How Quant Strategies Drive the Alpha Enhanced Approach to Equity Investing

Today’s equity markets are more diverse and challenging than ever. This has created structural advantages for an Alpha Enhanced approach to equity investing, which seeks to deliver alpha stability and consistency while balancing portfolio risks. We think a quantitative – systematic and data-driven – stock-selection process is the most effective way to implement the Alpha Enhanced approach, particularly in complex and inherently inefficient markets. This combination – an Alpha Enhanced approach powered by a quant engine – can offer investors a low correlation to traditional managers, limit macro biases, and construct diversified portfolios, all with the aim of optimizing returns without uncompensated active risk. We believe these advantages provide a strong argument for deploying Alpha Enhanced strategies at the core of institutional public equity portfolios.

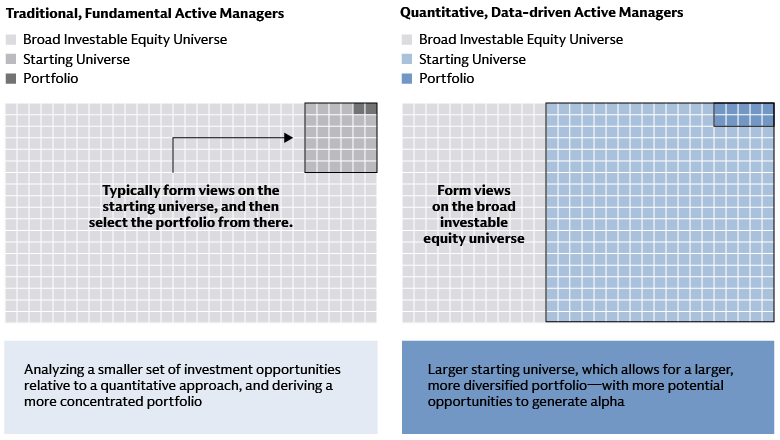

Diversification Driven by the Scalability of Systematic Investing

Alpha Enhanced investment strategies work by taking a large number of small active bets across market caps, sectors and geographies in a diversified manner, aiming to limit concentration, avoid unintended risk exposures, and maintain a composition that is close to the benchmark. The goal of this approach is to seek alpha stability and consistency while balancing portfolio risks. These strategies are built to deliver on three main objectives:

- Consistent positive performance over the long term

- Alpha efficiency tied to the tendency for potential risk-adjusted outperformance to be highest at lower levels of tracking error

- Risk balance potentially achieved by holding a larger number of names than strategies with a high active weight, and by tracking their benchmarks more closely

To achieve these objectives, Alpha Enhanced strategies incorporate a versatile alpha-seeking component that is controlled and risk-managed, potentially allowing investors to use their portfolio risk budgets more efficiently. These strategies’ tracking-error budgets are set in line with investors’ risk appetites but tend to fall in a range of 50 to 200 basis points. The added risk gives portfolio managers scope to improve risk-adjusted returns by overweighting or underweighting stocks based on forward-looking, stock-specific views.

In practice, this necessitates a systematic investment approach capable of covering the full scope of an equity universe at scale, even in complex and less efficient markets. To achieve this, quant strategies consolidate fragmented data into a single, actionable picture, enabling consistent application of an investment strategy across market segments. In our view, this is only possible thanks to the scalability of the systematic approach. This scope at scale allows quant-driven Alpha Enhanced strategies to take a large number of positions, which may enable diversification in line with the benchmark and efficient tracking-error management.

We think this breadth of coverage is a significant advantage for quant managers because it allows them to apply their investment theses across a broad universe of securities. This results in strategies capable of generating excess returns without taking on significant levels of active risk even in a long-only implementation.

Source: Goldman Sachs Asset Management. As of November 26, 2025. For illustrative purposes only.

