Industrializing Alpha: A Look at Multi-Manager Hedge Funds and Modern Allocation Strategies

Multi-manager hedge funds have become a dominant force in the hedge fund industry in recent years. Also known as “multi-manager platforms”, “multi-PM funds”, and “pod shops”, multi-manager hedge funds are characterized by their strategy of allocating capital across a large number of underlying portfolio managers (PMs) who invest autonomously, rather than an investment process that relies on a single centralized decision-maker. Most often, these firms have a senior leadership group that makes capital allocation decisions and a central risk management function responsible for managing risk at both for the overall fund and at the individual PM level.

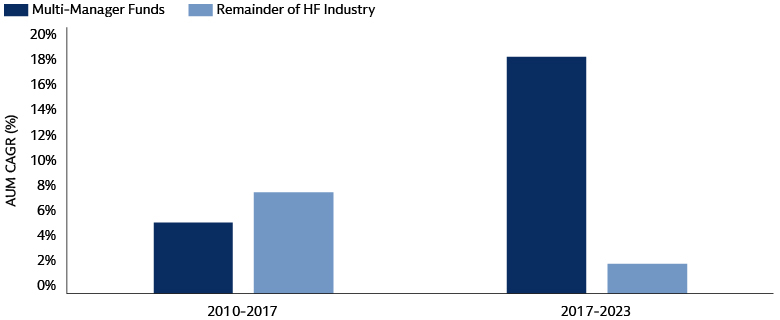

Multi-manager hedge funds have generated stronger risk-adjusted results with lower correlations relative to the broader hedge fund universe in recent years. These outcomes have garnered significant investor interest, allowing multi-manager firms to grow AUM by 175% from 2017 to 2023, while the rest of the hedge fund universe grew 13% over the same timeframe.1 Multi-manager firms have utilized their increased scale (and fees) to maintain and extend their competitive positioning, leading to what has been considered an “arms race” to attract talented personnel, expand strategies, and implement cutting-edge infrastructure, technology, and data strategies.

Source: Goldman Sachs, GBM Prime Insights & Analytics, as of June 30, 2023.

Today, multi-manager hedge funds are carefully navigating the increased set of risks and considerations that have come along with their rapid growth, as they seek to avoid becoming victims of their own success. In trying to accommodate their rapidly increasing AUM, multi-manager funds have faced the challenge of scaling up their investment teams within the reality of a finite supply of high-quality investment talent and a limit to how high fees can go without proving detrimental to future returns. Multi-manager hedge funds have also sought to expand into new investment strategies, which has led to firms looking increasingly similar, providing less differentiated exposures, and competing with each other in even more ways. These factors have resulted in frequent "poaching” of individuals from one platform to another, while the increased level of competition and converging mix of strategies being implemented can potentially degrade the alpha potential and differentiation that a platform can provide. With many multi-manager funds utilizing significant amounts of leverage and following similar styles of risk management, we see increased potential for more frequent and severe “deleveraging” events. Further, the most in-demand multi-manager firms have sought to improve their competitive positioning and titrate client demand by changing investor terms, making these firms difficult to access with high fees and restrictive liquidity rights for limited partners (LPs).

The rapid growth and significant changes across the multi-manager hedge fund landscape in recent years has led many in the hedge fund industry to ask, “have we reached ‘peak platform’?” While there is certainly no clear-cut answer to this question, we believe that many of the well-built and innovative multi-manager platforms will thrive, while others will be outcompeted and have difficulty achieving success. In fact, a few large platforms have returned a portion of their capital to investors in recent years to avoid diluting their returns, signaling that some managers recognize that there are constraints on deploying incremental capital. We also believe that investors can access the greatest amount of skill in the hedge fund industry by taking an unconstrained approach across strategies and structures – while multi-manager platforms have captured a significant amount of talent, there remains a large pool of skilled investors outside of that ecosystem who should not be ignored. Talented hedge fund managers exist outside of the multi-manager universe due to their own choice – some people prefer to be entrepreneurial or manage strategies as they see fit – and by virtue of the strict portfolio and risk requirements to operate in a multi-manager model, which do not suit all types of strategies and asset classes. In our view, investors will be able to harness the maximum amount of skill by considering all types of hedge fund strategies. Alpha potential can be maximized through an approach that includes both multi-manager funds and other hedge fund strategies, and complements these manager investments with additional alpha generation opportunities such as co-investments and structural innovations such as separately managed accounts.

