American Workers Living Paycheck to Paycheck Face Daunting Retirement Savings Challenges

New solutions are rays of hope that can help close the retirement savings gap for millions of Americans

NEW YORK – October 2, 2025 - According to the 2025 Goldman Sachs Asset Management Retirement Survey & Insights Report titled, New Economics of Retirement, 42% of younger working respondents (Gen Z, Millennials, and Gen X) state they are living paycheck to paycheck and almost three-quarters (74%) report struggling to save for retirement due to the effects of the “Financial Vortex” of competing financial priorities.

Looking at national trends for those who report living paycheck to paycheck, 55% of workers may be living paycheck to paycheck by 2033, and 65% by 2043, raising the question of whether retirement is growing unaffordable for many.1

“The cost of major life events is taking up a larger percentage of household income, a trend that affects workers at the lowest level of income as well as the highest,” said Greg Wilson, Head of Retirement at Goldman Sachs Asset Management. “The ’save more’ strategy may be sufficient for some, but we believe many others will need to more thoughtfully use investment, advice, and retirement income strategies to close their savings gap. Otherwise, retirement may increasingly become unaffordable for too many workers.”

Financial Vortex and Life Events May Lead to Retirement Savings Shortfall

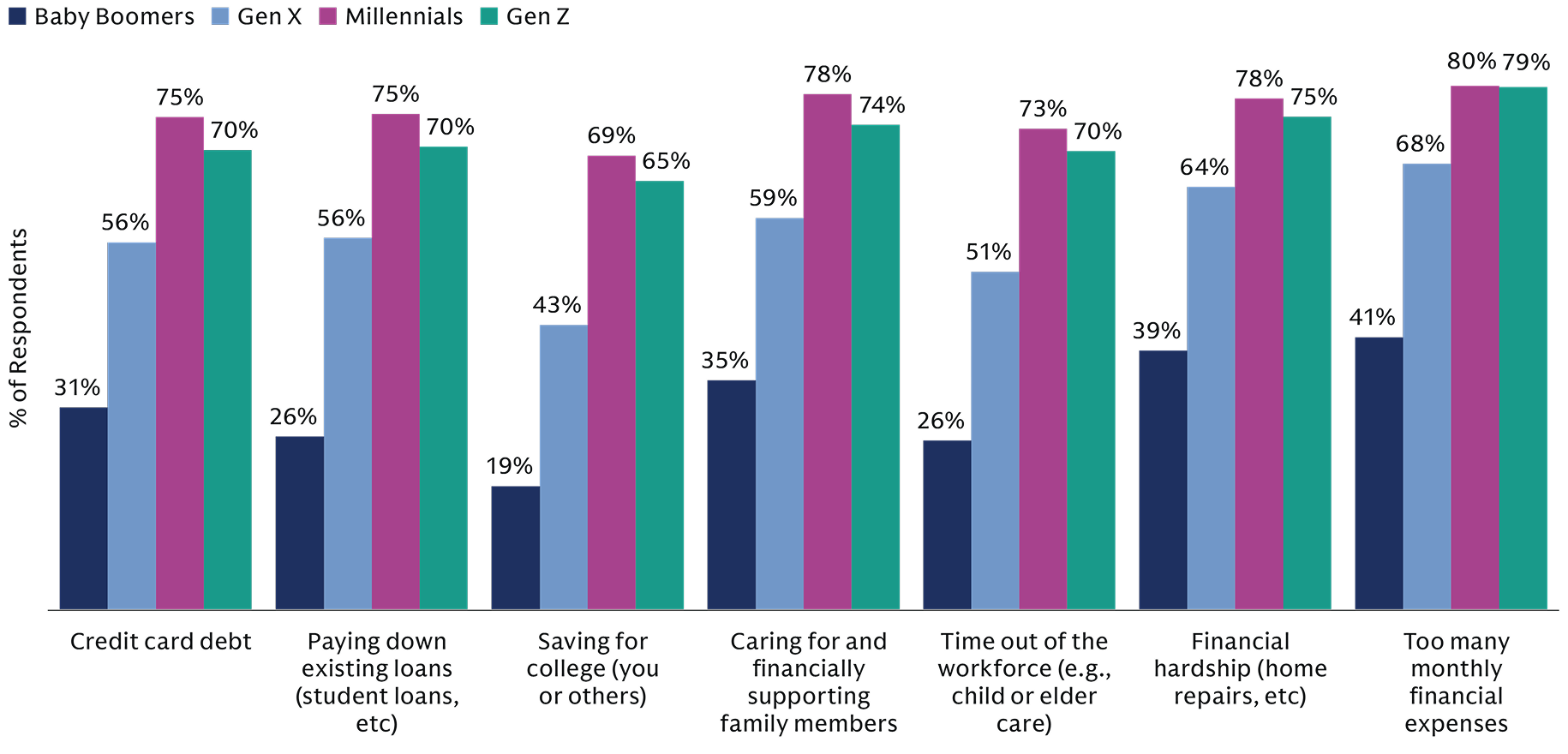

Far more younger workers are impacted by the Financial Vortex, which showed an uptick in impact in our latest survey data, following a few years of modest decline. On average, those saying their savings are materially constrained by the Financial Vortex:

- 31% of working Boomers

- 57% of Gen X

- 75% of Millennials

- 72% of Gen Z

Major life events also have a key impact on retirement savings. Notably, 66% of Gen Z and 59% of Millennials experienced at least one major life event – including buying a new home, divorce, marriage, sending a child to college – in the past 24 months. As a result, 70% of those with a life event either (i) paused retirement savings contributions, (ii) took a retirement-plan loan, or (iii) planned to retire later.

How costly are changes to savings and plans due to the Financial Vortex and/or life events on retirement? Illustrative calculations in the report demonstrate how a saver can fall behind if they cannot balance these events effectively.

