Investing Where AI, Energy and Politics Intersect

AI and renewable energy have been on the rise for decades, but their development has taken off in recent years. ChatGPT, launched in late 2022, has the fastest-growing user base of any consumer internet application in history1 and made the world aware of the rise of generative AI. The clean-energy transition has accelerated thanks to record investment and supportive policies implemented by governments around the world as clean-tech competition heats up.2 The rapid advances in AI and clean energy are playing out against the most acute geopolitical turbulence since the Cold War, driven by escalating competition between the US and China, wars in Europe and the Middle East and the reconfiguration of global alliances.

Investors increasingly understand that AI, clean-energy and geopolitics could shape the global economy in the years ahead. What is somewhat less appreciated is how profoundly they are interrelated. Goldman Sachs' Jared Cohen and John Goldstein share their views on the ways these major forces overlap and intersect, and some of the opportunities and risks that are emerging as they evolve alongside each other.

What is the overarching investment thesis that links AI, the energy transition, and geopolitics?

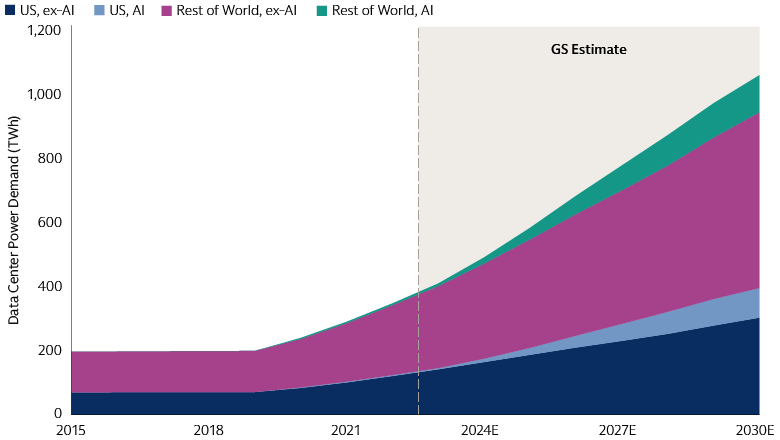

Goldstein: Let’s start with AI and energy. On average, processing a ChatGPT query is much more energy-intensive than a Google search. With use of generative AI expected to continue rising in the years ahead, by 2030 this simple fact will help drive a 160% increase in power demand from the data centers that process all that traffic.3 From the sustainability perspective, you’d hope this increased demand would be met with clean, renewable power. For that to happen, the electricity grid will need to be upgraded to facilitate the import and export of clean energy. Utilities will have to find ways to drastically boost their renewable power output and ensure a consistent supply. We’ll need advancements in new enabling technologies, such as high-capacity batteries. Meanwhile, armed conflicts will continue to affect energy prices and drive supply concerns.

The interplay of these forces could play out in various ways. AI may strain the energy system, but it may also help find solutions to make data centers and the grid more efficient. The sharp rise in demand for energy could accelerate the shift to renewable sources, or it could lead utilities to ramp up their use of readily available fossil fuels in the short term. These kinds of critical questions arise wherever AI, energy and geopolitics intersect. For investors, the challenge is to understand these interdependencies and map out their investment implications. Investors who stay in their silos and focus on a single theme will miss out on opportunities and underestimate the risks.

Source: Masanet et al (2020), Cisco, IEA, Goldman Sachs Global Investment Research, GS SUSTAIN. As of April 28, 2024.

How do you see the power demand from AI evolving, and what can countries do to meet it and stay ahead of competitors?

Cohen: For the first year after the public release of ChatGPT, much of the world’s attention was focused on the shortage of high-performance chips and the specialized processors known as graphics processing units (GPUs). The supply chain in those areas is smoothing out now.4 The bottleneck we’re increasingly hearing about from our clients today is power. These systems are far more energy intensive than typical data centers that are based on central processing units (CPUs), and that power consumption trajectory is expected to continue up and to the right. Some of the latest processors use up to 1,200 watts of energy per chip, compared with the previous generation that used 700 watts.5 Within five years, it is predicted that as much as 50% of hyperscale data center workloads will come from AI.6 This requires a dramatic rethinking of today’s landscape for computing. Hyperscalers have already committed hundreds of billions of dollars toward this buildout.7 That’s just the start.

When it comes to energy, there are ways that AI can make energy systems more sustainable and reduce inefficiencies. But to really lead, the US and other countries will need an all-of-the-above strategy, innovating in the energy space while responsibly using domestic energy resources, including natural gas and renewable power.

An abundance of energy is clearly essential to the AI revolution. What opportunities and challenges could this expected surge in demand create for investors?

Goldstein: In looking for investment opportunities, it’s useful to identify areas where innovation and growth are essential to the success of the whole enterprise. The development of AI will require a sharp increase in available electricity and the ability to deliver that electricity to where it’s needed. This is particularly true for renewable energy. Achieving these goals will entail changes to the transmission system. Will this translate into new transmission, or distributed generation? That’s an important question, but the need to make better use of the grid is a certainty. Building new transmission is expensive and takes time, so a lot of work is being done to optimize the existing transmission network.