Basics of the Multi-Manager Business Model

Multi-manager hedge funds follow a strategy that is based upon capital being allocated to multiple portfolio managers (“PMs” or “pods”). PMs manage this capital independently from each other and are generally compensated based on their own performance rather than the aggregate results of all PMs. Large multi-manager firms can have 100 or more PMs, while smaller firms can be more concentrated, though it would be abnormal to see an exceedingly low number of PMs given that there are significant benefits achieved through PM diversification. Most often, PMs at these firms have granular specializations, such trading a specific equity market sector, arbitraging M&A deals, or trading interest rates in a specific manner. PMs usually implement strategies focused on generating consistent alpha with limited beta and a low correlation to broader markets. Multi-manager platforms also generally apply strict portfolio construction and risk management frameworks, which are designed to ensure that PMs are managing portfolios consistent with their expertise and also serve to limit the negative impact that any individual PM can have on the overall portfolio. Multi-manager funds typically utilize varying degrees of leverage to amplify the alpha generated by the individual PMs.

Multi-Manager Evolution and Hedge Fund Industry Impacts

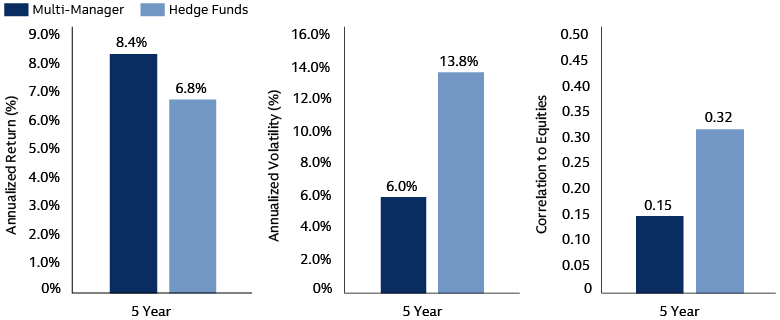

During the post-GFC recovery, which saw a resurgence in the broader hedge fund industry, multi-manager hedge funds initially grew at a slower rate than the rest of the industry. This was due in part to certain directional strategies being able to generate exceptional performance as markets rebounded from the severe 2008-2009 drawdown. Additionally, many investors were hesitant to take on exposure to multi-manager funds at this fragile point in time given multi-manager funds’ limited transparency and high leverage. However, this trend began to reverse around 2017; since then, multi-manager strategies have grown more than 6 times faster than the rest of the hedge fund universe as investors became more accepting of the business model as managers delivered on the promise of consistent, uncorrelated, alpha-driven performance characteristics. Over the last five years, multi-manager hedge funds have produced higher returns, with meaningfully lower volatility and lower equity correlation, relative to the composite universes of broad hedge funds and multi-strategy (not multi-manager) funds.2

