Performance in Focus: Is it Sustainability or Implementation of Sustainability?

Sustainable investing's recent volatile performance has investors questioning its ability to deliver returns. Assessing this question requires a deeper understanding of what drove performance fluctuations, what insights we can draw from it, and what the implications for investors are going forward.

A deep dive into sustainable funds over the past few years highlights that performance fluctuations often had more to do with the way sustainable-investing strategies were implemented than with sustainability itself. Specifically, many of the products created in this period had significant tilts and biases that added volatility and impacted performance in our view. Reflecting on this recent history, we highlight key insights across equity and fixed income:

- Quantitative equity solutions could be promising avenues to address some of the recent challenges – carefully mitigate unintended tilts and biases, utilize curated data to generate investment insights, and leverage diversifying shorter-term alpha sources to seek to enhance returns and mitigate short-term performance volatility as longer-term themes play out.

- Against the broad backdrop of challenging performance, there is a very select but identifiable cohort of fundamental sustainable equity managers with a demonstrated track record of performance across market cycles.

- Pay more attention to fixed income solutions as an efficient way to increase sustainability exposure with limited impact on a portfolio’s overall financial characteristics. This is partly because fixed income tends to be more broad-based and have lower performance dispersion across sectors.

Equities: Ebbs and Flows

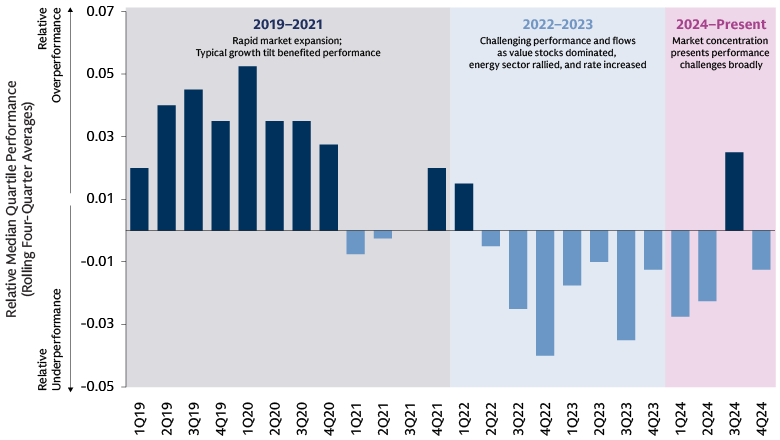

We see three distinct periods in the recent history of sustainable equity fund performance. In each of these periods, performance was largely driven by characteristics of these portfolios’ implementation relative to broader market dynamics, such as sector and style biases, rather than specific traits of sustainability itself.

Rapid market expansion with typical growth tilt benefited performance

Sustainable equity funds globally outperformed their conventional peers in nine of 12 quarters. This outperformance, driven largely by sustainable equity funds’ higher exposure to large cap growth stocks and energy underweight, led to surging interest from investors seen in record inflows that remained resilient despite market volatility in 2020-2021.

Challenging performance and flows

Positive momentum faltered abruptly in 2022; sustainable equity funds1 outperformed their conventional peers in just one quarter. Several factors contributed. First, value stocks dominated in 2022, while sustainable funds typically had growth tilts. Second, sustainable funds typically had an underweight to energy, which was the top-performing sector in 2022, up 47%. Finally, the higher interest rate environment was a significant headwind for long-duration growth stocks, with renewables taking a significant beating.

Market concentration presents performance challenges broadly

Starting in 2024, equity market performance gains were highly concentrated in a handful of stocks, notably the so-called “Magnificent Seven.” This narrow market leadership was challenging for active managers broadly and many sustainable funds struggled.

Source: Global Investment Research, Morningstar, Goldman Sachs Asset Management. Relative quartile position of median sustainable equity fund vs traditional funds peers (e.g. If the Median Sustainable Equity fund is in top 47% of funds, then the relative overperformance is 3%); sustainable equity funds are defined per Morningstar category. “US Sustainable Funds Continued to Break Records in 2020,” Morningstar, Feb 2021. As of December 31, 2024. Past performance does not predict future returns and does not guarantee future results, which may vary.

