Opportunities in the Fast-Growing Market for Sustainable Corporate Loans

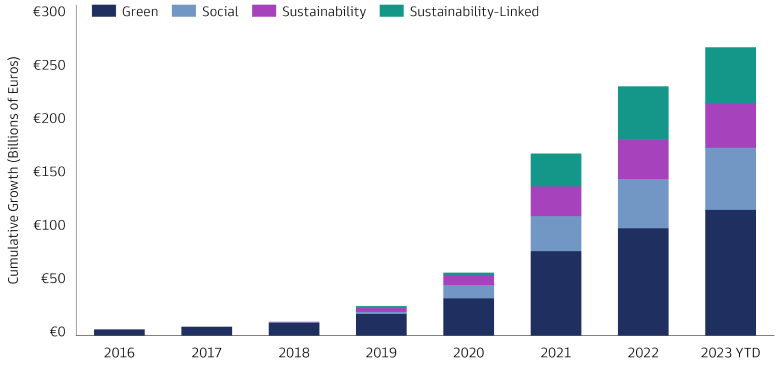

The growth of sustainability investments in private debt is gaining pace. The market for private placements and loans carrying labels such as “green”, “social”, and “sustainability” has increased almost twentyfold from €12.8 billion in 2018 to €270 billion in June 2023.1 Under these labels, a borrower commits to invest the proceeds in green and/or social projects with clear and measurable environmental or social benefits. Other sustainable investment opportunities might lie in “net-zero” strategies to reduce carbon emissions or broader sustainability-linked loans.

This article identifies the most prevailing sustainable investing opportunities in private debt, their structure, and advantages

What are corporate loans?

Corporate loans in Europe can come in the form of US Private Placements (USPP), Euro Private Placements (EUPP) and Schuldscheindarlehen or Schuldschein (SSD), an originally German bond/loan hybrid, and are essentially long-term loans to companies. They also include loans drafted using a Loan Market Association (LMA) template, and other private placements. These debt instruments typically fund general corporate purposes, asset acquisitions, capital and operational expenditure and working capital. Depending on those financing needs, the debt instrument can carry a green, social, sustainable, or sustainability-linked label. These investments are often sourced through banks and arrangers, but they can also be sourced directly through borrowers and asset managers, which provide closer engagement opportunities. Some deals are non-sponsor transactions, which may give investors access to yet another corner of the market.

The corporate loans strategy seeks to maximize long-term total return. This is mainly done via fixed-rate corporate private debt instruments in various forms and with additional amendment and waiver fees, coupon step-ups, prepayment penalties, up-front spread, and privately negotiated covenant protections that might reduce losses.

What is the investment opportunity?

Given the more stringent capital charges for long-term financing, we observe that banks are incentivized to move towards an "originate to distribute" model. This offers institutional investors an opportunity to fill the gap. We expect this gap to stimulate further growth in the European private placement market as institutional investors seek premiums above the more liquid corporate bond market. Labeled loans offer new opportunities for private debt investors to contribute to sustainable development.

Corporate loans can provide diversification opportunities to institutional investors outside their traditional markets or even as a substitute for public credit allocations. The loans can offer an illiquidity or complexity premium, lower volatility than public market investments and opportunities for “green” and social-minded investors.

How are these trends creating opportunities for sustainability-minded investors?

The market for privately placed loans carrying labels such as “green”, “social”, and “sustainability” is evolving rapidly. These labeled loans are very similar to green, social, and sustainability bonds in that the borrower commits to invest the funds in green and/or social projects with clear and measurable environmental or social benefits. We believe that these labeled loans contribute to environmental or social objectives and should have good governance in place. Apart from the strategic material or non-material contribution to environmental and social goals, the structure of these labeled loans is similar to their conventional peers and provides the same recourse to the issuer. Additionality refers to a positive impact that would not have been made without additional investment: for example, providing capital for new renewable energy generation instead of existing renewable energy capacity.

The many guidelines available, such as the Green Bond Principles, Green Loan Principles, the European Union taxonomy for sustainable activities, and the Climate Bonds Taxonomy developed by the Climate Bonds Initiative help make the structuring of these loans relatively simple and transparent. The goal is for the impact and allocation of proceeds to be clearly identified and regularly monitored and measured.

