From Core to Credit: A New Fixed Income Playbook

We have entered a new era of fixed income opportunities, where the resurgence of yield creates a compelling case for investors to restore or initiate a core fixed income allocation. Core fixed income refers to a portfolio of high-quality, lower risk fixed income securities, such as government bonds and investment-grade corporate bonds. Core fixed income securities can offer balance and stability to a well-diversified portfolio through a predictable stream of income, lower volatility than cyclical assets and potential diversification benefits due to their low or negative correlation with other assets such as equities.

Beyond the more familiar fixed income terrain, opportunities also arise in private credit, offering diversification benefits and the potential for enhanced yields. But opportunity comes with uncertainty and challenges. The global economy, society, and financial markets are undergoing a profound transformation driven by five key structural forces: decarbonization, digitization, deglobalization, destabilization in geopolitics, and demographic aging. Active security selection, diversification, and dynamic asset allocation can help investors navigate these contours and construct resilient, return-focused portfolios.

Strengthen Your Core

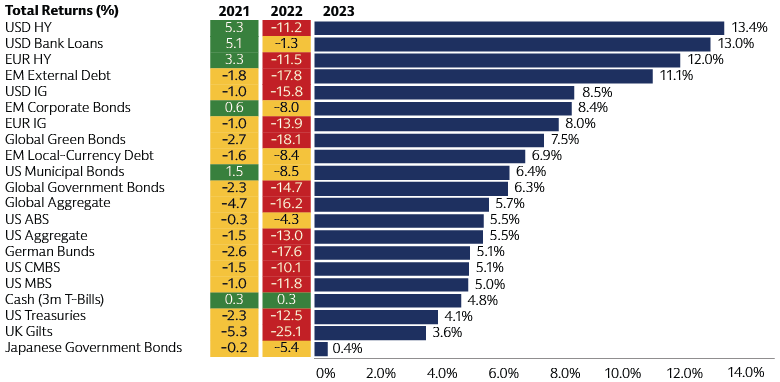

The 'great escape' from the low-yield environment of the last cycle has been turbulent. In 2022, almost every financial asset grappled with negative returns due to swift monetary tightening triggered by surging inflation. The turning point arrived in November 2023, marked by growing evidence of disinflation and a reinforced belief that major central banks had reached the peak of their policy rate hiking cycle. This set the stage for a robust conclusion to the year across fixed income assets.

Source: Goldman Sachs Asset Management, Macrobond, Bloomberg, J.P.Morgan, ICE BofAML, Markit iBoxx. Annual total returns as of 2023. Local currency. Past performance does not guarantee future results, which may vary.

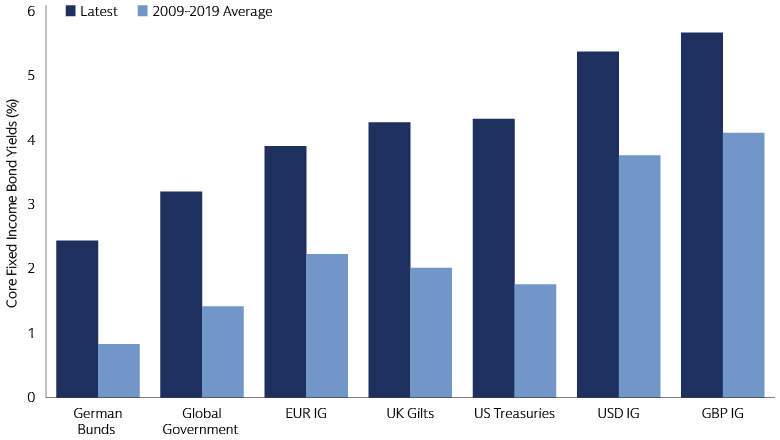

Even after this formidable performance, investors enter 2024 with the opportunity to reap the most attractive yields on high-quality bonds since before the global financial crisis. Investors no longer need to tread into riskier parts of the financial market for income. They can consider fortifying or establishing an allocation to core fixed income instead, comprising investment grade corporate, securitized and government bonds, while allocating to assets like high yield corporate credit and emerging market debt for their capital appreciation potential.

Source: Macrobond, ICE BofAML, Goldman Sachs Asset Management. As of January 17, 2024.

We believe core fixed income bonds can benefit from an expected decrease in central bank policy rates by year-end. The higher starting yields on these assets compared to the last cycle and even a year ago is also beneficial. Higher yields create a protective shield for investors. They can guard against potential increases in yields triggered by upside inflation shocks, potentially caused by geopolitical tensions disrupting global supply chains or commodity markets.

For perspective, yields on US investment grade corporate bonds would need to rise more than 0.72% for investors to incur negative total returns over the subsequent 12 months. We see such a yield rise as unlikely given our constructive assessment of balance sheet fundamentals and the benign economic landscape. This 'yield buffer' has decreased from a cycle peak in October but it remains the most substantial since 2010. We see core fixed income as a means of capital preservation and steady stream of income in a well-diversified investment portfolio.

Core bonds also tend to exhibit greater liquidity relative to cyclical corners of the fixed income market or equities. This is an attractive characteristic in a world subject to more frequent changes in economic conditions.

Source: Goldman Sachs Asset Management, Macrobond, Bloomberg. As of January 12, 2024. This analysis is based on carry (expected total return beyond price appreciation) and does not include roll (the change in yield from “rolling down” a credit curve over time). We assume no default losses.These examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially.

Reach for Rates for Resilience

The seismic shocks of the pandemic and global conflicts have underscored the importance of preparedness and resilience across our economy, healthcare, and supply chains. This echoes with equal resonance in the realm of investment portfolios. In a world fraught with uncertainties, from cybersecurity risks linked to artificial intelligence to unforeseen "green swan" events triggered by climate tipping points, constructing resilient portfolios becomes all the more pressing.

