Impact Report 2023: Goldman Sachs Green, Social and Impact Bond Funds

Our green bond funds seek to advance the climate transition by investing in bonds whose proceeds are used to finance environmentally beneficial projects. These projects are aligned with the Green Bond Principles,1 a set of voluntary best-practice guidelines for issuers, across categories including renewable energy, clean transportation and green buildings. The Goldman Sachs Social Bond fund aims to address or mitigate specific social issues and to achieve positive outcomes aligned with key categories set out in the Social Bond Principles,2 including affordable basic infrastructure, access to essential services, affordable housing and employment generation.

The Goldman Sachs Global Impact Corporate Bond fund, launched in 2023, invests in a portfolio of green, social and sustainability bonds issued by companies around the world, providing exposure to the full range of opportunities in the transition to a more sustainable economy. Sustainability bonds are used to finance a combination of environmental and social projects and initiatives.

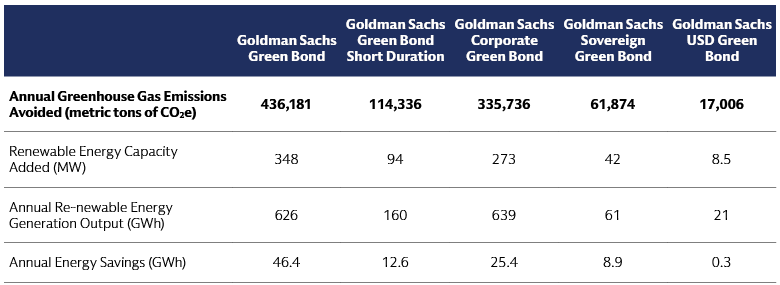

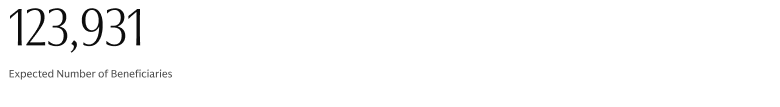

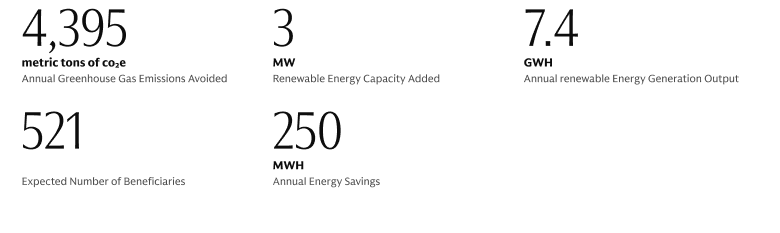

In our Impact Report for 2023, we share the expected impact associated with the investments in our five green bond funds3 across these key metrics: annual greenhouse gas (GHG) emissions avoided, renewable energy capacity, annual renewable energy generation output, and annual energy savings. For the Goldman Sachs Social Bond fund, we measure the number of expected beneficiaries from the projects supported by the bonds in the portfolio. These same environmental and social metrics are also used in our reporting on the Goldman Sachs Global Impact Corporate Bond fund.4 We now manage a total of €11 billion in assets across all these funds.5

Source: Goldman Sachs Asset Management. Data provided by issuers. As of December29, 2023. These metrics are at a point in time as of the date indicated and are subject to change over time. For information on the methodology used to calculate these metrics as well as any limitations or assumptions within the calculations, see page 54 of this report.

Source: Goldman Sachs Asset Management. Data provided by issuers. As of December 29, 2023. These metrics are at a point in time as of the date indicated and are subject to change over time. For information on the methodology used to calculate these metrics as well as any limitations or assumptions within the calculations, see page 29 of this report.

Source: Goldman Sachs Asset Management. Data provided by issuers. As of December 29, 2023. These metrics are at a point in time as of the date indicated and are subject to change over time. For information on the methodology used to calculate these metrics as well as any limitations or assumptions within the calculations, see the Impact Calculation Methodology section on page 54 of this report. For information on the “Expected Number of Beneficiaries” metric, see page 29.

In addition to presenting and contextualizing the expected impact our green, social and impact bond funds had in 2023, this report sets out our approach to investing in these markets and explains the tools we use to screen issuers and gauge the credibility of their sustainability ambitions. As a result of our screening process, which looks beyond the label at the underlying projects and issuers’ sustainability strategies, we reject 36% of the green bonds tracked in our database as well as 30% of the social bonds.6

The report also explores our commitment to promoting and exercising effective bondholder engagement with the issuers in the portfolios we manage on behalf of our clients. This includes investment research and monitoring and our efforts to facilitate market development. Within Goldman Sachs Asset Management’s public markets investing business, the Global Stewardship Team helps drive the continued enhancement of our approach to stewardship in collaboration with our public investment teams. We define "investment research and monitoring engagements" as active dialogue or exchange of written communication with a company or issuers undertaken primarily to seek information or to inform our investment decisions. For example, research analysts engaging on earnings, business operations, or other strategic matters.

1“Green Bond Principles: Voluntary Process Guidelines for Issuing Green Bonds,” International Capital Market Association. As of June 2021.

2“Social Bond Principles: Voluntary Process Guidelines for Issuing Social Bonds,” ICMA. As of June 2023.

3Goldman Sachs Green Bond, Goldman Sachs Green Bond Short Duration, Goldman Sachs Corporate Green Bond, Goldman Sachs Sovereign Green Bond and Goldman Sachs USD Green Bond

4Green, social and sustainability bond issuers provide these metrics to investors in their annual impact reporting. We collect the available data reported by issuers of bonds held in our portfolios, then prorate the numbers by the amount of our investment to yield an aggregate expected impact number for our green and social bond funds. To aggregate bond information at the portfolio level, we use the portfolio level share of allocation and impact per bond. This is calculated as the percentage of a bond’s total issuance held by the fund. In this report, we use the portfolio holdings on December 31, 2023, for this calculation. The aggregated fund level use of proceeds, regional allocation, United Nations Sustainable Development Goal (SDG) contribution and impact metrics can then be derived by adding up the portfolio-level share of weighted bond allocations, SDG contributions and impacts. As outlined in the Impact Calculation Methodology section of this report, our approach tends to yield a conservative estimate of portfolio-level impact for two main reasons. The first is that impact data are not available for newly issued bonds, because issuers usually only publish their allocation and impact reports one year after issuance. For the newly issued bonds in our portfolio, we usually look for older bonds from the same issuer. If both the new and older bonds fall under the same framework and are subject to the same eligible asset pool, we assume the new issue’s impact is the same as that of the older bond. If a bond is the first from a given issuer, however, we adopt a conservative approach and assume its impact is zero. The second reason arises when we have doubts as to how an issuer arrives at the impact figures they provide. If our concerns remain unresolved after engagement with the issuer, we again adopt a conservative approach and assume the bond’s impact is zero.