Alpha Generation Through Changing Market Environments

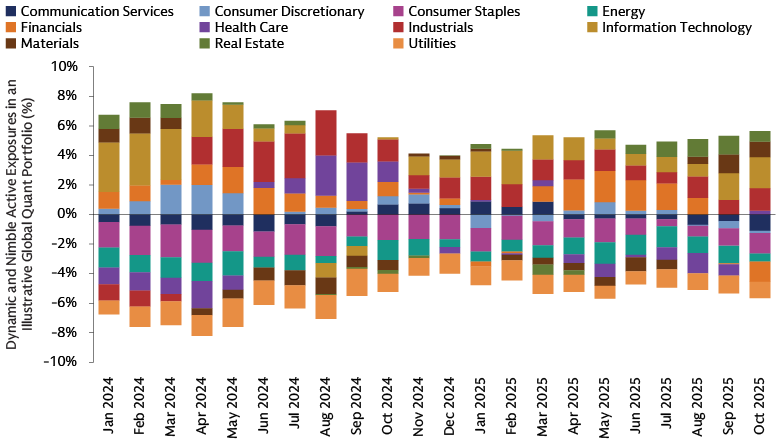

Quant strategies can add dynamism to an equity portfolio, allowing effective adaptation to changing market conditions. This ability to react swiftly to new information enables more frequent rebalancing and continuous evaluation of potential risks and alpha opportunities. Frequent rebalancing is necessitated by a strategy focused on small active bets along the benchmark in pursuit of consistent alpha. A nimble approach is also needed to navigate heightened market volatility, especially for strategies that seek to control risks.

Source: Goldman Sachs Asset Management. As of October 31, 2025. For illustrative purposes only.

Alpha Enhanced strategies tend to rely on diversified return and risk drivers in pursuit of idiosyncratic excess return. Thanks to this adaptability, systematic approaches can remain structurally independent of specific factors or styles. By leveraging alternative data sources, these strategies can target structurally different alpha to retain the diversification that supports alpha consistency.

To maintain a style-pure, macro-agnostic profile, Alpha Enhanced strategies tend to focus on stock-specific information, intentionally reducing the risks inherent in more top-down, macroeconomic considerations as well as biases related to country, sector or style. This ensures exposure to market beta with a tight focus on risk management through market cycles and periods of volatility while maintaining the ability to exploit investment opportunities. The majority of stocks in a diversified Alpha Enhanced strategy are chosen based on longer-term factors, but the rest of the portfolio is nimble enough to take advantage of shorter-term drivers of return, like sentiment-based factors and a certain degree of momentum.

