Retirement Mindset Matters

Methodology Appendix

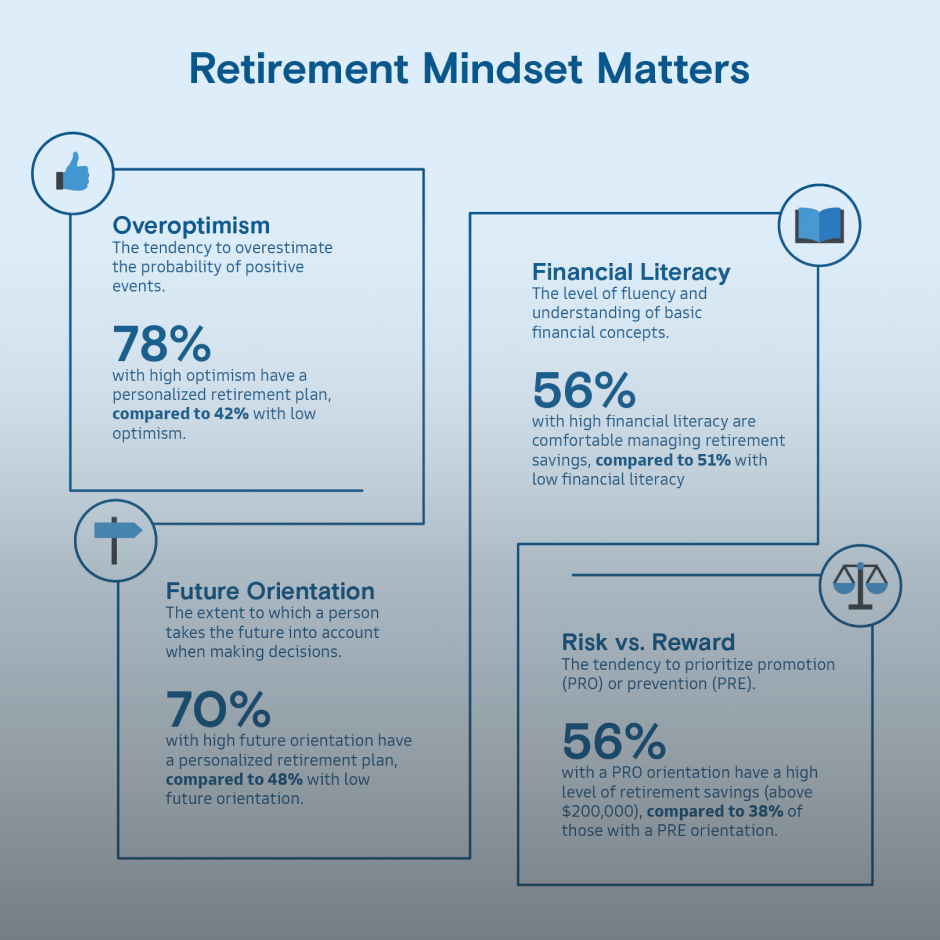

Optimism

Syntoniq assessed an individual’s optimism by comparing the following:

An individual’s reported confidence in meeting their retirement savings goals versus the amount of retirement savings concerns they had.

Whether an individual expected a delay in retirement due to competing financial priorities versus their average impact rating of competing financial priorities.

An individual’s guess of the number of financial literacy questions they thought they answered correctly versus the actual number of questions they answered correctly.

Future Orientation

In order to assess Future Orientation, Syntoniq calculated an average score from respondents’ answers from the following questions:

Whether an individual is willing to sacrifice their immediate happiness or well-being in order to achieve future outcomes.

How an individual would best describe their financial saving or spending personality.

Whether an individual often thinks what their life would be like 10 years from now.

While items 1 and 3 used scaled answers, item 2 was based on the selected number of characteristics indicating long-term versus short-term financial perspectives (e.g., saving versus spending).1

Risk-Return Focus

Risk-Return Focus is measured by the following scaled items:

Whether an individual generally focuses on preventing mistakes and avoiding failure versus whether the individual strives to achieve success and pursue goals.

