Fiduciary Management or OCIO: Choosing an External Investment Manager

UK defined-benefit pension schemes are operating in an increasingly demanding environment. Trustees face a long list of challenges, including a complex and evolving regulatory framework and uncertain investment markets. We think that the resources available to many schemes have not expanded to meet these demands, however, leaving trustee boards and their corporate sponsors stretched.

In response, a growing number of pension schemes are seeking outside help in managing their investments.1 Two related services, known as OCIO (outsourced chief investment officer) and fiduciary management, may allow pension schemes to delegate activities such as asset allocation and the implementation of investment strategy to a specialist firm, often an asset manager. This potentially allows schemes to tap into the investment expertise of the external manager and frees up trustees to spend more time on strategic planning.

The terms OCIO and fiduciary management are often used interchangeably and the terms can mean different things in different geographies. While there is no technical or formally agreed definition of each service, we think it is helpful to draw some distinctions which we address below. Both services may help pension trustees make more informed decisions and potentially improve portfolio management, and both can allow a scheme’s trustees and staff to focus more on activities such as strategic decision-making. We believe the choice between the two services comes down primarily to the level of control trustees want to retain over their investments given their scheme’s specific objectives and existing capabilities, and how much they are willing to delegate to a single party.

What’s the difference?

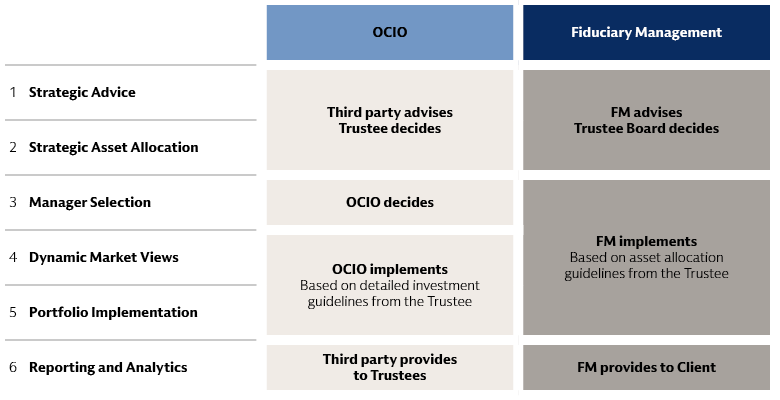

OCIO – as we define it – involves a partial delegation of responsibilities to the external manager. The board of trustees sets high-level investment strategy, including risk and return targets, often with advice from a third-party consultant. Strategic asset allocation decisions are made by the trustees, again usually with advice from a third party. Execution of the investment policy is then handled by the OCIO. Oversight can be provided by the pension scheme’s own staff or a third party.

Fiduciary management involves a fuller delegation of responsibilities. The external manager assumes full fiduciary responsibility and is active at all levels of the investment process. This means the fiduciary manager first provides advice to the board of trustees on investment strategy and then executes all remaining investment functions, including making asset allocation decisions and providing reporting and analytics to trustees.

The breakdown of responsibilities in OCIO and fiduciary management is presented in the following table. The assignment of responsibilities shown here reflects common arrangements in delegated management, although in practice we see a wide range of models reflecting scheme specific requirements.

Source: Multi Asset Solutions, Goldman Sachs Asset Management. For discussion purposes only. As of 30 September, 2024. Examples only: Other permutations are achievable.

How to choose?

Having made the decision to outsource, trustees need to decide which delegation model to choose. We believe the key question here is whether the manager appointed to execute the investment strategy should also provide advice on its construction, or if these functions should be divided between two parties.

In answering this question, key considerations include the complexity of the two models. In the OCIO model, trustees have relationships with two external firms, while fiduciary management involves a single relationship. The cost of outsourcing may also vary: engaging a single provider typically leads to lower overall costs.

A third factor to potentially consider is consistency between the strategic investment advice provided to trustees with the approach applied in execution. In some cases, enlisting different parties to develop and execute strategic policy may lead to a disconnect between these functions. Finally, both delegation models involve significant reliance on the external firm – the OCIO or fiduciary manager. Appointing a separate strategic adviser could help avoid excessive reliance on a single organization.

We think that finding the right delegated-management service depends on a pension scheme’s specific needs. Generally speaking, it seems larger schemes with experienced in-house asset-management operations may prefer the OCIO option, thereby reducing the costs of delegation and retaining greater control of the investment process. Smaller schemes with more limited resources may opt for a fiduciary-management arrangement with the full delegation of responsibilities.

1. The share of UK schemes using some form of fiduciary management stands at about 18%. See “Latest Trends in Fiduciary Management: 2023 Isio UK Survey,” Isio Services Ltd. Data as of June 30, 2023. The survey results are based on the responses from 16 fiduciary managers operating in the UK defined-benefit pensions market, including Goldman Sachs Asset Management.