Riding the Tri-Cycle in Private Markets: Identifying Compensated Risks in a Dynamic Environment

Introduction

An inflection point in the business cycle, against a background of a profoundly changing world order, makes for a dynamic environment for today’s investors. Investors are contending with disruptive developments across three modulations – the sentiment cycle, the business cycle, and the secular trends that transcend cycles. A risk-based framework can be helpful in translating these developments into actionable portfolio strategies. For private markets investors, the endeavor is two-fold: evaluating the outlook for existing portfolios and determining the strategy for deploying new capital. Identifying the key risks to monitor can be instrumental in understanding vulnerabilities that may be embedded in current positions. Identifying which risks are most likely to be attractively compensated, and which risks to mitigate, can be a useful tool for setting the strategy going forward.

Source: Goldman Sachs Asset Management.

The Three Modulations

Watch the Spin

The sentiment cycle reflects evolving investor risk posture and outlook as market participants digest short-term economic movements. Private market assets are largely insulated from the day-to-day sentiment gyrations, but a view across months or quarters can highlight opportunities and challenges of market dislocations. Furthermore, sentiment impacts the broader portfolio and drives both denominator and numerator effects, the former via changing market values in different parts of the portfolio, the latter via changes in the pacing of distributions and capital calls.

Today, a combination of declines in public market asset valuations and a slower pace of distributions from mature private funds have led to a growing number of Limited Partners (LPs) being over-allocated to private markets. However, the vast majority intend to stay the course, increasing or maintaining their long-term allocations to the asset class. Many LPs are therefore coming to the secondary markets to generate liquidity and capital capacity to invest in new vintages and adjust strategic allocations. General Partners (GPs), likewise, are looking for solutions to extend the duration of attractive investments that they hesitate to exit in a challenging market. In this environment, secondaries investors are well-positioned to capitalize on being a provider of liquidity and solutions capital.

A New Rotation

The business cycle evolves across multi-year periods and is driven by macroeconomic developments. Private ownership of companies and assets can facilitate dynamic adaptation to meaningful changes in the outlook for GDP, inflation and rates. GPs may adapt their strategies for managing existing portfolios and pursuing new investments. LPs can tilt their annual commitment approach via strategy tilts and manager style preferences. This modulation will be the focus of this piece.

The Big Wheel

Secular trends are decade-plus developments that are likely to shape the world: deglobalization, changing demographics, digitization, decarbonization, and destabilization of the world order. The momentum of these secular trends transcends the business cycle. The long-term nature of private markets enables investors to capture opportunities presented by these trends by setting a strategic direction for the portfolio and identifying the key characteristics of success for a manager.

A New Rotation: The Business Cycle

Our base-case scenario draws on the views of the Goldman Sachs Global Investment Research macroeconomics team and reflects the structural challenges and opportunities of an evolving world order. We anticipate the upcoming years to experience positive but muted real GDP growth, inflation higher than the past decade’s but generally moderate and well-managed (although with pockets of the economy potentially experiencing periods of high inflation), and interest rates stabilizing at moderately higher levels than the prior decade. We recognize, however, that experiences will differ by region.

Acknowledging the uncertainty inherent in any forecasting exercise, we consider two other potential scenarios. Our upside case assumes robust real GDP growth and moderate, well-managed inflation that should nonetheless be structurally higher than the last decade. This combination would lead to stable but moderately higher interest rates. While more optimistic, this scenario acknowledges that the experience of the last decade is unlikely to be repeated. The structural headwinds arising from the secular trends noted earlier will continue to impact the world, but our upside case assumes that innovation and adaptability will enable the economy to successfully address them.

Our downside case assumes that the structural challenges will exceed society’s ability to innovate to address them. In this scenario, real GDP growth is flat to negative, inflation is higher and volatile, and interest rates are rising as policymakers aim to control inflation.

