Enhanced Indexing: A Little Active Goes A Long Way

Debates on active versus passive investing are long-standing, and stem from differences in investment philosophy, market dynamics, and the pursuit of greater returns. We believe both approaches have distinct advantages. In our view, the real question isn't which is inherently superior, but rather how to find a middle ground and leverage both in a complementary manner. We believe enhanced indexing provides a solution by seeking to marry cost efficiency, transparency and greater predictability of passive investing with the dynamism and enhanced risk management of an active approach. In our view, the appeal of these attributes is strengthened by an environment of elevated market uncertainty and market volatility.

When considering how to implement an enhanced indexing approach, we believe an exchange-traded fund (ETF) wrapper could be an ideal vehicle. This method of delivery can provide a mechanism that complements the cost-effective nature of enhanced index strategies; offering daily holdings transparency alongside flexibility and liquidity facilitated through intra-day trading.

Ultimately, the benefits of an ETF wrapper are far-reaching with investor accessibility standing out as a key advantage —particularly for enhanced indexing strategies. Historically, the appeal of low tracking error strategies has been reserved for institutional investors, however, the scalability of a data-driven approach coupled with a low fee structure open the door to investors who want to be “benchmark-aware” while seeking to source stable and consistent alpha.

The ability to integrate investor goals is also a key attraction of enhanced index ETFs, acting as versatile core portfolio building blocks, while offering the flexibility to customize portfolio levers beyond a standard index, ranging from investment universe definitions, tracking error levels, and alpha drivers, to value-based investing criteria such as sustainability goals. Ultimately, we believe that relying on a data-driven systematic engine reinforces flexibility in portfolio construction and calibration in levels of active risk.

The Core Proposition of Enhanced Indexing Strategies: Seeking Alpha Stability and Consistency While Balancing Risks

Enhanced index strategies track benchmarks closely, providing broad market exposure (beta). They also apply active stock selection, overweighting or underweighting stocks based on forward looking views, but moderating the magnitude of index deviations by seeking to employ a highly disciplined, efficient and risk-controlled approach. The magnitude of this risk is set in line with the appetite of the investor, typically ranging from 100 to 200 bps in tracking error. The tracking error level accounts for the size of active weights taken, which are carefully distributed in a balanced manner across market cap, sector and country levels. This limits concentration of active weights to avoid unintended risk exposures and maintain a portfolio composition that is close to the benchmark. As such, we believe enhanced indexing helps incorporate three key features to investor portfolios:

Alpha Stability: Achieving Consistent Outperformance

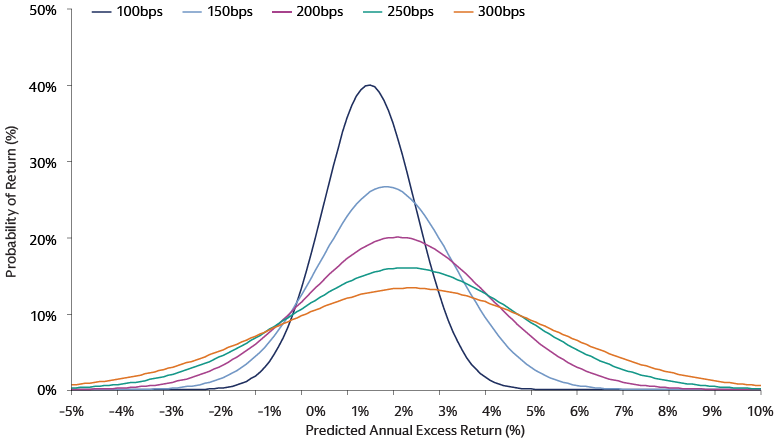

Like active strategies, enhanced index strategies aim to outperform a benchmark; yet, like passive strategies, target a more stable performance versus that benchmark. With a focus on consistency of positive performance rather than magnitude, low tracking error strategies may achieve positive excess returns more frequently, albeit at smaller magnitudes than higher tracking error strategies. As a result, we find enhanced index strategies can generate positive annualized excess returns versus the benchmark and thus above passive strategies, especially over longer-term horizons given the effects of compounding.

Source: Goldman Sachs Asset Management. For illustrative purposes only. The illustration shows the probability of a portfolio to achieve various levels of annual excess returns for various levels of tracking error. For instance, while a portfolio with 100 bps of tracking error (in dark blue) may have an average predicted annual excess return that is lower than one with 200 bps of tracking error (in purple) – seen in the horizontal midpoint of each respective bell curve, the probability of achieving that return is higher for the 100 bps portfolio – seen in the vertical height of each bell curve. Withal, a lower tracking error portfolio encompasses a much higher certainty of controlled positive return. The illustration is not related to any Goldman Sachs Asset Management product or strategy.

