Market Know-How 4Q 2025

Continental Shift

Europe continues to grapple with economic, political, and structural challenges. Plus ça change. Yet increasingly, there is broad recognition among European policymakers that many of these issues—such as the energy transition, the need for a coherent regional defense strategy, and investment in technology and digitization—now demand urgent action. Problems that have long weighed on European growth, productivity, and profitability are being reframed: no longer chronic, they are now acute, requiring immediate redress.

The solutions, however, are neither simple nor costless. Policy coordination, prioritization, and—crucially—financing remain thorny issues that demand careful handling by Europe’s political leadership. Nonetheless, we believe there is clear evidence of a sea change. Several European countries have announced multi-year commitments to invest significantly across a broad array of sectors. This marks a politically driven structural shift with long-term investment implications, rather than a fleeting cyclical upswing.

As a result, the European growth and investment landscape is being reshaped. European assets have performed well so far this year, and the euro has seen a notable rebound—trends we expect to continue into 2026. Even the modest fiscal stimulus now feeding through to the economy represents a meaningful departure from the post-GFC austerity. Combined with the substantial monetary easing already delivered by the ECB—much of which has yet to fully transmit to the real economy—this may create a more supportive backdrop for European corporate profitability and creditworthiness.

Europe’s challenges remain significant. The initiatives launched this year are no panacea, and much work lies ahead. Different regions face different constraints and limitations. But for large parts of Europe, the economic and investment outlook has improved meaningfully. In our view, the repricing of European assets still leaves attractive upside potential for dynamic and diversified investors. We explore some of those opportunities in this latest edition of the Market Know-How.

Short-Term Macro Themes

We expect global growth to cool into year-end, before re-accelerating in 2026, as fiscal stimulus takes effect and consumption recovers. Inflation paths are likely to continue to diverge, but decreased trade uncertainty may allow the Fed, BoJ and BoE to resume policy normalization.

Europe & US: Fiscal To The Rescue?

- We see growth slowing in the US and Europe into year-end as tariffs bite, pressuring US real disposable incomes and Europe’s net trade. Looking forward to 2026, we expect Europe to gain momentum on stronger household and government spending. In the US, the One Big Beautiful Bill Act may lend support, given the front-loading of spending and the back-loading of savings.

- Germany’s fiscal shift and the EU defense push underpin our constructive view on Europe. While Germany faces continued structural industrial headwinds from China competition, slower global growth and elevated energy prices, we expect a significant cyclical rebound in 2026, driven by the forthcoming fiscal stimulus. Analysis suggests a potential boost to public spending of 2.2% of GDP by 2027 and a growth impulse of 0.5pp per year during this time.1 We believe the rollout pace is the biggest near-term hurdle, compounded by capacity bottlenecks in Germany’s and Europe’s defense industrial base. We estimate that Germany’s new fiscal space will be just under €100 billion in 2026. For instance, Rheinmetall—Germany’s largest defense producer—generated under €10 billion in revenue last year and has multi-year backlogs, implying that scaling productive capacity to match budget ambitions will take time and will likely require supplementing domestic production with US imports, at least in the short term.

- German fiscal expansion is the key theme in Europe this year with implications beyond Germany as capex revival spreads across the union, in our view. However, even if the fiscal stimulus were slightly delayed, Europe has a high level of unused savings that could be channelled into consumption and investment with financial market reform. This comes against a still resilient labor market, positive real wage growth and easier monetary policy which are all supportive factors. European policymakers have a window of opportunity to build on this improved macro picture with reforms that lead to a lasting improvement in Europe’s economic performance. For example, the launch of the Savings and Investment Union (SIU) may unlock capital and drive innovation which could strengthen Europe’s long-term resilience. Despite political developments in France, we believe Europe is entering a period of significant opportunity.

- In the US, recent employment data show that the labor market has softened materially, especially if the Quarterly Census of Employment and Wages (QCEW) data revisions to payrolls were to be confirmed. GIR’s baseline forecast is that the economy gradually reaccelerates toward potential in 2026 as the drag from higher tariffs abates, fiscal policy turns more expansionary, and financial conditions remain easy amid monetary easing. Given still-elevated uncertainty around the effect of tariffs on inflation and growth, we believe that recession and stagflation risks, while not our base case scenario, remain important tail risks.

