How Sustainability Is Transforming the Economy and Creating Opportunities for Investors

The climate transition and the drive to create a more inclusive society are transforming the global economy. If the past year has taught investors anything, it’s that the process is going to be unpredictable.

The decade prior to 2022 saw a rapid expansion of the sustainable investing theme, propelled by swelling investor demand and the multiplying commitments of governments and companies to address the challenges of climate change and social inequality. Last year’s market volatility delivered a reality check, as the spiraling cost of living and energy supply concerns exacerbated by the war in Ukraine shifted attention to immediate economic issues.

Yet while 2022 may have brought the honeymoon for sustainable investing to an end, it did not derail the underlying economic restructuring. In fact, the sustainability transition could be accelerated by factors such as last year's energy shock, which underscored the need for securing natural gas from alternative suppliers, while increasing ambition for renewables. This also led to some countries setting net zero emissions targets for their energy systems. For investors, understanding this process will be essential to managing their assets effectively in the years ahead.

Uniting to Drive the Sustainable Transition

With climate change continuing to affect economies, businesses and communities around the world, the transition to a low-carbon economy is more important than ever. This decarbonization push will require transformative changes throughout the economy – especially in high-emitting sectors such as agriculture, construction, heavy industry and transport – driven by a united effort that includes supportive public policy and rapid advances in technology.

The transformation of the economy is not a distant goal; it’s happening now. We are in the midst of one of the biggest secular macroeconomic shifts in memory, propelled by a strengthening global consensus on the need to address climate change and social inequality that has been mapped out in landmark documents such as the United Nations’ Sustainable Development Goals.1

Reshaping the economy will require investment in companies and their value chains across all sectors, not just those with obvious links to sustainability themes such as renewable energy. After all, the complexity and scale of this systemic change require holistic, scalable solutions. Decarbonizing transport, buildings and industry, for example, will rely on a complex ecosystem of low-carbon technologies including energy storage and carbon capture along with access to clean power.

To make all this happen, mobilizing capital at scale will be critical – and vast amounts of investment are needed. Goldman Sachs Global Investment Research estimates that the price tag for decarbonizing 75% of the global economy now stands at $3.1 trillion per year.2 Key related goals will also come at a cost, and current investment meets only a fraction of annual needs. The shortfall in financing to protect biodiversity, for example, stands at $700 billion per year, according to a key UN agreement signed in December 2022.3

Reality Check for Sustainable Investing

Sustainable investing has expanded rapidly over the past two decades, driven by the increasing commitments of governments, companies and asset managers to support the transition. This growth can be seen in the rising volume of assets managed by signatories to the Principles for Responsible Investment (PRI), a financial industry initiative that helps firms integrate environmental, social and governance (ESG) criteria into their investment and ownership decisions. The roughly 4,000 signatories to the PRI represented more than $120 trillion of assets at the end of 2021, up from just $10 trillion in 2007.4 Goldman Sachs Asset Management is a signatory to the PRI.

After years of favorable market conditions for sustainable investing, 2022 delivered a shock. Market volatility and the surging price of energy driven by supply and security concerns exacerbated by the conflict in Ukraine gave a lift to companies such as traditional energy producers that many sustainability-focused investors had typically omitted from their portfolios. This served as a drag on ESG strategies, as reflected in the underperformance of MSCI’s five main ESG stock indexes compared with the broader market.5 MSCI attributed the underperformance of its ESG indexes primarily to the strong performance of the energy sector and a rally in value stocks amid last year’s inflationary pressures and aggressive central bank tightening of monetary policy.6

While 2022 was challenging for sustainable investing strategies, the market turmoil did not undermine the long-term importance of ESG factors to the performance of listed companies. In a report published last December, Goldman Sachs Global Investment Research showed that stocks scoring higher for environmental and social criteria performed better than lower-scoring stocks in the first 11 months of 2022. This continued a trend stretching back more than a decade: in a study going back to the start of 2012, the lowest-ranking group of companies based on environmental and social criteria consistently underperformed the higher-ranking groups.7

ESG Shock Can Expand Opportunities

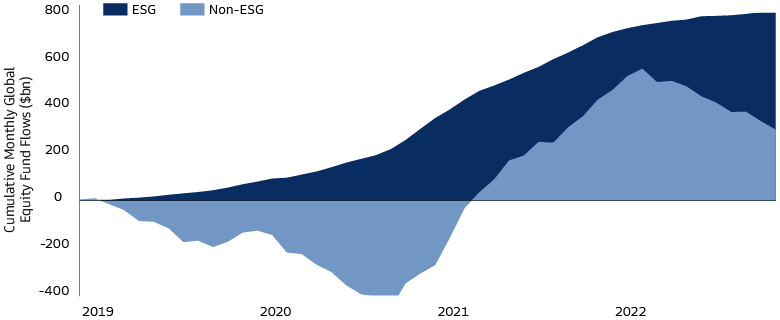

We believe that the strategic consequences of 2022 will potentially support the transformation of the global economy, opening up wider investment opportunities. The sustainability investment case remains strong, supported first of all by resilient investor demand. The flow of investor money into sustainable mutual funds shows this clearly: while these inflows last year were well below highs seen during the pandemic, they remained positive despite the market turmoil. Non-ESG funds, by contrast, suffered outflows throughout 2022.8

Source: Morningstar, Goldman Sachs Global Investment Research. As of December 2022.

