A New Kind of Recession - Rolling Recession

It’s human nature to want to classify and label observations. Whether the classification is large or small, red or blue, round or square, such organization can help provide structure and context to decision-making. But what happens when the observation is medium purple trapezoidal? Sometimes strict definitions may not properly categorize observations.

The macroeconomic debate has centered on the likelihood of a hard or soft landing for the economy. Many observers in the recession or hard-landing camp point to the inverted yield curve, an aggressive Federal Reserve reaction function, and depressed leading indicators to validate recessionary expectations. In the US, the official arbiter of the economic cycle is the National Bureau of Economic Research. NBER emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months. There is a somewhat simultaneous and comprehensive contraction associated with the typical recession, where the broader economy succumbs to cyclical, monetary, and/or financial pressures.

On the other hand, there is an increasingly popular view that a soft landing is the more likely outcome. This refers to an environment in which the Fed tightens monetary policy to fight inflation without causing a US recession. Labor market strength, a robust private sector balance, growing real income, and the absence of systemically hefty bubbles could pave a narrow path for recovery. A soft landing may have below trend growth to resolve a macroeconomic disequilibrium, but we do not expect the slowdown to descend to recessionary levels. Depending on your macroeconomic expectations (hard- or soft-landing), portfolio implementation is likely to vary. Hard landings often elicit an up-in-quality or defensive response, while soft-landings invite patience with the strategic plan.

While both hard- and soft-landing camps are academically confident perhaps the actual economic outcome lies somewhere in the middle...a rolling recession. Rather than a simultaneous and comprehensive downturn, or the outright avoidance of a contraction, a rolling recession is a more staggered response to shifting dynamics such as tighter financial conditions, higher cost of capital, and inflation. As the US economy has evolved from a heavy industrial to a service and financial economy, the impact on the business cycle, inflation and monetary policy has become uneven.

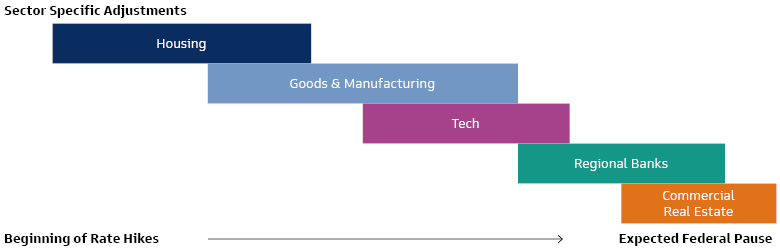

We can observe a cascading series of sector adjustments in the current economic cycle. In early 2022, the most rate-sensitive part of the US economy, housing, experienced a major downturn in aggregate demand as a spike in mortgage rates further constrained affordability. Many in the mortgage industry would say housing has already gone through and exited recession. Later in 2022, the consumer sector experienced pockets of inventory gluts as consumption patterns shifted from goods to services at the same time the supply chain recovered. Heavy price cutting and margin pressure ensued during the Fall. Shortly thereafter, the elevated cost of capital began to weigh on the information technology sector that had overexpanded during the work-from-home surge. Layoffs were frequent, but many displaced workers found a new job relatively quickly. Then in March of 2023, the technology sector gladly handed the baton to regional banks which revealed some of the unintended consequences of higher rates. While regional banking is adjusting to a new regulatory regime with tighter lending standards, the uncertainty across commercial real estate continues. There is clearly a common economic thread across these sectors. But much of their adjustment has been idiosyncratic. In our view, the rebalancing of these industries is not systemically large enough to contaminate the broader economy.

Source: Goldman Sachs Asset Management. As of September 29, 2023. For illustrative purposes only.

To be sure, many sectors are also thriving. We witness tremendous resiliency across travel and leisure, healthcare, artificial intelligence, multi-family housing, and industrial and storage commercial real estate to name a few.

Whether it’s a hard or a soft landing of the economy, a recession may be the most widely anticipated nonevent since the Y2K problem. We find many investment portfolios misaligned in anticipation of some clarion hard- or soft-landing signal. We would suggest investors observe the data as not lacking in clarity, but being a poor fit with traditional economic classifications. In our view, a rolling recession more accurately describes prevailing conditions and better informs portfolio decision-making.