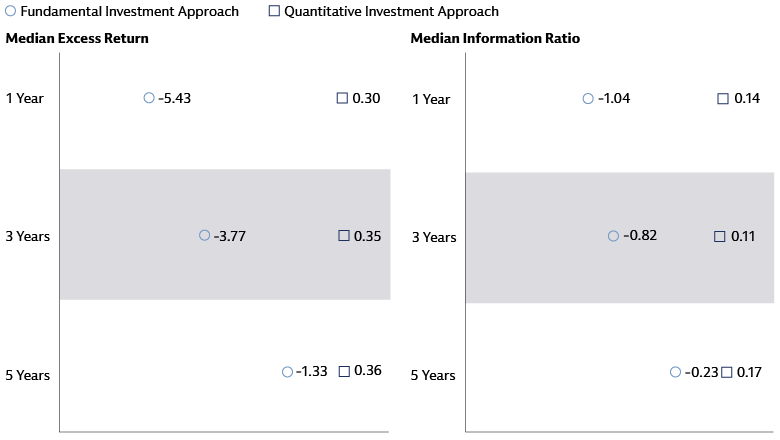

A disciplined, risk-aware quantitative approach with data-driven investment insights can effectively diversify exposure while still leaning into sustainability, especially for core allocations. Sustainable quantitative equity strategies have consistently outperformed sustainable fundamental strategies, partly due to their more diversified exposures. Fundamental equity strategies, such as thematic climate solutions funds, may have also been more exposed to sectors like renewables, which have underperformed in high interest-rate environments.

Source: Goldman Sachs Asset Management. Underlying universe – eVestment “Equity ESG Focused” category, with MSCI World-ND as benchmark. Quantitative and fundamental strategies are defined per eVestment. Not intended to reflect any Goldman Sachs performance or product. As of December 31, 2024. Past performance does not predict future returns and does not guarantee future results, which may vary.

For quant strategies, we derive a few lessons that can be integrated when designing sustainable investment solutions that seek to drive returns:

Many asset owners have specific ex-ante sustainability objectives (e.g. carbon intensity reduction, screens, minimum sustainable investment percentages). These criteria are important for many asset owners from a values or risk management perspective. They could also carry additional tracking error and active risk from a short-to-medium term return perspective. With an increasing emphasis on performance, a transparent approach that decomposes active performance from long-term sustainability objectives versus bottom-up stock selection is valuable. In addition to clear attribution, thoughtful portfolio construction could also strategically use the active risk associated with implementing sustainability criteria for further alpha generation.2

Careful portfolio construction with stricter sector and style management could enhance performance. Leverage portfolio construction tools to seek more balanced exposures and manage risks from style and sector tilts.

Given the long-term, non-linear nature of the climate and energy transition, investors can leverage diversifying alpha sources (e.g. short- or medium-term stock selection, smart beta factors) seeking to enhance portfolio performance and reduce short-term volatility.

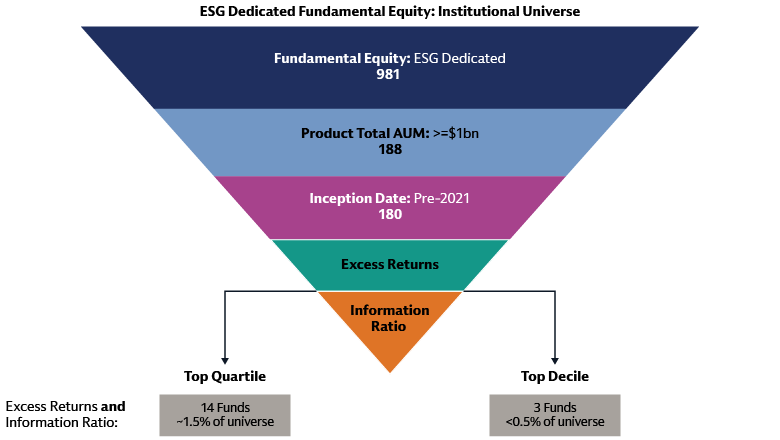

In fundamental active strategies, the significant incremental volatility of concentrated thematic strategies has been difficult for many to integrate into their portfolios. Amid some of the aggregate challenges of active strategies, there is a small but identifiable cohort of more broad-based managers that have demonstrated the ability to perform across cycles over time. Of 981 ESG-dedicated fundamental equity strategies, only three funds meet the criteria of having more than $1 billion in assets under management, a track record of more than five years, and top-decile performance relative to their peer universe.3

Source: Goldman Sachs Asset Management, eVestment. Underlying universe – eVestment ESG Dedicated Fundamental Equity (n = 981 products). As of May 21, 2025 . Past performance does not predict future returns and does not guarantee future results, which may vary.

