Building a Tailored Approach to Hedging Euro-Denominated Liabilities

Investors have a range of assets available for hedging their euro-denominated liabilities, but as recent political and fiscal events have made clear, allocations to these assets must be managed proactively. Issuers once viewed as safe havens have seen their bonds underperform the market, while countries considered to be on shaky fiscal ground have strengthened their positions. The variety of methods European pension schemes use to value their liabilities means there is no single preferred approach to instrument selection. We think a tailored approach is needed to reflect the market backdrop and align with each investor’s unique circumstances.

Opportunities and Risks

Governments in the euro area differ in their creditworthiness, and their relative strength varies over time. Bonds issued by Germany and France, the currency union’s largest economies, have underperformed recently because of fiscal and political concerns. The situation has begun to stabilize in Germany, but uncertainty continues to cloud the picture in France. By contrast, the fiscal situation in Italy, Portugal and Spain is improving. These trends are reflected in recent decisions by ratings agencies. For example, France was downgraded by Fitch Ratings and Morningstar DBRS in September 2025,1 while Portugal received an upgrade from Fitch and S&P Global Ratings.2

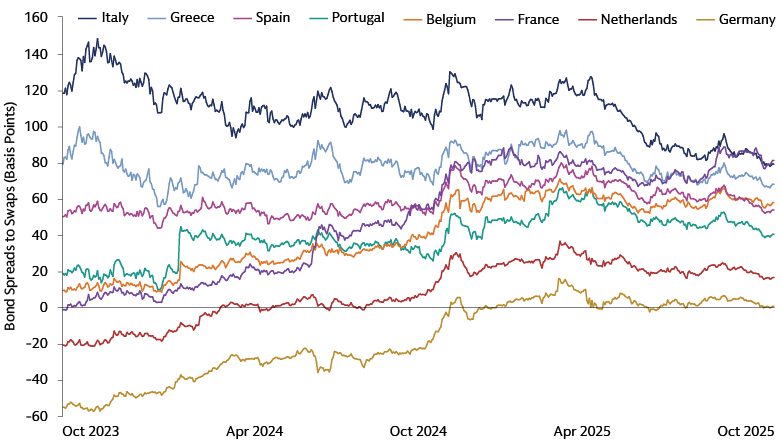

For investors, these fluctuations create downside risks as well as opportunities to add value, underscoring the need for proactive management of euro-area government bond allocations. The chart below shows the additional yield available from eight major euro-area government bond issuers. This highlights opportunities to optimize the yield of an LDI portfolio by allocation to certain bonds, and how this relative value changes over time. Upward sloping lines represent bonds underperforming swaps – their relative yield rising and price falling – and downward sloping lines show outperformance. Over the past two years, countries traditionally considered to be higher-quality issuers, such as Germany, France and the Netherlands, have underperformed, while traditionally lower-quality issuers such as Greece and Italy have outperformed. Spain is an interesting case: its bonds have underperformed swaps, but outperformed France to the extent that France now has a higher yield. Before making any allocation decision, however, we think investors should look beyond the headline yield and consider what is already priced in and what may be priced in later.

Source: Bloomberg. As of October 28, 2025

Matching Maturity Profiles

The maximum maturity of bonds available from euro-area government issuers varies significantly. Germany, the Netherlands and Spain top out at a 30-year maturity. Belgium, France and Italy issue 50-year bonds, while Austria has a 95-year bond in the market.3 This variety is likely to necessitate a blend of bonds and swaps to deliver an appropriately accurate liability match across the full maturity spectrum, in our view.

Navigating Liquidity Changes

Larger countries tend to issue more bonds, which are therefore more liquid and cheaper to trade. By contrast, bonds from smaller issuers can have relatively limited liquidity. While this general point is hardly surprising, investors should be mindful of a less obvious nuance: the liquidity of any given bond varies over time. For example, Germany recently stopped issuing inflation-linked bonds.4 As a result, existing inflation-linked issuance will become less liquid over time. With this in mind, we think some investors will probably retain their positions, while others may rotate into the inflation-linked bonds of countries such as France or Spain, or use swaps to gain inflation exposure.

Beyond Government Bonds

The universe of hedging assets can reasonably be extended beyond euro-area government bonds to those issued by the European Union as well as sovereign, supranational and agency issuers, in our view. The latter group, known as SSA issuers, comprises governments issuing in a non-home currency, entities whose debt carries a government guarantee, and quasi-government issuers. These bonds are typically of high quality but offer a modest yield pick-up, often to reflect a smaller issuance size and resultant lower liquidity. Examples include the European Investment Bank and Germany’s KfW Development Bank.5 We think issuers like these can help investors further diversify their portfolios. They can also offer sustainability exposure thanks to their increased issuance of green, social and sustainability bonds in recent years. Bonds from such issuers will not be appropriate for all investors, but we think they are worth considering when setting the parameters of an LDI portfolio.

Value can also be found in the swap component of a euro hedging portfolio by considering whether swaps should be bilateral or centrally cleared, and if the latter, which clearing house will be used. While this level of technical detail is the responsibility of the LDI manager, we think investors should be aware of such issues.

Daily Portfolio Management

What pension fund managers do with all this information depends on their schemes’ specific circumstances, and on their approach to valuation in particular. A scheme that values liabilities using swaps can create an effective and accurate hedge using swaps alone, thereby minimizing risk relative to its discount rate. The trustees could then permit an off-benchmark allocation to government bonds to seek to enhance the return of the hedging portfolio. Yet many schemes already have significant passive allocations to government bonds, particularly French and German, that were acquired as part of a 1.0 version of LDI prior to adding a more capital-efficient swaps hedge. We would encourage schemes in this position to review their bond allocation to ensure that any such exposure is intentional and overseen in real time.

Other schemes that have typically discounted using German bonds have held their physical LDI assets in bonds and employed swaps to deliver a completion hedge, largely because swaps have historically yielded more than German bonds. This is no longer the case, so we think it is worth considering levered bond exposure in place of swaps. This could reduce risk relative to the valuation basis while also enhancing yield.

Whatever the specifics of a scheme’s hedging arrangements, the market backdrop changes significantly and in real time, necessitating daily oversight of the hedging portfolio and hedge instrument allocations. Investors should ensure that this oversight and management are performed by market-facing delegates who are empowered to respond to market changes in a timely manner and within an appropriate risk-management framework.

1On the Fitch decision, see “Fitch Downgrades France to 'A+'; Outlook Stable,” Fitch Ratings. As of September 12, 2025. On the Morningstar DBRS decision, see “Morningstar DBRS Downgrades the Republic of France to AA, Trend Changed to Stable,” Morningstar DBRS. As of September 19, 2025.

2On the Fitch decision, see “Fitch Upgrades Portugal to 'A'; Outlook Stable,” Fitch Ratings. As of September 12, 2025. On the S&P decision, see “Portugal Upgraded To 'A+' On External And Government Deleveraging; Outlook Stable,” S&P Global Ratings. As of August 29, 2025.

3The Austrian example was originated in 2020 as a 100-year bond. See “New issuance | 100-year Austrian Government Bond,” Austrian Treasury website. As of June 24, 2020.

4“Federal Government Discontinues Programme for Inflation-linked Bonds,” Bundesrepublik Deutschland Finanzagentur GmbH press release. As of November 22, 2023.

5“Sustainable Debt: Global State of the Market H1 2025,” Climate Bonds Initiative. Data as of June 30, 2025. In the first half of 2025, the EIB was the largest non-sovereign issuer of green bonds aligned with the Climate Bonds Initiative’s methodology, followed by KfW.