A Conversation on Inclusive Growth Investing: A Cornerstone to Achieving Economic Growth

Greg Shell, the Head of Inclusive Growth Strategy, recently sat down with Salome Makharadze, Head of Private Market Sustainability Client Solutions and Product Strategy, to discuss his views on inclusive growth trends and opportunities in private markets after more than a decade of leading impact investing initiatives.

What has led you to dedicate your career to working and investing in inclusive growth?

Greg Shell: I’m a capitalist and I believe deeply in the potential for private capital to improve people’s standard of living. My entire career has been as an investment professional, seeking out themes and opportunities to challenge the orthodoxy that companies only exist in service to increasing profits. Concurrently, I've dedicated significant time to civic society—as a board member, mentor, and volunteer across numerous not-for-profit organizations.

I believe in the transformative power of education and the need to take a deep interest in solving challenges within society. This comes from my experience growing up outside of Boston, where I had the opportunity to be part of an accelerated academic program that had a huge impact on my ultimate trajectory.

Working in the field of inclusive growth investing provides me with an opportunity to use the power of investment capital to scale private companies whose business models help address societal challenges that are affecting people's lives in a real way. I often ask myself, “what could be better than for an investment professional to marry their profession and vocation with a personal passion in something that gives meaning to their life?”

How do you define inclusive growth?

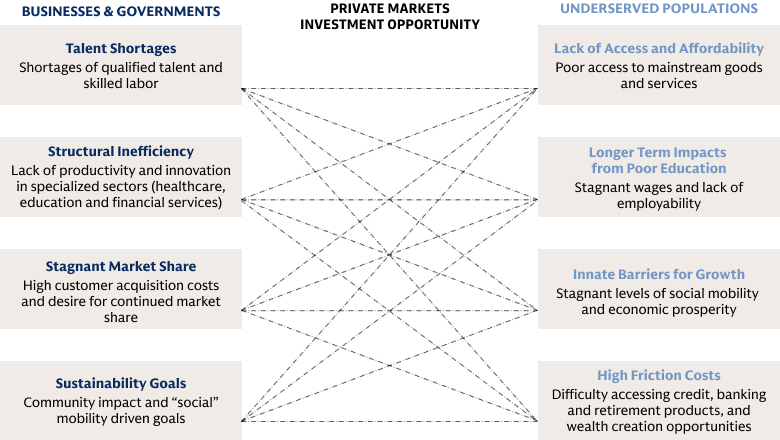

Shell: Inclusive growth investing is an acknowledgement that our economy would be larger, faster-growing, and more sustainable if we could bring more economic participants into the mainstream economy. There is a strong economic case to close access gaps for underserved populations because these gaps and overall inequality result in decreased aggregate demand and slower economic growth than what could be realized if these groups could be fully engaged. At the same time, many motivated stakeholders, such as businesses and governments, are recognizing the material costs of inequality and are seeking cost-effective solutions to address pain points and opportunities to grow in new markets. We believe private markets are able to bridge the gap for the two groups of stakeholders with the attractive market opportunity to invest in companies that improve outcomes by driving accessibility, affordability and quality healthcare, education and financial services.

How do you think about the evolution of inclusive growth investing?

Shell: My highest ambition since entering the field of impact investing has been for it to come off the sidelines and into the mainstream, which is something we’ve seen happen with the climate and energy transition thesis. It wasn't that long ago when the notion of investing in clean technology was an untouchable, un-investable universe. In the early days of climate investing, many opportunities were too early in development or capital intensive to attract investors; a virtuous cycle of demand was required to generate investable opportunities.1 When I think about how far we’ve come, it's quite remarkable.

While the climate thesis was predicated on declining cost curves to spur increased demand, funding for inclusive growth solutions already exists thanks to a large ecosystem of payors—including federal programs and agencies, governments, and private businesses—that are willing and able to fund initiatives to meet the needs of underserved populations. The limiting factor—and opportunity—has been a lack of economically viable solutions, but that is beginning to change with rise of new business models and technologies.

What are some of the themes driving the inclusive growth thesis?

Shell: We believe that inclusive growth investing requires an approach that is accessible, innovative, and affordable, centered on three critical areas that also present significant commercial opportunities: healthcare, education, and financial services. We believe it is important to prioritize the very bottom of the hierarchy of needs, by addressing basic healthcare for underserved populations, as well as to invest in the infrastructure and systems to affordably improve health outcomes. It’s also clear that education is essential for people to be prepared for—and be able to access—the jobs of the future, especially given the increasing pace of digitization and automation, ongoing training is required to propel people to higher levels. Lastly, with progress on these measures, inclusive financial services can accelerate efforts to capture and build wealth over time.

When put together, these themes cover a staggering number of people who are not able to participate in the economy to their fullest potential, reducing potential growth that is needed to meaningfully improve social mobility. Not only is the investment opportunity very large, but there are sub-themes in those three categories that contain high-growth businesses with innovative business models.

Where do you see opportunities for private capital to be deployed within inclusive growth themes?

