Breaking New Ground: Philippe Camu on Infrastructure’s Unprecedented Opportunity Set

Infrastructure as an asset class has evolved significantly, moving beyond traditional roads and ports to encompass a vast and dynamic landscape at the intersection of major global trends. Philippe Camu, with 20 years of experience in the sector, highlights the current moment as one of unprecedented opportunity, driven by immense capital demand and several overarching global megatrends. In this environment, Philippe believes successful outcomes will critically depend on experience, discipline, and agility.

Infrastructure Redefined

The infrastructure of tomorrow is here, and it looks vastly different from yesterday's. Having witnessed various market cycles unfold, it's clear that we are breaking new ground in what constitutes an infrastructure investment. The landscape has been fundamentally redefined, moving far beyond the traditional roads, ports, airports and regulated utilities that once dominated the sector.

Today, the infrastructure landscape is rapidly expanding to include new categories, such as data centers, sustainable logistics, circular economy, energy storage, waste management, and waste to energy. This profound evolution is driven by the decarbonization drive, unprecedented power demand required for AI, the digitization of our economies, and the complexities of deglobalization.

Goldman Sachs Alternatives has been an early mover in the infrastructure space, investing into the first waves of renewables and digital infrastructure, including broadband, fiber, and telecom towers. Our experience and global vantage point leads us to believe that the current investment opportunity set in infrastructure is truly unparalleled, shaped by these powerful, converging global megatrends.

Supply and Demand Dynamics

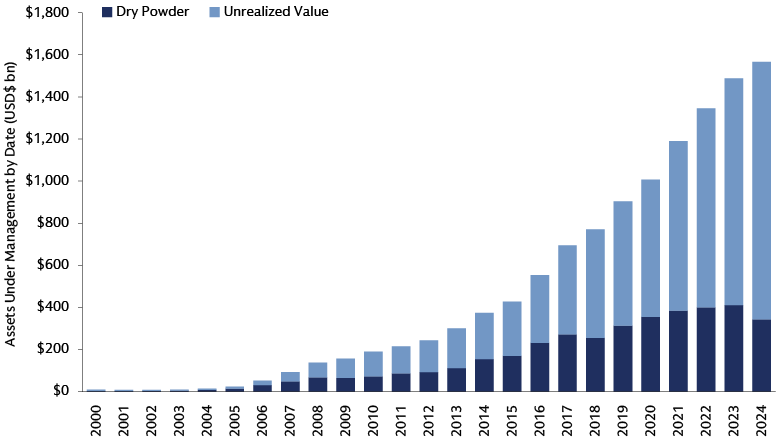

As the definition of infrastructure has broadened and evolved, so too has the amount of capital flowing into the asset class. Private capital for infrastructure has grown more than 30x from ~$50 billion in 2006 (when there were only a handful of infrastructure GPs in the market with us), to approximately $1.5 trillion in 2024.1 Projections also indicate the market for private infrastructure investing is likely to further expand to an estimated $2 trillion by 2030.

Source: Preqin. As of August 2025.

The substantial growth of infrastructure as an asset class is a clear testament to its compelling characteristics: stable returns, low volatility, and inflation protection, alongside a low correlation with traditional asset classes like stocks and bonds. The growth of the asset class has been largely driven by institutional investors to date. However, a substantial "wealth wave" is also gaining momentum, with increasing appetite from individual investors and wealth managers who are seeking attractive risk-adjusted returns, downside protection, and long-term opportunities tied to the megatrends highlighted.

This increased supply of private capital is critical to meet the immense and growing demand for investment. Early infrastructure, such as railroads, copper and cable networks, and the first telecommunications systems required significant capital for their time. However, the capital required to develop and maintain today's sophisticated and interconnected assets, especially those driven by digitalization and decarbonization, is on an entirely different scale. Estimates suggests there is a $15 trillion gap between projected investments and the amount needed to provide adequate global infrastructure by 2040.2

Discipline and Diversification

Our extensive experience across numerous market cycles has profoundly shaped our perspective and approach to infrastructure investing. We have observed firsthand and been present throughout infrastructure's journey, which has not been without challenges. The asset class has been tested through numerous cycles and continues to prevail. For instance, transportation assets faced challenges during the 2008 financial crisis as traffic volumes dropped significantly. Renewables have also recently been tested with rising interest rates impacting the cost of capital expenditure, making financing more difficult and expensive for projects that require large upfront investments.