For allocators seeking fundamental sustainable equity options, there is a small cohort that not just outperform against their sustainable peers, but have demonstrated ability to outperform their broader conventional peer set.

Fixed Income: A Story of Resilience

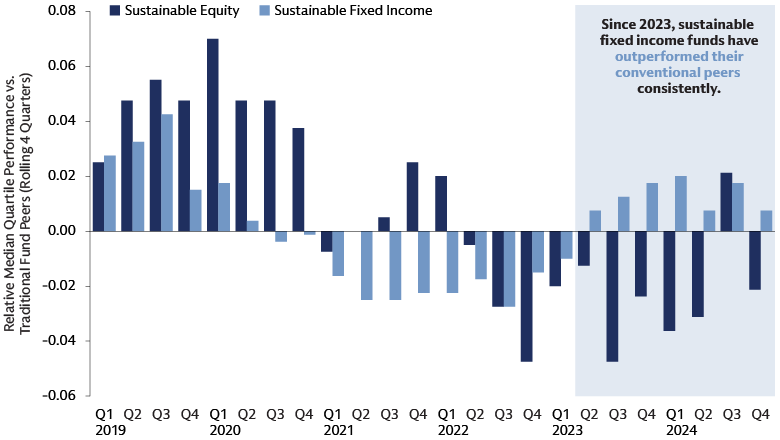

The performance of sustainable fixed income funds differs significantly from that of equity funds. While sustainable equity performance peaked in 2020 and has continued to underperform for the past three years, sustainable fixed income performance recovered in 2023 and has consistently outperformed their conventional peers since. We have also seen smaller dispersion in sustainable fixed income fund performance than in sustainable equity. The greater performance resilience of sustainable fixed income has been rewarded with flows and can be a constructive part of a broader sustainability-oriented portfolio.

Source: Goldman Sachs Global Investment Research, Morningstar, Goldman Sachs Asset Management. As of December 31, 2024.

Relative quartile position of median sustainable equity funds (4,623 funds) and sustainable fixed income funds (1,750) vs traditional funds as defined by Morningstar. (e.g. If the Median Sustainable Equity fund is in top 47% of funds, then the relative overperformance is 3%). Not intended to reflect Goldman Sachs performance or product. Past performance does not predict future returns and does not guarantee future results, which may vary.

The performance resilience is mainly due to two factors. First, fixed income tends to have lower performance dispersion across sectors and styles because credit markets prioritize principal return and interest payments over growth, making sector allocation less impactful than in equity. Second, sustainable fixed income funds are typically managed against broad market indices with fewer thematic tilts, which also helps minimize performance deviations.

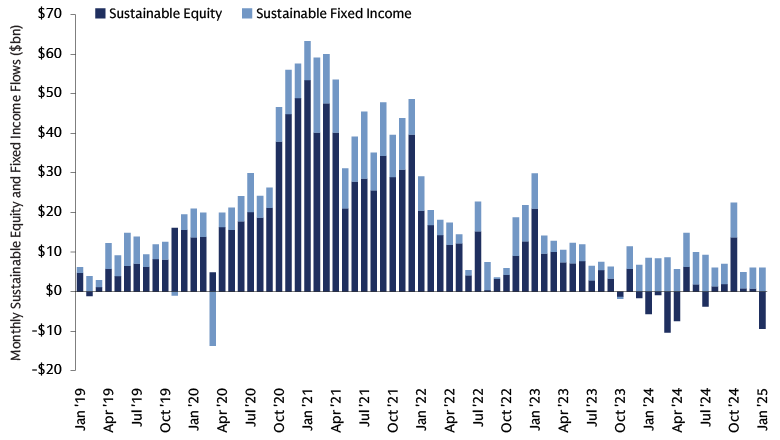

While flows into fixed income funds have never reached the heights seen by sustainable equity funds in 2020-2021, they have demonstrated to be far more resilient. This has been particularly evident over the past year and a half, as fixed income funds consistently brought in net new money while equity funds suffered frequent outflows.

Source: Goldman Sachs Global Investment Research, Morningstar. As of January 31, 2025. Not intended to reflect and Goldman Sachs performance or product.

As green bonds have grown to a sizeable market since 2007, reaching $2.7 trillion at end of 2024,4 they could be an effective tool to increase thematic exposure with a modest impact on portfolios’ risk-return profile. We believe this can be done in two ways: integrating them within a broader sustainable fixed income portfolio, or as a standalone green bond allocation. Because the instruments themselves are similar in underlying financial characteristics, the broader dynamic in lower dispersion in fixed income, growing convergence in benchmarks, green bonds could be effective at increasing thematic exposure with little additional tracking error.

