Stronger for Longer: Investing in India's Economic Ascent

India’s economy remains robust. Reforms continue to improve the business environment. The country is benefiting from a young, expanding population and a geopolitical backdrop favoring its rise as a manufacturing base. Maturing capital markets also bode well for future investment opportunities. While many aspects of India’s growth story are well-known, navigating a vast country experiencing major demographic, economic and societal shifts is not without complexities. These include rural poverty, infrastructure gaps, and the country’s ambitions to balance growth while decarbonizing. We expect India to remain an attractive investment opportunity and a stronger-for-longer growth story. To capitalize, investors should consider a selective approach and focus on solid businesses aligned with secular tailwinds.

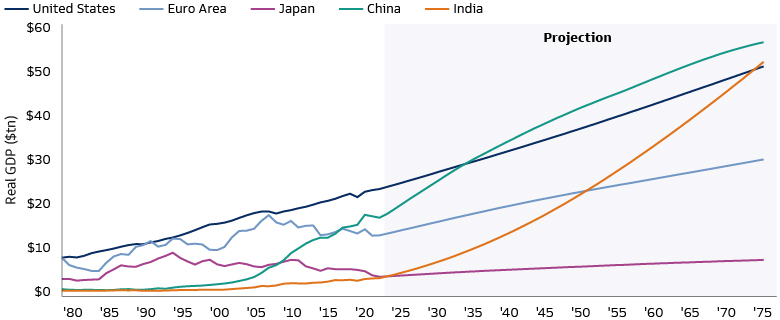

Source: Goldman Sachs Global Investment Research. As of February 12, 2024.

Steady Economy, Unstable World

India has been one of the fastest-growing major economies over the past two decades. Maintaining economic stability by improving the quality of fiscal expenditure (fewer subsidies, more investment) has been a priority for India’s authorities in recent years. The strategy appears to have been effective. Gross domestic product (GDP) was resilient in 2022 (+6.7%) and 2023 (+6.4%). Growth is expected to stay robust in 2024 and estimates suggest that India's GDP can continue to grow at 6.7% per year on average over the next decade.1

Somewhat elevated inflation domestically may mean continued hawkish guidance from the Reserve Bank of India (RBI) in 2024 until inflation aligns with the central bank’s 4.0% goal. The RBI introduced an inflation targeting framework in 2016, setting India’s monetary policy on par with international standards. There has been focus on lowering food inflation, which is 48% of India’s CPI basket and historically a volatile swing factor for overall inflation. The adoption of an inflation target, combined with policy efforts to stabilize food prices, have helped contain inflation expectations.

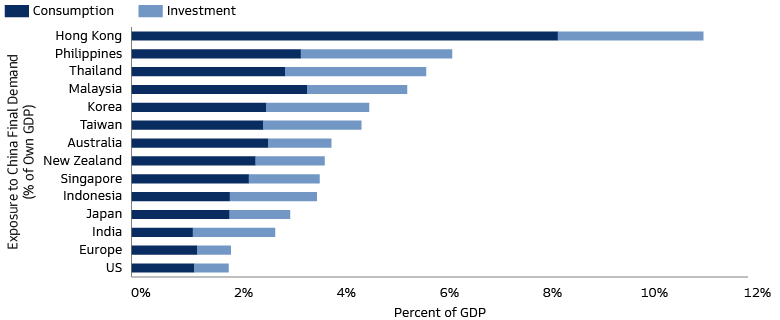

India’s largely domestically driven growth provides a cushion against external shocks. However, external factors, such US dollar strength and geopolitical uncertainty, warrant some caution. Spikes in crude prices may have adverse impacts on the Indian rupee (INR) given India’s status as a net oil importer, although ~$600 billion of currency reserves should allow the RBI to keep the INR stable. China’s macroeconomic challenges are a source of concern. However, when looking at Asia Pacific economies, India has the least economic linkage to China’s end demand (through consumption and investment channels).2

Source: World Input Output Database, OECD, Goldman Sachs Global Investment Research. Based on World Input-Output Database (2022) for 2019 data. As of November 14, 2023.

Capital Market Momentum

MSCI India returned 21% in 2023, outperforming broader EMs.3 While rich public equity valuations are a concern for some investors, India has historically commanded a premium over other EM equity markets. The country has one of the least correlated public equity markets to global indices and is home to a diverse mix of large blue chips and small caps. A growing number of domestic retail investors add depth to the market. Broadly, we think corporate fundamentals are grounded in strong macroeconomic stability and good earnings visibility over the next few years. It will be important to monitor company results as earnings, in India’s case, have been the primary driver of stock returns.

