Navigating Opportunities in the UK Gilt Market

Riding the Easing Cycle

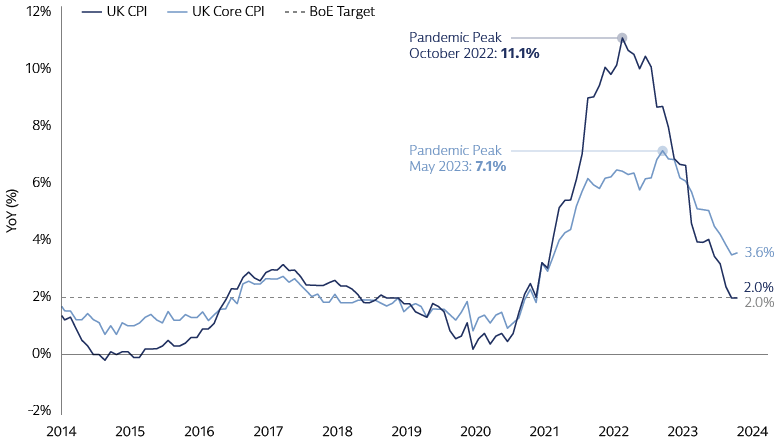

Headline inflation aligned with the Bank of England’s (BoE) target of 2% in June 2024 and stayed there in July. Core inflation has also decreased substantially, nearly halving from its recent peak to 3.6% in June. Despite potential short-term increases due to a fading drag from energy prices, the trend is towards further normalization. In light of this, the BoE commenced its rate cutting cycle in August, reducing the policy rate from 5.25% to 5%.

Source: Macrobond, Goldman Sachs Asset Management. As of June 30, 2024.

Despite concerns from some policymakers about ongoing inflation, a second rate cut by the BoE in November seems likely for several reasons. First, the labour market is showing signs of loosening, which is expected to reduce wage growth from the current 5.6% annual rate to a range of 3.5-4%, which is more in line with the 2% inflation target. The unemployment rate has risen to 4.4% from a cycle low of 3.6%, a more pronounced increase than in other developed markets. Second, the sustained strength services inflation is partly due to volatile categories and one-off events, such as the 'Taylor Swift effect', which have temporarily inflated prices in certain inflation categories like hotels, and restaurants. Lastly, the UK's economic growth has exceeded expectations this year, yet consumer spending remains subdued.

Overall, the BoE’s easing cycle, informed by a cooling labour market and disinflation, presents a favorable environment for Gilts.

Past Peak QT

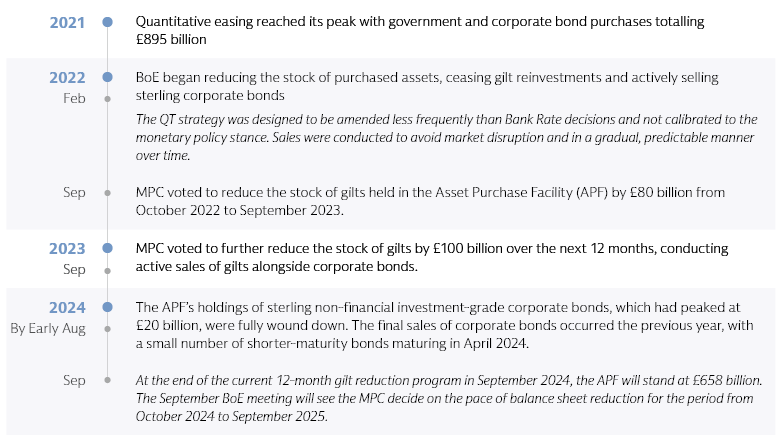

The BoE has been on a path of quantitative tightening (QT) since February 2022, reducing its balance sheet by not reinvesting proceeds from maturing bonds as well as actively selling sterling corporate bonds and Gilts. The impact of QT on Gilt yields has been modest, as detailed in the BoE’s August 2024 Monetary Policy Report.1 For example, in analyzing the change in the 10-year gilt yield from February 2022 to June 2024, which saw a 275-basis point increase, the term premium—additional compensation investors demand for holding longer-term bonds over a series of shorter-term bonds—contributed 75 basis points to this rise. Announcements related to QT are estimated to account for only 10-20 basis points of the increase in the term premium. Other factors influencing the term premium include uncertainties around economic and interest rate forecasts, as well as the supply and demand for gilts.