5Goldman Sachs Asset Management. As of March 31, 2024.

6Goldman Sachs Asset Management. Data as of February 2, 2024. This metric is at a point in time and is subject to change.

The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of movements in the markets or because we are not able to pay you. The real risk may be significantly different if the Product is not held to maturity. The risk indicator assumes you keep the Product for 5 years.

We have classified the seven funds covered in this report – Goldman Sachs Green Bond, Goldman Sachs Green Bond Short Duration, Goldman Sachs Corporate Green Bond, Goldman Sachs Sovereign Green Bond, Goldman Sachs USD Green Bond, Goldman Sachs Social Bond and Goldman Sachs Global Impact Corporate Bond – as 3 out of 7, which is a medium-low risk class. This rates the potential losses from future performance at a medium-low level, and poor market conditions are unlikely to impact the fund's capacity to pay you.

Be aware of currency risk when the currency of the fund is different than the official currency of the Member State where the Fund is marketed to you. You will receive payments in a different currency than the official currency of the Member State where the Fund is marketed to you, so the final return you will get depends on the exchange rate between the two currencies. The risk is not considered in the indicator shown above.

Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity, interest rate, prepayment and extension risk. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline in the bond’s price. The value of securities with variable and floating interest rates are generally less sensitive to interest rate changes than securities with fixed interest rates. Variable and floating rate securities may decline in value if interest rates do not move as expected. Conversely, variable and floating rate securities will not generally rise in value if market interest rates decline. Credit risk is the risk that an issuer will default on payments of interest and principal. Credit risk is higher when investing in high yield bonds, also known as junk bonds. Prepayment risk is the risk that the issuer of a security may pay off principal more quickly than originally anticipated. Extension risk is the risk that the issuer of a security may pay off principal more slowly than originally anticipated. All fixed income investments may be worth less than their original cost upon redemption or maturity.

Mutual funds are subject to various risks, as described fully in each Fund’s prospectus. There can be no assurance that the Funds will achieve their investment objectives. The Funds may be subject to style risk, which is the risk that the particular investing style of the Fund (i.e., growth or value) may be out of favor in the marketplace for various periods of time.

The relevant risks of all seven funds are the following:

Market risk: This risk is associated with financial instruments that are affected by the economic development of individual companies, by the overall situation of the global economy and by the economic and political conditions prevailing in each relevant country.

Credit risk: Possible failure of the issuers of underlying investments may impact the value of your investments.

Liquidity risk: Underlying investment may be difficult to sell, which would impact your ability to redeem your investment.

Sustainability risk: Occurrence of an environmental, social or governance event or condition, that could cause an actual or a potential material negative impact on the value of investments.

An additional relevant risk of the Goldman Sachs Corporate Green Bond fund is the following:

Hedging share classes, a method to try to manage specific interest rate risk, may lead to additional credit risk and to residual market risk depending on the effectiveness of the hedging performed.

An additional relevant risk of the Goldman Sachs Social Bond fund is the following:

Concentration risk: Investments concentrated in a specific region or theme could be highly impacted by a single event.

Complete information on the risks of investing in each Fund are set out in the Fund’s prospectus.

The prospectus, the Key Information Document (KID) or UK Key Investor Information Document (KIID) (as applicable), information on sustainability-related aspects of the fund (such as the SFDR classification), and other legally required documents relating to the fund (containing information about the fund, the costs and the risks involved) are available on am.gs.com/documents in the relevant languages of the countries where the fund is registered or notified for marketing purposes. Goldman Sachs Asset Management B.V. may decide to terminate the arrangements made for the marketing of the fund in accordance with article 93a UCITS Directive and article 32a AIFM Directive as implemented in Dutch law in article 2:121ca and 2:124.0a Wft. Information about investor rights and collective redress mechanisms are available on am.gs.com/policies-and-governance. Investment sustains risk. The decision to invest in a fund should take into account all the characteristics, objectives, and associated risks of a fund as described in the prospectus. The investment promoted concerns the acquisition of units or shares in a fund, and not in an underlying asset in which the fund invests. Please note that the value of any investment may rise or fall and that past performance is not indicative of future results and should in no event be deemed as such. A return on investment may increase or decrease as a result of currency fluctuation.

1. Goldman Sachs Green Bond

Fund Characteristics | |

1. Investment Objective | Measured over a period of 5 years we aim to beat the performance of the benchmark Bloomberg MSCI Euro Green Bond Index. The benchmark is a broad representation of our investment universe. The fund can also include bonds that are not part of the benchmark universe. We actively manage the fund with a focus on bond selection. We combine our analysis on specific issuers of bonds with a broader ESG and market analysis to construct the optimal portfolio. We aim to exploit differences in valuations of issuers of bonds within sectors and differences in valuations between sectors and different quality segments (ratings). Therefore, the fund positioning can materially deviate from the benchmark. The fund does not aim to provide you with a dividend. It will reinvest all earnings. |

2. Investment Policy | To determine our eligible universe, we check if the selected bonds adhere to the Green Bond Principles as formulated by the International Capital Market Association. Furthermore, issuers are screened using exclusionary screening. For risk management purposes, sector and country deviation limits are maintained relative to the benchmark. |

3. Type of Assets in Which Fund May Invest | The fund primarily invests in a portfolio of global corporate green bonds of high quality (with a rating of AAA to BBB-) mainly denominated in Euro. Green bonds are bond instruments where the proceeds will be applied to finance or re-finance new and/or existing projects that are beneficial to the environment. The fund may invest in bonds with a higher risk (with a quality rating lower than BBB-) up to 10% of its net assets. |

4. Actively or Not Actively Managed Against Benchmark + Degree of Freedom from Benchmark | We actively manage this fund with a focus on bond selection. |

5. Leverage | NA |

6. SFDR Disclosure (optional) | Article 9 |

Risks | |

The risk of this fund is set at 3 (on a scale of 1 - lower risk to 7 - higher risk). Historical data, such as is used for calculating this indicator, may not be a reliable indication of the future risk profile of this fund. There is no guarantee that the risk indicator will remain unchanged, it may shift over time. The lowest category of risk does not mean that the investment is risk free. This fund is in category 3 because of the behaviour of the product during the measuring period. The overall market risk, taking into account past performances and future potential evolution of the markets, associated with bonds used to reach the investment objective is considered medium. These financial instruments are impacted by various factors. These include, but are not limited to, the development of the financial market, the economic development of issuers of these financial instruments who are themselves affected by the general world economic situation and the economic and political conditions in each country. Expected credit risk, the risk of failure of the issuers of underlying investments is medium. The Sub-Fund’s liquidity risk is set to medium. Liquidity risks arise when a specific underlying investment is difficult to sell. Moreover, currency fluctuation may impact highly the Sub-Fund’s performance. No guarantee is provided as to the recovery of the initial investment. | |