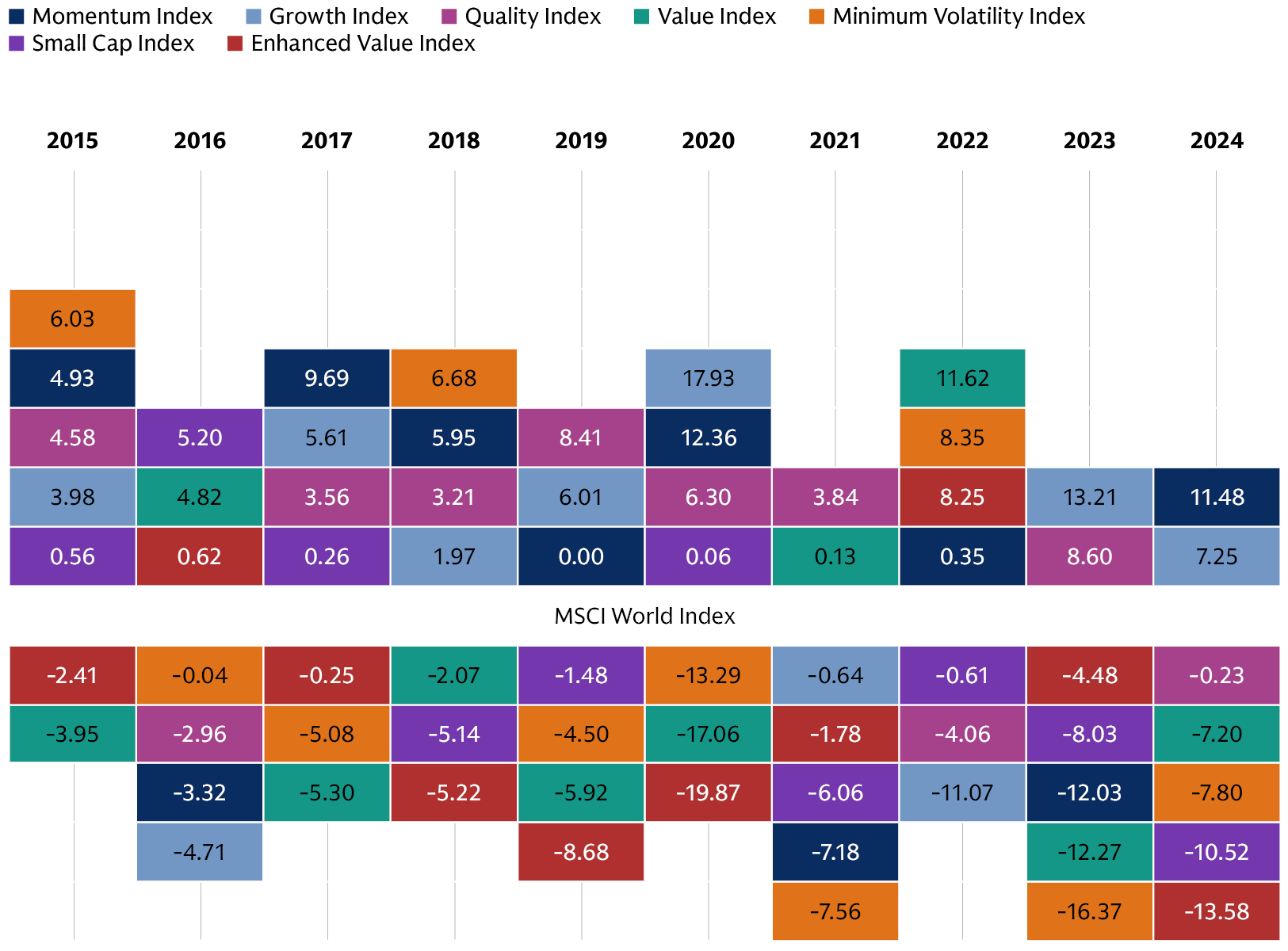

A comparison of the annual returns of common factor indices with the MSCI World Index shows that investment styles can be hit or miss over time. A factor that drives outperformance one year may underperform the next. This highlights the value of a style-pure approach for systematic strategies designed to generate alpha consistently year after year.

Source: Goldman Sachs Asset Management, Bloomberg. As of December 31, 2024. For illustrative purposes only. Factors are represented by MSCI factor indices in USD. These include MSCI World TR Net Index, MSCI World Growth TR Net Index, MSCI World Value TR Net, MSCI World Enhanced Value, MSCI World Minimum Volatility TR Net, MSCI World Quality TR Net, MSCI World Small Cap. Index descriptions are provided in the glossary. Please refer to MSCI for the factors’ definitions. Style excess returns are calculated by subtracting the annual performance of the MSCI factor index by the MSCI World Index (Net Total Return, USD).

Recent history underscores the challenges that may come with heightened factor volatility for approaches that are not style-pure. For example, the quality factor rebounded by 4% in the week ending October 24, 2025, after a 17% drawdown since July – the factor's steepest decline in recent years apart from late 2020 and early 2021.1 As similar reversals become more frequent and pronounced, active strategies seeking to deliver consistent returns, but which are not style-pure, may face challenges from investment style biases.