Each scenario may call for a different approach to future commitments, whether via strategy tilts or GP characteristics to emphasize in manager selection. Diversifying a private markets portfolio across attractive opportunities in different states of the world can be one way to mitigate the impacts of an uncertain future.

Existing Investments: Risks to Monitor

The private equity ownership structure may be advantaged in a challenging macroeconomic environment, given its long-term orientation, track record of value creation in excess of public companies,1 and ability to support companies in a downturn – which academic studies have found can lead to a lower cost of distress.2 To date, private equity-owned companies have continued to outperform their public peers as macro headwinds have mounted. According to Burgiss data, as of 3Q 2022, the median private equity-owned company experienced 19% year-over-year revenue growth and 12% EBITDA growth. This compares to 10% and 7%, respectively, for the median S&P 500 company.3 However, private equity companies are not immune from business cycle challenges. Operating margin pressures are one example: 2022 was the first year in which median EBITDA growth failed to keep pace with, or exceed, median revenue growth in over a decade. These pressures are likely to continue. Private equity portfolio managers are noting that in various sectors, their companies’ customers have limited ability to absorb further price increases, having absorbed much in 2022. A shift in the composition of higher costs may be exacerbating this dynamic as well. Over the course of 2022, cost pressures were coming from a mix of raw material and wage pressures; today, a greater portion is coming from wage pressures for many companies. Companies are finding that customers are more willing to absorb higher material costs, which are more visible to them, than higher labor costs, which may not be as obvious. As such, companies are approaching the point at which further price increases can impact demand.

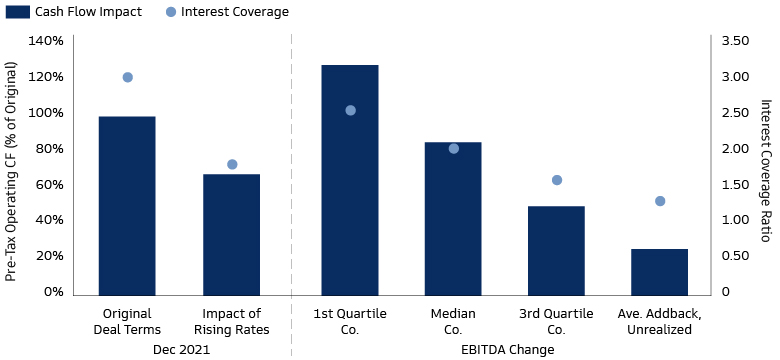

Rising interest rates are contributing to cash flow pressures. Their impact can be estimated by considering a hypothetical leveraged buyout (LBO) deal structured in line with average 2020/2021 industry terms. Such a company would have seen its pre-tax operating cash flows decline by over 30%, and interest coverage ratio cut by over 40% due to rising rates. Neutralizing the effect on cash flows would require over 20% EBITDA growth. Many private equity-owned companies have been able to achieve that last year – the top-quartile company in the Burgiss universe grew EBITDA by over 40% year over year. And the median company, at 12% EBITDA growth, would have experienced a 15% decline in pre-tax operating cash flows and a 1x decline in interest coverage – to a still-healthy 2.0x. However, the third-quartile company in the Burgiss universe experienced a 12% EBITDA decline – a result that would have cut cash flows by half and decreased interest coverage to 1.6x when coupled with higher debt costs.

When buyout multiples reached new highs in the mid-to-late 2010s, private equity managers began noting that they were underwriting to assumptions of multiple contraction on exit and predicated their valuation theses on fundamental value creation. Yet multiples continued rising. This reflected public market dynamics, a shift towards higher-growth sectors, and, in some cases, overly optimistic value creation assumptions. Lenders were willing to underwrite robust value creation assumptions as well. As we covered in "Preparing for the Rising Tide of Rates,” EBITDA addbacks averaged 25-30% of pro forma EBITDA for deals signed in 2015-2020,4 much of that in expected cost savings – but cost savings can be particularly hard to achieve amidst heightened inflation. Over the next several years, instances of overly optimistic underwriting will likely become clear, with value creation plans that rely on margin expansion, rather than top-line growth, particularly challenged.

