What's the Worst That Could Happen? Defaults and Recovery Rates in Private Credit

As rates began to rise and market headwinds converged in 2022, distress levels for both high yield (HY) and leveraged loan (LL) markets increased sharply from 2% to 9%, respectively, and have remained elevated early in 2023.1 In both markets, however, distress is defined based on trading levels rather than fundamentals.2 Indeed, despite rising levels of distress as reflected by market movements, there have yet to be signs of widespread operational difficulties or deterioration in fundamentals among borrowers.3 This is particularly true for PE-backed companies, many of which have been turning to private credit as an alternative to syndicated markets. Defaults remained low on an absolute basis in both HY and LL, as well as private credit; however, the impact from rising interest expenses associated with floating-rate liabilities—much of which was left unhedged—is likely to have ramifications for the most indebted borrowers in 2023.

The outlook for HY defaults is largely sanguine,4 as credit quality in the HY market has improved in recent years and many borrowers took advantage of the low interest rate environment to refinance and push out maturities. For leveraged loans, credit quality and covenant protections have fallen in recent years,5 which could portend higher levels of distress and defaults if headwinds persist. Private credit is more opaque, with borrowers tending to be smaller and on average lower rated, which may suggest higher default risk broadly, but the strategy may benefit from stronger covenants and closer relationships between borrowers and lenders. These benefits were on display during the depths of the pandemic, with private credit posting a lower default rate than leveraged loans as borrowers and lenders worked together to find solutions; however, the pandemic was an exogenous market shock, and the market may perform differently during a prolonged down cycle.6 As private credit gains increasing attention, we believe it is important to remember that the space is highly idiosyncratic with wide dispersion in positioning, as well as documentation and expertise, that can impact how different portfolios perform in down cycles.

Historical Default and Recovery Rates

While private credit data is lacking, the HY and LL markets may provide clues into what is likely to transpire in a downturn. Direct lending in private credit is oriented towards financial sponsors and transaction activity. Loans for LBOs have similar default rates as those for other purposes but take longer to default,7 likely because PE owners are able to help companies navigate headwinds and provide additional capital infusions during times of distress.

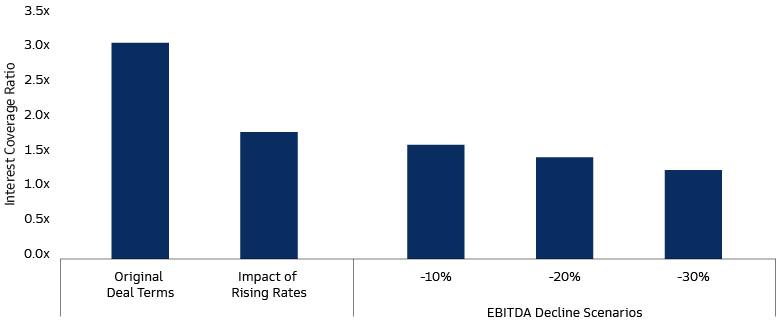

Importantly, when assessing individual positions, higher debt levels do not necessarily translate to higher rates of default. As rates fell over the last decade, for example, default rates remained low even as leverage levels rose. Rather, it is a borrower’s ability to continually service that debt—calculated via the interest coverage ratio—that is the primary indicator of default risk. For borrowers with interest coverage of at least 3x, the long-term default rate is around 2%; defaults rise to over 5% with interest coverage of 2-3x, then spike above 11% for borrowers with interest coverage below 2x. This distinction is particularly pertinent today, as rising interest expenses for floating-rate borrowers pressure coverage ratios at a time when margins are likely to also be pressured by upward trending input and labor costs that are becoming more difficult to pass along to customers.8

The average interest coverage ratio for new LL issues is still around 3x, but there is wide variation between borrowers and coverage ratios can change quickly amid rising rates and the increasing prevalence of addbacks in initial underwriting. Private creditors often benefit from financial maintenance covenants, which allow for early intervention when cash flow begins to appear impaired. In many cases, however, lenders need to be even more proactive and monitor borrowers’ financials on an ongoing basis to understand the full picture and detect potential issues that may fall outside the purview of a formal covenant.

Historically, when borrowers have defaulted the recovery rate for all loans has averaged around 70% of par; leveraged loans are slightly lower at about 60% while subordinated debt generally recovers around 40%. Looking across debt markets, recovery rates have trended lower in recent years due to a combination of structural factors. One is that bank loans today have lower debt cushions (i.e., subordinate debt to absorb losses) than they have had historically (26% vs. 43%).9 Another factor is the higher concentration of covenant-lite loans (i.e., without maintenance covenants), which have become the de facto option in the LL market.

Whereas decades ago only the highest quality borrowers could negotiate covenant-lite terms, in the last three to five years lower-quality borrowers have enjoyed looser terms while also taking on less subordinated debt. While the largest private credit deals also tend to be covenant lite, middle-market transactions often carry maintenance covenants that provide quicker recourse. Furthermore, the lack of syndication and tighter documentation in private credit deals often enables lenders to come to the table more quickly in time of impending stress, even without a covenant breach. And in general, private credit terms tend to include bespoke protections and provisions not found in the HY or LL market, which rely on more standardized terms to facilitate syndication.