Whether an individual finds growth and fulfillment or stability and security more important.

Whether when it comes to trying out new things, an individual often finds themself focusing on losses or gains.

Financial Literacy

Financial literacy was measured by an individual’s number of correct responses to five multiple-choice questions.

Suppose you had $100 in a savings account and the interest rate was 2% per year. After 5 years, how much do you think you would have in the account if you left the money to grow?

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, how much would you be able to buy with the money in this account?

If interest rates rise, what will typically happen to bond prices?

A 15-year mortgage typically requires higher monthly payments than a 30-year mortgage, but the total interest paid over the life of the loan will be less.

Buying a single company’s stock usually provides a safer return than a stock mutual fund (i.e., portfolio of stocks).

Disclosures

Baby Boomers refers to people born between 1946 and 1964. Generation X refers to people born between 1965 and 1980. Millennials refers to people born between 1981 and 1996. Generation Z refers to people born between 1997 and 2012.

THESE MATERIALS ARE PROVIDED SOLELY ON THE BASIS THAT THEY WILL NOT CONSTITUTE INVESTMENT ADVICE AND WILL NOT FORM A PRIMARY BASIS FOR ANY PERSON'S OR PLAN'S INVESTMENT DECISIONS, AND GOLDMAN SACHS IS NOT A FIDUCIARY WITH RESPECT TO ANY PERSON OR PLAN BY REASON OF PROVIDING THE MATERIAL OR CONTENT HEREIN. PLAN FIDUCIARIES SHOULD CONSIDER THEIR OWN CIRCUMSTANCES IN ASSESSING ANY POTENTIAL INVESTMENT COURSE OF ACTION.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

All investing involves risk.

Views expressed discussed are those of survey respondents, compiled by Goldman Sachs Asset Management as of June 2023 – July 2023.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

Diversification does not protect an investor from market risk and does not ensure a profit.

United States: In the United States, this material is offered by and has been approved by Goldman Sachs Asset Management, L.P. and Goldman Sachs & Co. LLC, which are registered investment advisers with the Securities and Exchange Commission.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA): This marketing communication is disseminated by Goldman Sachs Asset Management B.V., including through its branches (“GSAM BV”). GSAM BV is authorised and regulated by the Dutch Authority for the Financial Markets (Autoriteit Financiële Markten, Vijzelgracht 50, 1017 HS Amsterdam, The Netherlands) as an alternative investment fund manager (“AIFM”) as well as a manager of undertakings for collective investment in transferable securities (“UCITS”). Under its licence as an AIFM, the Manager is authorized to provide the investment services of (i) reception and transmission of orders in financial instruments; (ii) portfolio management; and (iii) investment advice. Under its licence as a manager of UCITS, the Manager is authorized to provide the investment services of (i) portfolio management; and (ii) investment advice. Information about investor rights and collective redress mechanisms are available on www.gsam.com/responsible-investing (section Policies & Governance). Capital is at risk. Any claims arising out of or in connection with the terms and conditions of this disclaimer are governed by Dutch law.

In the European Union, this material has been approved by either Goldman Sachs Asset Management Funds Services Limited, which is regulated by the Central Bank of Ireland or Goldman Sachs Asset Management B.V, which is regulated by The Netherlands Authority for the Financial Markets (AFM).

Denmark and Sweden: This material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches ("GSBE"). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

In the European Union, this material has been approved by either Goldman Sachs Asset Management Funds Services Limited, which is regulated by the Central Bank of Ireland or Goldman Sachs Asset Management B.V, which is regulated by The Netherlands Authority for the Financial Markets (AFM).