A company underwritten to the average addback and unable to realize this assumed improvement would see its pre-tax operating cash flows decline by over 60% due to EBITDA and interest rate effects, while its interest coverage ratio would have dropped to 1.3x. The company would still be able to cover its debt service, but would have little room for operational missteps or further interest rate increases – at a time when corporate margins seem primed for a downturn while interest rates may rise further, albeit at a slower pace. The company would also have little resources for growth initiatives, and its ability to repay its debt upon maturity comes into question. Refinancing activity has pushed out the maturity wall, but nonetheless, almost $300 billion of loans is currently scheduled to come due in the next three years.5 With around $10 billion due this year, few credits are currently stressed. However, rating agencies are anticipating default rates to rise through 2023 and 2024 to the longer-term average of 3-4%. Novel rescue financing structures implemented in the immediate aftermath of COVID-19 are introducing additional complexity for distressed lenders to navigate.

Source: Goldman Sachs Asset Management. For illustrative purposes only. Original deal term reflects aggregate LBO industry statistics as of 2021 for EBITDA multiples, leverage used and SOFR floor amounts (source: LCD) and a spread on private credit sourced from the KBRA database. Impact of rising rates reflects SOFR as of 3/1/2023 (4.5%) vs. 12/31/2021 (floor: 0.50%), (source: Federal Reserve Bank of New York). Past performance is not indicative of future results.

Aggregate industry-level data suggest that dealmaking approaches are now starting to change, with the challenging environment having forced the hand of some GPs. Deals have become smaller, with more conservative capital structures – according to KBRA data, the average buyout is using 1.4x less turn of leverage. The average deal size has declined, as lenders are cautious about financing large acquisitions. Buy-and-build strategies are increasingly in favor, due to both a lower average entry multiple and more straightforward value creation strategies. Financial sponsors are more measured in their deployment pace, focusing on the highest-quality deals and walking away when the sellers’ pricing expectations diverge from their own. All this has contributed to meaningful declines in deal volumes.

Over time, deal volume will return – GPs have incentive to deploy their dry powder. In monitoring the implications of dry powder, we believe risk lies less in absolute levels of dry powder and more in its age, since pressure to deploy is felt most acutely toward the end of the investment period. A recent academic study has found that deals executed by funds with high amounts of dry powder toward the end of the investment period tend to be larger, more expensive, and less levered – and to display significantly lower returns than other deals.6 Today, funds that are 3-5 years old, and most likely to feel pressure to deploy, account for around 40% of total dry powder. Some of this dry powder is being held in reserve, to fortify existing portfolio companies and, especially in venture capital and growth strategies, to invest in follow-on deals in portfolio companies that are on attractive trajectories. When used prudently, this approach creates value. In other cases, it merely forestalls the decline.

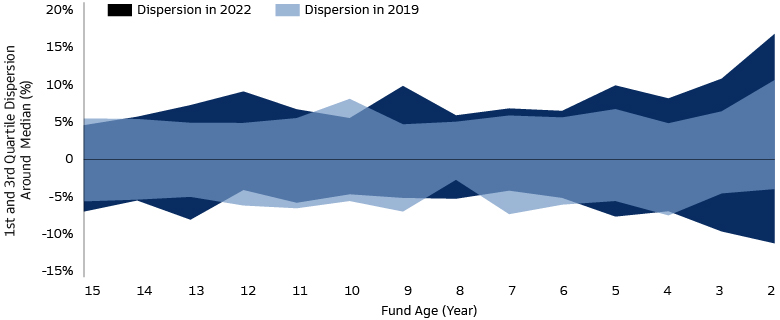

In aggregate, we anticipate that overall returns for recent vintages should be lower than what was underwritten to. MOICs would be impacted by the overall value realized in investments; IRRs would be further impacted by a potentially longer average investment duration as funds avoid selling attractive assets in a less hospitable environment. However, there should be a greater degree of dispersion across funds than has been the case in the past. A comparison of returns in the most recent quarter with that of three years ago shows that dispersion is already increasing for funds whose value is still largely unrealized.