Alpha Efficiency: Increasing Efficiency with Lower Levels of Active Risk

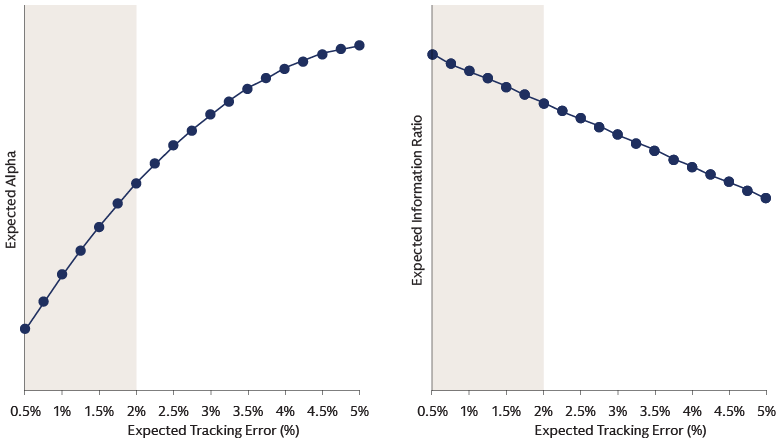

With larger deviations from the benchmark, risk increases (tracking error), but so does the potential for excess returns. However, the relationship is non-linear. As total tracking error increases, the additional excess return expected from taking incremental active risk decreases, such that the ‘first units’ of risk are better compensated then the ‘last units’ of risk. Therefore, risk-adjusted outperformance tends to be highest at lower tracking error levels. As a result, lower tracking error (enhanced index) strategies may target more durable alpha generation.

Source: Goldman Sachs Asset Management. For illustrative purposes only. The illustration shows the relationship between expected tracking error and expected alpha. What is generally observed is that as tracking error increases, we see a decreasing marginal return to alpha. Changing the structure of the index involves a lot of effort and thus “costs” more for every extra change necessary, such that operating at lower levels of risk entails lower marginal costs. Therefore, at lower tracking error levels, the information ratio tends to find its maximum. Put differently, the risk adjusted outperformance tends to be highest at lower tracking error levels.

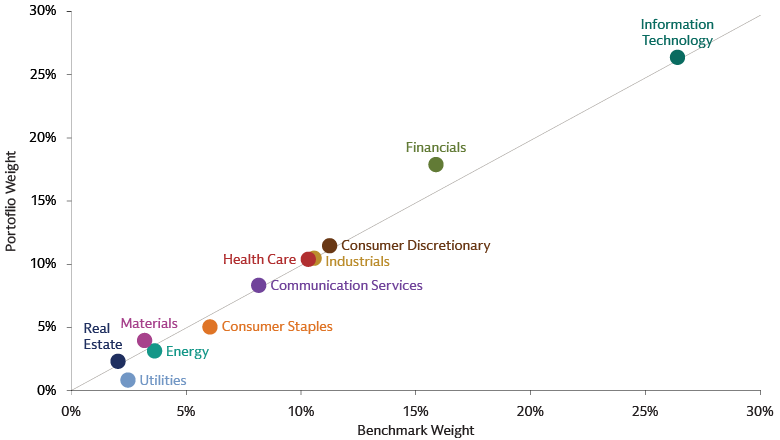

Risk Balance: Staying Close to the Index

To keep the tracking error at a low level, enhanced indexing portfolios tend to hold a larger number of names on average, tracking their benchmarks more closely, and take smaller active bets across a larger number of names (compared to higher tracking error portfolios), better diversifying sources of risk as the smaller bets are distributed across the whole benchmark rather than concentrated.

As a result, an enhanced index portfolio should not cause significant deviations in the composition relative to the benchmark, thereby maintaining the same characteristics as a passive portfolio. The nimble and dynamic nature of such approach affords a mechanism to firmly control any unintended biases which may be more challenging in a non-systematic framework.

Source: Goldman Sachs Asset Management. As of December 2024. For illustrative purposes only.

Unwrapping the Potential Benefits of an Active ETF Wrapper

We believe complementing an enhanced index approach with an active ETF wrapper offers an innovative way to navigate the equity market, providing potential benefits to equity investors.

The ETF serves as the enabling vehicle, allowing:

ETFs typically offer lower expense ratios than traditional active funds, reducing the performance drag of fees. The ETF wrapper facilitates access to sophisticated investment capabilities for a wide range of clients through their cost-effectiveness and ease of trading.

The inherently transparent structure of ETFs through daily holdings disclosure helps investors understand the performance drivers and align holistic asset allocation more effectively.

The ability to trade ETF shares intraday gives investors greater trading flexibility, particularly when navigating unpredictable markets.

A Little Active Can Go a Long Way

Ultimately, we believe the harmonious balance between active and passive investing benefits investors through the predictability of passive investing with the dynamism and enhanced risk management of an active approach. By pursuing alpha stability, efficiency, and balancing risk with an active ETF wrapper, enhanced index ETFs can potentially enable a balance of investor goals across dimensions of risk and return, sustainability and cost. To achieve these outcomes, we believe the maintaining of a data-driven informational advantage is essential. In our view, a robust alpha and portfolio construction engine, backed by tenured expertise in alpha generation, appropriate infrastructure, data, and technology, and continuous research are instrumental to success.