Source: Goldman Sachs, GBM Prime Insights & Analytics, as of June 30, 2023

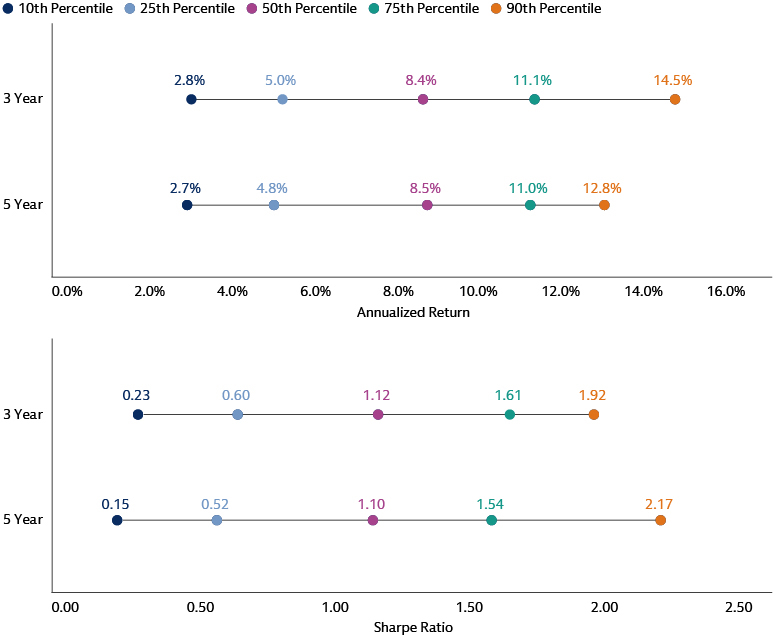

While composite returns for multi-manager funds are attractive, dispersion of both absolute returns and Sharpe ratio is meaningful – based on the most recent 5-year sample data from Goldman Sachs Prime Services, the 75th percentile multi-manager return is 11.0%, while a 25th percentile return is only 4.8%. Over the same time, a 75th percentile Sharpe ratio was 1.54, well in excess of the 0.52 Sharpe ratio for a 25th percentile manager. We believe that this dispersion is likely to persist as competition remains intense amongst multi-manager incumbents and as the number of new entrants remains is robust. As such, investors stand to have vastly different experiences from multi-manager investments depending upon their manager selection decisions.

Source: Goldman Sachs Prime Services, The Evolution of the Multi-Manager Landscape, September 2023

Competitive Dynamics Across the Multi-Manager Universe

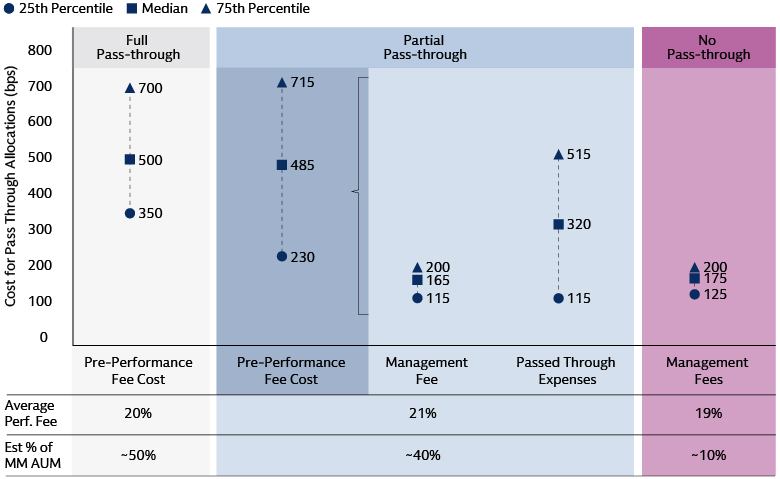

For today’s top-performing managers, the ability to maintain strong returns is not a given and requires ongoing investment. Heightened investor demand has led many multi-manager funds to accept billions of inflows and required them to scale their businesses as rapidly as possible to deploy this capital – necessitating an influx of PMs and some firms building out entirely new strategies to diversify their businesses. A critical feature of the multi-manager business model that has enabled this expansion is the “pass-through” fee structure, which permits managers to charge investors with expenses required to run and manage the fund (in addition to a set management fee). In addition to the performance-based incentive fee also charged, the pass-through fee structure has become nearly universal for multi-manager firms, with 8 of 9 new launches in the last 5 years having either full or partial pass-through expense structures.

Pass-through fees have enabled firms to tackle their need to recruit by offering escalating compensation packages. Multi-manager firms more than tripled their collective headcount from approximately 5,300 individuals in 2015 to over 18,000 in 2023, while the headcount in the rest of the hedge fund industry only expanded by about 10% (from 44,000 to 48,400).3 In addition to enabling rapid headcount growth, pass-through fees have also enabled multi-manager firms to build out new strategies and the required infrastructure, technology, and data to do so. During this growth phase, the multi-manager universe saw a significant shift in the ratio of investment to non-investment professionals – 60% of employees were investment professionals in 2015, versus 46% in 2023 – signaling the significant operational complexity that exists for large and growing multi-manager hedge funds.