- Ten-year late start to savings: -38% hit on retirement savings.

- Out of work for eight years: -27%

- Early career cashout: -17%

- Early retirement at 62: -25%

- 1% lower investment return: -20%

- Multiple scenarios (over career): -43%

These examples are for illustrative purposes only and are not actual results. Portfolio Rate of Return is at 6% as this is assumed to be a conservative total return of a diversified portfolio. The figures above are for illustrative purposes only based on certain assumptions, hypothetical information, estimates, projections and statements regarding certain life events of a hypothetical retirement saver. This does not reflect results of any Goldman Sachs product. If any assumptions used do not prove to be true, results may vary substantially. Please refer to the end notes for additional disclosure.

“Our survey makes the connection unmistakable: broad-based financial stability and retirement progress move in lockstep,” said Nancy DeRusso, Head of Financial Planning at Goldman Sachs Ayco. “We see a direct correlation between day‑to‑day financial resilience and staying on track for retirement. That’s why, when clients call to review their retirement plan, we routinely look beyond the portfolio—addressing budgeting habits, investment choices, and even how spousal accounts are coordinated. The takeaway is simple and powerful: financial stability is retirement stability.”

New Economics of Retirement Highlights the Reality for Today’s Retirement Saver

The retirement savings landscape is being reshaped by the growing savings gap driven by rising costs and the increasing number of competing financial priorities facing individuals and families. Additionally, as this trend is ongoing, it will likely continue to force workers to strike a finely tuned balance between their immediate financial needs and long-term planning.

Leveraging economic data beyond the participant survey, we track the impact on retirement savers:

- The ratio of the cost of basic expenses to after-tax income has increased dramatically from 2000 to 2025, far outpacing median wage growth and leaving little to save for retirement2. Examples include cost of home ownership, up from 33% to 51%3; paid childcare, up from 12% to 18%4; private college costs, up from 65% to 85%5; and healthcare, up from 10% to 16%6.