In bond markets, India’s upcoming inclusion in the JPM GBI-EM Global Diversified Index—a flagship local currency bond index widely followed by EM investors—is an example of the country’s increasing international economic relevance. Once India’s phase-in period completes in March 2025, Asia will represent around 48% of the index with China and India likely at the maximum 10% cap. Estimates suggest the index inclusion could generate inflows of more than USD 40 billion for India’s bond market over the following year.4

Given the relatively high yield and lower volatility of Indian government bonds, and low correlation with other assets and bond markets, investors may be attracted to running overweight positions. A deep local investor base—large Indian insurance companies and commercial banks own the bulk of government debt securities—somewhat limits vulnerability of the local bond market to sudden outflows from global investors.

Other routes allow global fixed income investors to gain exposure to India’s growth story, including bonds issued in INR by supranational issuers, such as development banks financing projects in the country. We also see opportunities in India’s corporate bond market, which offers an attractive blend of yield, credit quality and companies aligned to secular growth themes, including digital services and renewable energy.

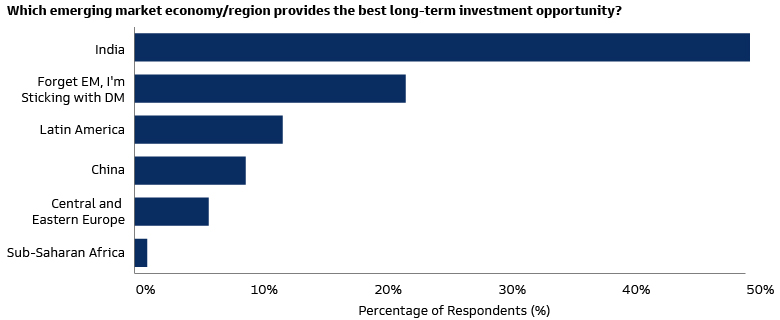

India’s private markets are showing resilience. Private equity investments grew by 10% in the first half of 2023, reaching $16.5 billion.5 Buyout activity for quality assets has accelerated in recent years, particularly in the healthcare sector. India’s global market share of initial public offerings (IPOs) across sectors rose to an all-time high in 2023, outpacing Hong Kong, amid a global slowdown led by a slump in US listings.6 This enabled strong exit opportunities for the country’s broadening private equity investor base, which has quadrupled from 200 to 800 active investors since the early 2010s.

Private credit activity is also on the rise. Over fifty global and domestic private credit alternative investment funds (AIFs) have been registered in India in the last five years. During that time, private credit investments have increased from 5% of India’s total alternative investments by value in 2018 to 16% in the first half of 2023, led by infrastructure deals.7 Creditor-friendly insolvency and bankruptcy laws have improved confidence in the market and demand for new avenues of debt capital.

Source: Goldman Sachs Global Investment Research. Based on 216 respondents at the Goldman Sachs Global Strategy Conference, London. As of January 16, 2024.

Five More Years of Modi?

India, the world’s largest democracy, is one of more than 70 nations holding regional, national, or parliamentary votes in 2024. India’s two largest political parties are the Bharatiya Janata Party (BJP) and the Indian National Congress (INC). The BJP-led National Democratic Alliance (NDA) runs the current central government and hopes to be re-elected this year. The BJP’s strong performance in recent state elections, combined with national opinion polls, points toward Prime Minister Modi securing a third five-year term.8 Greater probability of continuity in the government, along with stability in economic policy, is likely to be positive for Indian assets, including equities.

Under Modi, whose premiership began in 2014, reforms across banking, manufacturing, inflation management, coupled with a focus on physical and digital infrastructure, have boosted the medium and long-term growth potential of the economy. Efforts to broaden access to bank accounts and financial services, particularly in rural areas, have shown positive outcomes, including the formalization of the economy, increased financial literacy among citizens, and improvements to government fiscal spending and tax gathering. We expect a continued focus on reform measures, irrespective of the political backdrop.

Geopolitics, Supply Chains and “Make in India”

India is not immune to geopolitical disruptions, major conflicts, and their repercussions. However, the country is a potential long-term beneficiary of a more fractured global economy. Perhaps the biggest opportunity for India to spur economic growth in the next decade is to develop globally competitive manufacturing hubs as more companies make decisions about producing goods outside China and Russia. If India can capitalize, new manufacturing ecosystems may emerge with more employment and training for workers, along with opportunities for public and private capital to support infrastructure investments.

