HOW SOCIAL BONDS CAN HELP INVESTORS ADVANCE THEIR IMPACT AGENDA

When COVID-19 struck in 2020, governments around the world acted to slow the spread of the virus by closing borders, restricting the operation of businesses and telling people to stay at home. Many also rolled out financial support programs to soften the economic impact of these measures and to help companies and individuals weather the downturn.

To pay for these economic rescue packages, some governments tapped the nascent social bond market. The European Union, for example, issued nearly €100 billion in social bonds in just over two years to finance its SURE program, whose goal was to protect jobs and incomes during the economic slump.1 The EU lent the proceeds on favorable terms to 19 member states to support sectors such as hotels, manufacturing, restaurants and retailers that were hard hit by the pandemic. About 31.5 million people and 2.5 million firms were covered by SURE in 2020, while 9 million people and more than 900,000 firms benefitted in 2021.2

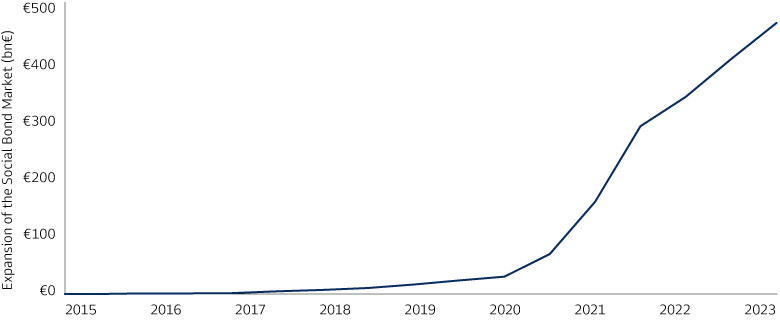

The EU wasn’t alone in turning to social bonds to finance its COVID-19 response. The pandemic provided a springboard for the market, which had made its debut in 2015. A total of 50 social bonds were issued in 2019, just before the outbreak. In 2020 that number more than quadrupled to 227 bonds, and it doubled again the following year to 468. By the end of 2022, social bonds had grown into a €464 billion market, almost a third the size of the green bond market.3

Goldman Sachs Asset Management, Bloomberg. As of January 1, 2023.

Potential Social Impact

Social bonds are fixed income securities with a social element. Their financial characteristics such as structure, risk and return are similar to those of conventional bonds. The main difference is that the legal documentation of social bonds spells out how their proceeds will be used, with the goal of financing only projects with clear social benefits.

The rapid rise of social bonds has been built on strong demand from investors interested in making a positive impact on society in addition to generating financial returns.4 The importance of this social objective is highlighted in a recent survey of European professional investors conducted for Goldman Sachs Asset Management, which shows that a commitment to sustainability and the potential for real-world impact top the list of motivators for social bond investments.5

Social bonds can be used to finance a wide range of projects with social benefits, such as building affordable housing and expanding access to healthcare. The first formal social bond, issued by Instituto de Crédito Oficial (ICO) in 2015, was used to provide loans to small and medium-sized enterprises in economically depressed regions of Spain with the goal of protecting and creating jobs.6

The Social Bond Principles, a set of voluntary guidelines for issuers first published in 2017 by the International Capital Market Association (ICMA),7 provide broad categories of social projects eligible for financing with social bonds.8 These include providing affordable basic infrastructure and socioeconomic advancement and empowerment, such as reducing income inequality. The guidelines also provide recommendations for external reviews to verify a bond’s social credentials and for reporting by issuers on the use of proceeds.

Social bonds may also help improve a portfolio’s alignment with the United Nations’ Sustainable Development Goals (SDGs), a 15-year action plan for protecting the environment, ending poverty and reducing inequality.9 The SDGs, adopted in 2015, have emerged as a common language for understanding how companies and portfolios are positioned for environmental and social impact.

Water Security in Africa

When investors in our survey were asked where they would most like to make a positive impact through an allocation to social bonds, the top response was affordable basic infrastructure.10 This broad category in the Social Bond Principles covers essentials including clean drinking water, sewers, sanitation, transport and energy.

The African Development Bank Group (AfDB) uses social bonds to finance a wide variety of projects across the continent, such as investments in water and sanitation infrastructure to improve the security and management of often scarce water resources. Water security is essential to the achievement of a range of social goals, including alleviating poverty, improving health and driving inclusive economic growth, according to the AfDB.11

The AfDB has been a regular issuer of social bonds since entering the market in 2017.12 Other eligible projects financed through the bank’s social bond program include providing small farmers with climate-adapted staple-crop seeds to boost food security and mitigate the impact of rising food prices exacerbated by climate change and the war in Ukraine. The bank is also providing financing for tech-enabled small and medium-sized companies to drive job creation and contribute to the innovation economy.13

The AfDB’s social bond issuance program is designed to support a variety of the UN Sustainable Development Goals. The bank’s efforts to boost food security through irrigation projects and the provision of farm infrastructure, for example, are aligned with SDG 2 (Zero Hunger).14 Eligible projects aimed at expanding access to education support SDG 4 (Quality Education), while projects designed to deliver safe and affordable drinking water align with SDG 6 (Clean Water and Sanitation.)