Global resolve to achieve key sustainability goals also remains robust. Companies have continued to commit to reducing greenhouse gas (GHG) emissions in line with the overall goal of achieving net zero emissions by 2050. Governments around the world are also scaling up their commitments to the net zero agenda. On the critical issue of the financing needed for mitigation and adaptation efforts, leaders at the COP27 global climate conference in Egypt in November 2022 agreed to establish a loss and damage fund to support countries most vulnerable to the impact of climate change.9

The challenges of 2022, in particular the energy security issues in major European economies, will also add to the sense of urgency to accomplish global sustainability goals, and this could accelerate the energy transition by boosting efforts to develop and deploy sustainable alternatives to fossil fuels. Despite some short-term setbacks caused by the energy shock, such as increased reliance on coal in 2022,10 we believe last year’s turmoil has strengthened longer-term incentives to advance the shift to renewables and increased electrification.

Creating the Right Incentives

A successful transition will require a swift ramping up of investment. For example, the nearly 190 countries that signed the UN’s landmark Kunming-Montreal Global Biodiversity Framework in December aim to mobilize at least $200 billion per year in biodiversity-related funding from public and private sources.11 To muster private capital on this scale, public policy must create the right incentives, especially in high-emission, hard-to-abate sectors such as industrial, transport, energy, chemicals and construction.

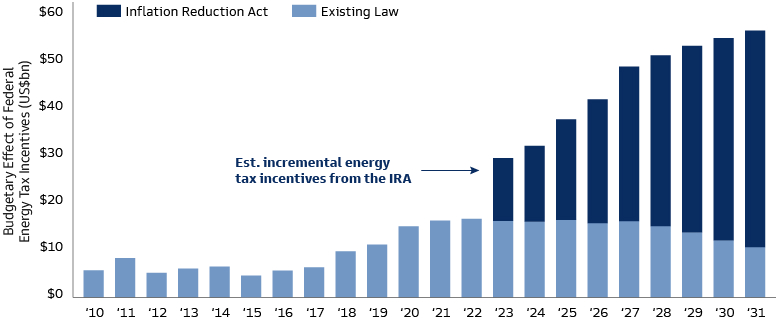

Recent evidence shows that policy makers are getting the message. In 2022, the US finalized the Inflation Reduction Act (IRA), which includes climate-related measures designed to accelerate the transition to a clean energy economy. The Act unleashes more than $390 billion in federal support for climate and energy initiatives over 10 years, with about $270 billion of that coming in the form of incremental tax incentives – a level of spending that could boost the competitiveness of the US in clean energy. It could be most transformative for battery storage, hydrogen, carbon capture and energy efficiency, according to Goldman Sachs Global Investment Research.12

Source: US Treasury, Congressional Budget Office, Goldman Sachs Global Investment Research. As of January 3, 2023. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved.

The impact of the Inflation Reduction Act will also be felt outside the US, including in the European Union, which has long been a leader in promoting the development of sustainable solutions through sweeping initiatives such as the European Green Deal, which sets out the bloc’s strategy for reaching net zero GHG emissions by 2050. In February 2023, a few months after the US Act was signed into law in Washington, EU policy makers unveiled a Green Deal Industrial Plan to increase the competitiveness of Europe’s net zero industry and speed the transition to climate neutrality. The plan foresees investment in strategic net zero sectors, including through tax benefits.13

Other countries are also deploying investment and incentives in the race to shape the future of clean energy. China has invested heavily in clean energy supply chains and currently dominates the manufacturing and trade of most clean energy technologies, according to the International Energy Agency (IEA).14 India’s government recently launched a range of initiatives to spur development of renewable energy technologies under its Production-Linked Incentive Scheme.15

Finding Transformative Investment Opportunities

We believe companies that transition successfully will be best positioned for success in the new sustainable economy. For investors, this is not an impact bet but an understanding of where the economy is going. Investments that help accelerate the transition therefore have the potential to provide attractive financial returns. The task for investors is to be the smartest at spotting opportunities amid the turbulence.

Green solution providers are essential to the development of solutions that will facilitate the transformation. The scale of innovation needed is highlighted by the IEA in a report on reaching net zero by 2050. While most of the global reductions in GHG emissions needed through 2030 can be achieved with technologies that are readily available today, in 2050 nearly half of reductions will come from technologies that are currently at the demonstration or prototype phase.16

Green solutions firms cannot do it alone, however. Our real lives depend on an enormous range of products from traditional industries, and the biggest investment opportunities will likely be found in these sectors – where the challenges are the greatest. If companies such as producers of energy and building materials navigate the transition well, they can become leaders in the sustainable economy, gaining market share and enhancing their business models and cost structures. The leaders in these industries will create integrated products that take ESG considerations into account. To find them, sustainable investors will need to broaden their scope.