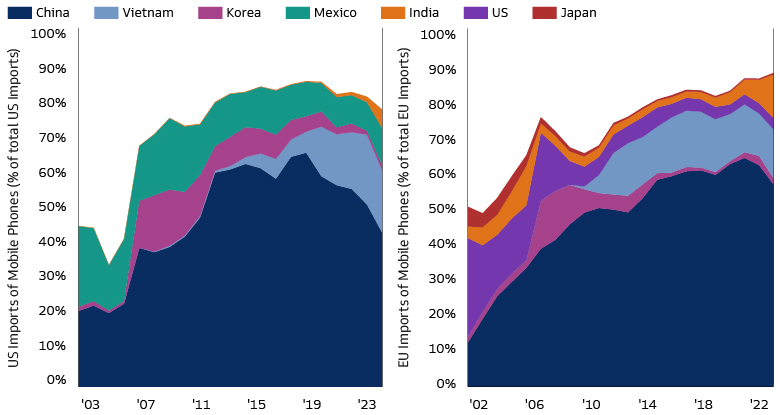

The “Make in India” (MII) initiative—first unveiled a decade ago—aims reduce India’s reliance on imported goods and increase exports of high-quality goods. India’s government has cut corporate taxes for new manufacturing production and launched Production Linked Incentive (PLI) schemes across multiple sectors. Progress has been made since MII was first introduced in areas like electronics given fast-growing domestic demand. Capex intensive industries—such as electric vehicles and semiconductors—may have to rely on global corporations as they develop due to a lack of raw materials domestically.

Source: Haver Analytics, Goldman Sachs Global Investment Research. As of September 10, 2023.

Infrastructure gaps, logistics red tape, and a high risk of power cuts are among the barriers to ramping up manufacturing in India. Different languages and work-life preferences, as well as dispersed production sites, also have an impact. India’s workers tend to work close to home, whereas Chinese workers, for instance, are used to living away from their hometowns. The scattering of factories across India could limit production efficiency compared to China’s mega sites.

Digitization Drive

India has embraced innovation over the last decade. The country now has over 750 million internet users and about half a billion smartphone users.9 Mobile data usage in India has seen a 20x increase in five years and is among the highest in the world today. This has been spurred by a sharp drop in mobile data costs. There has been a rapid increase in internet access, fintech, e-commerce, education, and healthcare technology in recent years. We expect this to continue.

A defining feature of India’s digitization drive is the lead taken by the government in building digital infrastructure. This is reflected in India’s healthy ecosystem of tech startups in areas like e-commerce and online payments, some of which are listing publicly. India may also be positioned to benefit from artificial intelligence (AI). New AI tools and techniques could be used to improve healthcare and education. Indian IT services companies have historically been able to profit from tech disruption by building products and services catering to major tech shifts. Firms that adapt successfully could play key roles in lowering costs and boosting revenues for clients around AI.

Demographically Different

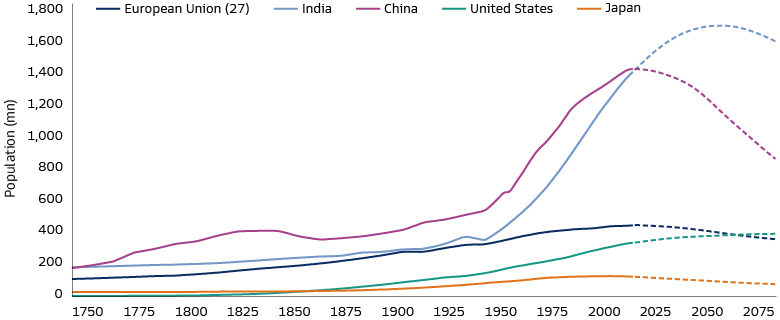

India's population overtook China in 2023 to become the largest globally. The country also has one of the youngest demographics in the world with a median age of 28 years, compared to 39 years in China and the US.10 Millennials and GenZ will account for more than 50% of India’s population by 2030.11 This abundant labor force can help India achieve its near-term domestic growth goals while capitalizing on global supply-chain diversification opportunities. We expect India’s demographic dividend to not only unlock opportunities in services and manufacturing sectors but also unleash the spending power of the country’s young population. We expect consumption stories related to Millennials—especially in e-commerce, food delivery, and the fintech space—to be a driving force in India’s growth.