Switzerland: For Qualified Investor use only – Not for distribution to general public. This is marketing material. This document is provided to you by Goldman Sachs Asset Management Schweiz Gmbh. Any future contractual relationships will be entered into with affiliates of Goldman Sachs Asset Management Schweiz Gmbh, which are domiciled outside of Switzerland. We would like to remind you that foreign (Non-Swiss) legal and regulatory systems may not provide the same level of protection in relation to client confidentiality and data protection as offered to you by Swiss law.

Asia excluding Japan: Please note that neither Goldman Sachs Asset Management (Hong Kong) Limited (“GSAMHK”) or Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H ) (“GSAMS”) nor any other entities involved in the Goldman Sachs Asset Management business that provide this material and information maintain any licenses, authorizations or registrations in Asia (other than Japan), except that it conducts businesses (subject to applicable local regulations) in and from the following jurisdictions: Hong Kong, Singapore, India and China. This material has been issued for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited and in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H).

Australia and New Zealand: This material is distributed in Australia and New Zealand by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (’GSAMA’) and is intended for viewing only by wholesale clients in Australia for the purposes of section 761G of the Corporations Act 2001 (Cth) and to clients who either fall within any or all of the categories of investors set out in section 3(2) or sub-section 5(2CC) of the Securities Act 1978, fall within the definition of a wholesale client for the purposes of the Financial Service Providers (Registration and Dispute Resolution) Act 2008 (FSPA) and the Financial Advisers Act 2008 (FAA),and fall within the definition of a wholesale investor under one of clause 37, clause 38, clause 39 or clause 40 of Schedule 1 of the Financial Markets Conduct Act 2013 (FMCA) of New Zealand (collectively, a “NZ Wholesale Investor”). GSAMA is not a registered financial service provider under the FSPA. GSAMA does not have a place of business in New Zealand. In New Zealand, this document, and any access to it, is intended only for a person who has first satisfied GSAMA that the person is a NZ Wholesale Investor. This document is intended for viewing only by the intended recipient. This document may not be reproduced or distributed to any person in whole or in part without the prior written consent of GSAMA.

To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 (Cth), that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 (Cth).

Any advice provided in this document is provided by either of the following entities. They are exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia and therefore do not hold any Australian Financial Services Licences, and are regulated under their respective laws applicable to their jurisdictions, which differ from Australian laws. Any financial services given to any person by these entities by distributing this document in Australia are provided to such persons pursuant to the respective ASIC Class Orders and ASIC Instrument mentioned below.

- Goldman Sachs Asset Management, LP (GSAMLP), Goldman Sachs & Co. LLC (GSCo), pursuant ASIC Class Order 03/1100; regulated by the US Securities and Exchange Commission under US laws.

- Goldman Sachs Asset Management International (GSAMI), Goldman Sachs International (GSI), pursuant to ASIC Class Order 03/1099; regulated by the Financial Conduct Authority; GSI is also authorized by the Prudential Regulation Authority, and both entities are under UK laws.

- Goldman Sachs Asset Management (Singapore) Pte. Ltd. (GSAMS), pursuant to ASIC Class Order 03/1102; regulated by the Monetary Authority of Singapore under Singaporean laws

- Goldman Sachs Asset Management (Hong Kong) Limited (GSAMHK), pursuant to ASIC Class Order 03/1103 and Goldman Sachs (Asia) LLC (GSALLC), pursuant to ASIC Instrument 04/0250; regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws

No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

FOR DISTRIBUTION ONLY TO FINANCIAL INSTITUTIONS, FINANCIAL SERVICES LICENSEES AND THEIR ADVISERS. NOT FOR VIEWING BY RETAIL CLIENTS OR MEMBERS OF THE GENERAL PUBLIC.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law (“FIEL”). Also, Any description regarding investment strategies on collective investment scheme under Article 2 paragraph (2) item 5 or item 6 of FIEL has been approved only for Qualified Institutional Investors defined in Article 10 of Cabinet Office Ordinance of Definitions under Article 2 of FIEL.

Confidentiality No part of this material may, without Goldman Sachs Asset Management’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorized agent of the recipient.