Source: Cambridge Associates, data through 2Q 2022. Past performance is not indicative of future results.

On the real asset side, our colleagues have previously written about the ways in which different real estate sectors, geographies, and assets may fare differently given higher inflation, slower growth, rising rates, and long-term secular trends. In infrastructure, too, much depends on individual asset quality, sectors, and geographies – as previously discussed in the article "Infrastructure in Inflation: The Coming Dispersion”. Similar to the case in private equity, infrastructure GPs are noting limits to their ability to pass on rising costs in certain sectors. This may be a bigger factor for businesses whose cost structures are meaningfully different from the components of the PPI index, which typically drives revenue escalators. More labor-intensive businesses and new construction are seeing greater margin pressure than less labor-intensive businesses. These dynamics are likely to support pricing of existing assets.

Office and retail sectors are particularly vulnerable to liquidity imbalances. A CBRE analysis projects a $53 billion funding gap for office properties and a further $3.5 billion for retail properties over the next 3 years,7 as loans mature amidst declining equity values and a dearth of available financing. With around $1.1 trillion in commercial real estate loans likely to require refinancing or maturity extensions in 2023-2024, asset owners may experience more stress, in some cases opting for strategic defaults. This is particularly true for those with unhedged floating-rate exposure which, similar to corporate assets, is leading to rising interest costs that can create cash flow issues for some asset owners.

Over the long term, however, the outlook for these sectors may not be clear-cut – supporting a thoughtfully executed opportunistic approach. While the current situation reflects disruption of the “traditional wisdom”, we also caution about assuming that today’s “new wisdom” will continue unabated. For instance, many large companies have been able to bring employees into the office on at least a partial basis. However, the office of the next decade will likely look different than that of the last decade. Digital enablement and sustainability are becoming more highly valued. In Manhattan, for example, visits to Class A+ office buildings are two-thirds of the way back to their pre-COVID 19 levels, while visits to Class B buildings are just over half-way back.8 Demand for specialized office space for sectors such as life sciences should continue to grow, and more office properties may be developed in the tier 2 cities that experienced net migration – perhaps the best way to bring workers back into the office is to bring the office closer to them. Similarly, the “new wisdom” of e-commerce supplanting brick and mortar retail may be a more muted trend than currently assumed. While e-commerce should continue to grow, some online-native direct-to-consumer companies are beginning to appreciate the value of a physical presence for marketing and customer acquisition.

With the scope of infrastructure evolving towards digital enablement, some infrastructure GPs have taken on equity-like exposure, with more product risk, to keep pace with broader market beta. This may have been a tailwind over the past several years but a headwind today. As such, greater performance dispersion is likely in real assets as well.

New Commitments: Risks Likely to Be Compensated, Risks to Mitigate

Institutional investors are largely maintaining their strategic commitments to the private markets – but staying the course does not mean a static portfolio. Opportunities exist to tactically tilt commitments across strategies and to sharpen focus on the approach to manager selection. For investors considering such approaches to new commitments, we lay out which risks we believe are likely to be compensated in each of our three scenarios, and which risks to mitigate.

Private Equity

BASE CASE:

Risk Likely to Be Compensated: Transformation

Whether enhancing digital capabilities, introducing sustainable approaches, or repositioning the company for a changed world, transformation should be at the core of the private equity value creation thesis. This becomes even more critical given our expectations of lower return contributions from two other LBO value creation levers: multiple expansion and leverage. Opportunities for transformation transcend sectors or regions. A recent Bain study9 has found that performance varies more across private equity-backed companies within a sector than they do across sectors – illustrating the impact of operational value creation. In our view, new investment should be predicated on a revenue growth strategy, not solely margin enhancement, as top line growth is the main driver of long-term value. In a scenario of muted overall growth, a company can exceed that trajectory by gaining market share or raising prices above market. These approaches call for a superior product and customer experience, and a robust, data-driven pricing strategy.