These experiences have taught us fundamental lessons. Crucially, infrastructure's ability to withstand challenges results from its distinct qualities—such as its essential nature, its barriers to entry, resilience of cash flows, and inflation protection. This underscores the critical importance of discipline when allocating capital, diversification across regions and sub-sectors, and the avoidance of excessive leverage. Today, while offering significant opportunities, the infrastructure landscape necessitates a highly agile and discerning approach. One concern is the potential for "bubble territory" in certain segments, driven by an abundance of capital and numerous investors targeting similar assets. Specific infrastructure sectors, such as data centers and utilities, can be very expensive. The experience with assets like UK water, which moved from being among the most expensive segments to struggling to attract capital, serves as a cautionary tale. A strategy rooted in diversification is critical and provides the flexibility to lean into the area of the infrastructure market most attractive at any one point in time, understanding that the most attractive sectors will evolve, just as the world around us continues to.

Take Privates: Capitalizing on Dislocation

Agility is paramount in navigating these risks and seizing opportunities when market dislocations occur. The current market environment is dynamic, and we find such periods particularly favorable, allowing us to capitalize on volatility at the opportune moment through Public-to-Private (P2P) transactions.

Underlying infrastructure businesses in public markets can possess inherent characteristics valuable to private investors that public markets often fail to reflect accurately during periods of dislocation, distress, or heightened volatility. Private infrastructure, unlike its public counterpart, tends to exhibit lower observed volatility, with valuations being less reactive to short-term macroeconomic events. Our ability to create rapid and significant value on P2Ps is a large part of our track record.

We have seen this play out time and again, having successfully invested through numerous cycles including the Global Financial Crisis, the Eurozone debt crisis, and the COVID-19 pandemic. Therefore, we monitor public stocks across all infrastructure subsectors, identifying potential targets that align with our investment criteria. This allows us to be ready to deploy capital swiftly when valuation disconnects arise. This proactive stance, coupled with a track record of proven ability to execute quickly and manage the inherent complexities of such P2P transactions, provides a distinct and competitive advantage.

Infrastructure is Distinct from Traditional Private Equity

While both infrastructure and traditional private equity involve investing in private companies or assets to generate returns, their core investment philosophies and risk-return profiles differ. Infrastructure as an asset class is often characterized by its emphasis on downside protection and resilience, providing a "sleep well at night" quality for investors, while still offering avenues for substantial value creation.

Our underwriting philosophy for infrastructure investments heavily emphasizes understanding and mitigating potential downsides, aiming to secure a minimum hurdle return even under challenging conditions. This contrasts with some private equity approaches that may prioritize more aggressive growth strategies. Infrastructure's focus on capital preservation is further bolstered by the physical nature of the assets, which retain value and can offer an inflation hedge.

While the foundation of infrastructure investing is downside protection, significant upside can be generated through active asset management. This includes operational improvements, such as optimizing efficiency, expanding customer and contract bases, and integrating new technologies. For instance, infrastructure investors can implement digital transformation initiatives, professionalize management teams, and pursue bolt-on acquisitions to scale businesses. Given their size, mid-market assets often have meaningful value creation potential and a less crowded deployment environment, providing access to attractive entry points with the potential to grow assets during hold periods, ultimately selling to large-cap buyers.

Megatrends and Policy-Driven Tailwinds

The landscape of infrastructure investment is fundamentally shaped by its pivotal role in addressing several overarching global megatrends. These include the transformative impact of artificial intelligence (AI) growth, evolving demographic shifts, critical supply and demand dynamics within the energy and power sectors, and the ongoing recalibration of globalized economies. In navigating this dynamic environment, our strategic focus centers on four key thematic areas: digital infrastructure, energy transition, transport & logistics, and the circular economy.

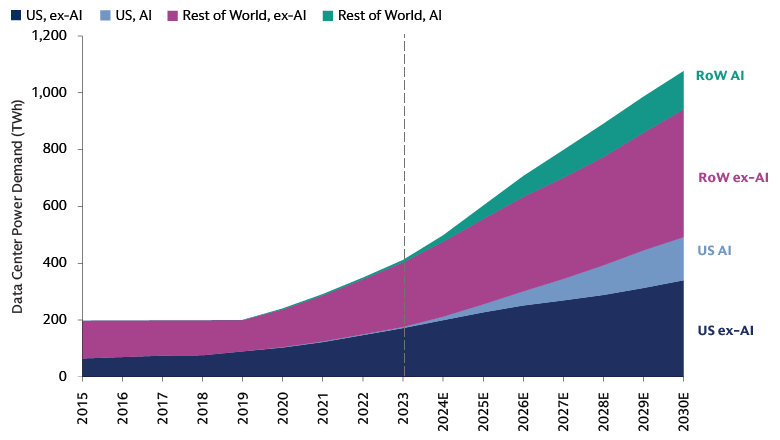

- Digital Infrastructure: The explosion of data usage, cloud adoption, and the pervasive rise of AI are fueling unprecedented demand for power and, in turn, digital infrastructure. Meta, Amazon, Alphabet and Microsoft intend to spend as much as $320 billion combined on AI technologies and datacenter buildouts in 2025.3 AI, in particular, requires faster, lower latency, and more secure connections, leading to substantial investment in hyperscale data centers, fiber networks, and mobile towers.

