Private Secondaries Markets: To Liquidity, and Beyond

Investors often look to secondaries to gain private market exposure along with additional benefits, such as J-curve mitigation and diversification. Many of these attributes are most closely associated with traditional LP portfolio sales, but secondary firms have also provided other types of capital solutions to GPs and LPs over the last two decades, from team spinouts to structured notes, that provide differentiated access to private markets. Today, continuation vehicles and preferred equity structures have become more common. As activity evolves from LP portfolio sales to include more bespoke solutions, investors should be cognizant of both the skill sets needed to source, underwrite, and execute these more-complicated transactions, as well as the risk-return implications of potentially different transaction types.

The Evolution of Secondaries

The evolution of private markets has continually led to new challenges and opportunities that require unique capital solutions. As the private markets grew in the 1990s and early 2000s from a niche US market funded by wealthy individuals and a small number of institutions into a broader asset class with distinct strategies and a global presence, more investors became LPs in an increasing number of funds. Inevitably, some investors experienced disruptions to their liquidity profiles or shifts in strategy that required them to exit these holdings. The GPs managing the funds recognized that transferring one LP’s interest to another was preferable to default, leading to the beginnings of the secondary market. Funds dedicated to these LP secondary transactions were created, and over time grew to execute more complicated transactions—from multi-fund portfolios, to structured transactions, to “strip” sales designed to streamline portfolio management while retaining economic exposure.

Today, with private market holdings in excess of $10 trillion across private equity, real estate, infrastructure, and credit assets, the secondary market provides liquidity solutions to LPs looking to reshape their portfolios or adapt investment strategies to a dynamic environment.1 However, secondary managers—as sophisticated private markets investors with flexible capital, valuation expertise, and the ability to manage complexity—have also long been providing solutions to other market participants. In the mid-2000s, some secondary firms partnered with banks looking to streamline internal private equity investing teams, ultimately spinning out these teams into new private equity firms seeded by their existing portfolios in “synthetic secondaries.” In the last decade, secondary firms have been key to helping GPs find creative solutions for legacy portfolios and manage assets through periods of disruption. Indeed, many investors with mature private market portfolios now view the secondary market as a way to regularly manage portfolio allocations, in addition to solving liquidity needs.

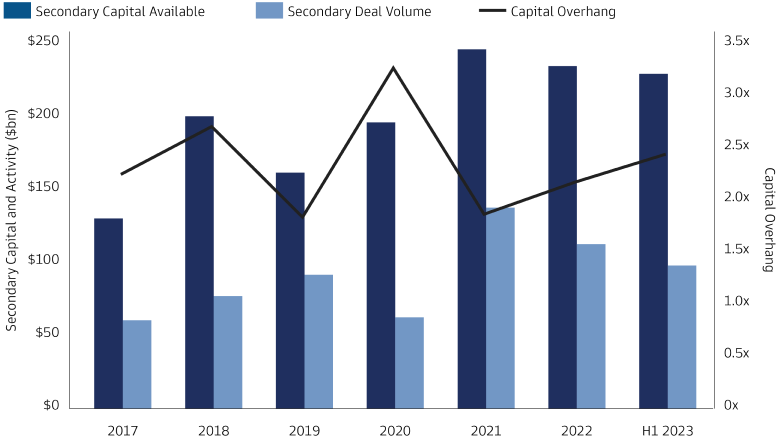

This creativity and capital flexibility, combined with attractive return generation for secondary LPs, has helped fuel strong activity in secondaries and driven AUM to more than $550 billion as of 1Q 2023. Even with this rapid growth, private market AUM (i.e., the potential supply of secondaries) has grown more than secondaries (20% CAGR vs. 17% since 2018). As a result, the secondary market remains under-capitalized relative to the broader private markets industry from which it derives its opportunity set. Furthermore, the secondaries space itself remains relatively concentrated, with the top 10 buyers accounting for at least 55% of deal activity since 2021.2 However, as the primary market has matured and the variety of secondary transactions continues to expand, secondary firms will need more than size and scale to compete; new skillsets will be required and adaptability will be necessary to structure capital solutions to meet the variety of needs of primary LPs and GPs, as well as their portfolio companies.

Source: Jefferies Global Secondary Market Review – July 2023. Capital overhang = capital available / deal volume.

Liquidity Solutions

LP Portfolio Sales

LP portfolio sales were the first secondary transactions to be executed and have historically represented the majority of the market. In the early days of the secondary market, transactions were often non-economic and the result of stress within the selling LP—liquidity constraints, strategic changes, regulatory changes, or life changes for individual investors. As a consequence, providers of liquidity were able to acquire interests at often-meaningful discounts to NAV.