C&C / Fees overview

Share Classes | ISIN | Currency | Management Fee (%) | Fixed Service Fee (%) | Ongoing Charges Including Management Fee (%) | Minimum |

I Capitalisation | LU1365052627 | EUR | 0.20 | 0.12 | 0.33 | €250,000 |

I Distribution | LU1365053195 | EUR | 0.20 | 0.12 | 0.33 | €250,000 |

P Distribution | LU1619163584 | EUR | 0.40 | 0.15 | 0.60 | - |

N Capitalisation* | LU1465052890 | EUR | 0.20 | 0.15 | 0.40 | - |

P Capitalisation | LU1586216068 | EUR | 0.40 | 0.15 | 0.60 | - |

P Capitalisation (Hedged I) | LU1840630427 | SEK | 0.40 | 0.15 | 0.62 | - |

X Capitalisation | LU1738491338 | EUR | 0.75 | 0.15 | 0.95 | - |

I Capitalisation (Hedged I) | LU1861144340 | USD | 0.20 | 0.12 | 0.35 | €250,000 |

I Capitalisation (Hedged I) | LU2213813608 | GBP | 0.20 | 0.12 | 0.35 | €250,000 |

Fee data as of 31 July 2024

* Not available yet

Fees are generally billed and payable at the end of each quarter and are based on average month-end market values during the quarter. Additional information is provided in our Form ADV Part 2. Details of the fees payable by you in connection with the fund are set out in the fund’s offering documents/ MiFID II costs and charges document. The fees are the fees the fund charges to investors to cover the costs of running the Fund, which will impact on the overall return which an investor receives. Additional costs, including transaction fees, will also be incurred. These costs are paid out by the Fund, which will impact on the overall return of the Fund. Fund charges will be incurred in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations. All charges will be paid out by the Fund, which will impact on the overall return of the Fund. Any future returns will be subject to tax which depends on the personal tax situation of each investor, which may change over time. The cost may increase or decrease as a result of currency and exchange rate fluctuations

2. Goldman Sachs Social Bond

Fund Characteristics | |

1. Investment Objective | Measured over a period of 5 years we aim to beat the performance of the benchmark iBoxx EUR Investment Grade Social Bonds (10% Issuer Cap). The benchmark is a broad representation of our investment universe. The fund can also include bonds that are not part of the benchmark universe. We actively manage the fund with a focus on bond selection. We combine our analysis on specific issuers of bonds with a broader ESG and market analysis to construct the optimal portfolio. We aim to exploit differences in valuations of issuers of bonds within sectors and differences in valuations between sectors and different quality segments (ratings). Therefore, the fund positioning can materially deviate from the benchmark. |

2. Investment Policy | To determine our eligible universe, we check if the selected bonds adhere to the Social Bond Principles as formulated by the International Capital Market Association. Furthermore, issuers are screened using exclusionary screening. For risk management purposes, sector and country deviation limits are maintained relative to the benchmark. |

3. Type of Assets in Which Fund May Invest | The fund mainly invests in a portfolio of Social bonds and money market instruments of high quality (with a rating of AAA to BBB-) mainly denominated in Euro. Social bonds are any type of bond instruments where the proceeds will be applied to finance or re-finance in part or in full new and/or existing projects that provide clear social benefits especially but not exclusively for a target population(s). The fund may also invest in sustainability bonds. The fund may invest in bonds with a higher risk (with a quality rating lower than BBB-) up to 10% of its net assets. |

4. Actively or Not Actively Managed Against Benchmark + Degree of Freedom from Benchmark | We actively manage this fund with a focus on bond selection. |

5. Leverage | NA |

6. SFDR Disclosure (optional) | Article 9 |

Risks | |

The risk of this fund is set at 2 (on a scale of 1 - lower risk to 7 - higher risk). Historical data, such as is used for calculating this indicator, may not be a reliable indication of the future risk profile of this fund. There is no guarantee that the risk indicator will remain unchanged, it may shift over time. The lowest category of risk does not mean that the investment is risk free. This fund is in category 2 because of the behaviour of the product during the measuring period. The overall market risk associated with the bonds or other financial instruments used to reach the investment objectives is considered medium. These financial instruments are impacted by various factors. These include, but are not limited to, the development of the financial market, the economic development of issuers of these financial instruments who are themselves affected by the general world economic situation and the economic and political conditions in each country. Expected credit risk, the risk of failure of the issuers of underlying investments is medium. The fund’s liquidity risk is set to medium. Liquidity risks arise when a specific underlying investment is difficult to sell. No guarantee is provided as to the recovery of the initial investment. Based on the assessment of the sustainability risks, the sustainability risk profile of the Sub-Fund can be categorized as high, medium or low. The risk profile indicates on a qualitative basis, the likelihood and level of the negative impacts due to sustainability risks on the performance of the fund. This is based on the level and result of integration of environmental, social and governance factors in the investment process of the fund. The sustainability risk profile of the fund is medium. | |

C&C / Fees overview

Share Classes | ISIN | Currency | Management Fee (%) | Fixed Service Fee (%) | Ongoing Charges Including Management Fee (%) | Minimum |

I Capitalisation | LU2489470984 | EUR | 0.20 | 0.12 | 0.33 | €250,000 |

N Capitalisation * | LU24896309001 | EUR | 0.20 | 0.15 | 0.55 | - |

P Capitalisation | LU2489471016 | EUR | 0.40 | 0.15 | 0.60 | - |

R Capitalisation | LU2489471107 | EUR | 0.20 | 0.15 | 0.40 | - |

X Capitalisation | LU2489471289 | EUR | 0.75 | 0.15 | 0.95 | - |

I Capitalisation (Hedged I)* | LU2545728532 | CHF | 0.20 | 0.12 | 0.35 | €250,000 |

I Capitalisation (Hedged I) | LU2496309183 | GBP | 0.20 | 0.12 | 0.35 | €250,000 |

Fee data as of 31 July 2024

* Not available yet

Fees are generally billed and payable at the end of each quarter and are based on average month-end market values during the quarter. Additional information is provided in our Form ADV Part 2. Details of the fees payable by you in connection with the fund are set out in the fund’s offering documents/ MiFID II costs and charges document. The fees are the fees the fund charges to investors to cover the costs of running the Fund, which will impact on the overall return which an investor receives. Additional costs, including transaction fees, will also be incurred. These costs are paid out by the Fund, which will impact on the overall return of the Fund. Fund charges will be incurred in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations. All charges will be paid out by the Fund, which will impact on the overall return of the Fund. Any future returns will be subject to tax which depends on the personal tax situation of each investor, which may change over time. The cost may increase or decrease as a result of currency and exchange rate fluctuations.