Source: Cisco, IEA, Masanet et al. (2020), Goldman Sachs Global Investment Research. As of June 4, 2025.

- Energy Transition: The global imperative to decarbonize and meet growing energy demands is driving massive investment in energy transition infrastructure. This includes not only renewable power generation like wind and solar, but also complex new storage systems, transmission grids, and distribution networks necessary to integrate intermittent renewable sources and ensure a reliable power supply.

- Transport & Logistics: Evolving global trade patterns are reshaping transport and logistics. Deglobalization, characterized by a renewed focus on reshoring industries and building national economic self-sufficiency, necessitates better local and regional transportation infrastructure. Supply chain vulnerabilities exposed during recent global events are prompting companies to diversify their supply sources and engage in nearshoring and friendshoring, which in turn requires significant investment in supporting infrastructure like upgraded highways, railways, bridges, tunnels, and ports.

- Circular Economy: The circular economy is gaining increasing traction as a crucial approach to address resource scarcity, waste generation, and environmental concerns. This thematic area focuses on minimizing raw material use and pollution by returning finished items to the product cycle through recycling, repair, redesign, and reuse. Investments in the circular economy offer attractive infrastructure characteristics such as high barriers to entry, contracted business models, and resilience through economic cycles.

Today’s infrastructure market is also characterized by significant opportunities driven by supportive government policies, particularly in the US and Europe, and evolving geopolitical and economic priorities, even if the full impact of these policies has yet to materialize.

In the US, policy changes favor long-term supply chain security and re-industrialization. Initiatives like the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) have allocated significant federal spending aimed at bridging the funding gap in the nation's infrastructure needs. The current US administration has heralded a “golden age” for American manufacturing and technological dominance. These plans include AI data centers and infrastructure that powers them, including high-voltage‑ transmission lines and other equipment.4

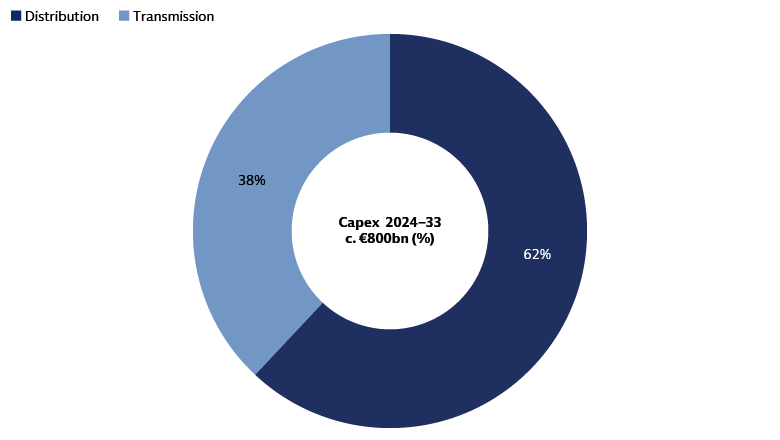

In Europe—a region undergoing fiscal transformation—policymakers acknowledge substantial infrastructure investment needs, particularly relating to power grids. Data from the EU and Nexans indicates that European electricity transmission and distribution infrastructure is now circa 40 years old, and rapidly ageing. Programs like the NextGenerationEU aim to finance EU-wide real assets. This push is expected to drive significant investment in areas like clean energy, digital infrastructure, and physical structures, leading to an overhaul of Europe's infrastructure.

Source: Goldman Sachs Global Investment Research. As of October 14, 2024.

Navigating the Next Chapter

The infrastructure investment landscape, increasingly characterized by a continually evolving definition of what constitutes infrastructure, presents an unprecedented yet complex opportunity set. Navigating these dynamic shifts successfully, we've learned, demands a discerning approach.

True resilience and value in infrastructure stems from the specific characteristics of the underlying assets—stable cash flows, essential services, and high barriers to entry—rather than traditional categorizations. The asset class has evolved well beyond conventional roads, airports, ports and regulated utilities to encompass critical digital and sustainable infrastructure, such as data centers and renewable energy assets. This evolution requires investors to look past outdated classifications and focus instead on the intrinsic qualities that drive long-term value. Having navigated numerous market cycles, we've concluded that strategic diversification across regions and sub-sectors, coupled with disciplined leverage, is key to achieving robust, sustainable returns. Looking ahead, diversification across infrastructure sub-sectors and geographies will be critical to capitalize on an unprecedented opportunity set.

1Preqin, as of August 2025.

2Global Infrastructure Hub.

3CNBC. As of February 2025.

4White House. As of July 23, 2025.