- Rising costs, among other factors, have contributed to significant shifts in life goals: The median age of first marriages7 increased (women from 25 to 29, men from 27 to 30), first-time home buyers was up from 31 to 388, and first-time mothers rose from 25 to 289.

- Life expectancy is longer and forecasted to increase: in 2000, the average unisex length of retirement was 17.5 years. In 2023, it was 19.2 years; by 2033 and 2043, it may be 20.4 and 21 years, respectively10.

- The cost of retirement is outpacing inflation with expenditures among retirees from 2000-2023 rising at an annual rate of 3.6%11 compared to 2.6% for inflation (CPI) during the same period.

Source: Goldman Sachs Asset Management, October 2025. Goldman Sachs does not provide accounting, tax or legal advice. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation

"Some say that life gets in the way of retirement savings, but workers should be able to enjoy life’s milestones and take on challenges without letting them derail their retirement plans,” said Chris Ceder, Senior Retirement Strategist at Goldman Sachs Asset Management. “That requires a new approach. We need to anticipate the growing challenges ahead and be willing to evaluate more solutions. By thoughtfully incorporating new investment strategies, potential income options, and practical behavioral changes, we can help close the savings gap and keep individuals on a path to retirement.”

Optimism and Concerns About Outliving Retirement Savings Co-exist

Almost seven in ten (68%) workers surveyed said they are at least somewhat confident that they will be able to meet their retirement savings goals, though just 34% are very confident. And retirement savings are up: 55% increased their retirement savings over the past year, while only 8% reduced their savings.

But this optimism doesn’t eliminate their concerns: 58% of working respondents believe they will outlive their retirement savings.

Further, 49% find managing retirement savings stressful; only 11% find it without stress.

“Save More” Isn’t the Only Answer: New Solutions Emerge

"New, more sophisticated solutions are coming to market, including alternative asset classes that may diversify risk and return drivers and potential guaranteed income strategies that add stability and predictability,” said Greg Calnon, Co-head of Public Investing at Goldman Sachs Asset Management. “Plan providers can help retirement savers responsibly integrate these solutions into a personalized retirement plan to improve outcomes. Personalized investing and advice will be essential to maximize the potential opportunity.”

As the challenges for retirement savers mount, it can be incredibly difficult to close a retirement savings gap with higher savings alone. The ray of hope provided by new and innovative options can boost overall retirement savings:

- Early Savings Accounts: $500 in annual savings from ages 1 to 20, to jump start one’s retirement savings, can boost final retirement savings by 14%.

- Access to Defined Contribution Plan: Savers with access to an employer-sponsored retirement plan have a 29% higher savings to income ratio than those without access to a plan.

- Allocation to private markets: A modest allocation to diversified private-market investments can add 0.50% of excess annual return over the course of a career, resulting in 14% higher retirement savings.**

- Investing with a Personalized Plan: Retired respondents who saved with a personalized plan for retirement had a 27% higher savings to income ratio than those who saved without a personalized plan.

- Guaranteed Income May Boost Retirement Income: A 30% allocation to guaranteed income (single premium income annuity at 7.1%) can boost retirement income by 23% relative to the 4% rule.

Source: Goldman Sachs Asset Management, October 2025 There is no guarantee that objectives will be met. Diversification does not protect an investor from market risk and does not ensure a profit. These examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially.

** Based on a modeled glidepath portfolio (illustrated on pg 28) we integrated private equity and private credit and evaluated the risk and return between the portfolio with and without private market investments. 14% represents the difference in retirement savings based on a 50bps higher return. Further described on pages 28 -29 of the report.

These examples are for illustrative purposes only and are not actual results. Portfolio Rate of Return is at 6% as this is assumed to be a conservative total return of a diversified portfolio. The chart above is for illustrative purposes only based on certain assumptions, hypothetical information, estimates, projections and statements regarding certain life events of a hypothetical retirement saver. This does not reflect results of any Goldman Sachs product. If any assumptions used do not prove to be true, results may vary substantially. Please refer to page 35 in the end notes for additional disclosure.