UK: Between a Rock and a Hard Place

- As the Autumn Budget approaches on November 26, the government finds itself once again facing fiscal pressures, with a £20–30 billion budget gap to fill. We foresee Chancellor Reeves likely has three options: 1) adjusting the fiscal rules, 2) lowering spending and/or 3) raising taxes. With changes to the fiscal rules unlikely at this stage and given the difficulty in cutting spending, we continue to think that the third option is the most likely. Economists believe an extension of existing tax threshold freezes to 2030—raising up to £10 billion—remains possible.2 While tax increases would imply a somewhat steeper fiscal consolidation, the fiscal trajectory depends importantly on the path for interest rates.

Diverging Inflation and Monetary Trends Across the Atlantic

- We see inflation paths diverging into year-end and H1 2026. In the Euro area, headline inflation is back at 2% and likely to move below target in the near term, largely driven by negative energy price base effects, increased Chinese import competition and a firmer euro, alongside easing wage pressures. With this in mind, we believe the ECB is done cutting rates for now, though persistent trade frictions tilt risks to additional cuts.

- In the UK, inflation is set to tick up temporarily—potentially peaking near 4%—before drifting back toward target by late next year. This short-term rise comes on the back of increasing energy and food prices, though sticky services inflation remains a concern. Some seasonal factors like school holidays might be behind part of this continued strength in services inflation. That said, if inflation rises further (particularly if it reaches 4%, which is seen as a psychological threshold), this may start influencing inflation expectations and wage demand, threating medium-term price stability. Given elevated inflation, the BoE is likely to remain cautious, but continued labor market cooling and slower pay growth may allow the BoE to ease rates further in the coming months. The timing of the Budget—after the November BoE meeting—however, likely implies that if there is a rate cut this year, it would more likely come in December. By then, the Monetary Policy Committee may also have more clarity on the National Living Wage and next year’s pay settlement.

- In the US, we expect inflation to push higher and remain above target into 2026, due to the impact of higher tariffs. While these temporary tariff hikes will affect goods prices in the short term, we continue to expect continued progress in the services sector, especially as the labor market cools further. With clearer signs of a softening labor market and short-term inflation expectations normalizing, we expect the Fed to look through tariff-driven price pressures and keep easing. Our modal base case is two additional 25 bp cuts this year, followed by two more 25 bp cuts in 2026, taking the terminal rate to a 3.00–3.25% range.

Japan: Back To Hiking

- Japan’s inflation has now been running above 2% for 40 months straight. While the recent strength has been mostly driven by a rise in rice prices, services inflation is moving higher. The BoJ is particularly attentive to services inflation—seen as the truer gauge of domestic pressures—which remains just under, but edging toward, 2%. With a trade deal now secured, we expect the BoJ to resume its hiking cycle by year-end.

China: From Deflation to Reflation?

- The resilience of the Chinese economy despite much higher US tariffs remains impressive, in our view. Despite a sharp decline in exports to the US, overall exports are up in nominal dollar terms so far this year as Chinese producers found enough new markets and export channels to pick up the slack.

- In addition, recent anti-involution campaign—measures and regulations to cut production capacity and curb disorderly pricing schemes—and a pick-up in liquidity have lifted investors’ hopes for a new reflationary environment. Chinese authorities are putting pressure on some industries to restore pricing power while continued monetary easing is leading to a pick-up in money and credit growth.

- These have contributed to a rally in the domestic equity market, boosting confidence despite softer economic momentum. We see deflation risks easing in the coming months, though some negative price pressures are likely to remain into next year given persistent weak domestic demand. We also believe further stimulus is on the cards given the headwinds to the economy.

Long-Term Macro Themes

In our view, the next economic cycle will be characterized by higher inflation, elevated interest rates and heightened macroeconomic volatility, driven by six key factors. We believe investors need to position their portfolios for CHANGE.

CHANGE

Climate transition – High level of debt – Ageing demographics – New finance –Global fragmentation – Evolving technology

