Investing in Goldman Sachs Global Securitised Income Bond

Fund Factsheet

Source: Goldman Sachs Asset Management, as of October 31, 2025, yield based on Gross MDist USD share class.

The fund / the investment manager may at its discretion pay dividend out of the capital of the fund, or out of gross income while charging/ paying all or part of the fund’s fees and expenses

to/out of the capital of the fund, resulting in an increase in distributable income for the payment of dividends by the fund and therefore, the fund may effectively pay dividend out of capital. Payment of dividends out of capital amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment. Any distributions involving payment of dividends out of the fund’s capital or payment of dividends effectively out of the fund’s capital (as the case may be) may result in an immediate reduction of the net asset value per share/unit. Distribution of dividends (if any) is not applicable to all share classes and is not guaranteed, and is subject to the sole and absolute discretion of Management Company. Dividend yield is not indicative of your investment’s return.

It is not uncommon for investors to be invested in securitised bonds through global credit portfolios. Through the Goldman Sachs Global Securitised Income Bond (GSIB), investors have easy access to a broader spectrum of quality securitised bonds that provides a strong, alternative income potential.

Allocating to GSIB can complement investors’ existing holdings in global bond portfolios given its low sensitivity to interest rates and low beta to other credit sectors.

Most global bond portfolios are invested in corporate and government bonds which typically have longer duration of more than 5 years.* GSIB’s low duration of 0.2 years also protects investors from large price movements as the outlook for interest rate changes.

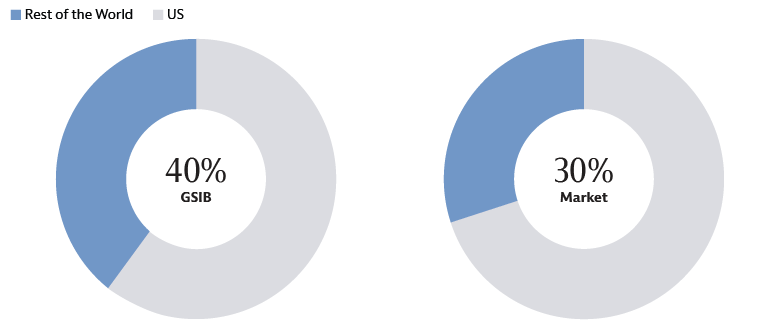

The global securitised bond market is concentrated with US assets making up the majority allocation. GSIB provides investors with a more diversified exposure and has more than 40% invested in non-US securitised assets.

Source: Goldman Sachs Asset Management, as of October 31, 2025, JP Morgan markets, Q2 2025. Includes Collateralized Loan Obligations, Asset-Backed Security, Residential Mortgage-Backed Security and Commercial Mortgage-Backed Security.

Source: Goldman Sachs Asset Management, as of September 30, 2025. Assets Under Supervision (AUS) includes asset under management and other client assets for which Goldman Sachs does not have full discretion.

* Based on Bloomberg Global Aggregate Index weights, as of September 30, 2025.