India’s middle-class population, the largest in the world, is expected to account for 80% of the country’s population and 75% of consumer spending by 2030. We expect this to drive greater demand for premium goods and consumer durables broadly. The auto industry is also expected to grow steadily, including electric vehicles as the government pushes for cleaner fuel through tax benefits and subsidies. Residential property demand is projected to triple in the cities over the next decade due to talent migration to urban areas, driving growth in the cement industry.12 Around one third India’s population lives in cities, a far lower urbanization rate compared to China at 63%, Indonesia at 58%, and South Africa at 68%.13

Source: HYDE (2017), Gapminder (2022), United Nations (2022), Our World in Data, Goldman Sachs Global Investment Research. Strategy Espresso: European companies exposed to India: The Nifty Economy. As of July 6, 2023.

For all India’s demographic advantages, the country has significant social challenges. When adjusted for differences in purchasing power, the minimum wage in India is significantly lower than in most other Asian economies. While relatively lower wages in India may help support the economics of global corporations’ supply chain expansion into India, low pay remains a serious challenge to India achieving decent working conditions and inclusive growth. Most of India’s labor force also operates in the informal sector where workers have no written contracts, paid leave, health benefits or social security.

A major challenge (and opportunity) is that only one in five Indian women are in the formal workforce, among the lowest rates anywhere, and one that has declined, acting as an impediment to growth.14 The status of women in India is gradually improving, but progress is slow. Inequalities, such as gender pay gaps, low age of marriage, and prevailing social norms, limit occupational choices for women. India’s macroeconomic strength and favorable demographics may provide opportunities to promote women in the workforce and empower more female entrepreneurs.

Decarbonization

India seeks to simultaneously grow and decarbonize its economy. The country will need to play a major role in cutting emissions alongside China, the US, and other major economies to limit global warning to 1.5 degrees. Despite being the world’s most populous country, India has relatively low per capita emissions versus other major markets.15 But India’s growing energy needs are still being met by its heavy reliance on coal, along with oil and gas. India has a weaker decarbonization target relative to other countries, both in the near-term (2030) and longer-term (net zero by 2070).

The country experienced extreme weather events, such as heatwaves, storms, and heavy rains, almost every day in the first half of 2023.16 Variability in monsoon patterns coupled with temperature changes affect crop production and food security. Authorities have stated that climate risks can no longer be overlooked and acknowledged sustainable finance is a tool to mitigate them. The RBI established a 'Sustainable Finance Group' (SFG) in 2021. India issued its first sovereign green bond at the start of 2023.17

India is among the most cost-competitive places to deploy renewable energy at scale due to lower wage costs and an abundance of solar power. Solarization of agriculture is one example of an economically viable use case for India’s renewable energy transition. We expect commissioning of big-ticket solar projects by Indian conglomerates in 2024. As the share of renewables goes up, the development of storage plants will be critical for reliable supply and grid stability. The government is also focused on making India a global hub for the production and export of hydrogen produced from renewable energy.

A Stronger for Longer Growth Story

India stands out for its macroeconomic stability. Its long-term growth potential is underpinned by cross-sector reforms, efforts to attract foreign capital, maturing capital markets, demographics, supply chain realignment, and digitalization. India is also unique given its neutral geopolitical position around trade and engagement. The country has a newly influential and complex geopolitical role. It will be important for investors to monitor changes in geopolitics, supply chain shifts, as well as domestic politics in an election year.

Overall, we see exciting long-term investment opportunities in India. Visibility in earnings and the potential continuity in government, and therefore policy, remain key tailwinds for equities. Fixed income opportunities may arise from local emerging market bond index inclusion, and among issuers in India’s corporate bond market aligned with secular growth themes. The country’s evolving private markets provide additional avenues to deploy capital. We advocate an active approach to best identify opportunities to buy into India’s stronger-for-longer growth story.

1Goldman Sachs Global Investment Research (GIR). As of July 3, 2023.

2Goldman Sachs GIR. As of November 14, 2023.

3MSCI, Goldman Sachs Asset Management. As of December 31, 2023.

4Goldman Sachs GIR. As of September 22, 2023.

5Bain & Company. As of August 30, 2023.

6Reuters. As of December 19, 2023.

7Praxis Global Alliance, Indian Venture and Alternate Capital Association (IVCA). As of December 2023.

8Source: Bloomberg, Election Commission of India, Goldman Sachs Global Investment Research. As of December 4, 2023.

9Internet and Mobile Association of India. As of May 3, 2023.

10Worlddata, census.gov. As of February 2024.

11EY India. As of April 2023.

12CLSA. As of November 2023

13World Bank, Haver Analytics. As of February 22, 2024

14Goldman Sachs GIR. Women (Still) Hold Up Half the Sky. As of June 2023.

15Climate Change Performance Index (CPPI). As of December 31, 2023.

16Centre for Science and Environment (CSE). As of July 15, 2023.

17The World Bank. As of June 12, 2023.