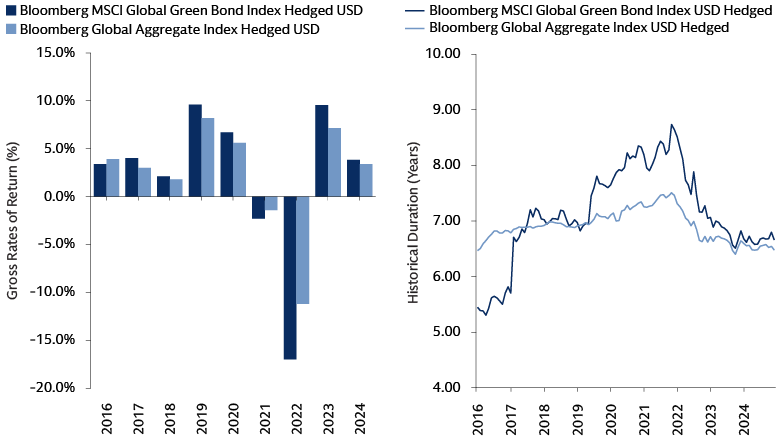

At the global level, green bond performance has compared favorably with conventional bonds over the past decade, outperforming in six out of the last nine years. The relative negative performance in 2022 was largely driven by the global green bond index having a slightly longer duration, making it more sensitive to interest rate hikes. Green bond index performance relative to broader market indices primarily diverges due to structural differences between the indices (e.g., duration, spread risk, currency composition), rather than the underlying bonds themselves. As the green bond market matures and diversifies, we expect these structural differences to fade, bringing the performance of green bonds into closer alignment with the broader market.5

Source: Goldman Sachs Asset Management, Bloomberg, as of December 31, 2024. Not intended to reflect any Goldman Sachs performance or product. Past performance does not predict future returns and does not guarantee future results, which may vary.

We believe one of the lessons of sustainable fixed income in general or green bonds is that sustainable investors can replace a portion of their conventional fixed income allocation without sacrificing liquidity or returns. Because it is more broad market based and less thematic, sustainable fixed income has the potential to increase sustainability exposure without much impact on a fixed income portfolio’s financial characteristics, making it an easier substitute for traditional fixed income for investors seeking more sustainable investments in their portfolios.

Pricing of Climate Risks

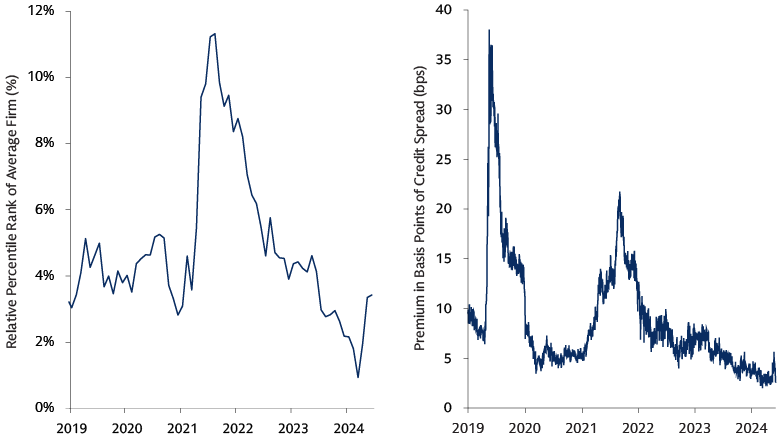

The pricing of climate risk has been volatile across equity and credit markets in recent years. The valuation of climate solution firms in equity markets has come down since 2022, when there was a significant premium. In credit markets, the average spread premium between firms that score the best in environmental risk compared with those score the worst has also normalized since 2022. This means the cost of gaining thematic exposure to climate solutions firms has come down.

Given broader policy uncertainty, shifting views on climate mitigation efforts, and increasing risks from acute and chronic climate hazards, it will not be a straight line from here. We also do not know where the long-term equilibrium will land. For investors navigating these markets and long-term secular trends like climate transition, market efficiency and how much of these risks are being priced in remain an important lens to overlay on specific investment strategies.