3. Goldman Sachs Global Impact Corporate Bond

Fund Characteristics | |

1. Investment Objective | Measured over a period of 5 years the fund aims to beat the performance of the benchmark iBoxx Global Green, Social & Sustainable Bonds EUR Hedged Total Return Index (EUR) – Corporates. The benchmark is a broad representation of the fund's investment universe. The fund may also include investments into bonds that are not part of the benchmark universe. The fund is actively managed with a focus on bond selection where analysis of specific issuers of bonds is combined with a broader market analysis to construct the optimal portfolio, with deviation limits maintained relative to the benchmark. The aim is to exploit differences in valuations of issuers of bonds between sectors and differences in valuations between sectors and different quality segments (ratings). Therefore, the fund's investments can materially deviate from the benchmark. You can sell your participation in this fund on each (working) day on which the value of the units is calculated, which for this fund occurs daily. The fund does not aim to provide you with a dividend. It will reinvest all earnings. |

2. Investment Policy | To determine our eligible universe, we check if the selected bonds adhere to the Green Bond Principles as formulated by the International Capital Market Association. Furthermore, issuers are screened using exclusionary screening. For risk management purposes, sector and country deviation limits are maintained relative to the benchmark. |

3. Type of Assets in Which Fund May Invest | The fund invests at least 85% of its net assets in a portfolio of green bonds and money market instruments of high quality (with a rating of AAA to BBB-) mainly denominated in Euro. Green bonds are bond instruments where the proceeds will be applied to finance or re-finance in part or in full new and/or existing projects that are beneficial to the environment. The fund may invest in bonds with a higher risk (with a quality rating lower than BBB-) up to 10% of its net assets. |

4. Actively or Not Actively Managed Against Benchmark + Degree of Freedom from Benchmark | We actively manage this fund with a focus on bond selection. |

5. Leverage | NA |

6. SFDR Disclosure (optional) | Article 9 |

Risks | |

The risk of this fund is set at 3 (on a scale of 1 - lower risk to 7 - higher risk). Historical data, such as is used for calculating this indicator, may not be a reliable indication of the future risk profile of this fund. There is no guarantee that the risk indicator will remain unchanged, it may shift over time. The lowest category of risk does not mean that the investment is risk free. This fund is in category 3 because of the behaviour of the product during the measuring period. The overall market risk, taking into account past performances and future potential evolution of the markets, associated with bonds used to reach the investment objective is considered medium. These financial instruments are impacted by various factors. These include, but are not limited to, the development of the financial market, the economic development of issuers of these financial instruments who are themselves affected by the general world economic situation and the economic and political conditions in each country. Expected credit risk, the risk of failure of the issuers of underlying investments is medium. The Sub-Fund’s liquidity risk is set to medium. Liquidity risks arise when a specific underlying investment is difficult to sell. Moreover, currency fluctuation may impact highly the Sub-Fund’s performance. No guarantee is provided as to the recovery of the initial investment. | |

C&C / Fees overview

Share Classes | ISIN | Currency | Management Fee (%) | Fixed Service Fee (%) | Ongoing Charges Including Management Fee (%) | Minimum |

I Capitalisation | LU2580621675 | EUR | 0.20 | 0.12 | 0.33 | €250,000 |

I Capitalisation (hedged I) | LU2349459391 | CHF | 0.20 | 0.12 | 0.35 | €250,000 |

I Distribution | LU2102358251 | EUR | 0.20 | 0.12 | 0.33 | €250,000 |

P Capitalisation | LU2580622053 | EUR | 0.47 | 0.15 | 0.67 | - |

R Capitalisation | LU2580622137 | EUR | 0.27 | 0.15 | 0.47 | - |

Z Capitalisation | LU2580622640 | EUR | - | 0.12 | 0.13 | - |

Fee data as of 31 July 2024

Fees are generally billed and payable at the end of each quarter and are based on average month-end market values during the quarter. Additional information is provided in our Form ADV Part 2. Details of the fees payable by you in connection with the fund are set out in the fund’s offering documents/ MiFID II costs and charges document. The fees are the fees the fund charges to investors to cover the costs of running the Fund, which will impact on the overall return which an investor receives. Additional costs, including transaction fees, will also be incurred. These costs are paid out by the Fund, which will impact on the overall return of the Fund. Fund charges will be incurred in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations. All charges will be paid out by the Fund, which will impact on the overall return of the Fund. Any future returns will be subject to tax which depends on the personal tax situation of each investor, which may change over time. The cost may increase or decrease as a result of currency and exchange rate fluctuations.

4. Goldman Sachs Corporate Green Bond

Fund Characteristics | |

1. Investment Objective | Measured over a period of 5 years we aim to beat the performance of the Bloomberg Barclays Euro Green Corporate Bond 5% Issuer Capped benchmark. The benchmark is a broad representation of our investment universe. The fund can also include bonds that are not part of the benchmark universe. In order to achieve that goal, we take active management decisions that will result in over and underweight positions as compared to the Benchmark as well as in investments into securities that are not part of the Benchmark. For portfolio construction and risk management, we use measures widely used in the industry and relevant for the asset class that allow us to assess and manage the Fund’s risk compared to the Benchmark. We combine our analysis on specific issuers of bonds with a broader ESG and market analysis to construct the optimal portfolio. We aim to exploit differences in valuations of issuers of bonds within sectors and differences in valuations between sectors and different quality segments (ratings). Therefore the fund positioning can materially deviate from the benchmark. The fund does not aim to provide you with a dividend. It will reinvest all earnings. |

2. Investment Policy | To determine our eligible universe, we check if the selected bonds adhere to the Green Bond Principles as formulated by the International Capital Market Association. Furthermore issuers with severe environmental, social and governance (ESG) controversies or poor ESG ratings and policies are excluded. For risk management purposes, sector and country deviation limits are maintained relative to the benchmark. |

3. Type of Assets in Which Fund May Invest | The fund invests at least 85% of its net assets in a portfolio of global corporate green bonds of high quality (with a rating of AAA to BBB-) mainly denominated in Euro. Green bonds are bond instruments where the proceeds will be applied to finance or re-finance new and/or existing projects that are beneficial to the environment. The fund may invest in bonds with a higher risk (with a quality rating lower than BBB-) up to 10% of its net assets. |

4. Actively or Not Actively Managed Against Benchmark + Degree of Freedom from Benchmark | We actively manage this fund with a focus on bond selection. |

5. Leverage | NA |

6. SFDR Disclosure (optional) | Article 9 |

Risks | |

The risk of this fund is set at 2 (on a scale of 1 - lower risk to 7 - higher risk), which is a low risk class. This rates the potential losses from future performance at a low level, and poor market conditions are very unlikely to impact the Fund's capacity to pay you. The actual risk can vary significantly if you cash in at an early stage and you may get back less. You may not be able to cash in early. You may have to pay significant extra costs to cash in early. Be aware of currency risk when the currency of the Fund is different than the official currency of the Member State where the Fund is marketed to you. You will receive payments in a different currency than the official currency of the Member State where the Fund is marketed to you, so the final return you will get depends on the exchange rate between the two currencies. The risk is not considered in the indicator shown above. | |