Having moved beyond the zero or lower bound on yields, we believe government bonds, or rates—a key component of core fixed income securities—now reprise their role as a source of portfolio resilience against downside growth risks. The protective role of government bonds was demonstrated in March 2023 when the US Treasury 2-year yield dropped the most in a month since 1982, following stress in the US regional banking sector. The shift to an environment where downside growth risks overshadow upside inflation and hawkish policy risks should also foster a return to negative correlations between bonds and risk assets, further reinforcing the portfolio value of government bonds. This means that when other assets in a portfolio experience volatility or value decline, government bonds can help mitigate losses and provide a source of stability.

Expand Your Credit Horizons

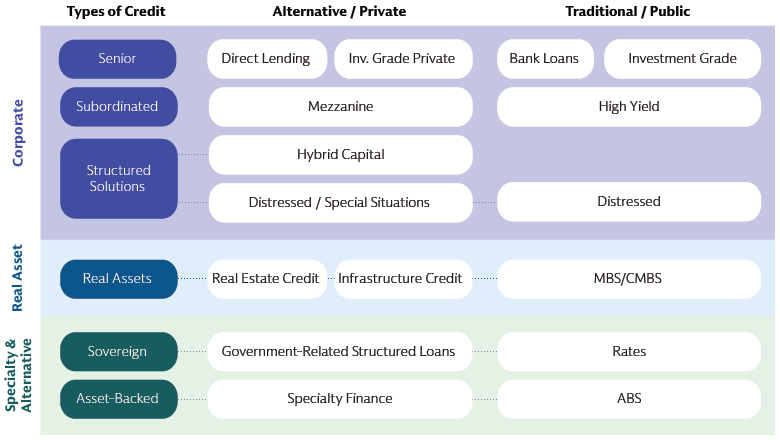

For investors willing to look beyond public capital markets, private credit has developed into a diversified asset class with opportunities across the borrower, credit quality, and risk/return spectrums. The asset class offers enhanced yields, insulation from near-term market volatility, and potential diversification benefits.

While currently the majority of private credit assets under management is in corporate lending, the asset class also encompasses diversifying strategies such as real asset credit and specialty finance. These strategies feature varying risk/return profiles and degrees of sensitivity to the economic cycle. Real asset credit may lend to property types levered to long-term secular trends or idiosyncratic supply/demand dynamics, while specialty finance lenders provide loans backed by equipment and other tangible assets, future revenue streams like royalty payments, or financial asset pools such as consumer lending. We believe asset finance is a growing segment of the market.

In corporate private credit, payment defaults have been muted so far this cycle. Borrowers’ operating fundamentals have remained largely resilient. In cases of stress, the bilateral nature of private credit has allowed borrowers and lenders to proactively address potential distress and therefore mitigate defaults. Furthermore, many borrowers are backed by financial sponsors that have supported their assets through distress to protect their equity investment.

The prospect of US Federal Reserve interest rate cuts in 2024 is a welcome development for borrowers given the floating-rate nature of their liabilities. But the effects from these cuts are likely to be limited. We expect the relatively benign default dynamic should continue, but with greater dispersion amongst individual loans. Business with less leverage or stronger cash flows should be better able to withstand the interest rate environment, while some fully-levered companies and business models will be tested by higher debt burdens. Strong businesses with balance sheets unsuitable for the current rate environment may drive demand for creative structured financing solutions, including hybrid capital.

We believe investors should employ a granular and sophisticated approach to allocating across private credit strategies. One framework is to draw parallels between private credit investment strategies and their closest counterparts in public markets. This can help define portfolio characteristics, roles, and diversification approaches.

Source: Goldman Sachs Asset Management. For illustrative purposes only. As of September 2023.

New fund structures can make private credit more accessible and allow for more dynamic asset allocation. For example, the semi-liquid market can offer immediate private market exposure and yield with periodic liquidity (subject to gates and queues), and reinvestment of proceeds to facilitate compounding of capital over time.

Stay Selective and Active

Profound changes in the economy and markets create a new era of opportunity across traditional and alternative fixed income categories. Investors should remain selective and active, balancing cyclical dynamics with underlying structural trends to find returns while avoiding financial distress.

As structural trends of decarbonization, digitization, deglobalization, destabilization in geopolitics, and demographic shifts accelerate, the gap between companies or countries on the wrong side of change is likely to widen. Identifying resilient companies and sovereign bond issuers with clear, long-term vision will become increasingly important.

Dispersion across asset classes, sectors, and regions is also likely to increase as interest rates settle higher. Developed market sovereign issuers with worrisome fiscal trajectories, certain emerging market governments burdened by substantial dollar-denominated debt, smaller companies with limited funding sources, and banks exposed to commercial real estate may face challenges.

Company-by-company, bond-by-bond analysis can help identify companies well-positioned to manage elevated capital costs and aligned with long-term secular megatrends. Active management and dynamic asset allocation may prove valuable in an environment of greater monetary policy divergence, providing opportunities for cross-market interest rate views.

In private credit, manager selection will become even more important as a higher-for-longer rate environment creates greater dispersion between well-positioned companies and those experiencing stress.

The bright side of today's fixed income regime includes higher income and total return potential. However, the dark side entails slowing growth and possible challenges among highly indebted entities. Accelerating secular trends present both opportunities and challenges for investors. Success may depend on a new fixed income playbook, relying on active management, dynamic asset allocation, and the flexibility to draw on a full suite of assets, from core bonds to private credit.