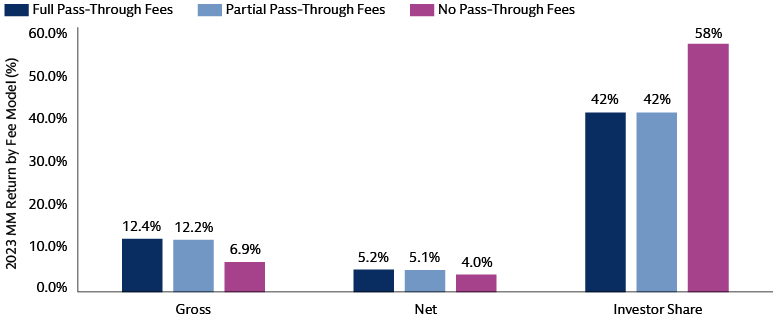

Despite multi-manager firms growing their assets, which helps investors absorb costs across a larger base, in many cases firms’ operational costs increased even more rapidly than their AUM growth, causing expenses charged to investors to rise substantially. In 2023, the estimated cost of the pass-through expense (including management fees) for managers with this structure was approximately 5%, before an incentive fee charge.4 Managers with full and partial pass-throughs substantially outperformed managers without a pass-through structure on a gross basis in 2023, indicating that the high levels of spending may have enabled firms with pass-throughs to generate outperformance. However, after accounting for the full fee load, the gap narrowed substantially but pass-through managers still outperformed slightly on a net basis. Some investors view relatively high fees and spending as a necessity for managers to maintain competitive positioning, while others have strong aversions to bearing such high costs. As a result of higher fee loads, investors have been receiving a lower share of the returns generated by multi-manager funds, capturing 54% of returns generated in 2021 versus 41% in 2023.5 While some of these figures are shorter-term in nature, it is critical for investors to ensure that managers with expense pass-throughs are utilizing this capability judiciously so that managers and their investors experience a mutually beneficial partnership.

Source: Barclays, “Multi-Manager Hedge Funds Review”, As of January 202

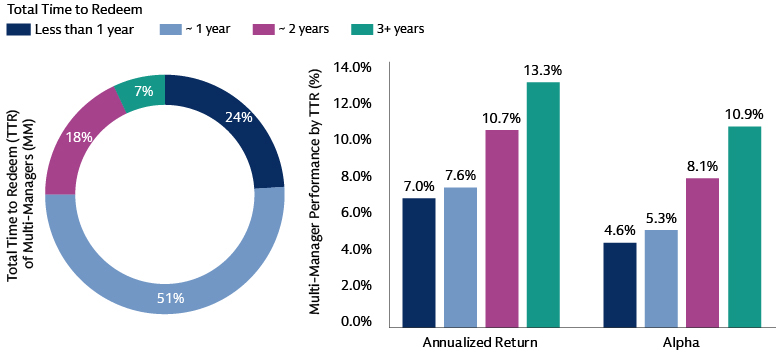

In addition to higher fees, many multi-manager firms have extended their liquidity terms. About 25% of the multi-manager universe now has liquidity terms that require 2+ years to fully redeem6, with some high-profile managers putting forth redemption terms that stretch out 3-5 years. Managers have defended the practice by arguing that it provides stability to pursue multi-year initiatives that will be beneficial for long-term alpha generation, as well as to attract and retain PMs when pitching their business relative to competitors with more liquid terms. Firms with the longest redemption terms have outperformed over the last 5 years;7 however, it is important to consider that strong performance has also likely allowed these firms to command less-liquid terms – in other words, there is likely a two-way relationship between strong performance and the ability for a manager to raise less-liquid capital from investors.

Source: Barclays, “Multi-Manager Hedge Funds Review”, As of January 2024.

