Navigating EM External Debt: Earning Carry, Finding Alpha

The External EMD Market

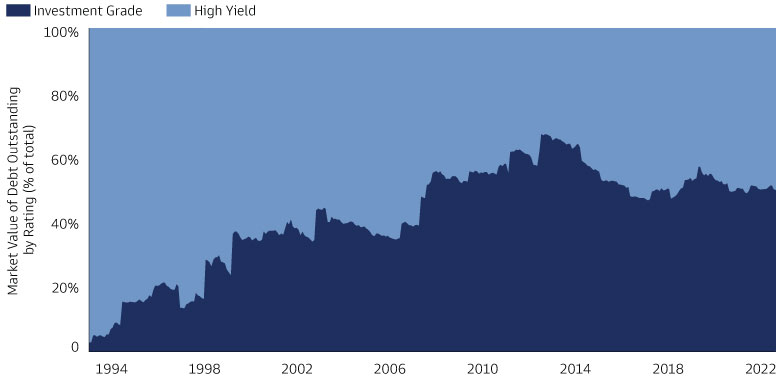

Public debt in emerging markets (EM) has surged to levels unseen since the 1980s, driven by lower borrowing costs (in the decade preceding the recent global monetary tightening cycle) and debt-driven growth in response to China’s economic deceleration.2 But unlike the 1980s, many larger EM sovereigns have lower external debt, while local currency debt markets have deepened, and average quality of an issuer in the J.P. Morgan Globally Diversified Emerging Market Bond Index (EMBI) index has improved (Exhibit 1).

Source: J.P.Morgan, Goldman Sachs Asset Management. As of August 10, 2023.

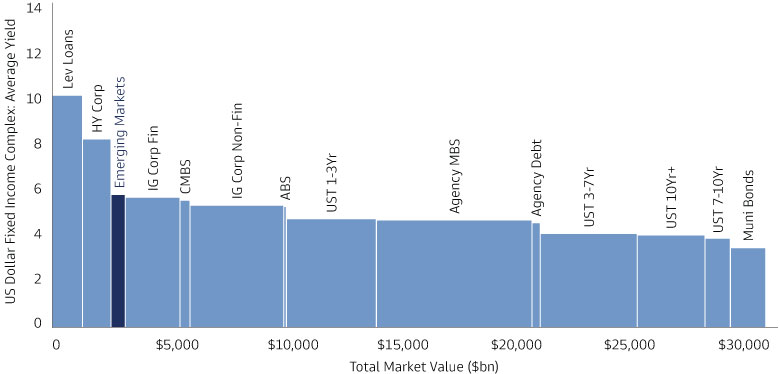

We believe the external EMD market holds significant appeal for global bond investors, serving as an attractive source of yield in the realm of us dollar-dominated bonds (Exhibit 2). The asset class, however, is marked by substantial heterogeneity. The number of EM sovereigns issuing US dollar bonds has nearly doubled since the early 2000s, surpassing 70. This expansion has ushered in greater differentiation in macro fundamentals, fuelling avenues for active management. Dispersion has been accentuated by the pandemic and surge in US interest rates since 2022, exposing vulnerabilities in certain EM economies with current account deficits and high short-term debt relative to currency reserves.3

Source: iBoxx, Bloomberg-Barclays, S&P LCD, Goldman Sachs Global Investment Research Global Credit Trader as of July 21, 2023. Based on iBoxx indices for the IG corporate credit and US Treasury markets, the Bloomberg-Barclays indices for the HY, MBS, CMBS and ABS markets, the EMBI index for the EM credit market, and the S&P LSTA index for the leveraged loan market.

Navigating Segmentation

Segmenting the external EMD market reveals three distinctive groups of issuers:

1. The Resilient: A group of IG and BB-rated high yield (HY) sovereigns—whose bonds outstanding account for ~74% of the EMBI by market value of debt outstanding4 —demonstrate resilience to macro headwinds due to prudent debt management and strong economic fundamentals. Bonds issued by these sovereigns deliver a yield of almost 6%, offering global investors attractive carry alongside diversification advantages. On a duration-adjusted basis, IG and BB-rated external EM bonds offer a spread premium over comparable quality US corporate bonds, making this part of the external EMD market an attractive proposition for ‘buy and hold’ investors seeking to lock-in higher yields over longer investment horizons.