This growth should be supported by a disciplined cost structure and attractive unit scale economics, to enable companies to grow in a capital-efficient manner. We believe that capital efficiency will become more important in the years ahead, given our expectations of a structurally higher cost of capital.

Valuation discipline is also crucial, and sourcing strategies may need to adapt to prioritize areas where entry valuations may be more attractive. Buy-and-build strategies generally feature a lower blended average entry multiple in addition to a clearer path to value creation. Public-to-private strategies may be a fruitful sourcing channel, as large corporations divest noncore assets in an effort to streamline their businesses for efficiency and resource optimization in a higher cost of capital environment. Strategic solutions may come to the fore as well. For instance, company owners may be interested in structured transactions that combine elements of credit and equity, avoiding triggering a change-of-control provision that would necessitate refinancing debt at higher rates than the original financing. Venture capital and growth strategies have seen a slowdown in deal flow, but we believe this will prove to be temporary. Numerous prominent companies were started during prior economic downturns, and we believe this cycle should be no different. GPs who can add value to their portfolio companies should continue to see demand for capital from promising entrepreneurs. Alongside growth initiatives, the economics of scaling portfolio companies should come into more focus in the decade ahead.

Risk to Mitigate: Operational Risk

The success of a transformation strategy relies on execution expertise. LPs should seek out GPs with a proven ability to grow and create value in portfolio companies, investment discipline in terms of both investment pacing and valuations, and a culture of continuous skillset enhancement to be able to adapt value creation strategies to an environment in which understanding technology, geopolitics, and the evolving customer preferences becomes more important than ever. A focus on select economies or geographies may mitigate macroeconomic and geopolitical risks outside the investor’s scope of control.

UPSIDE CASE:

Risk Likely to Be Compensated: Moonshots

Many of the world’s challenges require new sophisticated technologies, bold ideas, and innovative solutions. These solutions are likely to be more capital intensive than the innovations of the last decade, as they are likely to involve a larger component of physical presence. For instance, robotic innovations to address a declining labor force in countries with aging populations would have greater physical asset requirements than software-based solutions for faster flow of information. Such breakthrough ideas may find a more supportive adoption and funding environment in the upside scenario, as here investors may have the greatest optimism and appetite for product risk. Sustainability solutions may also find the greatest adoption in this scenario despite initially higher cost curves, as willingness to pay a premium is highest when the underlying customer’s financial health is at its best. It is also likely that the path to the upside scenario, with its more robust growth and muted inflation despite the pressures of aging populations, deglobalized supply chains, and climate change, would be driven by successful moonshots. Rechargeable EV batteries, battery recycling and fusion energy are examples of moonshots – technologies that, if and when commercialized in an economically feasible manner, have the potential to transform sustainability efforts. Capital is needed to develop and manufacture these solutions, as well as many others that may not yet be on investors’ radars.

Risk to Mitigate: Lax Discipline

Amidst broad-based optimism that would characterize an upside economic scenario, valuation and pacing discipline continues to be important for successful investing, as well as a grounding in reality. History offers plenty of examples where the perceived potential or pace of technological development exceeded the foreseeable reality, leading to a herd-like investor mentality. The path to commercial success may be long, but it must be feasible and allow for attractive base-case returns.

DOWNSIDE CASE:

Risk Likely to Be Compensated: Defensive Posture

In this scenario, low growth and high inflation may mean that upside is generally limited, and the risk/return asymmetry is to the downside. As such, trading off upside risk for downside mitigation may be a smart bet. Companies may increasingly turn to hybrid financing to avoid outright sale or appearance of value diminution; investors, too, may choose to trade off some upside in return for downside mitigation. With a more risk-off posture, less financing might be available for large capital-intensive projects whose growth and efficiency benefits are years away. As such, costs are likely to be structurally higher, and cost mitigation strategies more important. Private equity portfolios may become more concentrated, as GPs optimize their limited resources with a focus on the most promising opportunities.

