynamic alpha engine is applied to smooth out the strategy’s return profile over time. The alpha overlay helps address performance risk, while the systematic, sequenced approach improves transparency, allowing the investor to measure the impacts of sustainability criteria and the alpha contribution on performance.

Identifying Hidden Tilts

Passive sustainable equity strategies typically start with an equity universe or parent index that is modified according to a set of sustainability criteria. The methodologies used to determine these criteria vary widely. Some are relatively static, such as industry exclusions, while others are more dynamic, with a focus on companies whose positive environmental, social and governance (ESG) characteristics are expected to promote long-term growth. In practice, passive sustainable equity strategies often involve a combination of the two as well as implied decarbonization targets, such as alignment to global climate objectives.

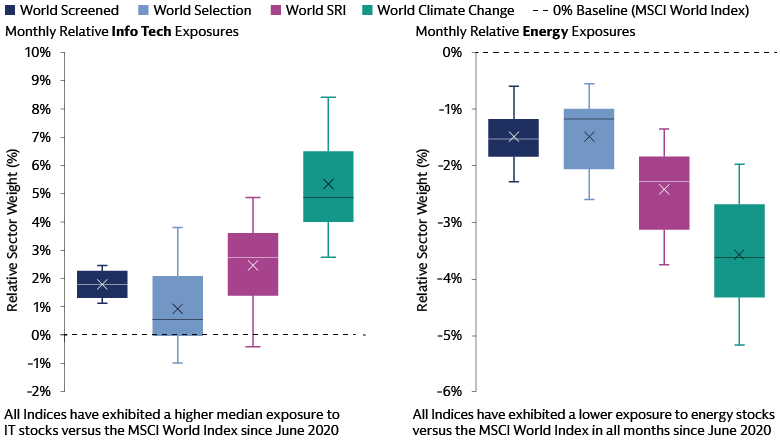

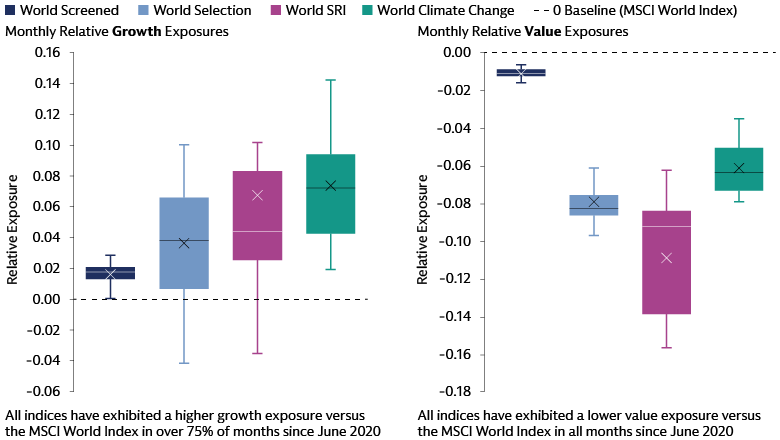

Regardless of the methodology, by modifying the composition of the parent index, the imposition of sustainability criteria amounts to an active stock-selection decision. The scale and nature of these modifications varies by strategy, but some commonalities can be observed: more concentrated holdings in information technology, a tilt toward growth companies and a lower exposure to energy compared with the parent index. To demonstrate this, we compared four widely used sustainable indices – the MSCI World Climate Change Index, MSCI World Screen Index, MSCI World Selection Index and MSCI World SRI Index – with their parent, the MSCI World Index.

Source: Goldman Sachs Asset Management. Monthly Exposures to GICS sectors and Axioma risk model styles, from June 2020 to July 2025. Box plots do not include outliers.

Source: Goldman Sachs Asset Management. Monthly Exposures to GICS sectors and Axioma risk model styles, from June 2020 to July 2025. Box plots do not include outliers.

Measuring the Risks

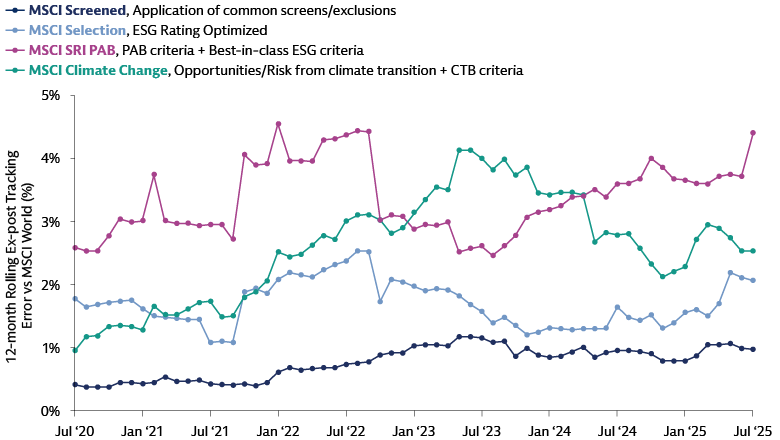

By altering the composition of the parent index, sustainability-related tilts can affect performance. This potential to affect returns can be seen in the implicit tracking error of the four sustainable indices in our analysis below3 compared with the parent index. The tracking error varies between the four indices based on how far their composition deviates from that of the parent index based on sectoral, geographical or stylistic criteria.

Source: Goldman Sachs Asset Management, MSCI. As of August 2025. Leverages monthly excess return data, calculating ex-post tracking error on 12-month rolling average basis.

As this chart shows, tracking error varies significantly over time in response to the market environment, notably during 2022 and 2023.