Left side: Considering all firms in MSCI ACWI with > 25% of revenues from green business segments, as per Goldman Sachs Asset Management Sustainable Investment Platform definition. Valuation defined as the simple average re-rank of each firm’s Value, Earnings Yield and Dividend Yield in the MSCI ACWI. Source: Goldman Sachs Asset Management Sustainable Investment Platform, MSCI, Axioma. As of April 2025. Right Side: Comparing the average spread premium between 1st and 5th quintile of Barclays Global IG Corp, ex financials, ranked by MSCI Environmental score. Average spread premium defined as the difference between observed spread and expected spread when considering traditional risk factors: credit quality, duration, liquidity, sector, country. Source MSCI, Bloomberg, Barclays, Goldman Sachs Asset Management Sustainable Investment Platform. As of April 2025.

Implications for Portfolio Construction

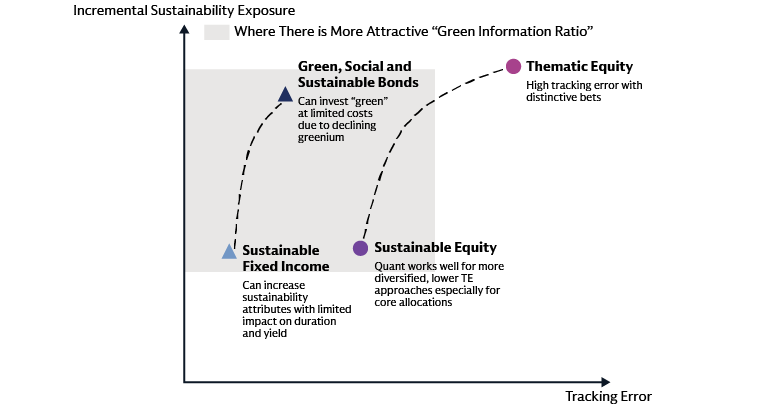

As we reflect on the lessons of sustainable investing from the past few years and various approaches, it is important to arm investors with the right tools for different asset classes. A key question is how to pick the right tool in the context of your portfolio. One key insight and organizing framework is the recognition that different investment options offer varying levels of what could be called the “green information ratio,” or the degree of thematic sustainability exposure to be gained per unit of incremental tracking error. Different asset classes exhibit distinct characteristics when analyzed through this lens.

Source: Goldman Sachs Asset Management. For illustrative purposes only and specific implementation will cover a range for both tracking error and incremental thematic exposure.

- Sustainable Equity: For a diversified core equity allocation with lower tracking error, a modest amount of tracking error can give a decent amount of sustainability exposure. We believe a disciplined, risk-aware quantitative engine can lend itself well to this purpose.

- Sustainable Fixed Income: Because of the low performance dispersion across sectors in fixed income currently, a sustainable fixed income strategy could more easily accommodate high sustainability exposure while preserving the financial characteristics of a fixed income portfolio. This gives fixed income an attractive green information ratio.

- Green, Social, and Sustainability Bonds: High thematic exposure with lower tracking error as investors can now invest in sustainable assets at limited cost thanks to the declining greenium. Also, as the structural difference in duration fades, we expect composition and performance of green bond and aggregate indices to align more closely.

- Thematic Equity: Ability to add high thematic exposure, but distinctive bets come with high tracking error/low green information ratio. Incorporating into portfolio requires high conviction in the theme.

Sustainable investing is investing first and foremost, and the rules of portfolio construction and risk management apply. We think robust portfolio construction and a more nuanced view on the trade-offs between thematic exposure and tracking error can contribute to more consistent outperformance over time.

Looking Ahead

Sustainable investing is entering a new phase in which performance will be the key driver of market growth. The key question for investors is how to achieve this. We believe understanding past performance drivers is crucial for building next-generation approaches that integrate a clear thesis, thoughtful portfolio construction, and a more nuanced view of how different tools and asset classes fit in a holistic portfolio solution.

1 Per Morningstar category.

2 For example, if a portfolio is implemented in two steps with the first step being ex-ante sustainability criteria implementation and second step being short-to-medium term stock selection/alpha model, the total portfolio tracking error does not have to be the sum of its parts. The respective tracking error from both steps can be dynamically adjusted in periods when characteristics between alpha views and sustainability considerations are correlated. This allows the alpha engine to utilize more tracking error, effectively “recycling” active risk from sustainability criteria.

3 eVestment, Goldman Sachs Asset Management. As of May 21, 2025.

4 Goldman Sachs Asset Management, Bloomberg. As of December 31, 2024.

5 “Beyond Impact: Analysing the Drivers of Green Bond Performance,” Goldman Sachs Asset Management. As of May 2024.