How big is this market?

The global market for green, social and sustainable private placement and loans has grown from €12.8 billion at the end of 2018 to €270 billion in June 2023.2 Due to the changing economic environment, labeled issuance slowed in 2022 from a peak year in 2021, in line with the rest of the market. We expect issuance in the first half of 2023 to be similar to the year-earlier period, followed by more robust growth in the second half of the year.

Source: Bloomberg Private Placements Monitor, as of June 29, 2023. 3

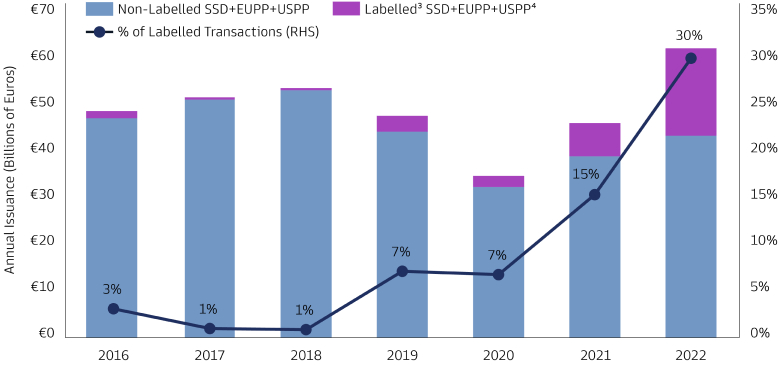

Source: Private Placement Monitor, Rabobank, CACIB, Heleba, Bloomberg, Goldman Sachs Asset Management. As of Dec. 31, 2022. 4

Zooming in on US Private Placements (USPP), Euro Private Placements (EUPP) and Schuldschein (SSD), we note that the share of loans with sustainability components is increasing across the board. In the first quarter of 2023, more than half5 of the Schuldschein transactions carried an ESG link or a green label, compared with a 40%6 share in 2022. A similar trend is evident in the EUPP space, where the percentage of green and sustainability transactions increased to 42% in 2022 from 17% in 2019 and 2% in 2018.7 Thanks in large part to EUPPs and SSDs, the European market for sustainable offerings is outpacing the USPP market, which has started to show only a moderate rise in labeled loans between 2021-2022. Ca 22% of USPPs issued in Europe in 2022 carried a label compared to ca 2% in 2021.8

What’s driving this growth?

We expect continued growth in the labeled loan market, steered by the same forces driving its rapid expansion over the past five years:

- Corporates are becoming more ambitious about moving toward a sustainable business strategy and reducing their exposure to environment and climate-related risks. At the end of 2021, a total of 2,253 com-panies representing $38 trillion of market capitalization followed emission reduction targets approved by the Science Based Targets initiative (SBTi). About 80% of those targets were aligned with the path to limiting global warming to 1.5oC.9 This illustrates how publicly listed and private companies are moving toward more sustainable solutions.

- Many institutional investors have set net-zero emission goals at the company level. These commitments are cascading down to their investment portfolios. Given such strategies, several European institutional investors are creating separate allocation buckets for sustainable solutions that either replace or complement traditional investments. These investors seek to combine attractive returns and promoting a transition to a low-carbon economy.

- Government policy is facilitating the growth of these labeled loans. Numerous governments are setting greenhouse gas (GHG) reduction targets and developing environmental and social taxonomies for investments.

These trends are already creating opportunities for growth in environmental and social investment solutions in the private debt market. One should keep in mind that the market for these use-of-proceeds instruments is still evolving and might not allow investors to create a well-diversified labeled loan portfolio.

How can you create a sustainable but diversified corporate loan portfolio?

A diversified, sustainable corporate loan portfolio combines a sufficient illiquidity premium and deployment speed with sustainability factors that minimize financial and reputational risks and maximize risk-adjusted returns. To have greater breadth and depth in the deal selection process, we see some complementary opportunities to the use-of-proceeds loans.