The transition to clean energy will affect all aspects of the traditional energy market, and utilities are right at the heart of the action. How will these companies, which traditionally had flat demand and long planning cycles, adjust to growing demand in real time? We’re talking about a transformation of the sector. We have seen some utilities expressing concern about their ability to meet the urgent need for increased output. Will increased demand accelerate the buildout of renewables and energy storage? Will it drive innovative new sources of clean, firm power? Or will it increase the role of natural gas and push out the horizon of utilities’ decarbonization plans? In considering these questions, it’s worth remembering that many of the main players behind the rapid expansion of AI – the big tech companies – have strong clean energy ambitions, which could influence how utilities respond.

How could deglobalization and the increased focus of many countries including the US on self-sufficiency and boosting domestic production affect the development of AI and clean energy?

Cohen: The world economy is becoming more divided. China is following a “dual-circulation”8 model to gain leadership in critical technologies and become self-sufficient, while much of the West is seeking to “de-risk” supply chains and keep its own technological advantages over China intact, especially when it comes to AI. This trend isn’t going away.

The fact that this evolution has been viewed from the start as geopolitically relevant makes it distinct from the wave over the past two decades. We could see greater demand for chips and increased buildout of digital infrastructure due to governments around the world pursuing the sovereign AI model via resilient, self-sufficient supply chains.

The economic division is directly related to the trends we’re seeing in AI and energy. If the energy demanded by AI systems continues to increase, the challenge for the US is that its power system is built in terms of decades, not months or even a few years. America will have to work through these issues, including permitting reform at the federal and state levels that will allow it to increase capacity in a more sustainable way to capture the needed investment and buildouts.

Goldstein: At the end of the day, if we want to meet increased power demand with a focus on clean energy, you will have the push and pull from geopolitics. If the US continues to decouple its economy and make it harder to buy from China, can it create a robust alternative? That’s what the Inflation Reduction Act is trying to do. The decision to rebuild domestically and cut off lower-priced products from elsewhere could also affect the inflation dynamic, particularly for clean energy.

With AI and clean energy developing at varying speeds around the world, how will these differences affect where investment opportunities arise?

Goldstein: Initially we’ve seen sustainability-related manufacturing located in places that had the competitive advantage of abundant, stable and low-cost clean energy. Think of the north of Sweden, where two of the biggest industrial projects in the world have been built to produce batteries and green steel, largely because of the access to cheap hydropower. A tech giant is looking into using nuclear power for data centers. Once the sources of plentiful clean energy are gobbled up, the focus could shift to electricity interconnectors, which enable the import and export of electricity.

Cohen: Harnessing the power of AI will require one of the largest infrastructure buildouts in human history. The scale of the ambition is extraordinary, but so are the opportunities. And whoever gets this right could determine the future of economic growth, geopolitics, and progress for decades to come.

For now, the price of power is less of a concern for AI data center operators than the reliability and quantity of the power supply. When AI chips are running, they return most of the cost of running a data center. When these chips are underutilized, however, the downtime can prove even more expensive for operators than steep hikes in the price of power.9 This presents a challenge in running these systems on pure renewable energy like solar and wind, where the certainty of power supply can vary by the time of year or even the time of day. Lulls when wind and solar power can’t be produced are a big challenge for data center operators fully committed to using renewable energy.

To solve the power supply problem, we’ll see hybrid solutions for the time being. Looking ahead to the gigawatt scale data centers necessary for training the next generation of large language models, the big questions are who is going to build them and where. The US is well positioned but will need to build new power generation quickly.

Most people now live in a country with a national AI development strategy. Many countries also have a game plan for clean energy. Yet the effects of these two revolutions will not be the same everywhere. For example, developed markets on average are expected to see greater productivity gains from AI adoption than emerging markets.10 What are the concerns about AI and clean energy exacerbating inequality, and how could this affect their development?

Cohen: The power demanded by new AI systems could widen the gap between advanced and developing countries. That’s because the new high-powered, gigawatt-scale data centers will mostly be in highly developed countries like the US or in emerging markets with tremendous access to capital, as well as energy and regulatory flexibility, like the Sunni Gulf states.

Overall, investment will continue to shift toward developed countries, potentially exacerbating the gap between advanced and developing countries’ power usage. This divergence isn’t inevitable, however. We’ll likely see many countries try to address these issues by forming new technology partnerships, including in the Global South. For example, Microsoft and G42, a technology group based in the United Arab Emirates, are collaborating with the Kenyan government to build a data center powered by geothermal energy in the east African country.11

Goldstein: If AI demand and insufficient supply cause a spike in energy prices that affects low-income households, this probably won’t be politically tenable anywhere in the world, particularly in countries already struggling with higher inflation. AI has the potential to boost global economic output,12 but this probably won’t occur evenly across the globe. The technology’s capacity to automate many tasks may be a boon for many workers, allowing them to move into better-paid jobs, but the risk remains that displaced workers could struggle to find roles in the new economy. This could limit the pace of development of AI and clean energy down the line.

1 Reuters. As of February 2, 2023.

2 BloombergNEF. As of January 30, 2024.

3 Goldman Sachs Global Investment Research. As of May 14, 2024.

4 CNBC. As of July 27, 2023.

5 Forbes. As of June 20, 2024.

6 Structure Research, JLL, CBRE, EY-Parthenon Research and Analysis.

7 Fortune. As of April 30, 2024.

8 Financial Times. As of December 16, 2020.

9 SemiAnalysis. As of December 4, 2023.

10 Goldman Sachs Global Investment Research. As of May 13, 2024.

11 Microsoft. As of May 22, 2024.

12 Goldman Sachs Global Investment Research. As of April 5, 2023.