Comparisons to Other Hedge Fund Models – Multi-PM Platform HFs First Blurred the Lines Between "Direct vs Fund of Fund”, and Now “Proprietary vs External”

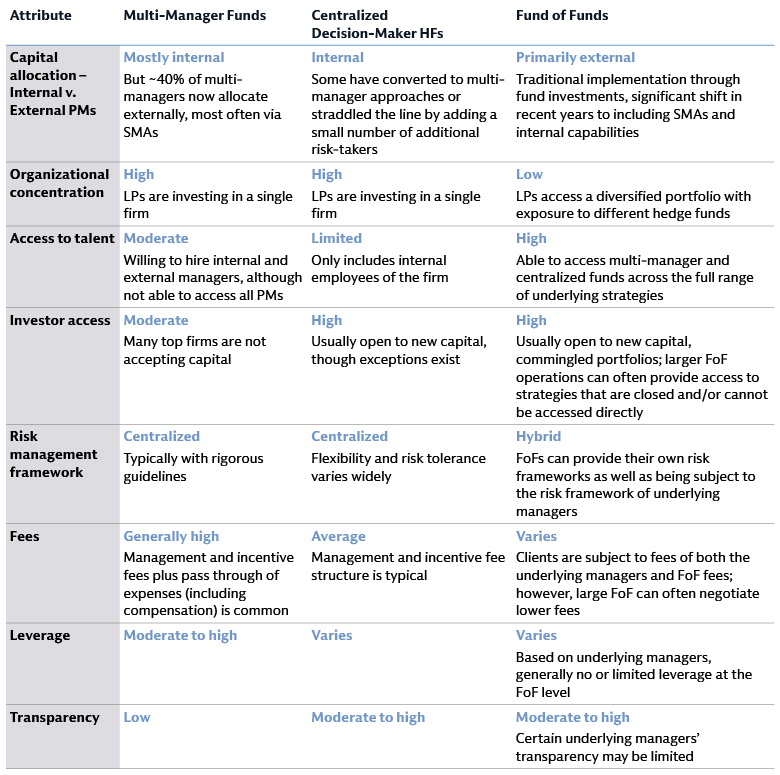

The shifting balance of capital toward multi-manager firms has led to several important developments in the way that these managers are operating their business, as well as having knock-on effects in the hedge fund industry more broadly. Multi-manager strategies have similarities and differences to both “traditional” hedge fund models that feature centralized decision-making as well as fund-of fund approaches, with a significant blurring of the lines across these models having occurred over many years. For example, while single-PM funds historically operated funds for the benefit of LPs, many of these funds now also manage accounts for multi-manager platforms. And while multi-manager platforms historically employed PMs on an exclusive basis, a significant percentage now allocate capital to external managers, bringing closer to what was historically considered the realm of fund-of-funds strategies. All the while, many fund-of-funds businesses have evolved by developing sophisticated separately managed account (“SMA”) capabilities, bringing them closer to the multi-manager style of investing.

Centralized decision-making hedge funds

The “traditional” form of a hedge fund features a centralized decision-making structure with either a single PM (often called the Chief Investment Officer, or CIO), or small group of individuals who have discretion over the positioning of the entire portfolio. Inherently this results in a single individual bearing massive responsibility within the investment process and, ultimately, for the ongoing success of the organization. Without that individual, investors often have limited confidence in the organization’s ongoing potential. The centralized decision-making model also makes it exceedingly difficult to develop the same degree of diversification in quantum of positions and viewpoints relative to those that can be achieved by multi-manager firms and fund-of-funds.

In contrast, the multi-manager model operates more like a factory designed to extract the skill of underlying PMs, with specialized functions that recruit and develop talent in large numbers then extract this skill in a consistent portfolio and risk structure. The institutionalization required to succeed as a multi-manager strategy also means that there is generally not a singular decision maker whose involvement is critical on a day-to-day basis. This lack of reliance on any single individual, can help multi-manager firms transition to being “skill factories” that are more durable than their centralized counterparts. Nonetheless, certain multi-manager firms have the backing of visionary and innovative founders whose decisions are impactful for the longer-term success and health of their firms. Fund-of-funds businesses have many parallels to multi-manager firms in this regard, taking advantage of the ability to source skill from the entire hedge fund universe and putting in place structures and processes to extract this skill consistently.