C&C / Fees overview

Share Classes | ISIN | Currency | Management Fee (%) | Fixed Service Fee (%) | Ongoing Charges Including Management Fee (%) | Minimum |

I Capitalisation | LU2102358178 | EUR | 0.27 | 0.12 | 0.40 | €250,000 |

I Capitalisation | LU2299106711 | GBP | 0.27 | 0.12 | 0.40 | €250,000 |

P Capitalisation | LU2102358418 | EUR | 0.47 | 0.15 | 0.67 | - |

R Capitalisation | LU2102358509 | EUR | 0.27 | 0.15 | 0.47 | - |

Z Capitalisation | LU2102358764 | EUR | - | 0.12 | 0.13 | - |

Fee data as of 31 July 2024

Fees are generally billed and payable at the end of each quarter and are based on average month-end market values during the quarter. Additional information is provided in our Form ADV Part 2. Details of the fees payable by you in connection with the fund are set out in the fund’s offering documents/ MiFID II costs and charges document. The fees are the fees the fund charges to investors to cover the costs of running the Fund, which will impact on the overall return which an investor receives. Additional costs, including transaction fees, will also be incurred. These costs are paid out by the Fund, which will impact on the overall return of the Fund. Fund charges will be incurred in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations. All charges will be paid out by the Fund, which will impact on the overall return of the Fund. Any future returns will be subject to tax which depends on the personal tax situation of each investor, which may change over time. The cost may increase or decrease as a result of currency and exchange rate fluctuations.

5. Goldman Sachs Green Bond Short Duration

Fund Characteristics | |

1. Investment Objective | The fund does not intend to measure its performance against that index. The benchmark is a broad representation of our investment universe. The fund can also include bonds that are not part of the benchmark universe. You can sell your participation in this fund on each (working) day on which the value of the units is calculated, which for this fund occurs daily. The fund does not aim to provide you with a dividend. It will reinvest all earnings. The return of the Portfolio depends on the performance of the Portfolio, which is directly related to the performance of its investments. The risk and reward profile of the Portfolio described in this key information document assumes that you hold your investments in the Portfolio for at least the Recommended Holding Period as set out below under the heading “How long should I hold it and can I take money early out". Please see the section “How long should I hold it and can I take my money out early?” below for additional details (including restrictions and/or penalties) on the ability to redeem your investment in the Fund. |

2. Investment Policy | To determine our eligible universe, we check if the selected bonds adhere to the Green Bond Principles as formulated by the International Capital Market Association. Furthermore, issuers are screened using exclusionary screening. For risk management purposes, sector and country deviation limits are maintained relative to the benchmark. |

3. Type of Assets in Which Fund May Invest | The fund primarily invests in a portfolio of global corporate green bonds of high quality (with a rating of AAA to BBB-) mainly denominated in Euro. Green bonds are bond instruments where the proceeds will be applied to finance or re-finance new and/or existing projects that are beneficial to the environment. The fund may invest in bonds with a higher risk (with a quality rating lower than BBB-) up to 10% of its net assets. |

4. Actively or Not Actively Managed Against Benchmark + Degree of Freedom from Benchmark | We actively manage this fund with a focus on bond selection. |

5. Leverage | NA |

6. SFDR Disclosure (optional) | Article 9 |

Risks | |

The risk of this fund is set at 3 (on a scale of 1 - lower risk to 7 - higher risk). Historical data, such as is used for calculating this indicator, may not be a reliable indication of the future risk profile of this fund. There is no guarantee that the risk indicator will remain unchanged, it may shift over time. The lowest category of risk does not mean that the investment is risk free. This fund is in category 3 because of the behaviour of the product during the measuring period. The overall market risk, taking into account past performances and future potential evolution of the markets, associated with bonds used to reach the investment objective is considered medium. These financial instruments are impacted by various factors. These include, but are not limited to, the development of the financial market, the economic development of issuers of these financial instruments who are themselves affected by the general world economic situation and the economic and political conditions in each country. Expected credit risk, the risk of failure of the issuers of underlying investments is medium. The Sub-Fund’s liquidity risk is set to medium. Liquidity risks arise when a specific underlying investment is difficult to sell. Moreover, currency fluctuation may impact highly the Sub-Fund’s performance. No guarantee is provided as to the recovery of the initial investment. | |

C&C / Fees overview

Share Classes | ISIN | Currency | Management Fee (%) | Fixed Service Fee (%) | Ongoing Charges Including Management Fee (%) | Minimum |

I Capitalisation | LU1922482994 | EUR | 0.20 | 0.12 | 0.33 | €250,000 |

I Capitalisation (Hedged I) | LU2400966334 | CHF | 0.20 | 0.12 | 0.35 | €250,000 |

I Capitalisation (Hedged I) | LU1922483612 | GBP | 0.20 | 0.12 | 0.35 | €250,000 |

I Capitalisation (Hedged I) | LU1922483968 | USD | 0.20 | 0.12 | 0.35 | €250,000 |

I Distribution | LU1932640938 | EUR | 0.20 | 0.12 | 0.33 | €250,000 |

P Capitalisation | LU1922483299 | EUR | 0.40 | 0.15 | 0.60 | - |

R Capitalisation | LU1922483455 | EUR | 0.20 | 0.15 | 0.40 | - |

R Capitalisation (Hedged I) | LU2508678757 | USD | 0.20 | 0.15 | 0.40 | - |

X Capitalisation | LU1983361905 | EUR | 0.75 | 0.15 | 0.95 | - |

Fee data as of 31 July 2024

Fees are generally billed and payable at the end of each quarter and are based on average month-end market values during the quarter. Additional information is provided in our Form ADV Part 2. Details of the fees payable by you in connection with the fund are set out in the fund’s offering documents/ MiFID II costs and charges document. The fees are the fees the fund charges to investors to cover the costs of running the Fund, which will impact on the overall return which an investor receives. Additional costs, including transaction fees, will also be incurred. These costs are paid out by the Fund, which will impact on the overall return of the Fund. Fund charges will be incurred in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations. All charges will be paid out by the Fund, which will impact on the overall return of the Fund. Any future returns will be subject to tax which depends on the personal tax situation of each investor, which may change over time. The cost may increase or decrease as a result of currency and exchange rate fluctuations.