The idiosyncratic nature of excess-return drivers in Alpha Enhanced strategies can be seen through the typically low correlation among quant managers and their even lower correlation with fundamental managers. This low correlation enhances diversification and portfolio resilience in market downturns. For example, analyzing the monthly excess returns correlation among managers in the eVestment global large-cap equity space, we found that the median correlation among all quant managers in the space was 0.11, and that of quant managers versus fundamental managers was as low as 0.02.2 This highlights the structural advantage of systematic investing in building the portfolio resilience needed to generate consistent alpha.

Risk-adjusted Alpha Generation

Systematic, data-driven strategies offer investors a dynamic approach to portfolio management that is capable of playing both offense and defense; that is, seeking alpha while managing risks through diversification. This versatility allows investors to seek alpha, diversify risk, and optimize risk budgets according to their specific objectives.

By contrast, passive index-tracking strategies offer limited risk management and lack the mechanisms to manage volatility or adapt to investors’ preferences. For these reasons, we think passive exposures may not be the most efficient use of portfolio risk budget, especially amid moderating forward market-return expectations, elevated index concentration risk, and rapid growth in the amount of information available to investors. In this environment, we think the ability to enhance purely passive portfolios with the addition of an active dimension is critical.

The conservative offense provided by Alpha Enhanced strategies focuses on consistent returns by harvesting alpha from a large number of smaller active bets. More aggressive strategies, such as equity extension, which allow both long and short bets, can potentially deliver higher excess returns. They also add greater risk to portfolios, however, with a typical tracking-error budget of 300 to 600 basis points. Alpha Enhanced approaches seek to provide alpha stability, achieving positive excess returns more frequently, albeit at smaller magnitudes.

On the defensive side, the Alpha Enhanced approach is to construct highly diversified portfolios by making more but smaller bets. This keeps tracking error in check by limiting the divergence of a portfolio’s risk profile from its benchmark. As a result, Alpha Enhanced strategies tend to exhibit a balanced diversification of risk sources by spreading active weights along the index and avoiding concentration. This balanced distribution of active weights in turn allows investors to better control the impact of any active bet on the risk-return, style and diversification profile of the portfolio, and to adapt as necessary.

Opportunities for Systematic Investing Created by Equity Market Evolution

The landscape for alpha generation is evolving toward an expanding opportunity set for active, systematic and data-driven managers, driven by structural market evolutions that increase mispricings, amplify dispersion, and broaden the availability of alpha-rich information for investors with the ability to capture it. The rise of passive investing paradoxically contributes to market inefficiencies by making a growing portion of trading indifferent to fundamentals, thereby magnifying mispricings that active strategies can exploit, especially through systematic decision-making.

Concurrently, a more diverse mix of market participants, including increased retail involvement, fragments market views and behaviors, widening the distribution of potential mispricings across assets. The decisive shift in the data and computing landscape, characterized by the proliferation of alternative datasets and democratized cloud computing, expands the scope of exploitable signals beyond traditional financial statements.

In addition, consistently elevated cross-sectional return dispersion amplifies the payoff from accurate stock-picking, potentially creating more room for selection skill to add value by identifying stock-specific edges beyond broad style tilts. We believe all these components favor investment strategies focused on exploiting market inefficiencies across a wide spectrum of potential return sources at scale and leaning into the widening insights coming from expanding data and compute power.

Quant's Information Edge in Inefficient Markets

We believe the varied structures of global equity markets also create opportunities for quant investing, particularly where structural complexity and inefficiency complicate the process of stock analysis and selection. And, notably, these challenges are not exclusive to new and emerging markets, being also prevalent in some of the major developed markets outside the US.