For the MSCI World Climate Change Index, the rolling 12-month average tracking error varied between about 100 basis points and 400 basis points over the five-year period. In some cases, we see tracking error increasing for one index while decreasing for another, as in 2023 when the climate change index diverges farther from the parent index while the selection index tracks more closely. Interpreting the causes of these swings is complicated by the intricate and interwoven nature of the sustainability criteria in each methodology. Nevertheless, our analysis makes clear that sustainable passive methodologies carry volatile and diverse implied tracking-error profiles that introduce risks to a portfolio.

The first of these is performance risk, as seen when sustainability-related tilts and biases led to underperformance in adverse market conditions, such as the energy supply shocks and higher inflation and interest rates in 2022-2023. This risk is often linked to the time horizon implied by a strategy’s sustainability convictions. Themes such as climate transition that play out over a prolonged period lean on longer-term sources of excess returns, and these may not always coincide with short- and medium-term performance drivers. Without a mechanism for reducing volatility, passive sustainable strategies may face challenges from cyclical and shorter-term market dynamics.

The second important consideration is the need to account for transparency and control risks. Most sustainable indices involve a combination of intricate and correlated sustainability parameters. The complexity of these parameters and their interactions may obscure the impact they have on the risk and return profile of investment strategies designed to track these indices. We believe that without a clear understanding of how sustainability criteria influence portfolio composition and performance, it will ultimately be difficult to actively manage the associated risks.

Adding an Active Component

A strategy for addressing sustainability-related risks in passive equity strategies needs to accomplish three key tasks:

- Systematically manage the risks introduced by sustainability criteria

- Smooth out performance volatility

- Provide transparency in the attribution of impact on performance

We think an Alpha Enhanced approach can help investors achieve these goals. These strategies are designed to create the potential for outperformance through investments that deviate from a benchmark while keeping risk within acceptable limits. An investment manager capable of implementing alpha views with a low correlation to a strategy’s sustainability-related tilts can most efficiently manage the risks that arise from sustainability criteria, in our view. The added alpha component can smooth out a strategy’s return profile by reducing the impact of sustainability-related tilts, thereby smoothing out short-term volatility and boosting resilience to cyclical market moves.

In analyzing performance, it can be challenging to separate the impacts from sustainability criteria and alpha views because the two components are intertwined. For this reason, we think a quantitative approach capable of sequencing the implementation of sustainability criteria and the alpha-engine overlay is needed. The first step is to minimize the tracking error introduced by sustainability criteria, dampening the impact of the resultant tilts and biases. The next step is to maximize the resultant risk-adjusted portfolio performance by incorporating a systematic alpha engine designed to operate within a tracking-error budget determined by the client.

This sequenced approach balances the two sources of active risk – the implementation of sustainability criteria and the addition of the alpha engine – in a way that can produce a more resilient sustainable equity solution, in our view. Integrating an alpha engine is intended to efficiently address performance risk, helping smooth out the performance impacts of sustainability criteria. Since passive sustainability approaches tend to be reliant on the idiosyncratic performance patterns resulting from sustainability parameters, a moderate alpha component can allow investors to incorporate more systematic sources of excess return, potentially balancing out the portfolio’s overall return profile.

By incorporating alpha views uncorrelated with sustainability criteria, this approach yields potential diversification benefits in the use of risk budgets, because some of the sustainability-related risk can be used for alpha generation. As a result, the total tracking error of the two-step process is lower than the tracking error each step would incur independently – a more efficient use of tracking error that can improve the risk-adjusted return profile of the portfolio, This approach could also contribute to cost efficiency by optimizing the active risk allocation and offering the potential for moderate excess returns that are not offered in typical passive index replication approaches.

Importantly, the fact that each step is done separately allows for a clear distinction between excess returns and tracking error originating from systematic bottom-up stock selection, versus the bespoke sustainability criteria. We view this transparency as a very powerful tool for investors to have more decision-useful data about how their sustainability objectives influence their portfolio’s risks and returns, which could in turn help investors better assess how they will evolve their sustainability parameters, keeping performance in mind.

Source: Goldman Sachs Asset Management. As of August 2025. For illustrative purposes only.

Performance-Driven Sustainable Equity Investing

Sustainable investing should be performance-driven and anchored in long-term value creation, in our view. As investors grapple with themes that are inherently long-term and non-linear, implementing sustainability objectives should not be a surface-level decision, but an active decision across multiple time horizons and in conjunction with other portfolio construction considerations.

The fundamental question for investors is not whether passive sustainable strategies carry active risk, but rather how to manage this inherent active risk most efficiently. We think an effective, resilient and performance-driven approach to sustainable equity investing requires taking control of the risks introduced by sustainability criteria. An effective approach involves moving beyond index replication to a more transparent, risk-managed approach that can leverage uncorrelated alpha views to balance potential underperformance from sustainability criteria, while leaving room to capture opportunities that may be created in the process.

1“Global Sustainable Fund Flows: Q2 2025 in Review,” Morningstar. As of July 24, 2025. Europe accounted for 73% of global sustainable investment funds and 85% of sustainable fund assets at the end of the second quarter of 2025.

2Kenneth R. French, Bloomberg and Goldman Sachs Asset Management. As of March 9, 2023. Data from January 1970 to January 2023. Value investing has a long track record of outperformance, dominating the period between 1970 and early 2007 on a cumulative basis. By contrast, growth prevailed from mid-2007 until the COVID-19 pandemic, when value started to outperform again. To read more, see “Growth vs. Value: Rethink Your Investment Style,” Goldman Sachs Asset Management. As of April 20, 2023.

3In measuring ex-post tracking error, we have used the MSCI World SRI Filtered PAB Index rather than the MSCI World SRI Index, which we used in the previous section, owing to data-availability constraints.