Goldman Sachs Green and Social Bond Funds Impact Report

At Goldman Sachs Asset Management, we are committed to helping investors manage the risks and seize the opportunities created by the transition to a more sustainable economy. Our green and social bond funds are two of the solutions we provide to help clients accomplish their goals related to the climate transition and inclusive growth.

Our green bond funds seek to advance the climate transition by investing in bonds whose proceeds are used to finance environmentally beneficial projects. These projects are aligned with the Green Bond Principles,1 a set of voluntary best-practice guidelines for issuers, across categories including renewable energy, clean transportation and green buildings.

The Goldman Sachs Social Bond fund aims to address or mitigate specific social issues and to achieve positive outcomes aligned with key categories set out in the Social Bond Principles,2 including affordable basic infrastructure, access to essential services, affordable housing and employment generation.

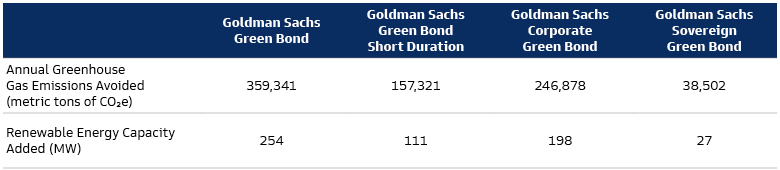

In our Impact Report for 2022, we share the expected impact associated with the investments in four of our green bond funds3 across two key metrics: annual greenhouse gas (GHG) emissions avoided and renewable energy capacity. This is our first report on the expected impact of the Goldman Sachs Social Bond fund, for which we measure performance on one key metric, the expected number of beneficiaries.4

Source: Goldman Sachs Asset Management, Data Provided by Issuers. As of December 31, 2022.

Source: Goldman Sachs Asset Management, Data Provided by Issuers. As of December 31, 2022.

In addition to demonstrating and contextualizing the expected impact our green and social bond funds had in 2022, this report also explains our reporting methodology and our approach to investing in these markets. Because green and social bonds are labeled by their issuers, our selection process looks beyond the label at the underlying projects and the sustainable strategies of the issuers. As a result, we currently reject 36% of green-labeled bonds in the market and 28% of social-labeled bonds.5

The report also explores our commitment to promoting and exercising effective bondholder engagement with the investee companies in the portfolios we manage on behalf of our clients. The Global Stewardship Team drives the continued enhancement of our approach to stewardship and serves as a dedicated resource for the public investment teams.

1 “Green Bond Principles: Voluntary Process Guidelines for Issuing Green Bonds,” ICMA. As of June 2021.

2 “Social Bond Principles: Voluntary Process Guidelines for Issuing Social Bonds,” ICMA. As of June 2023.

3 Goldman Sachs Green Bond, Goldman Sachs Green Bond Short Duration, Goldman Sachs Corporate Green Bond, Goldman Sachs Sovereign Green Bond

4 Green and social bond issuers provide these metrics to investors in their annual impact reporting. We collect the available data reported by issuers of bonds held in our portfolios, then prorate the numbers by the amount of our investment to yield an aggregate expected impact number for our green and social bond funds. To aggregate bond information at the portfolio level, we use the portfolio-level share of allocation and impact per bond. This is calculated as the percentage of a bond’s total issuance held by the fund. In this report, we use the portfolio holdings on December 31, 2022, for this calculation. The aggregated fund level use of proceeds, regional allocation, SDG contribution and impact metrics can then be derived by adding up the portfolio-level share of weighted bond allocations, SDG contributions and impacts. As outlined in the Impact Calculation Methodology section of this report, our approach tends to yield a conservative estimate of portfolio-level impact for two main reasons. The first is that impact data are not available for newly issued bonds, because issuers usually only publish their allocation and impact reports one year after issuance. For the newly issued bonds in our portfolio, we usually look for older bonds from the same issuer. If both the new and older bonds fall under the same framework and are subject to the same eligible asset pool, we assume the new issue’s impact is the same as that of the older bond. If a bond is the first from a given issuer, however, we adopt a conservative approach and assume its impact is zero. The second reason arises when we have doubts as to how an issuer arrives at the impact figures they provide. If our concerns remain unresolved after engagement with the issuer, we again adopt a conservative approach and assume the bond’s impact is zero.

5 Goldman Sachs Asset Management. Data as of July 17, 2023. This metric is at a point in time and is subject to change.