Risk to Mitigate: Entrenchment

Efficiency and cost mitigation strategies are important in a low-growth, high-cost environment. However, if new opportunities and growth initiatives are de-prioritized, upside potential will be limited. In our view, the best outcomes would result from a balance of efficiency and growth initiatives, and investors should avoid GPs that prioritize the former at the expense of the latter.

Private Credit

BASE CASE:

Risk Likely to Be Compensated: Financing Risk

With growth and return on capital low, and the cost of debt higher, senior credit may accrue a greater share of total value than other parts of the capital structure. Private senior lenders are already experiencing robust demand from high-quality borrowers, while underwriting at more conservative valuations and capital structures than recent history. As the current dislocation resolves, mergers & acquisitions (M&A) and corporate divestiture activity resumes, and public financing returns, the negotiating position between lenders and owners should be more balanced; however, we believe leveraged buyout (LBO) sponsors will continue to turn to private credit to benefit from its certainty of execution, flexibility, and ability to manage complexity.

With defaults muted in this scenario, fund-level leverage of senior or unitranche credit can enhance returns. However, when using fund-level leverage, investors must consider that risk is asymmetric to the downside, given that performing credit returns are driven by repayment of obligations and amortization of the original issue discount.

Risk to Mitigate: Credit Risk

A muted economic environment leaves less room for operational stumbles, making credit selection critical. It also means that risk/return tradeoffs across the capital structure should be considered carefully, with potential defaults impacting junior credit first. With senior credit benefitting from higher base rates and wider spreads in our base scenario, the increased yield from moving down the seniority spectrum may not be worth the higher risk.

UPSIDE CASE:

Risk Likely to Be Compensated: Credit Risk

A robust economy would increase the likelihood of full value realization across credit tranches and enhance the value of upside participation structures – such as warrants – that mezzanine and other junior instruments typically use to enhance returns. Taking credit risk is therefore likely to be most prudent in this scenario. The mezzanine opportunity set is likely to be robust in this scenario, as a strong M&A and LBO market enhances demand for this financing.

Diversifying outside corporate lending is also most prudent in a strong macroeconomic environment. Lending to consumers – typically the most economically sensitive segment – is least risky in this environment. Specialty finance can be an effective portfolio completion tool, provided the investors has access to lenders with the ability to price and structure complex assets. The complexity of pledging intangible assets, such as intellectual property, as collateral lie in the challenges of proper risk assessment, as well as the long timeframe for some intangibles to translate to sales. However, for sophisticated underwriters with the requisite valuation skills and tools, this opportunity, unique to private markets, can be a compensated risk.

Risk to Mitigate: Refinancing Risk

When a company is acquired or publicly listed, its debt is typically refinanced. In a robust M&A and IPO environment, the result is a credit portfolio with a lower duration than had been underwritten to, implying a lower MOIC despite no downward pressure on the IRR. Investors should calibrate their duration and cash flow expectations to reflect this dynamic.

DOWNSIDE CASE:

Risk Likely to Be Compensated: Barbell Exposure

In a volatile, uncertain economy, a two-pronged strategy may be worth pursuing. Downside mitigation can be sought via senior, unlevered corporate and real asset credit. Investors may choose to tilt a bit more to the latter than would be the case in the base case scenario – backed by tangible assets, real asset credit may provide a more resilient form of collateral. When public markets struggle with uncertainty, syndicated lending becomes less assured, and the value of certainty of pricing and execution offered by private credit may be reflected in pricing power. With new origination likely curtailed, new opportunities for private credit strategies may come from purchasing existing loans, potentially at an attractive discount. At the same time, more companies may experience distress, creating a rich opportunity set for opportunistic, distressed and special situations managers.