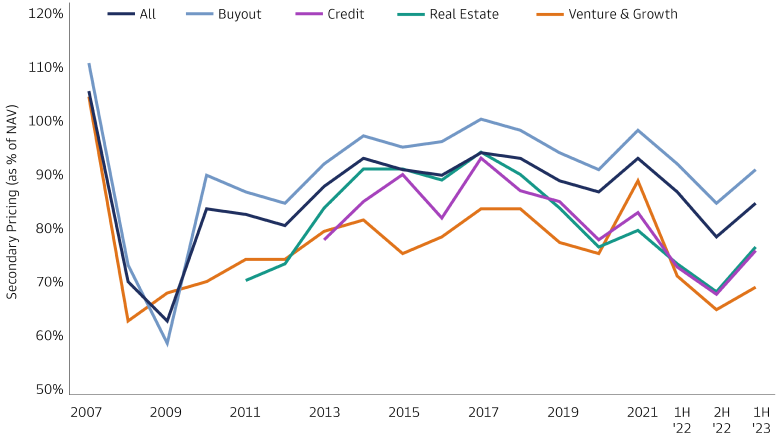

Source: Greenhill Cogent, Jefferies. As of June 2023.

Over the last decade, however, more transactions have been executed during benign market conditions and the secondary market is no longer seen solely as an expression of distress. Today, LP portfolio sales are widely viewed as a useful portfolio management tool to adjust exposures, free up capital and team resources from older commitments that have largely run their course and crystalize gains. As more buyers and sellers have entered the market for traditional LP secondaries, pricing has generally become more stable at narrower discounts to NAV. Even in 2020, when secondary pricing and transaction volume dropped sharply in the first half of the year during the initial throes of the COVID-19 pandemic, the market rebounded to pre-pandemic levels by 1H 2021.

Bid-ask spreads widened again in 2022, as dislocations in public markets and a slowdown in transaction activity made it more difficult for buyers and sellers to agree on pricing. But while transaction volume slowed in 2022, it was still one of the strongest years on record for executed transactions, and pricing rebounded in 1H 2023—illustrating the increased depth and resiliency of the market. One factor contributing to the resilience of the market is sellers’ increasing willingness to allow buyers to choose certain assets for a broader portfolio sale, which can help to achieve actionable pricing.

While the traditional secondary market is becoming more liquid, most transactions still occur at a discount to NAV. Younger funds, where assets have more time to appreciate, typically price closer to NAV, while older vintages tend to command higher discounts; in the first half of 2023, buyout funds less than five years old priced at 91% of NAV on average, while funds with a 2012 vintage or earlier sold at an average of 73% of NAV.3 Investors have been gravitating towards younger funds, with an average age of 7.0 years in 1H 2023—the first time it has dipped below 8 years since 2014. Another factor that has supported pricing in 2023 is the use of deferrals, which allows the buyers to fund part of a transaction at a later date in return for a higher price.

Discounts in the secondary market will also reflect the complexity involved in the transaction, as well as the type, quality, and familiarity of the assets involved. As such, the most efficient pricing in the secondary market remains for traditional buyout fund stakes, which represented 72% of secondary transaction volume in 2022 and 1H 2023.4

New Portfolio Types

As private markets have expanded to incorporate a broader array of assets, some secondary firms have expanded their expertise to evaluate adjacent strategies such as real estate, infrastructure, and private credit. Previously, these assets were often incorporated in portfolio sales as part of a larger transaction or excluded from sales. Today, larger LP portfolio sales and more specialized secondary funds support dedicated transactions in these spaces. Discounts for these assets tend to be wider than for traditional buyout strategies, partly due to the smaller set of buyers with the expertise to evaluate these assets, as well as their lower return profiles that require a larger discount to meet equity-focused secondary return targets. These strategies represent some of the fastest-developing areas of the secondary market, as specialist firms enter the space and established secondaries players launch dedicated vehicles.

Underpinning the opportunity in real estate, infrastructure, and private credit secondaries is the long-term growth in those asset classes, which now manage in excess of $3 trillion. Many LPs in these primary funds are also reconsidering how they define and classify different assets, leading to a widespread reassessment of asset exposure that has created an increased need for liquidity solutions. In real estate, for example, multi-tenant office buildings and shopping centers—once acquired for their core characteristics and perceived safety—are no longer viewed as “set it and forget it” investments. Conversely, industrial and rental housing assets—generally viewed as less stable historically due to shorter lease terms, fragmented ownership, and ease of over-building in expanding markets—are now exhibiting characteristics of “core” real estate, benefitting from healthy demand, outsized growth, and very liquid capital markets. As LPs seek to rebalance their risk profiles, the secondary markets can help facilitate the redeployment of capital.