Fund of funds

As the hedge fund industry developed, the range of strategies became increasingly complex, difficult to evaluate, and hard to access for many types of investors who could otherwise benefit from having hedge fund exposure. This led to the development of the fund of hedge funds (or “fund of funds”) industry, with fund of funds business formed by individuals with the requisite expertise and industry connections to build portfolios of underlying hedge fund managers for those lacking the necessary toolkit. Multi-manager strategies are arguably most akin to the fund-of-funds model. Fund-of-funds and multi-manager platforms both rely on professionals who can source and evaluate talent, a skill grounded in both quantitative analysis and qualitative judgement. Both types of business also invest their capital by allocating across a group of independent return drivers (i.e., PMs in the case of multi-managers, and hedge funds in the case of fund-of-funds).

To illustrate the blurring of the lines between these two groups, it is now commonplace for multi-manager platforms to have incorporated external manager investments into their capital deployment strategies. Approximately 40%8 of multi-manager hedge funds now have at least some capital allocated to externally managed strategies. Some multi-manager firms are nascent in their external investing efforts, while others integrated external allocations into their approach many years ago and have billions of dollars invested in external managers via SMAs. Similarly, many fund-of-funds businesses have moved toward a hybrid model whereby they have flexibility to access managers either through traditional fund structures or in a more direct way by negotiating with hedge funds to manage capital through an SMA.

As multi-manager platforms continue to compete for a finite pool of investment talent, modernized fund-of-funds businesses have been able to parlay their central position in the industry to access the skill available throughout the hedge fund universe—whether investing in the top multi-manager platforms or highly skilled boutiques—and are uniquely be able to do so across all formats (fund + SMA) and access points (including co-invests). The modern fund-of-funds investment model has shifted into becoming a skill factory in its own right.

Source: Goldman Sachs Asset Management. For illustrative purposes only.

A modern approach to hedge fund investing

Multi-manager strategies have collectively generated impressive performance and substantially grown their market share in the hedge fund industry. The pace of their growth and fierce competition present headwinds and return dispersion will be high, but we believe that multi-manager funds that remain prudently capitalized and have a strong level of talent that aligns with the organization’s strengths and infrastructure can continue to be very successful. Nonetheless, intense competition amongst platforms is likely to persist and the dispersion of outcomes will likely be significant. Along with these developments, the lines between various types of hedge funds have blurred, with single-manager hedge funds borrowing from the successful practices of multi-manager platforms and fund-of-funds adapting their businesses to extract alpha with increasing levels of sophistication.

While a select group of multi-manager platforms will likely thrive moving forward, we believe that there are also many other sources of alpha available in the hedge fund landscape that should not go ignored in the current landscape. We believe that the modern approach to hedge fund investing requires an unconstrained approach that enables investments across different hedge fund strategies and structures. This approach allows an investor to be well positioned to maximize their ability to access skilled investment managers and give them the best odds at generating alpha. The ability to invest across multi-manager platforms, boutique firms with a more centralized structure, and co-investment opportunities, along with the ability to implement these investments flexibly through fund investments, SMAs, or otherwise, will provide solid grounding for a successful hedge fund program in the years ahead.

1 Source: GS Prime Services database

2 GS Prime Services. As of June 30,2023.

3 Goldman Sachs Prime Services, “The Evolution of the Multi-Manager Landscape”, September 2023

4 Barclays, “Multi-Manager Hedge Funds Review”, As of January 2024.

5 Bloomberg, “Hedge Fund Startups on the Rise With Giant Firms Under Scrutiny,” March 4, 2024.

6 Barclays, “Multi-Manager Hedge Funds Review”, As of January 2024.

7 Barclays, “Multi-Manager Hedge Funds Review”, As of January 2024.

8 Barclays, “Multi-Manager Hedge Funds Review”, As of January 2024.