Taking Advantage of the Front-End Rates Opportunity

Savers in money markets could be better compensated by diversifying and investing in ultrashort duration bond strategies as the Federal Reserve's rate-cutting cycle continues, in our view. With an easing cycle now underway, coupled with the potential to earn income within a diversified, actively managed portfolio, there is an opportunity for investors housed in money markets to complement their cash allocations and access potentially greater returns.

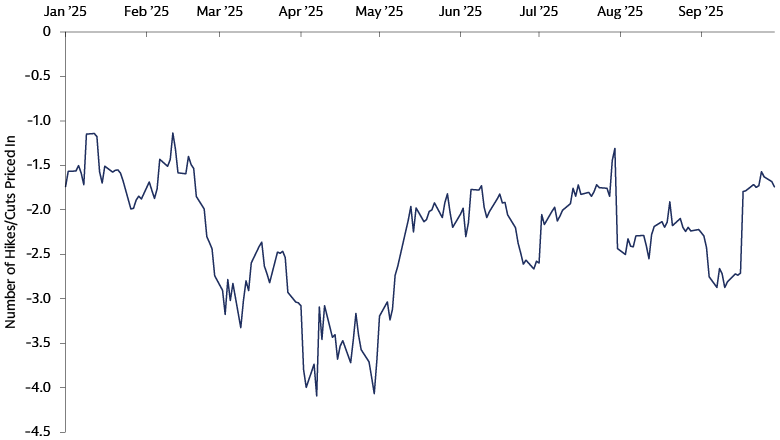

The underwhelming August nonfarm payrolls report and hefty downward revisions to the annual benchmark payroll numbers have intensified market expectations that the Federal Reserve will continue easing monetary policy, focusing on softening in the labor market despite the unclear picture on inflation. Markets are now expecting 1-2 additional rate cuts for the remainder of this year.1

Investors holed up in money markets, which have grown to approximately $7 trillion in the past few years, have been rewarded for their cautious positioning.2 Yet with further Fed easing down the line, we believe these investors can benefit more from complementing this exposure with ultrashort duration bonds to unlock potentially greater returns through income generation, diversification and active portfolio management.

Source: Bloomberg. As of September 30, 2025. For illustrative purposes only.

Get Ahead of Further Easing

Moving even just slightly up the yield curve into ultrashort bonds could offer investors the opportunity to capture higher income over a slightly longer time horizon. Adjustments in yields in government money market funds are relatively quick, with yields following the direction of interest rates. Strategies with even small increases in duration may offer a yield advantage and more stability for the distributed income, given the longer period before reinvestment. Additionally, active allocation to high quality corporates and securitized assets creates an added income potential from both, a yield and total return perspective.

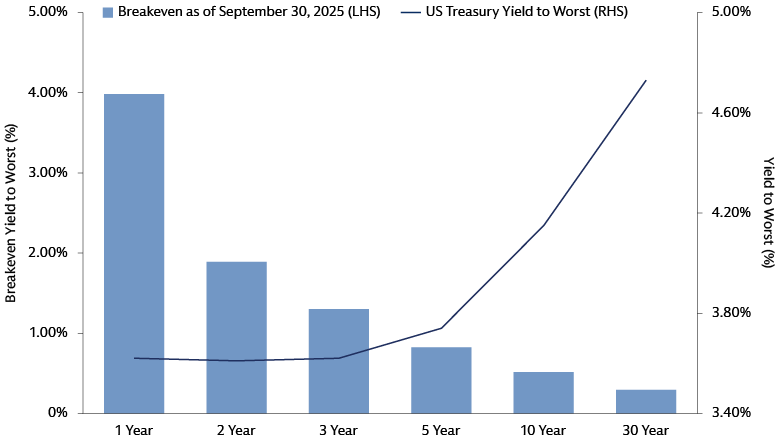

A break-even analysis, evaluating the yield level needed to avoid a 0% return, suggests that taking an incremental amount of interest rate risk today is profitable. The yield levels across front-end structures are historically attractive. Additionally, the markets are becoming more confident that additional easing is on its way as the labor market's health comes into focus. For example, an investor could earn 3.6% on a one-year US Treasury note, and yields would have to almost double before the investor earned a 0% return. This scenario is quite unlikely, and the trade-off on the increase in duration favors investors at this juncture with further Fed easing on the horizon.

Source: Bloomberg. As of September 30, 2025. For illustrative purposes only.

Taking Advantage of Diversification and Active Management

Ultrashort duration strategies also have structural benefits in terms of how they are constructed and managed, particularly when compared with incumbent strategies. Ultrashort duration funds, for example, can hold positions across asset classes such as sovereign, corporate and securitized debt, allowing them to offer potential diversification as well as possible return upside with access to several income streams.

Active ultrashort bond managers can also adjust the interest-rate sensitivity of their portfolios by shifting exposure to fixed-rate notes from floating rate or moving further along the rate curve. Doing this in an environment of falling interest rates can lock in another source of higher yields and income, instead of passively allowing that potential return to be gradually whittled away in floating rate notes.

Investors can be well-compensated through a diversified multi-sector approach to investing, which has the potential to deliver both attractive income and managing downside risks with yield levels. We believe that ultrashort bond investing provides this opportunity and could be particularly appealing to those in money market funds looking to boost their income and capitalize on a shifting policy environment.

1 Source: Bloomberg. As of September 30, 2025

2 Source: iMoneyNet. As of September 30, 2025