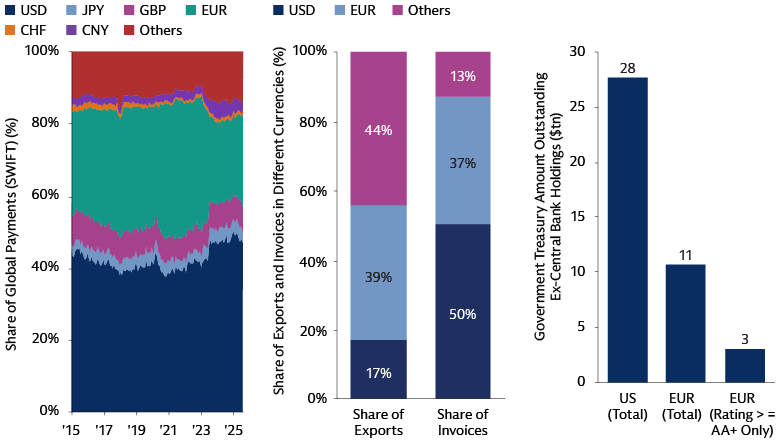

Source: LHS: As of August 2025. Middle: As of 2022. RHS: As of May 28, 2025. For illustrative purposes only.

- From 2014 to 2024, the US dollar appreciated sharply, supported by exceptional US asset returns alongside its role as a reserve currency and perceived global safe haven. Since the start of the year, however, changes in US trade policy and international relations brought about by the new Administration, coupled with improved economic sentiment in Europe, have put US exceptionalism into question, prompting, among other things, a downward move in the greenback.

- Several factors could contribute to a further gradual depreciation of the dollar. These include persistent concerns over US institutional credibility and fiscal sustainability, a more dovish Fed—whether stemming from a belief the economy is weakening or by political construct—improving investment prospects outside of the US prompting greater regional diversification and rising currency hedge ratios.

- But despite rising challenges and ongoing discussions around de-dollarization, the US dollar continues to dominate, and the dollar “supremacy” goes well beyond its role as a safe haven and reserve currency. In fact, the dollar plays a central role in the pricing of international goods and financial assets: roughly 50% of international transactions via SWIFT are carried out in dollars, over 40% of goods trade is priced in dollars and US financial markets are among the largest, deepest, most open and most liquid in the world.

- Historically, investors relied on the dollar’s safe-haven status providing a natural hedge for their US equity exposure and therefore maintained low hedge ratios. While we believe the dollar remains a core strategic asset, for non-US investors, an even temporarily weaker dollar necessitates a reassessment of hedging strategies. Not hedging dollar exposure for non-US investors has become costly and has resulted in increased global equity volatility. We believe this makes a compelling case to at least partially hedge equity exposure.

Market Themes

While trade uncertainty has subsided somewhat, Fed rate cuts are firmly on the table, and US tax cuts and deregulation are underway, we remain neutral on equities and rates and cautious on credit.

Broaden Your Equity Horizons

While some risks have diminished, potentially slower global growth, a softening US labor market, still elevated policy uncertainty, and rich valuations all advocate for maintaining diversified exposures, balancing positioning for AI tailwinds in the US large-cap market with opportunities elsewhere in the Developed Markets (DM) and Emerging Markets (EM) world.

Key Implications

Within DMs, we find attractive opportunities in global small caps, and equities in Europe and Japan, which tend to be more focused on the “old economy” and have delivered higher dividend income—a good complement to US tech exposure, in our view. Within EMs, China looks attractive from a tactical standpoint. In India, the Goods and Services Tax cuts are a tailwind for India equity earnings.

Focus on Income

We believe core fixed income is an attractive option to potentially provide investors with a defensive ballast while offering attractive carry. With inflation stabilizing, and central banks cutting rates, duration is once again providing a useful source of diversification.

Key Implications

Within rates, we are positioned for curves to steepen. We think there is value in UK rates both directionally and in the cross-market space, while we are underweight numerous points on the short-to-intermediate part of the yield curve in Japan. Within credit, while we see more spread value in high yield corporates and securitized credit at present, we are positive on investment grade (IG) credit in dedicated fixed income portfolios given attractive carry and strong fundamentals.

Seize Alternative Opportunities

The stock–bond correlation keeps swinging back into positive territory, exposing the limitations of traditional diversification methods, like 60/40 portfolios, especially at times of heightened inflation risk. As debt sustainability comes into question and geopolitical uncertainty remains high, we think that bonds and equities might remain positively correlated.

Key Implications

We believe investors should consider liquid alternatives to potentially achieve better downside mitigation and differentiated market exposure. Infrastructure and private credit may also provide investors with diversified exposure and mitigation against inflation risk.

Rethink Your $ Exposure

The US Dollar has been roughly flat over the last few months, but we do expect it to resume its fall before long, as the Fed cuts rates, the US economy proves unexceptional and hedging costs prompt some marginal redirection of flows to domestic markets.