The European equity market, for example, is inherently diverse and fragmented. It spans the 27-nation European Union and other financial centers including Switzerland and the UK. Trading occurs on dozens of stock exchanges governed by a variety of regulators, and securities are denominated in multiple national currencies in addition to the euro, pound sterling and Swiss franc. In addition to this structural complexity, actionable information can be harder to come by. Analyst coverage of listed European companies has been declining for years; a market cap-weighted average of 24 analysts now cover European stocks compared with 45 in the US.3 Europe also lags in news coverage of public companies, with an average of 14 articles tagged per stock, well below the 36 articles per stock in the US.4 Likewise, emerging markets are also a highly heterogeneous asset class, driven by different economic factors and exhibiting diverse market dynamics. Emerging markets are a similarly under-researched universe: sell-side analyst coverage is sparse and distributed disproportionately across stocks. As a result, valuable information may not always be reflected in asset prices, with a lower speed of diffusion.

We believe analyst coverage is also an issue in the Japanese equity market, with a market-cap weighted average of 18 analysts per company in the MSCI Japan Index and just 15 in the MSCI Japan IMI index.5 In contrast to the diversity of Europe, Japan’s equity market is strongly homogenous: one currency, one set of rules, and a small number of exchanges. The dominance of the Japanese language in the market can make it harder for international investors to access vital information, however. Just 54% of Japanese companies publish earnings reports in English, leaving nearly half the market far less visible to global capital.6

The relative inaccessibility of market information in Europe, Japan and many other markets creates a potential opportunity for investors capable of obtaining critical information. Quant strategies in particular may have an edge in these markets, where alternative data can play an important role in assessing risk and identifying opportunities. For example, Japan grants more patents than most developed countries, yet the vast majority of patent applications are in the Japanese language.7 This rich data source with limited access can potentially expand the available alpha opportunity set for quant investors with the necessary tools.

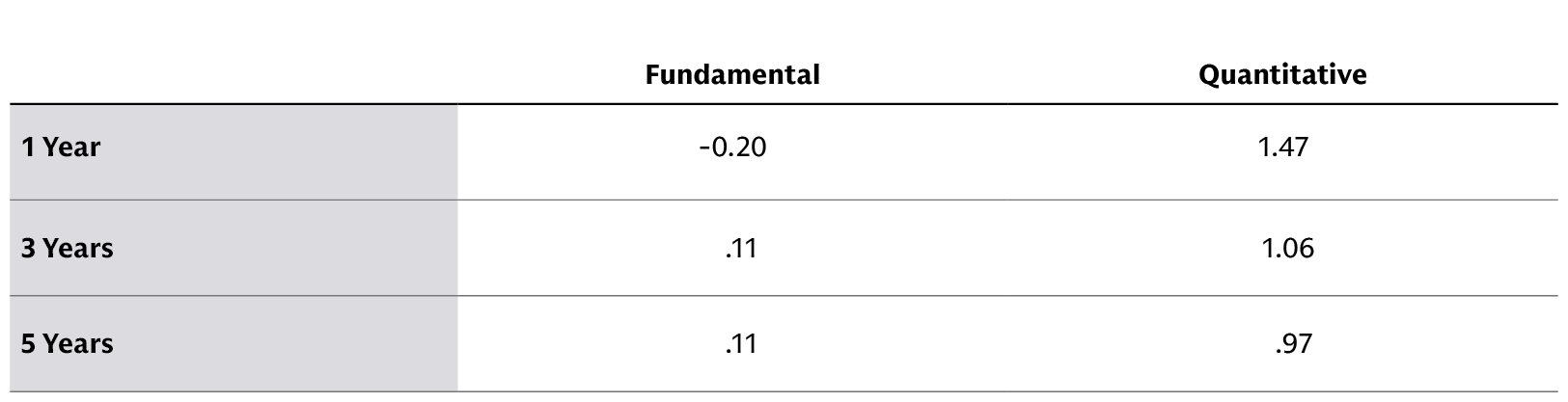

The edge that quant managers have in accessing and processing vital market data can be seen by comparing their median information ratios compared with those of their fundamental peers.8

Source: Representative of ACWI ex-US All Cap Core Equity eVestment Universe. As of July 24, 2025.