At the September BoE meeting, the Monetary Policy Committee (MPC) will decide on the pace of balance sheet reduction for October 2024 to September 2025. The pace may decrease, but even if it remains the same, the volume of active sales will significantly drop from around £50 billion to £13 billion due to a higher volume of maturing bonds over the next year, according to Goldman Sachs Global Investment Research.

In summary, even though the impact of QT on Gilt yields has been modest, the peak headwind from QT on gilt yields is behind us, and a reduction in the pace of active gilt sales could be a net positive going forward.

Source: Goldman Sachs Asset Management, Bank of England. As of August 8, 2024.

Stability in Sight

Political uncertainty has been a notable feature of the UK's economic landscape over the past decade, influenced by significant events such as the EU referendum and changes in Conservative Party leadership, which have impacted the investment environment. In 2022, a combination of policy uncertainty, inflation concerns, and institutional risk contributed to a sharp increase in Gilt yields. However, these risks have since receded, indicating a more stable outlook for Gilts moving forward. The early general election announcement this year initially heightened political uncertainty, but the Labour Party's victory on July 4, with a decisive parliamentary majority, has helped to alleviate these concerns.

Post-election, there has been a lack of substantial fiscal news. However, fiscal space is limited and a commitment to fiscal discipline is anticipated. A government audit has indicated a projected departmental overspend of £16.4 billion, even after efforts to implement cost-saving measures. This situation implies that the autumn budget may require difficult decisions regarding taxation and expenditure. The Budget Responsibility Bill, which is currently under review in the House of Commons, introduces a "fiscal lock" that would require independent assessments by the Office for Budget Responsibility (OBR) for significant fiscal changes, aiming to avoid the financial instability experienced in October 2022.2

Additionally, the government is exploring ways to create fiscal space through efficiency, such as reducing consultancy expenses and selling unutilized public buildings. The UK is also negotiating non-EU trade deals, which may mitigate some Brexit costs. Supply-side policies, including upskilling and reskilling, could enhance labor supply and improve growth prospects, positively impacting debt dynamics.

Overall, the fiscal direction appears stable and is unlikely to unsettle Gilt investors, even with no significant fiscal consolidation anticipated. This suggests capital flows should remain steady. In fact, signs of improving structural growth prospects could lead to an improvement in foreign investment into Gilts, which would support the asset class. Monitoring these developments is crucial, especially considering strong pension funding levels and potential shifts in insurers' incentives to hold government bonds, which could necessitate increased gilt purchases by other private investors.

Investment Implications

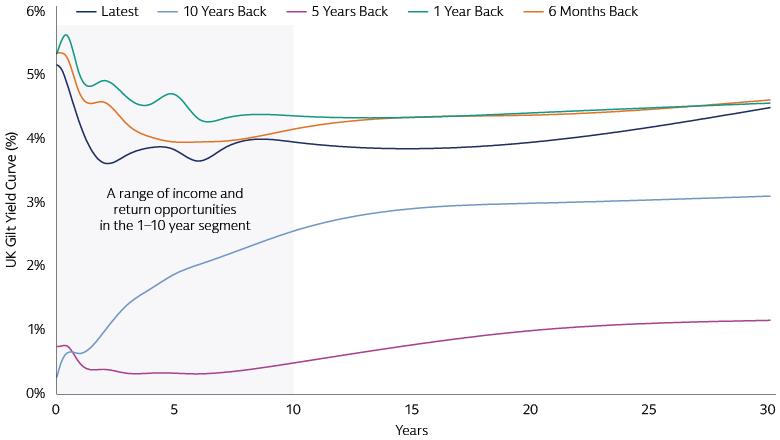

For investors, the combination of the BoE’s easing cycle, a peak in active QT, and a newfound political stability collectively foster a conducive environment for Gilts, especially when compared to the recent past. Currently, the front-end of the market is poised to benefit from rate cuts, while intermediate and longer-dated bonds are likely to experience relief from the lessened pace of active QT.

Source: Macrobond, Goldman Sachs Asset Management. As of August 8, 2024.

For those seeking to access Gilts for higher income compared to cash and as a diversification strategy against equity exposures, we believe there is value in strategies focusing on the 1–10-year segment of the yield curve. We believe this segment not only offers attractive income opportunities but also serves as a potential hedge against downside growth risks. Additionally, it bears a lower exposure to rate volatility compared to longer-dated bonds, making it a prudent choice for investors navigating the current economic landscape.