Risk to Mitigate: Inexperience

Distinct skillsets are required from managers underwriting at opposite ends of the credit spectrum, but financial, structuring, and legal expertise are critical given the higher probability of distress in this scenario. GPs with experience through full market cycles are more likely to successfully navigate defaulted credits and execute workouts to reach successful outcomes for their investors.

Private Real Assets

BASE CASE:

Risk Likely to Be Compensated: Transformation

For real estate, our base case scenario may be optimal – moderate growth with some inflation keeps supply in check, supporting pricing on existing properties, while reasonable interest rates support asset values overall. In infrastructure, some sectors are fragmented across many players, with a number of smaller companies poorly positioned to pass along inflation to their customers. These sectors may lend themselves to buy-and-build strategies. Digital fiber is an example of a sector in which a platform strategy today can be executed at a meaningfully lower overall valuation than acquiring a single large asset.

Similar to the case for corporate assets, value creation in real assets relies on transformation. Real assets stand well-positioned to capitalize on secular mega-trends. Reshoring of supply chains creates opportunity for warehouses and logistics – a dynamic that the auto sector is already benefitting from. Demographic trends present opportunities around life sciences real estate, student housing, and senior living facilities. Sustainability is most easily expressed in this asset class, by developing and repositioning properties to be more sustainable and developing infrastructure assets around the electrification theme. Today’s dislocations may present attractive opportunities for opportunistic investors to acquire dislocated assets and enhance their long-term value through sustainability and digital initiatives. New opportunities are being created in forestry, sustainable timber, and agriculture. However, the sustainability landscape is becoming more complex, with a growing number of solutions, technologies, and regulations. This makes for the importance of a thoughtful operational strategy and expertise.

Risk to Mitigate: Evolving Externalities

An evolving geopolitical environment is a critical externality to mitigate in real asset investing. Political sensitivities may impact assets that cater to international trade patterns if established relationships shift. Assets that rely on price escalators would be sensitive to any regulations capping their pricing power – which is more likely in politically sensitive sectors such as energy. Because of the immovable nature of most real assets, accessing the correct local expression of the global trend is critical to success.

Climate risk is another externality that may be of particular importance to real assets. Some obvious examples are properties near coasts, as well as ports – which, by definition, are built at sea level. Some types of infrastructure assets have also proven susceptible to extreme heat and cold temperatures, which are becoming more common.

UPSIDE CASE:

Risk Likely to Be Compensated: Longer Duration

Similar to corporate assets, the upside case may prove to be attractive for moonshot ideas – transformative, resource-intensive initiatives, with an emphasis on sustainability and digitization solutions. Valuations and lower capital costs in this scenario should be supportive of longer duration, value-add and opportunistic transformational projects. A broad spectrum of sustainability solutions may find the most eager customer adoption in this scenario. Infrastructure for electric vehicle battery storage and recycling needs manufacturing capacity. A reshoring of supply chains needs significant investment in near-shoring facilities. Going further out on the risk spectrum may also be prudent from a capital competition perspective. In an upside economic scenario, government finances may permit greater investment into infrastructure projects. With public financing typically focused on core assets, private investors may face increased competition in this end of the spectrum. The market may be more attractive, therefore, in value-add or opportunistic areas.

Risk to Mitigate: Strategy Drift

As the scope of real asset investing is redefined with an emphasis on digital, e-commerce logistics, and sustainability, investments will increasingly sit at an intersection of real estate and infrastructure. Furthermore, some opportunities in sustainability and digital enablement may overlap with growth equity. For real asset investors, it is important to maintain the discipline to pursue opportunities with real asset characteristics, rather than leaning primarily into technology risk in this portion of the portfolio. In infrastructure, for instance, these characteristics include asset intensity, functions critical to society, contractual cash flows, limited competition and inelastic demand. It behooves LPs to understand the underlying exposures in their private markets investments to ensure balance and desired exposures at the overall portfolio level.