Despite this advantage, institutional investors remain under-invested in quant strategies in their overall portfolios. Looking across the eVestment universe, which includes more than 100,000 active institutional public equity mandates spanning public pensions, endowments, foundations, and other entities globally, active fundamental strategies account for 89.4% of mandates, compared with just 6.6% for active quant strategies. This trend is also consistent across regions.9

The Case for Quant at the Core of Equity Portfolios

We believe there is a strong case for placing strategies built on data-driven, systematic stock selection, such as Alpha Enhanced, at the heart of institutional public equity portfolios. This approach to portfolio construction can enable the disciplined deployment of active risk while retaining market beta. We believe that quant managers are well positioned to realize the potential of Alpha Enhanced, especially those with the capacity to deploy data and technology at sufficient scale across investment universes and the expertise to manage risk effectively across markets. A focus on research and innovation is also required to allow quant managers to retain the edge that potentially generates consistent returns over the long term, in our view.

1 Goldman Sachs FICC and Equity, Goldman Sachs Global Investment Research. As of October 24, 2025. The quality factor in this analysis is a long/short basket pair designed to capture “quality,” defined as high returns on equity, low debt to equity, and low earnings variability.

2 Goldman Sachs Asset Management, eVestment. As of July 29, 2025. The data represent the correlation of monthly excess returns among quant and fundamental managers in the global large cap equity universe in eVestment for the time period based on data availability, Returns measured in USD and measured against the manager-preferred benchmark. Passive managers were excluded from the analysis.

3 Goldman Sachs Asset Management, MSCI, Bloomberg. As of October 29, 2025. In making this calculation, we used the S&P 500 to represent the US equity market and the MSCI Europe index for Europe.

4 Goldman Sachs Asset Management, MSCI, Bloomberg. As of October 29, 2025. In making this calculation, we used the S&P 500 to represent the US equity market and the MSCI Europe index for Europe.

5 Goldman Sachs Asset Management, MSCI, Bloomberg. As of October 29, 2025. In making this calculation, we used the S&P 500 to represent the US equity market and the MSCI Europe index for Europe.

6 “Summary Report of the English Disclosure Implementation Status Survey,” Japan Exchange Group. Data as of December 31, 2024.

7 Goldman Sachs Asset Management. LHS: World Population Review. Dataset does not include patents submitted via intragovernmental collectives, such as the Eurasian Patent Organization or the African Intellectual Property Organization, as those patents are not traced back to a single country by the World Intellectual Property Organization. Countries with most Patent grants are only shown. Germany has the highest number of patent grants within Europe. RHS: IPStart. During 2023, a total of 300,133 Patent applications were filed in Japan. Countries that filed patent applications in Japan include Japan, US, China, Korea, Germany and more. Data as of end-2023.

8 eVestment data. Data pulled on July 24, 2025, for the respective trailing time periods ending with the first quarter of 2025. Observed eVestment universe includes active strategies in the ACWI Ex-US eVestment investment universe. Currency used: USD. Filter: Median of IR, 1yr, 3yr, 5yr using Manager Preferred Benchmark.

9 eVestment. Data as of May 28, 2025. Observed eVestment universe includes active strategy mandates across the following regions and investor types – Regions: ACWI, ACWI Ex-US, Asia Pacific, Asia Pacific ex-Japan, Australia, Brazil, Canada, China, Chinese Taipei, EAFE, Eastern Europe, Emerging Asia, Emerging Markets ex-China, Europe, Europe ex-UK, Eurozone, France, Frontier Markets, Germany, Global, Global Emerging Markets, Greater China, India, Japan, Latin America, MENA, Middle East, New Zealand, Nordic, North America, Pan-European, Russia, Saudi Arabia, Switzerland, Thailand, United Kingdom, United States Investor Type: Corporate, Fiduciary Allocators, Foundation & Endowment, Health Care, Insurance, Public Fund, Sovereign Wealth Funds, Superannuation, Union / Multi-Employer. Currency used: USD. Excludes Passive funds and managers.