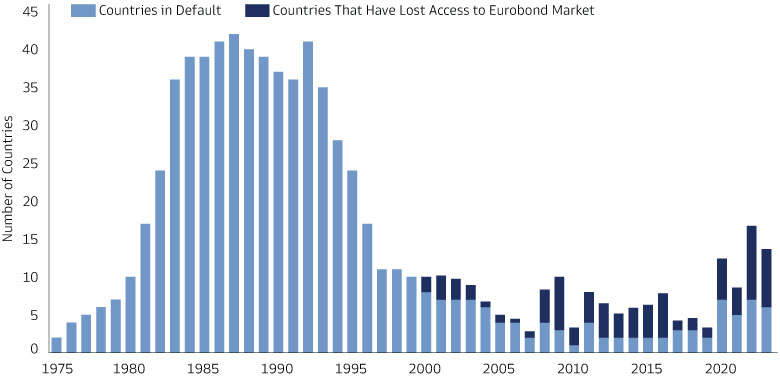

2. The Vulnerable: A cohort of HY-rated sovereigns face impaired or no market access, require support from international Financial Institutions (IFIs), and demonstrate macro vulnerabilities due to high current account deficits and low currency reserves. Notably, the combination of higher debt, higher rates, and external vulnerabilities has pushed the number of EM sovereigns in distress to the highest level since the late 1970s (Exhibit 3).

Source: Bloomberg, Cruces and Trebesch (2014), Asonima and Trebesch (2020), Goldman Sachs Global Investment Research. As of June 21, 2023.

3. The Improvers: Within the HY part of the market, we believe certain B-rated issuers are on an improving trajectory and offer opportunities for total return (or ‘alpha’) that can be unlocked through active management. This rating cohort exhibits high dispersion, encompassing countries like Jamaica and Bahrain, whose bond performance mirrors BB-rated counterparts, alongside those benefiting from IMF programs such as Ecuador and Egypt.

Earning Carry and Finding Alpha Potential

The following factors have led us to turn more constructive on the outlook for external EMD:

- Compelling valuations. Despite some compression from 2022 highs, spreads remain wide, and are hovering around similar levels observed during the Eurozone sovereign debt crisis.

- Potential technical tailwind. Negative net new supply and improved appetite for EM assets, driven by soft-landing optimism and disinflation progress, may establish a supportive technical backdrop for EM assets including external debt.

- Fading fundamental headwinds: Several dynamics portend an improving fundamental backdrop. First, we anticipate the peak in rating downgrade and default activity is likely behind us, due to the proximity to or potential surpassing of the peak in the US policy rate. Second, a moderation in commodity prices relative to 2022 is helpful for the current account positions of net commodity importing economies, mitigating external vulnerabilities for some sovereigns. Third, a moderation in US rate volatility may benefit high beta assets like external EMD. Lastly, we hold a cautiously optimistic stance regarding the outlook for distressed sovereigns owing to advances in debt restructuring and IMF support. Zambia’s successful restructuring in June, involving China, may serve as a precedent for future negotiations. Countries that count China as a significant creditor—like Sri Lanka, Ghana, Pakistan, and Angola—stand to benefit. Overall, a streamlined and institutionalized approach to sovereign debt restructuring is anticipated to unlock substantial value in the distressed portion of the external EMD market.

In conclusion, we believe the convergence of attractive valuations, a potential turnaround in technical dynamics, and an improving fundamental backdrop suggests external EMD can offer investors attractive income alongside opportunities for total return through active security selection.

Case Study: Actively Navigating El Salvador's Debt Dynamics

What happened? In 2022, concerns over El Salvador’s commitment to external debt obligations surfaced due to the country’s unconventional decision to accept bitcoin as legal tender.