Shell: Healthcare, for example, is a very large market and there are a significant number of people unable to access healthcare services that many of us take for granted. Some of this is due to cost, but another major factor is lack of access—the care is located far from where they live or work and there is a lack of accessible and affordable transportation. An increasing number of new tools, solutions, and business models are focused on addressing these issues to allow medical treatment to be delivered in a more efficacious manner, increasing the number of people able to access high-quality, affordable care.2 Secular tailwinds have been a catalyst to change how healthcare solutions are developed and delivered, including the forward adoption of telehealth solutions.

In education and workforce development, the current supply-demand mismatch in the labor market is only expected to widen in the coming years due to automation and digitization.3 As this happens, many pathways—from early childcare and K-12 education, to post-secondary schooling, through to corporate training—will be required to supply the future labor force that the economy will need, particularly in highly technical areas. While the need is significant, the US federal government has announced billions of dollars in funding to support workforce initiatives,4 and private companies have made significant in-house investment and/or partnered with educational institutions to develop educational programs.5

For underserved populations, healthcare and education services often are inaccessible due to high costs or lack of access/proximity; however, access to basic financial services and products that have become a requirement to fully participate in the economy continues to elude many Americans. Financial technology (FinTech) is one of the fast-growing areas for venture capital investment, averaging more than 2,000 deals and $80 billion of investment annually over the last three years.6 Fintech has the ability to democratize access to finance given its potential to lower costs, increase speed and accessibility, and allow for more tailored financial services.7 But given the history of financial service providers steering vulnerable populations to extractive products, as well as the increasing use of potentially-biased algorithms and data to drive these businesses, a sustainable investing lens is required to ensure that the most underserved populations are not exploited.

What is your response to investors who assume inclusive growth investing is concessionary?

Shell: While many investors still assume that accessing the inclusive growth space requires a concessionary approach, over the last decade annual startup investment by inclusive growth funds seeking market-rate returns has steadily increased from about $2 billion to about $20 billion in recent years.8 We have conviction that market-rate returns are not only possible to achieve for inclusive growth, but that the strategy is advantaged relative to more generalist strategies. The large addressable markets and secular-trend growth of the sub-themes offer potentially attractive opportunities. In addition, the business models that we’re looking for tend to deliver above-average profitability and cash-generating characteristics due to the large ecosystem of payors—including federal programs and agencies, governments, insurers, and private businesses—that are willing and able to fund initiatives to meet the needs of underserved populations.

We believe that success in the space will require not only domain expertise and deep knowledge of sustainable themes, but also significant operational resources and value creation capabilities to scale businesses. In addition to the traditional private equity toolkit, we will look to catalyze value creation by driving broad-based employee ownership while improving job quality and employee wellness. Together, we believe that these activities will help us to drive attractive returns, support companies to become leaders in their various industries, and deliver significant and measurable impact to all stakeholders.

Inclusive Growth Investing: A Cornerstone to Achieving Economic Growth

Widening inequality pushes down aggregate demand and results in underinvestment in human capital, damaging productivity by shrinking capacity for innovation. Many motivated stakeholders, including large corporates as well as the public sector, recognize the material costs of inequality, such as a shortage of skilled labor, sub-optimal productivity, and chronic health conditions. However, they have historically lacked viable options to address the pain points and shortcomings. Private capital provides the bridge between these two large groups by investing in innovative companies that improve outcomes by driving accessibility, affordability, and quality services. We believe the inclusive growth theme—centered on increasing accessibility and affordability of fundamental goods and services—has matured in recent years due to heightened focus, increasing institutionalization, and an initial wave of private capital investment that is leading to technological developments and commercial innovation.

Source: Goldman Sachs Asset Management. For illustrative purposes only.

The cycle of inequality is exacerbated by systemic barriers to healthcare, education, and financial services, which requires a comprehensive approach that is accessible, innovative, and affordable. Here are a few examples of potential commercial solutions:

Healthcare

Needs & Drivers: Maternity Care Deserts in the US Continue to Grow

Maternity care deserts are increasing, especially in rural areas of the US, and disproportionately impact underserved women.9 Lack of access to high quality maternal care leads to worse clinical outcomes (e.g., maternal & infant mortality, c-sections, NICU admissions, etc.) with higher associated costs for patients, hospitals, health systems, and payors. Hospitals and payors are increasingly investing in preventative measures to mitigate maternal health risks and reduce costs.

Potential Investment Examples: Maternal Care / OB-GYN-Focused Provider Enablement Platform

Platform focused on maternal health providers and OB-GYNs that provides technology, resources, and contracts to reduce administrative burden and improve patient outcomes.

Needs & Drivers: COVID-19 Exacerbated the Existing US Mental Health Crisis

COVID-19 exacerbated the US mental health crisis. More than a third of Americans reported symptoms of anxiety or depression in June 2022 vs. 11% in 2019, yet high out-of-pocket costs and provider shortages prevent many from receiving the care they need.10 One in four Americans choose between mental health treatment and paying for daily necessities, and more than two-thirds of Americans live in an area with a shortage of mental health professionals.11,12 Likewise, US health systems have more patients in need of mental health referrals than available providers in their communities; their inability to direct patients to providers, in turn, drives high rehospitalization rates and associated costs for patients with serious mental illness.