6. Goldman Sachs Sovereign Green Bond

Fund Characteristics | |

1. Investment Objective | The fund does not intend to measure its performance against that index. The benchmark is a broad representation of our investment universe. The fund can also include bonds that are not part of the benchmark universe. You can sell your participation in this fund on each (working) day on which the value of the units is calculated, which for this fund occurs daily. The fund does not aim to provide you with a dividend. It will reinvest all earnings. The return of the Portfolio depends on the performance of the Portfolio, which is directly related to the performance of its investments. The risk and reward profile of the Portfolio described in this key information document assumes that you hold your investments in the Portfolio for at least the Recommended Holding Period as set out below under the heading “How long should I hold it and can I take money early out". Please see the section “How long should I hold it and can I take my money out early?” below for additional details (including restrictions and/or penalties) on the ability to redeem your investment in the Fund. |

2. Investment Policy | To determine our eligible universe, we check if the selected bonds adhere to the Green Bond Principles as formulated by the International Capital Market Association. Furthermore, issuers are screened using exclusionary screening. For risk management purposes, sector and country deviation limits are maintained relative to the benchmark. |

3. Type of Assets in Which Fund May Invest | The fund primarily invests in a portfolio of global corporate green bonds of high quality (with a rating of AAA to BBB-) mainly denominated in Euro. Green bonds are bond instruments where the proceeds will be applied to finance or re-finance new and/or existing projects that are beneficial to the environment. The fund may invest in bonds with a higher risk (with a quality rating lower than BBB-) up to 10% of its net assets. |

4. Actively or Not Actively Managed Against Benchmark + Degree of Freedom from Benchmark | We actively manage this fund with a focus on bond selection. |

5. Leverage | NA |

6. SFDR Disclosure (optional) | Article 9 |

Risks | |

The risk of this fund is set at 3 (on a scale of 1 - lower risk to 7 - higher risk). Historical data, such as is used for calculating this indicator, may not be a reliable indication of the future risk profile of this fund. There is no guarantee that the risk indicator will remain unchanged, it may shift over time. The lowest category of risk does not mean that the investment is risk free. This fund is in category 3 because of the behaviour of the product during the measuring period. The overall market risk, taking into account past performances and future potential evolution of the markets, associated with bonds used to reach the investment objective is considered medium. These financial instruments are impacted by various factors. These include, but are not limited to, the development of the financial market, the economic development of issuers of these financial instruments who are themselves affected by the general world economic situation and the economic and political conditions in each country. Expected credit risk, the risk of failure of the issuers of underlying investments is medium. The Sub-Fund’s liquidity risk is set to medium. Liquidity risks arise when a specific underlying investment is difficult to sell. Moreover, currency fluctuation may impact highly the Sub-Fund’s performance. No guarantee is provided as to the recovery of the initial investment. | |

C&C / Fees overview

Share Classes | ISIN | Currency | Management Fee (%) | Fixed Service Fee (%) | Ongoing Charges Including Management Fee (%) | Minimum |

I Capitalisation | LU2280235313 | EUR | 0.20 | 0.12 | 0.33 | €250,000 |

I Distribution | LU2280235230 | EUR | 0.20 | 0.12 | 0.33 | €250,000 |

I Capitalisation (hedged i) | LU2400966417 | GBP | 0.20 | 0.12 | 0.35 | €250,000 |

X Capitalisation | LU2102358681 | EUR | 0.75 | 0.15 | 0.95 | - |

P Capitalisation | LU2280235586 | EUR | 0.40 | 0.15 | 0.60 | - |

Fee data as of 31 July 2024

Fees are generally billed and payable at the end of each quarter and are based on average month-end market values during the quarter. Additional information is provided in our Form ADV Part 2. Details of the fees payable by you in connection with the fund are set out in the fund’s offering documents/ MiFID II costs and charges document. The fees are the fees the fund charges to investors to cover the costs of running the Fund, which will impact on the overall return which an investor receives. Additional costs, including transaction fees, will also be incurred. These costs are paid out by the Fund, which will impact on the overall return of the Fund. Fund charges will be incurred in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations. All charges will be paid out by the Fund, which will impact on the overall return of the Fund. Any future returns will be subject to tax which depends on the personal tax situation of each investor, which may change over time. The cost may increase or decrease as a result of currency and exchange rate fluctuations.

7. Goldman Sachs USD Green Bond

Fund Characteristics | |

1. Investment Objective | Measured over a period of 5 years we aim to beat the performance of the benchmark Bloomberg MSCI Global Green Bond Index USD. The benchmark is a broad representation of our investment universe. The fund can also include bonds that are not part of the benchmark universe. We actively manage the fund with a focus on bond selection. We combine our analysis on specific issuers of bonds with a broader ESG and market analysis to construct the optimal portfolio. We aim to exploit differences in valuations of issuers of bonds within sectors and differences in valuations between sectors and different quality segments (ratings). Therefore the fund positioning can materially deviate from the benchmark. The fund does not aim to provide you with a dividend. It will reinvest all earnings. |

2. Investment Policy | To determine our eligible universe, we check if the selected bonds adhere to the Green Bond Principles as formulated by the International Capital Market Association. Furthermore issuers are screened using exclusionary screening. For risk management purposes, sector and country deviation limits are maintained relative to the benchmark. |

3. Type of Assets in Which Fund May Invest | The fund invests at least 85% of its net assets in a portfolio of green bonds and money market instruments of high quality (with a rating of AAA to BBB-) mainly denominated in Euro. Green bonds are bond instruments where the proceeds will be applied to finance or re-finance in part or in full new and/or existing projects that are beneficial to the environment. The fund may invest in bonds with a higher risk (with a quality rating lower than BBB-) up to 10% of its net assets. |

4. Actively or Not Actively Managed Against Benchmark + Degree of Freedom from Benchmark | We actively manage this fund with a focus on bond selection. |

5. Leverage | NA |

6. SFDR Disclosure (optional) | Article 9 |

Risks | |

The risk of this fund is set at 3 (on a scale of 1 - lower risk to 7 - higher risk). Historical data, such as is used for calculating this indicator, may not be a reliable indication of the future risk profile of this fund. There is no guarantee that the risk indicator will remain unchanged, it may shift over time. The lowest category of risk does not mean that the investment is risk free. This fund is in category 3 because of the behaviour of the product during the measuring period. The overall market risk, taking into account past performances and future potential evolution of the markets, associated with bonds used to reach the investment objective is considered medium. These financial instruments are impacted by various factors. These include, but are not limited to, the development of the financial market, the economic development of issuers of these financial instruments who are themselves affected by the general world economic situation and the economic and political conditions in each country. Expected credit risk, the risk of failure of the issuers of underlying investments is medium. The Sub-Fund’s liquidity risk is set to medium. Liquidity risks arise when a specific underlying investment is difficult to sell. Moreover, currency fluctuation may impact highly the Sub-Fund’s performance. No guarantee is provided as to the recovery of the initial investment. | |

C&C / Fees overview

Share Classes | ISIN | Currency | Management Fee (%) | Fixed Service Fee (%) | Ongoing Charges Including Management Fee (%) | Minimum |