Capital Solutions

Beyond Liquidity

While traditional LP secondary transactions remain at the core of the secondary market, other types of capital solutions have become more prominent in the past few years. Rather than solely seeking liquidity, many investors are pursuing structures that allow for extended holding periods that enable additional compounding of returns—evidenced by the rise of long-hold PE funds with durations of 20 years or more. Much of the initial activity in the space was used to support GPs’ use of buy-and-build strategies and technological transformation to create value in portfolio companies—approaches that may require more time to implement and mature than is allowed by the typical Limited Partnership structure.

The traditional Limited Partnership has a term of 10 years, generally with two one-year extensions, putting a limit on how long a GP has to execute their value creation plans. Within that 10-year period, there is typically a four- or five-year investment period, and LPs will generally expect to start seeing some liquidity by the time the fund is fully invested and the GP is fundraising again. Given these dynamics, GPs may feel a degree of pressure to sell assets four or five years after they make the investment, regardless of whether they have maximized the value. While some LPs have questioned the ability of private equity sponsors to drive excess returns over longer time periods, recent research suggests that the performance of sponsor-to-sponsor transactions, where one GP sells an investment to a second GP, is comparable to that of traditional buyout deals. This supports the argument that GPs are able to implement operational plans and acquisition strategies targeted at specific stages of development and profitability.

The secondary market can provide capital solutions that allow GPs to continue owning well-known assets in which they have high conviction and a clear plan for additional value creation, while also providing existing LPs a liquidity option and allowing for the entry of new LPs. Distinct from LP portfolio sales, these capital solutions evolved from “fund restructuring” transactions, which often involved complex situations with challenges at the underlying asset, GP, or both. Much like LP portfolio sales evolved from a market focused on distressed sellers facing liquidity challenges to a more robust (and less-stigmatized) market for reshaping portfolios, these “fund restructuring” transactions have shifted from deals designed to rework troubled situations to a market focused on high-quality assets managed by top GPs looking to extend value creation plans and realign incentives. With these new tools, GPs can look to optimize their own fund management and provide a more dynamic set of exit options for their LPs, while deepening relationships with strong companies and opening the aperture for new investors. This trend has only intensified in 2022 and 2023, as a slowdown in exits and more challenging financing conditions have compelled GPs to look for creative options.

Continuation Vehicles

Continuation vehicles aim to achieve a variety of objectives: liquidity for LPs looking to exit their position; the ability for current LPs to maintain exposure to the asset; and the opportunity for new investors to gain exposure to a high-quality asset managed by a GP already deeply immersed in the business, providing an extended holding period and new capital to fund further growth for the GP. These transactions typically involve the transfer of the target asset(s) from the original fund into a new vehicle, where existing LPs can elect whether they prefer to receive cash proceeds and exit the investment, or a pro-rata interest in the new vehicle. The secondary manager typically provides: an independent fair market value for the transaction; negotiates the structure and terms of the continuation vehicle to ensure continued alignment; and provides the capital that cashes out of any exiting LPs.

Continuation vehicles are bespoke and vary greatly in size and structure, with some centered on single assets while others have more diversified holdings. Continuation vehicle investors have the benefit of investing in known assets with a GP who already intimately understands its operations and has a compelling case for further value creation. The GP is able to continue executing from their existing playbook, enabling the secondary investors and LPs to bypass the early low-growth period common in new deals where a GP gains greater familiarity with the asset and refines their initial value creation plans. The GP’s familiarity with the business can also provide a degree of downside protection for the new LPs relative to a primary investment, as the value creation is largely focused on a continuation of the investment.

With the number of stakeholders involved in continuation vehicle transactions, including the liquidating LPs, the continuing LPs (in some cases), the GP, and the secondary fund/new LPs, ensuring the proper alignment of incentives is key. The GP and the secondary buyer typically negotiate new fee structures and economic protections, which may include the reinvestment of any economics a GP realizes from liquidating LPs into the continuation vehicle and a new investment from the GP. Since the specifics of each transaction tend to be unique, the economics of continuation vehicles are tailored to each deal but generally include mechanisms, such as reduced fees and revised hurdle rates.

Another important consideration for continuation vehicles is the higher level of concentration compared to traditional secondary transactions. Continuation vehicle transactions can include a portfolio of holdings, or a single asset. Single-asset transactions carry a higher degree of company-specific idiosyncratic risk, requiring the need for careful portfolio construction by the secondary manager to ensure suitable diversification. Consequentially, continuation vehicle diligence requires a deep understanding and expertise more akin to traditional buyout investing.