Active Management in Action: Our economists undertook a comprehensive evaluation of El Salvador’s debt repayment capacity. Diligent analysis revealed funding avenues without an IMF program, assuaging near-term concerns. Specifically, our assessment highlighted that El Salvador had access to financing from local banks, the Latin American development bank (CAF), and the multilateral development financial institution (CABEI). Our analysis extended to monitoring the balance sheets of local banks, aimed at gauging their ability to support short-term government obligations. Our engagement with El Salvador’s policymakers also proved insightful. Through discussions we gained an understanding of their willingness to uphold debt repayment commitments.

Our exposure and investment outcome: Our holistic evaluation of debt dynamics, encompassing funding sources, local banking capacity and policymakers’ willingness to honour debt obligations, led us to retain exposure to external bonds issued by El Salvador. This decision delivered substantial subsequent returns. Overall, we believe our navigation of El Salvador’s debt landscape demonstrates the benefits of our approach to active management. By synthesizing macroeconomic trends, financial evaluations, and insights from policymaker engagements, we believe we can deliver investment returns and mitigate risks in our clients’ portfolios.

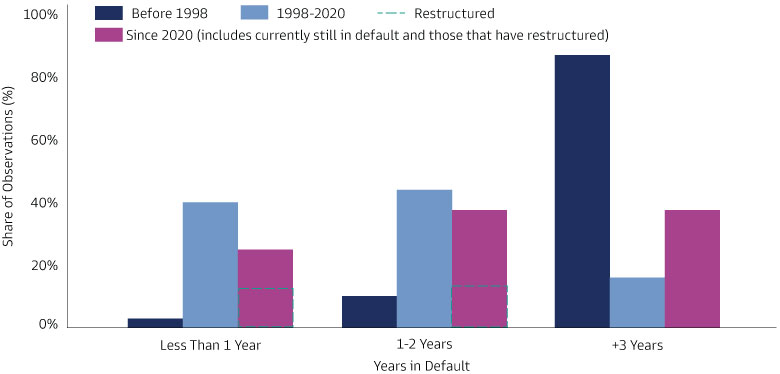

Context on Debt Restructurings

Since the late 1990s, debt restructurings in the external EMD market have evolved, with investors facing larger haircuts on EM bond investments but shorter restructuring periods—and therefore a shorter period of uncertainty—compared to the 1990s. Around 40% of restructurings from 1998 to 2020 lasted less than a year, with a similar proportion lasting one to two years. However, the pandemic triggered prolonged defaults of over three years in a few countries. This reflects various factors including China’s distinct debt restructuring approach (i.e., favouring debt rescheduling and re-profiling over haircuts), slow progress on debt relief under the “Common Framework” established by the G20 in 2021, country-specific issues, and tighter global financial conditions. However, we believe Zambia’s debt restructuring in June serves as a promising precedent for future negotiations.

Source: Cruces and Trebesch (2014), Asonuma and Trebesch (2020), Goldman Sachs Global Investment Research as of June 21, 2023. Includes data on countries that are still in default and have not restructured debt. The period 1970-1998 features numerous countries defaulting several times on the same debt; time spent in default is adjusted to be the first and last debt restructuring which was followed by regained market access. Goldman Sachs Asset Management leverages the resources of Goldman Sachs & Co. LLC subject to legal, internal, and regulatory restrictions.

Navigating External Emerging Market Debt with Goldman Sachs Asset Management

- A pioneer in EM investing: We have been investing in EM debt since 2000, and therefore possess a unique perspective to anticipate market trends and capitalize on investment opportunities.

- Deep expertise: The collective expertise of our EMD team of 29 professionals, including portfolio managers, sovereign economists, traders, and research analysts, converges to create diversified EMD investment portfolios.

- A trusted partner: We manage $29.9bn in EM debt, including $15.6bn in external EM debt.

- Expansive network: Our EMD team has access to insights from across Goldman Sachs Asset Management and Goldman Sachs, to provide clients with a distinctive vantage point to navigate fast-moving markets.

1 Also referred to as hard currency EMD or EM sovereign credit.

2 Chinese growth and import demand in the early 2000s helped to improve growth and public finances in many EM economies in the early 2000s.

3 See Navigating EM External Debt (January 6, 2023).

4 Source: J.P.Morgan, Goldman Sachs Asset Management. As of 2Q 2023.