I Capitalisation | LU2578936002 | USD | 0.20 | 0.12 | 0.33 | €250,000 |

I Capitalisation (hedged i) | LU2578935889 | EUR | 0.20 | 0.12 | 0.35 | €250,000 |

I Capitalisation (hedged i) | LU2578935616 | CHF | 0.20 | 0.12 | 0.35 | €250,000 |

I Capitalisation (hedged i) | LU2578935962 | GBP | 0.20 | 0.12 | 0.35 | €250,000 |

X Capitalisation | LU2578936770 | USD | 0.75 | 0.15 | 0.95 | - |

X Capitalisation (hedged i) | LU2578936697 | EUR | 0.75 | 0.15 | 0.97 | - |

P Capitalisation | LU2578936424 | USD | 0.40 | 0.15 | 0.60 | - |

P Capitalisation (hedged i) | LU2578936267 | EUR | 0.40 | 0.15 | 0.62 | - |

R Capitalisation | LU2578936341 | USD | 0.20 | 0.15 | 0.40 | - |

R Capitalisation (hedged i) | LU2578936184 | EUR | 0.20 | 0.15 | 0.42 | - |

Fee data as of 31 July 2024

Fees are generally billed and payable at the end of each quarter and are based on average month-end market values during the quarter. Additional information is provided in our Form ADV Part 2. Details of the fees payable by you in connection with the fund are set out in the fund’s offering documents/ MiFID II costs and charges document. The fees are the fees the fund charges to investors to cover the costs of running the Fund, which will impact on the overall return which an investor receives. Additional costs, including transaction fees, will also be incurred. These costs are paid out by the Fund, which will impact on the overall return of the Fund. Fund charges will be incurred in multiple currencies, meaning that payments may increase or decrease as a result of currency exchange fluctuations. All charges will be paid out by the Fund, which will impact on the overall return of the Fund. Any future returns will be subject to tax which depends on the personal tax situation of each investor, which may change over time. The cost may increase or decrease as a result of currency and exchange rate fluctuations

This is a marketing communication published by Goldman Sachs Asset Management B.V. (“GSAM B.V.”) and intended for MiFID professional investors only. Please refer to the fund documentation before making any final investment decisions. The prospectus, the Key Information Document (KID) or UK Key Investor Information Document (KIID) (as applicable), information on sustainability-related aspects of the fund (such as the SFDR classification), and other legally required documents relating to the fund (containing information about the fund, the costs and the risks involved) are available on am.gs.com/documents in the relevant languages of the countries where the fund is registered or notified for marketing purposes. Information about investor rights and collective redress mechanisms are available on am.gs.com/policies-and-governance.

The portfolio risk management process includes an effort to monitor and manage risk, but does not imply low risk.

There is no guarantee that objectives will be met.

Messaggio pubblicitario con finalità promozionali. Prima dell'adesione leggere il KID, che il proponente l’investimento deve consegnare prima della sottoscrizione, e il Prospetto disponibile sul sito Internet: https://am.gs.com/it-it/advisors e presso gli intermediari collocatori.

France: FOR PROFESSIONAL USE ONLY (WITHIN THE MEANING OF THE MIFID DIRECTIVE)- NOT FOR PUBLIC DISTRIBUTION. THIS DOCUMENT IS PROVIDED FOR SPECIFIC INFORMATION PURPOSES ONLY IN ORDER TO ENABLE THE RECIPIENT TO ASSESS THE FINANCIAL CHARACTERISTICS OF THE CONCERNED FINANCIAL INSTRUMENT(S) AS PROVIDED FOR IN ARTICLE L. 533-13-1, I, 2° OF THE FRENCH MONETARY AND FINANCIAL CODE AND DOES NOT CONSTITUTE AND MAY NOT BE USED AS MARKETING MATERIAL FOR INVESTORS OR POTENTIAL INVESTORS IN FRANCE.

For Qualified Investor use only – Not for offering or advertising to general public.

The engagement/proxy voting highlights presented here outline examples of Goldman Sachs Asset Management initiatives, there is no assurance that Goldman Sachs’ engagement/proxy voting directly caused the outcome described herein.

FOR INSTITUTIONAL, FINANCIAL INTERMEDIARIES OR FOR THIRD PARTY DISTRIBUTORS USE ONLY – NOT FOR USE AND/OR DISTRIBUTION TO THE GENERAL PUBLIC.

Please note that for the purposes of the European Sustainable Finance Disclosure Regulation (“SFDR”), the product is an Article 9 product that has a sustainable investment objective. Please note that this material includes certain information on Goldman Sachs sustainability practices and track record, at an organizational and investment team level, which may not necessarily be reflected in the portfolio. Any ESG characteristics, views, assessments, claims or similar referenced herein (i) will be based on, and limited to, the consideration of specific ESG attributes or metrics related to a product, issuer or service and not their broader or full ESG profile, and unless stated otherwise, (ii) may be limited to a point of time assessment and may not consider the broader lifecycle of the product, issuer or service, and (iii) may not consider any potential negative ESG impacts arising from or related to the product, issuer or service. Please refer to the offering documents of any product(s) prior to investment, for details on how and the extent to which the product(s) takes ESG considerations into account on a binding or non-binding basis.

This material is provided at your request solely for your use.

This material is provided at your request for informational purposes only. It is not an offer or solicitation to buy or sell any securities.

In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs International, which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

In the European Union, this material has been approved by Goldman Sachs Asset Management Fund Services Limited, which is regulated by the Central Bank of Ireland.

This marketing communication is disseminated by Goldman Sachs Asset Management B.V., including through its branches (“GSAM BV”). GSAM BV is authorised and regulated by the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten, Vijzelgracht 50, 1017 HS Amsterdam, The Netherlands) as an alternative investment fund manager (“AIFM”) as well as a manager of undertakings for collective investment in transferable securities (“UCITS”). Under its licence as an AIFM, the Manager is authorized to provide the investment services of (i) reception and transmission of orders in financial instruments; (ii) portfolio management; and (iii) investment advice. Under its licence as a manager of UCITS, the Manager is authorized to provide the investment services of (i) portfolio management; and (ii) investment advice.

Information about investor rights and collective redress mechanisms are available on www.gsam.com/responsible-investing (section Policies & Governance). Capital is at risk. Any claims arising out of or in connection with the terms and conditions of this disclaimer are governed by Dutch law.Information about investor rights and collective redress mechanisms are available on www.gsam.com/responsible-investing (section Policies & Governance). Capital is at risk. Any claims arising out of or in connection with the terms and conditions of this disclaimer are governed by Dutch law.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security. Views and opinions are current as of the date of this publication and may be subject to change, they should not be construed as investment advice.

