Pension Plan Completion Portfolio

A large public pension plan in North America that was looking to expand their existing portfolio without making comprehensive changes.

Generate returns from sources not currently in their strategic asset allocation.

- Offer the client a diversified range of investment opportunities beyond their current portfolio holdings to enhance potential returns

- Strategically alllocate risk within the mandate mindful of the client’s total investment portfolio, ensuring alignment with their comprehensive financial objectives

- Provide tailored options to optimize returns by exploring alternative investment avenues and adjusting asset allocations accordingly

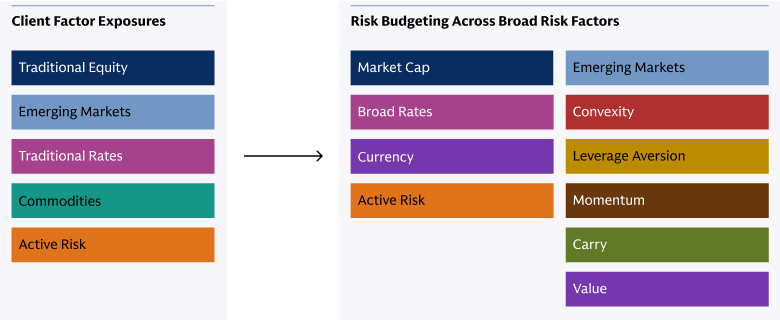

We employed a factor-based investment process to properly assess risks in the client’s existing portfolio on a multi-asset and cross-asset basis. The strategic asset allocation relied heavily on alternative risk premia strategies as well as tactical asset allocation to express short to medium term market views to diversify sources of return.

Within the context of the mandate, the client made high allocations to alternative risk premia strategies as well as to shorter-term tactical tilts and hedge funds to complement the traditional sources of return present in the rest of their portfolio. By adopting a factor-based investment lens, we were able to look through asset class labels in the client’s current allocation to identify common sources of risk to identify alternative sources of return distinct to the client’s current portfolio. The improvement in diversification brought by the more tactical and alternative approach sought to improve the overall risk/return composition of the client’s total portfolio.

Over time, the client began to internalize many of the core elements of the mandate, using alternative risk premia and risk-mitigating strategies elsewhere in its investment process, reflecting the observation that completion mandates can build clients’ internal capabilities and have impact on total portfolio holdings outside the scope of any particular mandate. As the client’s approach to factor diversification evolved, the mandate transitioned away from completion towards a more purely tactical and complementary approach.

The cited case studies represent examples of how we have partnered with various institutional clients on a broad range of services and offerings. The experiences outlined in the case studies may not be representative of the experience of other clients. The case studies have not been selected based on portfolio performance and are not indicative of future performance or success. This is not a testimonial for Goldman Sachs Asset Management’s advisory services.