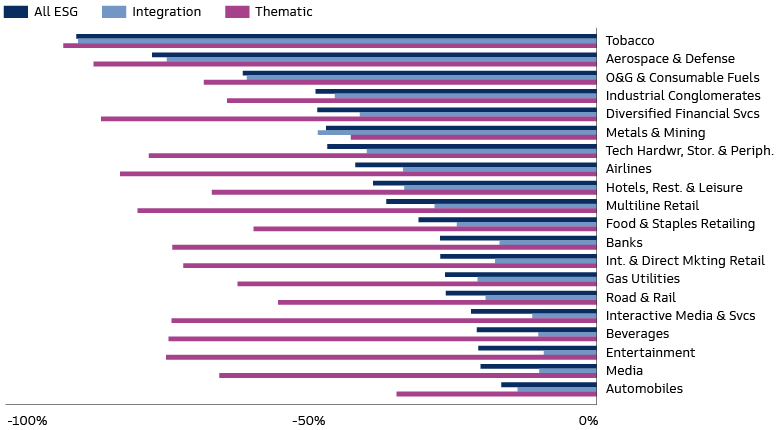

Many ESG investment strategies have a bias towards “pure play” sustainable business models. After all, it is a relatively straightforward task to create a carbon-light portfolio by investing in low-emission companies, even though some of these may have only a marginal relevance to the energy transition. This tendency to hold fewer stocks from high-emission sectors creates an opportunity for investment strategies focused on the transformation of heavy industry and high-GHG sectors where the potential for real-world impact is the greatest.

Source: Morningstar, Refinitiv Eikon, Goldman Sachs Asset Management. As of January 3, 2023

In fact, we are seeing a growing number of such transition and “improver” funds that provide capital and financial incentives for high-carbon industry leaders to step up their decarbonization efforts.17 Since our society and the global economy will still rely on these industries in a sustainable future, a system-wide sustainable transformation needs capital markets and global investors to provide support to both pure play green enablers as well as transition leaders in high-carbon industries.

The global economy is changing fast, propelled by a long-term regime shift around sustainability. This creates both new risks and new opportunities for investors, and embedding a forward-thinking, transformative approach in investment decisions and financial products will be crucial for future investment returns and prudent risk management. Such an approach has the potential to generate robust returns and make a positive contribution to the transformation of the economy. By guiding investors and the companies they invest in on their sustainability goals, this approach can also deliver greater impact for society.

1The SDGs are a 15-year global action plan for protecting the environment, ending poverty and reducing inequality.

2“Carbonomics: The Economics of Net Zero,” Goldman Sachs Global Investment Research. As of November 29, 2022.

3“COP15: Nations Adopt Four Goals, 23 Targets for 2030 in Landmark UN Biodiversity Agreement,” Convention on Biological Diversity. As of December 19, 2022.

4“About the PRI,” PRI Website. As of February 27, 2023.

5“The Performance of ESG Indexes: Year in Review,” MSCI. As of January 31, 2023. The broader market is represented in this comparison by MSCI’s flagship global index, the MSCI ACWI. MSCI explains in the report that its ESG indexes historically had lower relative allocations to the energy sector and higher allocations to information technology. These allocations contributed to the outperformance of ESG indexes in the decade before 2022, but this did not hold true last year.

6Growth investment strategies focus on companies’ future earnings and potential to outperform the market over time, while value strategies seek out companies currently trading below their fundamental value. Growth investing is often tightly linked with ESG and sustainability performance.

7“The PM’s Guide to the ESG Revolution IV: The Way Forward,” GS Sustain. As of December 15, 2022.

8“Global Sustainable Fund Flows: 4Q 2022 in Review,” Morningstar. As of January 26, 2023.

9”COP27 ends with announcement of historic loss and damage fund,” UN Environment Programme press release. As of November 22, 2022.

10“The world’s coal consumption is set to reach a new high in 2022 as the energy crisis shakes markets,” International Energy Agency. As of December 16, 2022.

11“Press Release: Nations Adopt Four Goals, 23 Targets for 2030 In Landmark UN Biodiversity Agreement,” United Nations. As of December 19, 2022.

12“10 Predictions for Sustainable Investing in 2023,” GS Sustain. As of Jan. 3, 2023.

13“The Green Deal Industrial Plan: Putting Europe’s Net-Zero Industry in the Lead,” European Commission press release. As of February 1, 2023.

14“Energy Technology Perspectives 2023,” IEA. As of January 12, 2023.

15“Government incentivizes local development and manufacturing of renewable energy technologies,” Ministry of New and Renewable Energy press release. As of March 22, 2022.

16“Net Zero by 2050, a Roadmap for the Global Energy Sector,” IEA. As of May 2021.

17“10 Predictions for Sustainable Investing in 2023,” GS Sustain. As of Jan. 3, 2023.