DOWNSIDE CASE:

Risk Likely to Be Compensated: Shorter Duration

In this scenario, investors may find a focus on core real assets to be advantageous. With shorter duration and cash yield being more valuable in a volatile, rising-rate environment, core assets and structured investments may offer compelling risk-adjusted opportunities. Real assets can perform relatively well due to their inflation mitigation and defensive positioning. Public financing may be strained as budget priorities shift, creating more demand for private financing of core assets.

At the same time, the market may see more opportunities in stressed situations, as rising rates and operating costs stress select assets under development. Similar to private credit, a barbell approach between core and opportunistic may be an interesting way to invest in this environment. Structured investments that give up control in return for yield with some upside may be attractive in this scenario.

Risk to Mitigate: Capital Structure Risk

In this scenario, assets are most vulnerable to rising financing and operating costs. With much real asset financing being floating-rate, maintaining prudent leverage levels becomes critical.

Overarching Themes

Across the various scenarios and strategies, three common themes emerge.

Transformation

This can take different expressions across different scenarios – from buy-and-build platform approaches as an intuitive way to build value, to extreme transformation of entire industries via moonshots, to transforming the portfolio by adding new, emerging, diversifying sources of returns that may become risks well compensated in particular environments.

Duration

Different scenarios call for different durations. For asset owners, more constructive markets may call for extending duration, accessing opportunities with longer-dated cash flows that may revolutionize critical industries and sectors. Private markets, which are structurally set up as long-term, patient capital, may be particularly well suited for long-duration investments. A downside case calls for mitigating duration risk. Conversely, for lenders, a too-short duration becomes a downside risk when the macroeconomic environment is at its healthiest.

Execution

Across strategies and scenarios, the key risk to mitigate is execution. This risk may take the form of an inability to create sufficient value in the underlying portfolio companies or assets, whether by failure to execute, complacency, inadequately ambitious growth plans, or an inability to properly manage around new and evolving risks. It may take the form of a lack of expertise in navigating stressed and complex situations. Lax valuation and capital deployment discipline are also forms of execution risk. For LPs, mitigating these risks requires an analytical approach to manager selection. LPs must go beyond past track records and the stories told by GPs, to select partners with a proven history of value creation and the ability to adapt to a changing environment. At the LP portfolio level, a further execution risk is that underlying exposures may end up different from those intended at commitment, due to strategy drift by its GPs. Portfolio monitoring must go beyond fund and strategy labels to better understand underlying portfolio exposures and be able to detect drifts and unintended concentrations in a world in which delineations between strategies are no longer as clear.

1 See, for instance: Andrea Auerbach, Keirsten Lawton, Caryn Slotsky, “US Private Equity Looking Back, Looking Forward: Ten Years of CA Operating Metrics,” Cambridge Associates, As of November 2022.

2 See, for instance, Haque, Sharjil, “Does Private Equity Systematically Over-Lever Portfolio Companies?”, July 30, 2021; and Belyakov, Alexander, “Economics of Leveraged Buyouts: Theory and Evidence from the UK Private Equity Industry.” As of March 19, 2020.

3 Burgiss (private equity data), Refinitiv (S&P 500 data). As of September 30, 2022.

4 S&P Global Market Intelligence. As of February 8, 2022.

5 LCD. As of December 31, 2022.

6 Lambert, Marie and Scivoletto, Alexandre and Tykvova, Tereza, Agency Costs of Dry Powder in Private Equity Funds (January 31, 2022). Available at SSRN: https://ssrn.com/abstract=4028838

7 CBRE. As of December 2022.

8 Placer.ai, Building Classifications determined by REBNY with assistance from Newmark Research; Chart: Rahul Mukherjee/Axios

9 Or Skolnik, Nadim Malik, and Brenda Rainey, “Raising Sector Strategy to the Next Level.” Bain Capital. As of February 2022.