Potential Investment Examples: Virtual Mental Health Care

Virtual mental health platform that provides comprehensive care across age and acuity spectrum, accepts commercial and government insurance, and trains providers.

For illustrative purposes only. Not representative of any actual, or contemplated, investments.

Education

Needs & Drivers: Supply-Demand Mismatch in the Labor Market

Businesses are having difficulty hiring technology workforce today and are concerned about decreasing levels of retention. Employees increasingly value employer-offered opportunities to upskill and reskill themselves, especially as some job functions are expected to be automated in the future. Driven by the need for talent and to improve retention, businesses are spending more on learning & development, but due to a lack of internal capacity to provide workforce training efficiently and effectively, businesses are increasingly outsourcing to workforce training companies with proven track records. Technology Workforce Training A company that provides technology workforce training solutions that help employers and governments to source and train as well as to upskill and reskill existing employees.

Potential Investment Examples: Technology Workforce Training

A company that provides technology workforce training solutions that help employers and governments to source and train as well as to upskill and reskill existing employees.

Needs & Drivers: Increased Government Funding Available to Address Increasing Achievement Gaps in K-12 Students

The COVID-19 pandemic erased more than 20 years of progress on the Nation’s Report Card assessments, with the impact on underserved students much more severe.13 While the Elementary and Secondary School Emergency Relief Fund allocated $130 billion to schools and districts to support the safe reopening of schools and address student needs,14 many school districts across the US are struggling to retain or find teachers. This is increasing the demand for solutions to supplement the core curriculum, especially targeting students who are falling behind.

Potential Investment Examples: K-12 Supplemental Curriculum Provider

A company that develops an evidence-based supplemental reading curriculum and connects teachers or tutors to assist students who are falling behind to deliver it, paid for by the school districts.

For illustrative purposes only. Not representative of any actual, or contemplated, investments.

Financial Services

Needs & Drivers: Limitations of Traditional Underwriting Models

Traditional credit underwriting models have difficulty underwriting the 49 million Americans without credit scores, impairing lenders’ addressable market. Lenders see value in alternative underwriting models that have the potential to enhance credit decision-making at a lower cost, enabling them to profitably extend responsible and fair credit access to historically underserved consumers. However, many AI-driven models risk noncompliance with the Equal Credit Opportunity Act.15

Potential Investment Examples: AI-Enabled Alternative Underwriting

AI-driven credit underwriting SaaS platform that helps lenders identify and mitigate biases in the credit underwriting process, leading to increased credit quality and profitability for lenders while maintaining fair lending compliance.

Needs & Drivers: Costs of Poor Employee Financial Health

Employee financial wellbeing is top of mind for companies and HR leaders across the US. Employees who experience financial stress are far less productive than peers who feel confident in their financial situation—costing employers an estimated 13-18% in annual salary on average.16 In an effort to attract quality talent and combat employee attrition, 84% of employers are deploying resources to financial wellness tools.17

Potential Investment Examples: Employee Financial Wellness

Business-to-business-to-consumer (B2B2C) platform providing financial wellness programs as an employee benefit, including financial coaching, employer-sponsored savings plans and 0% APR emergency loans, improving employee productivity, job satisfaction and retention.

For illustrative purposes only. Not representative of any actual, or contemplated, investments.

1 Goldman Sachs Global Investment Research, 2023.

2 Goldman Sachs Global Investment Research. 2023

3 McKinsey Global Institute Global Automation Impact Model. 2022.

4 The White House, “FACT SHEET: White House Announces over $40 Billion in American Rescue Plan Investments in Our Workforce – With More Coming” As of July 12, 2022.

5 US News and World Report, “Companies Invest in Partnerships, Workforce Training to Bridge Skills Gap” As of February 20, 2020.

6 PitchBook. As of 2022.

7 World Bank – On Fintech and Financial Inclusion, 2021

8 PitchBook. As of 2022.

9 March of Dimes, Maternity Care Deserts Report 2022. As of December 2022.

10 Association of American Medical Colleges - A growing psychiatrist shortage and an enormous demand for mental health services, 2022.

11 Cohen Veterans Network & National Council for Behavioral Health - America’s Mental Health, 2018.

12 Association of American Medical Colleges Research & Action Institute - Exploring Barriers to Mental Health Care in the U.S. 2022.

13 McKinsey: COVID-19 Learning Delay and Recovery: Where do US States Stand?, January 11, 2023.

14 US Department of Education, As of 2023.

15 CFPB – Adverse Action Notification Requirements in Connection with Credit Decisions Based on Complex Algorithms, May 26, 2022

16 Salary Finance – Inside the Wallets of Working Americans. As of February 2023.

17 BofA – 2022 Workplace Benefits Report, February 2022.