- There is growing interest in net-zero strategies aligned with the 1.5-degree scenario. This classification mainly targets investment in general corporate purposes with clear GHG emission disclosures and commitments, targets and a decarbonization strategy. The approach, based on the Net Zero Investment Framework developed by the Institutional Investors Group on Climate Change (IIGCC).10 This provides a common set of recommended actions, metrics and methodologies through which investors can maximize their contribution to achieving global net zero emissions by 2050 or sooner.11 Investors can then use a selective set of metrics to the United Nations’ Sustainable Development Goal12 that target environmental objectives.

- Sustainability-linked loans (SLL) are used for general corporate purposes and offer broader investment opportunities than loans tied to a project. The coupon rates on these loans can be related to performance and stimulate the borrower to achieve predetermined sustainability performance targets (SPTs).13 The sustainability performance is relevant and material to the borrower’s general strategy and operations and is measured through key performance indicators (KPIs). The portfolio’s alignment with the SDGs and the 1.5-degree scenario is improved by structuring transactions according to best market practices and a high level of transparency. About three fourths of SLL KPIs are used to assess GHG emissions, renewable energy and energy efficiency.14

- Sustainable investment opportunities can be linked to SDGs or coverage of companies with a relatively high exposure to ‘green’ sectors together with predetermined and traceable KPIs. These investing opportunities in private markets should contribute to environmental or social objectives without doing any significant harm to other such objectives and have good governance in place.

What is the role of active engagement with borrowers?

Engagement is an important element in all these investment opportunities. Engagement with borrowers is not just a risk management tool. Engagement can help align issuers’ activities with investors’ values as well as a means to understand, interrogate and seek to clarify – and perhaps to change - present and future sustainability features of a project, asset or activity. It allows investors to understand how borrowers plan to manage ESG risks and how those risks might affect their credit profile. For buy-and-hold asset strategies, engagement and selection of high-quality investments are a crucial aspect in avoiding stranded assets.

An allocation tool for fixed income investors seeking sustainable opportunities

Labeled corporate loans are increasing in popularity, especially in Europe.15 We see some complementary opportunities in sustainability-linked, SFDR-defined sustainable investments or net-zero strategies aligned with 1.5-degree scenario. These trends are also gaining pace among private placements, which can offer an illiquidity and complexity premium. Private placements also provide access to companies that focus on non-cyclical businesses. These companies typically have a low correlation to economic cycles. We believe that private placements combine potentially low loss rates and high recovery rates with enhanced risk-adjusted returns. This can make them a good fit for liability-matching investment strategies with long interest duration. We believe private loans with a sustainability component can offer investors a complement to, or even a substitute for, existing public credit allocations.

1 Global Private Placement Search, Bloomberg. As of June 29, 2023.

2 Global Private Placement Search, Bloomberg. As of June 29, 2023.

3 Labelled: Green, Social, Sustainability, and Sustainability-linked loans

4 Labelled USPP data is only applicable for 2022. Data prior to 2022 was not available.

5 “Schuldschein Market Update,” UniCredit. As of April 2023.

6 Source: PPM Monitor, Rabobank, CACIB, Heleba, Bloomberg, GSAM as per 31 Dec 2022

7 “European Private Placement Market overview,” CACIB. As of February 2023.

8 PPM Monitor, Goldman Sachs Asset management. As of Dec. 31, 2022.

9 “Companies committed to cut emissions in line with climate science now represent $38 trillion of global economy,” Science Based Targets. As of May 12, 2022.

10 “Net Zero Investment Framework Implementation Guide,” IIGCC. As of April 13, 2021.

11 “Net Zero Investment Framework Implementation Guide,” IIGCC. As of April 13, 2021.

12 “The 17 Sustainable Development Goals,” UN. As of May 2023.

13 “Sustainability Linked Loan Principles (SLLP)”, LSTA. As of May 2023.

14 “The Green Bond and ESG Chartbook”, UniCredit Research; Bloomberg New Energy Finance. As of March 2023.

15 PPM Monitor, Rabobank, CACIB, Heleba, Bloomberg, Goldman Sachs Asset Management. As of Dec. 31, 2022.