Ukrainian Refugees in Poland

In addition to addressing specific social issues, most social bonds are intended to make a positive impact on a designated population. Examples in the Social Bond Principles include women, aging populations and vulnerable youth, the unemployed and undereducated, people with disabilities and those who are underserved owing to a lack of quality access to essential goods and services.

The ICMA guidelines also list migrants and the displaced among potential target populations for social bonds. In Europe, the war in Ukraine has resulted in millions of people fleeing the country to seek safety in other countries. The largest number by far – about 1.6 million – have been registered for protection in Poland.15

The Council of Europe Development Bank (CEB) has provided grants and loans to support Ukrainian refugees across the continent, and particularly in the countries bordering Ukraine which face the challenge of furnishing housing, education, healthcare and jobs.16 This is in line with the mission of the CEB, which was created in 1956 in response to the flood of refugees and displaced persons in Western Europe following the Second World War.17

In June 2022, for example, the CEB made its largest-ever loan – €450 million – to Poland to help the government reimburse the emergency and social aid costs incurred by those aiding refugees from Ukraine. The loan partially finances an aid fund set up by the Polish government that channels funds to municipalities to cover accommodation costs and provide direct support to all registered Ukrainian citizens with one-off living benefits and monthly allowances for children.18

To finance its assistance efforts, including the loan to Poland, the CEB has turned to the social bond market, issuing a €1 billion social bond in April 202219 and a $1 billion bond two months later.20 The proceeds from these sales are earmarked to help refugees integrate into their host communities: housing for people on low incomes; health and social care; education and vocational training; and support for job creation and preservation by small businesses.

Projects like those outlined in this article are a big part of the reason investors are adding social bonds to their portfolios. In our survey, only 12% of respondents expressed no preference as to the social issues they wanted to address through a social bond investment, and only 17% had no preferred target population. Both results underscore that social objectives matter to social bond investors and that they come to the asset class with a clear impact agenda.

1 “The European instrument for temporary Support to mitigate Unemployment Risks in an Emergency (SURE),” European Commission website. As of April 14, 2023. By the time SURE came to an end, it had become the world’s largest social bond program, accounting for 16% of global issuance in 2021, according to the EU. See: “SURE,” European Commission press release. As of December 19, 2022.

2 “Fifth and Final Bi-Annual Report on the Implementation of SURE,” European Commission. As of June 2, 2023.

3 Goldman Sachs Asset Management, Bloomberg. As of Jan. 1, 2023. At the end of 2022, the green bond market stood at €1.5 trillion.

4 The strength of investor demand be seen in the growth of the six social bond funds launched since 2020. In just over three years, these funds have accumulated more than €740 million in assets under management, Bloomberg data show. As of March 23, 2023. This includes the Goldman Sachs Social Bond fund, which was launched in June 2022. These funds vary in the level of social bonds they hold as a percentage of total holdings.

5 “Investing in Inclusive Growth,” Goldman Sachs Asset Management. As of May 16, 2023.

6 “Spanish Government Bank Attracts ESG Investors to New €1bn ‘Social Bond,’” Responsible Investor. As of January 30, 2015. This bond matured in December 2017, according to Bloomberg data.

7 “Green Bond Principles evolve to encourage new categories of issuers and embrace Social & Sustainability Bond market participants,” ICMA press release. As of June 14, 2017. The Social Bond Principles were based on the Green Bond Principles that ICMA had first brought out in 2014.

8 “Social Bond Principles: Voluntary Process Guidelines for Issuing Social Bonds,” ICMA. As of June 2021.

9 See “The 17 Goals,” UN website. As of May 10, 2023.

10 “Investing in Inclusive Growth,” Goldman Sachs Asset Management. As of May 16, 2023.

11 “Green & Social Bond Newsletter,” AfDB. As of November 2022.

12 “Social Bond Program,” AfDB website. As of April 21, 2023.

13 “Green & Social Bond Newsletter,” AfDB. As of November 2022.

14 “African Development Bank Social Bond: Second Opinion by Sustainalytics,” Sustainalytics. As of September 26, 2017.

15 “Operational Data Portal: Ukraine Refugee Situation,” United Nations High Commissioner for Refugees website. As of April 21, 2023.

16 “2022 Social Inclusion Bond Report,” CEB. As of March 29, 2023.

17 “Mission and History,” CEB website. As of April 25, 2023.

18 “2022 Social Inclusion Bond Report,” CEB. As of March 29, 2023.

19 “CEB Issues EUR 1 Billion 7-Year Social Inclusion Bond Benchmark,” CEB press release. As of April 6, 2022.

20 “CEB’s New USD 1 Billion Social Inclusion Bond to Benefit Ukraine Refugees,” CEB press release. As of June 9, 2022.