Capital is at risk.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

Prospective investors should inform themselves as to any applicable legal requirements and taxation and exchange control regulations in the countries of their citizenship, residence or domicile which might be relevant.

This material is provided for educational and informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon the client’s investment objectives.

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

Emerging markets securities may be less liquid and more volatile and are subject to a number of additional risks, including but not limited to currency fluctuations and political instability. This material contains information that pertains to past performance or is the basis for previously made discretionary investment decisions. This information should not be construed as a current recommendation, research or investment advice. It should not be assumed that any investment decisions shown will prove to be profitable, or that any investment decisions made in the future will be profitable or will equal the performance of investments discussed herein. Any mention of an investment decision is intended only to illustrate our investment approach and/or strategy and is not indicative of the performance of our strategy as a whole. Any such illustration is not necessarily representative of other investment decisions.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Goldman Sachs Asset Management and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Goldman Sachs Asset Management has no obligation to provide any updates or changes.

Fees are generally billed and payable at the end of each quarter and are based on average month-end market values during the quarter. Additional information is provided in our Form ADV Part 2.

Portfolio holdings and/or allocations shown above are as of the date indicated and may not be representative of future investments. The holdings and/or allocations shown may not represent all of the portfolio's investments. Future investments may or may not be profitable.

Environmental, Social and Governance (“ESG”) strategies may take risks or eliminate exposures found in other strategies or broad market benchmarks that may cause performance to diverge from the performance of these other strategies or market benchmarks. ESG strategies will be subject to the risks associated with their underlying investments’ asset classes. Further, the demand within certain markets or sectors that an ESG strategy targets may not develop as forecasted or may develop more slowly than anticipated. Any ESG characteristics, views, assessments, claims or similar referenced herein (i) will be based on, and limited to, the consideration of specific ESG attributes or metrics related to a product, issuer or service and not their broader or full ESG profile, and unless stated otherwise, (ii) may be limited to a point of time assessment and may not consider the broader lifecycle of the product, issuer or service, and (iii) may not consider any potential negative ESG impacts arising from or related to the product, issuer or service.

Investments in fixed income securities are subject to the risks associated with debt securities generally, including credit, liquidity, interest rate, prepayment and extension risk. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline in the bond’s price. The value of securities with variable and floating interest rates are generally less sensitive to interest rate changes than securities with fixed interest rates. Variable and floating rate securities may decline in value if interest rates do not move as expected. Conversely, variable and floating rate securities will not generally rise in value if market interest rates decline. Credit risk is the risk that an issuer will default on payments of interest and principal. Credit risk is higher when investing in high yield bonds, also known as junk bonds. Prepayment risk is the risk that the issuer of a security may pay off principal more quickly than originally anticipated. Extension risk is the risk that the issuer of a security may pay off principal more slowly than originally anticipated. All fixed income investments may be worth less than their original cost upon redemption or maturity.

Mutual funds are subject to various risks, as described fully in each Fund’s prospectus. There can be no assurance that the Funds will achieve their investment objectives. The Funds may be subject to style risk, which is the risk that the particular investing style of the Fund (i.e., growth or value) may be out of favor in the marketplace for various periods of time.

Index Benchmarks

Indices are unmanaged. The figures for the index reflect the reinvestment of all income or dividends, as applicable, but do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

The indices referenced herein have been selected because they are well known, easily recognized by investors, and reflect those indices that the Investment Manager believes, in part based on industry practice, provide a suitable benchmark against which to evaluate the investment or broader market described herein. The exclusion of “failed” or closed hedge funds may mean that each index overstates the performance of hedge funds generally.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only and do not imply that the portfolio will achieve similar results. The index composition may not reflect the manner in which a portfolio is constructed. While an adviser seeks to design a portfolio which reflects appropriate risk and return features, portfolio characteristics may deviate from those of the benchmark.

Singapore: This material has been issued or approved for use in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H).

This document has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this document and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of shares may not be circulated or distributed, nor may shares be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to the public or any member of the public in Singapore other than (i) to an institutional investor specified in section 304 of the Securities and Futures Act, Chapter 289 of Singapore (“SFA”) or (ii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

The prospectus, the Key Information Document (KID) or UK Key Investor Information Document (KIID) (as applicable), the articles, the annual and semi-annual reports of the Fund may be obtained free of charge from the Swiss Representative. In respect of the Shares offered or advertised in Switzerland to Qualified Investors, the place of performance is at the registered office of the Swiss Representative. The place of jurisdiction is at the registered office of the representative or at the registered office or place of residence of the investor.

Swiss Representative: FIRST INDEPENDENT FUND SERVICES LTD, Feldeggstrasse 12, 8008 Zurich

Paying Agent: GOLDMAN SACHS BANK AG, Claridenstrasse 25, CH-8002 Zurich

Documents providing further detailed information about the fund/s, including the articles of incorporation, prospectus, supplement and the Key Information Document (KID) or UK Key Investor Information Document (KIID) (as applicable), annual/semi-annual report (as applicable), and a summary of your investor rights, are available free of charge in English language and as required, in your local language by navigating to your local language landing page via am.gs.com/documents and also from the fund’s paying and information agents. If GSAM B.V., the management company, decides to terminate its arrangement for marketing the fund/s in any EEA country where it is registered for sale, it will do so in accordance with the relevant UCITS rules. Information about investor rights and collective redress mechanisms are available on am.gs.com/policies-and-governance.

Offering Documents

This material is provided at your request for informational purposes only and does not constitute a solicitation in any jurisdiction in which such a solicitation is unlawful or to any person to whom it is unlawful. It only contains selected information with regards to the fund and does not constitute an offer to buy shares in the fund. Prior to an investment, prospective investors should carefully read the latest Key Information Document (KID) or UK Key Investor Information Document (KIID) (as applicable) as well as the offering documentation, including but not limited to the fund’s prospectus which contains inter alia a comprehensive disclosure of applicable risks.

Distribution of Shares

Shares of the fund may not be registered for public distribution in a number of jurisdictions (including but not limited to any Latin American, African or Asian countries). Therefore, the shares of the fund must not be marketed or offered in or to residents of any such jurisdictions unless such marketing or offering is made in compliance with applicable exemptions for the private placement of collective investment schemes and other applicable jurisdictional rules and regulations.

Investment Advice and Potential Loss

Financial advisers generally suggest a diversified portfolio of investments. The fund described herein does not represent a diversified investment by itself. This material must not be construed as investment or tax advice. Prospective investors should consult their financial and tax adviser before investing in order to determine whether an investment would be suitable for them. An investor should only invest if he/she has the necessary financial resources to bear a complete loss of this investment.

Swing Pricing

Please note that the fund operates a swing pricing policy. Investors should be aware that from time to time this may result in the fund performing differently compared to the reference benchmark based solely on the effect of swing pricing rather than price developments of underlying instruments.