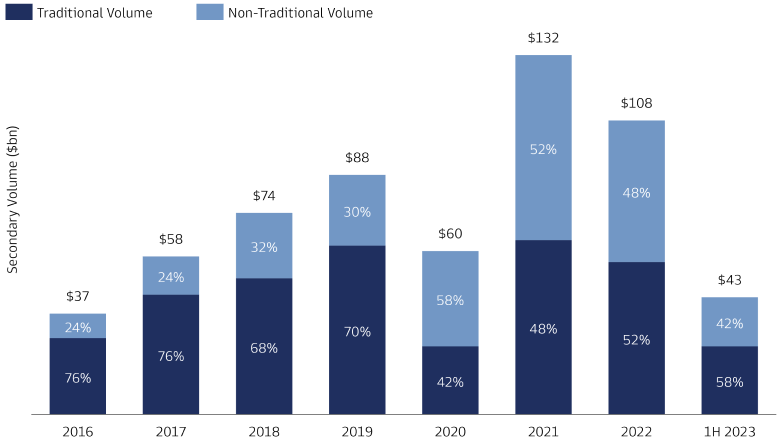

Continuation vehicles had been steadily gaining prominence prior to 2020, growing from less than 20% of the secondary market in 2015 to 30% of all transactions in 2019, even as the overall volume more than doubled. In the pandemic downturn in early 2020, many LPs pulled back on traditional portfolio sales as equity markets fell and discounts widened, but continuation vehicle transactions proved more resilient, representing more than half the total deal volume for the year. GP led deal activity slowed in 2022 along with the broader secondary market. As exits and distributions have slowed in 2022 and 2023, the relative need for LP portfolio sales has risen, pushing nontraditional volume to 42% of secondary activity in 1H 2023.5 Going forward, we expect secondary market volume to be split roughly evenly between LP portfolio sales and non-traditional activity, with cyclical factors impacting year-to-year changes.

Source: Jefferies Global Secondary Market Review – July 2023.

Hybrid Solutions

Preferred Equity

Another transaction type that has increased in frequency is preferred equity or structured secondaries. In these transactions, a secondary capital provider offers financing that is securitized by a portfolio of assets or collateral pool. Following the investment, the preferred equity holders receive a disproportionate share of the portfolio’s value until the initial investment is repaid with a contractual return, as well as potential for additional upside in the growth of the portfolio thereafter.

GPs utilize preferred equity to pursue buy-and-build strategies with portfolio companies in funds that have more limited remaining capital, but where extending the holding period through a continuation vehicle may not be necessary. Similar to other solutions in the secondary market, GPs can use the proceeds of preferred equity deals to satisfy LPs who have the desire to accelerate liquidity without giving up 100% of their upside. In more complex and multifaceted secondary transactions, preferred equity can also be a useful tool to help satisfy the requirements of the various parties involved.

Particularly in times of stress, preferred equity solutions can provide managers, funds, or assets with needed liquidity in exchange for a preference on future cash flows. GPs also turn to preferred equity rather than debt due to the bilateral nature of the financing arrangement and lack of covenants. Preferred equity drew particular attention during the COVID-19 pandemic when GPs turned to the strategy to fund portfolio companies as revenues were interrupted and credit markets were not available. Buyers in these deals were able to rely on the potential downside protection characteristics to deploy earlier into the pandemic than other transaction types, while borrowers took advantage of the speed and flexibility of these financing solutions. In the recent environment, preferred equity is increasingly viewed as a means of providing intermittent liquidity to existing LPs, while also potentially bolstering an asset’s balance sheet.

State of Change

The secondaries market is likely to continue its growth trajectory, with transaction volumes increasing alongside private markets more broadly. Secondaries firms are also likely to continue innovating around the structural limitations of private assets and the diverse needs of GPs and LPs, building new solutions around inefficiencies and complexity to pursue attractive returns for investors. While scale is necessary to execute larger portfolio transactions and remain competitive in the market, executing secondary transactions in the growing areas outside of traditional buyout LP interests requires the ability to value different types of assets, and understand future cash flow streams.

As the variety and complexity of transactions increase, a combination of experience and creativity will be required to design solutions benefitting all parties while maintaining an appropriate alignment of incentives. Moving forward, success across the full spectrum of capital solutions will require the breadth and flexibility to operate seamlessly throughout various asset classes, coupled with the depth and focus to structure and execute complex transactions to liquidity, and beyond.

1 Preqin. As of September 2023.

2 Evercore H1 2023 Secondary Market Survey. As of July 2023.

3 Jefferies H1 2023 Global Secondary Market Review. As of July 2023.

4 Jefferies H1 2023 Global Secondary Market Review. As of July 2023.

5 Jefferies H1 2023 Global Secondary Market Review. As of July 2023.