Methodology

Goldman Sachs Asset Management evaluated responses from working and retired Americans to understand the realities of preparing for and living in retirement. Our goal is to learn about the financial obstacles individuals need to overcome and the lessons they can apply. The Retirement Survey & Insights Report 2025 includes key findings that we hope will help plan advisors and plan sponsors better prepare employees for retirement. Findings are from 5,102 individuals surveyed in July 2025 and provide insights from a diverse set of perspectives, including working individuals (3,588 across generations), and retired individuals (1,514 age 45–75).

To better understand how people make retirement savings and advice decisions in the face of many competing priorities, we engaged behavioral economics firm Behave Technologies (formerly Syntoniq, Inc.). Behave Technologies developed key questions in response to our survey results to analyze four behavioral characteristics – optimism, future orientation, risk-reward focus, and financial literacy. Behave Technologies’ analysis helped provide deeper insights into retirement planning behaviors.

About Goldman Sachs: Goldman Sachs is a leading global financial institution that delivers a broad range of financial services to a large and diversified client base that includes corporations, financial institutions, governments and individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in all major financial centers around the world.

About Goldman Sachs Asset Management: Goldman Sachs Asset Management is the primary investing area within Goldman Sachs, delivering investment and advisory services across public and private markets for the world’s leading institutions, financial advisors, and individuals. The business is driven by a focus on partnership and shared success with its clients, seeking to deliver long-term investment performance drawing on its global network and deep expertise across industries and markets. Goldman Sachs Asset Management is a leading investor across fixed income, liquidity, equity, alternatives, and multi-asset solutions. Goldman Sachs oversees approximately $3.3 trillion in assets under supervision as of June 30, 2025. Follow us on LinkedIn.

Assets Under Supervision (AUS) includes assets under management and other client assets for which Goldman Sachs does not have full discretion.

1Lending Tree, Paycheck to Paycheck Survey; CFP Board Report https://consumerfed.org/wp-content/uploads/2010/08/Studies.CFA-CFPBoardReport7.23.12.pdf

2Median Household Income (after-tax): 2000: Median household income is $42,148 and assume effective tax rate is 18%; 2025: Median household income is $83,730 and assume effective tax rate is 18%; Source: US Census Bureau Median Household Income, Goldman Sachs Asset Management

3Cost of Home Ownership: 2000: Median home price: $119,600, 8% mortgage rate, 20% down payment, Insurance estimate - $500, annual maintenance cost 1% of home value, taxes 1.1% of home value; 2025: Median home price: $410,800, 6.5% mortgage rate, 20% down payment, Insurance estimate - $1500, annual maintenance cost 1% of home value, taxes 1.1% of home value: Sources: Federal Reserve Bank of St. Louis, US Census Bureau, Goldman Sachs Asset Management

4Cost of Child Care (Center-based): 2000: Median cost center-based childcare: $4,000 annually; 2025: Median cost center-based childcare: $12,500 annually; Source: Child Care Aware, Goldman Sachs Asset Management

5Cost of Private College: 2000: Average tuition $16,332; average room and board $6,209. 2025: Average tuition $43,350; average room and board $15,250; Source: College Board, Goldman Sachs Asset Management

6Cost of Healthcare: 2000: average employee paid healthcare premiums $1,715; estimated out of pocket expense $1,776 (assume three family members). 2025: average employee paid healthcare premiums $6,269; estimated out of pocket expense $4,542 (assumes three family members). Source: Kaiser Family Foundation, Goldman Sachs Asset Management

7Median age of marriage: https://www.census.gov/data/tables/time-series/demo/families/marital.html

8National Association of Realtors

9Center for Disease Control and Prevention. As of 2023, latest finalized available

10Social Security Administration; https://www.ssa.gov/oact/NOTES/ran2/an2024-2.pdf

11BLS, Consumer Expenditures Survey 2000, 2023