Considerations for Today’s Market

The sector composition of debt markets is meaningfully different than in prior downturns, which has implications for historical analyses. Telecoms, for example, often exhibit some of the lowest recovery rates in historical datasets due to struggles during the 2001 crash. Utilities, on the other hand, have the highest recovery rates—which makes intuitive sense given the regulatory framework and asset intensity. While seniority is always beneficial in maximizing recoveries, we believe it is particularly important in those asset-rich sectors. Oil & gas is another asset-heavy area that often headlines default cycles, but the broader macro environment makes troubles in this sector somewhat less likely in the current cycle.10

In today’s market, there is more focus on asset-lite businesses, with a higher concentration of riskier loans in software—which has been a focal point of buyout strategies. Many loans to these businesses were underwritten with recurring revenue, which is much different than cash flow. We believe the quality of the underwriting in these deals will be important as the operating environment proves more difficult, and mission-critical enterprise software companies with diversified contract bases are particularly well positioned. These businesses have largely proved resilient in the current operating environment, but for those that encounter distress, there are often few tangible assets to underpin a recovery. Healthcare is another area that has experienced heightened private market investment. While often viewed as essential, many healthcare areas that have proven popular with investors are in more discretionary categories, which may suffer from an economic downturn and/or inflationary pressures.

The LL universe of “weakest links” (i.e., issuers with a rating of B-minus or lower and a negative outlook) rose 49% from June 2022 to January 2023, with software and healthcare comprising the largest slices.11 In private credit, about one-quarter of private debt is allocated to software companies—the largest single industry—with another 13% in healthcare. The average private debt borrower in both these industries now has an interest coverage ratio below 2x—the point at which defaults begin to increase meaningfully.12

All Distress Is Not Created Equal

In the LL market, issuers can be placed on the “restructuring watch list” for a variety of reasons. Certain actions, such as “going concern” warnings or missed payments, are clear flags. Others pertain to ratings actions or downgrades which, while not ideal, may not necessarily point to acute operational problems; on the other hand, operational distress can often arise before a borrower is formally put on watch, which can make it difficult to assess for those without access to management. In the private credit space, the close nature of the borrower-lender relationship and embedded structural protections allows both sides to be proactive in addressing potential issues early in the process, leading to more selective defaults and workouts.13

If an investment is starting to falter and a manager needs to engage in a restructuring or workout situation, private credit investors have the advantage of being able to rely on fundamentals for early warning signs and be proactive to potentially prevent default, with lending contracts often including provisions for required reporting. Solutions are typically easier to enact in private credit because there is often a limited number of lenders—or even a single lender—rather than a syndicate that may have further sold positions on the secondary market. The ability to quickly workout a difficult situation is meaningful, as faster restructurings tend to benefit lenders.14

Private credit and sponsor-backed companies have exhibited a willingness to provide additional capital infusions, particularly as the average equity contribution has risen to nearly 50%. Indeed, the resources at a private credit manager’s disposal are paramount in a workout situation—with additional capital being the most critical resource. Lenders with size, scale, and well-managed dry powder can help companies through distress situations by working with sponsors to provide flexible, timely capital injections if and when needed.

There are occasions where lenders become the equity owners of a company following a default; in these cases, the skillset required to maximize value becomes quite different than that which was required to make the original loan. As such, managers with in-house private equity teams, deep industry expertise, highly experienced legal professionals and/or strong relationships across the industry can deploy these resources to help maximize recovery value. Nearly two-thirds of lenders rely on the initial investment team to also handle workout situations, but a dedicated workout team and resources can often provide a better framework for reaching a positive outcome.15 A hybrid approach to workouts, whereby the initial deal team maintains close involvement while the workout group assists in structuring and aligning incentives, can often lead to an optimal outcome while helping to address the sometimes contentious and adversarial nature of these situations.

When attempting to restructure and change the trajectory of a company, the first priority for lenders is to protect their principal investment and ensure value is retained. Deals can be structured in a multitude of ways to provide potential upside, including repricing in seeking to improve yield, extending duration, and/or adding warrants or other equity components. Extracting maximum value at this stage is not always the primary goal, as a right-sized capital structure without excessive debt is necessary to enable future growth.

Given the aspects of deal-by-deal selection, customization and active management which are central to private credit investing as compared to the broadly syndicated markets, default risk and recovery capabilities may significantly differ across managers. Indeed, experience is a key asset in workout situations, but few private creditors have experience operating through a full market cycle. Prior to the GFC, fewer than 100 private credit funds were raised annually; since 2015, more than 200 funds have closed each year, while annual capital raised has risen tenfold compared to the pre-GFC period.16 Even for those with experience, this cycle in unlikely to look like the last; the GFC downturn was defined by rapid valuation declines and widespread deleveraging, while today‘s mix of higher inflation and capital costs is likely to lead to a more prolonged cycle. Still, adaptability is a key trait that is learned over time. As such, there may be manager dispersion in a downturn, particularly between new entrants and more experienced lenders who may benefit from insights gleaned working through portfolios in prior cycles.

1LCD. As of March 30, 2023.

2The HY distressed ratio is measured as the % of loans with a spread of L+1000 or more. The LL distressed ratio is measured as the % of loans priced below 80.

3Burgiss. As of September 30, 2022.

4Goldman Sachs Global Investment Research, As of Feb 3, 2023

5LCD. As of March 30, 2023.

6S&P. Private Debt: A Lesser-Known Corner Of Finance Finds The Spotlight. As of October 12, 2021

7LCD Default Review. As of March 30, 2023.

8LCD Default Review. As of March 30, 2023.

9LCD 2020 Recovery Study. As of December 31, 2020. For illustrative purposes only.

10LCD. As of March 30, 2023.

11LCD. As of March 30, 2023.

12KBRA. December 31, 2022.

13S&P. Private Debt: A Lesser-Known Corner Of Finance Finds The Spotlight. As of October 12, 2021

14LCD Recovery Study. As of December 31, 2020. For illustrative purposes only.

15Alternative Credit Council. Financing the Economy. As of November 22, 2022.

16Preqin. As of March 30, 2023.