Key Implications

We are most positive on the Euro—as the German fiscal stimulus may support growth convergence and the policies of the Trump administration should moderate capital inflows into the US—and the Yen, given low valuations and shrinking interest rate differentials between Japan and the US.

European Equities

OUTLOOK

Riding the Capex Revival Wave

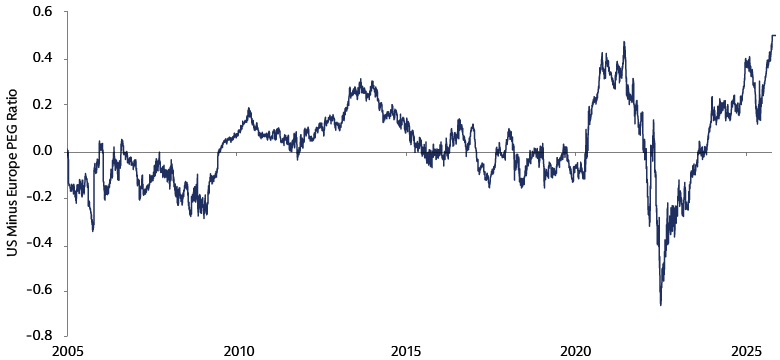

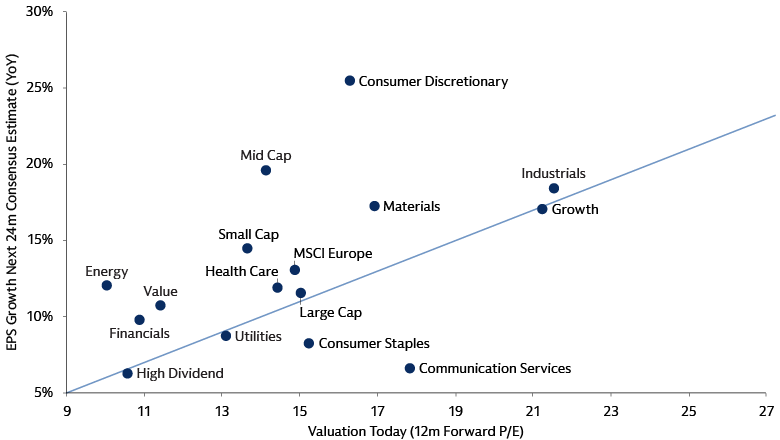

Despite recent performance, we think that there is room for European equities to rally further on the back of both favorable valuations and improving fundamentals. For a start, we expect stronger EPS growth in 2026, supported by structural tailwinds, including fiscal support, infrastructure investment and a notable ramp-up in private sector capital expenditure. Indeed, the capex-to-sales ratio for Europe ex-Financials has now climbed to a 10-year high, reflecting a shift in how corporates deploy cash. Much of this investment is flowing into sectors around the energy transition, defense and AI. Continued fiscal execution, industrial recovery, policy reform and potential geopolitical tailwinds will be key in unlocking the next leg of the rally, but we believe that these trends could contribute meaningfully to improving Europe’s long-term competitiveness and ROE. While select US equity sectors, notably tech, remain compelling, we believe that European equities now represent a good alternative to broader US equity exposure and at a still-affordable “price”. The PEG ratio spread between the S&P500 and STOXX 600 is near its widest outside the Covid shock, underscoring a still-pronounced valuation gap even after adjusting for medium-term forward earnings growth.

Turning Tailwinds into Tactical Advantage

Within Europe, while a stronger euro and lower oil prices could weigh on large-cap exporters, we expect domestically oriented names to continue showing resilience. In particular, valuations and forward EPS growth appear compelling in small caps, Financials, Utilities, Telecoms and Materials. We believe that these pockets also stand to benefit from resilient dividends, capex incentives and domestic demand. Selectivity remains critical, but with M&A activity potentially re-accelerating going into 2026 and the above-mentioned tailwinds, we believe that European equities continue to be compelling.

SOLUTIONS

Source: DataStream, Goldman Sachs Global Investment Research and Goldman Sachs Asset Management. As of September 30, 2025. PEG ratio refers to 12m forward P/E divided by second 12m forward EPS growth. US: S&P500 and Europe: STOXX600. For illustrative purposes only.

Source: Bloomberg and Goldman Sachs Asset Management. As of September 30, 2025. The chart shows MSCI Europe indices. For illustrative purposes only. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation

Credit

OUTLOOK

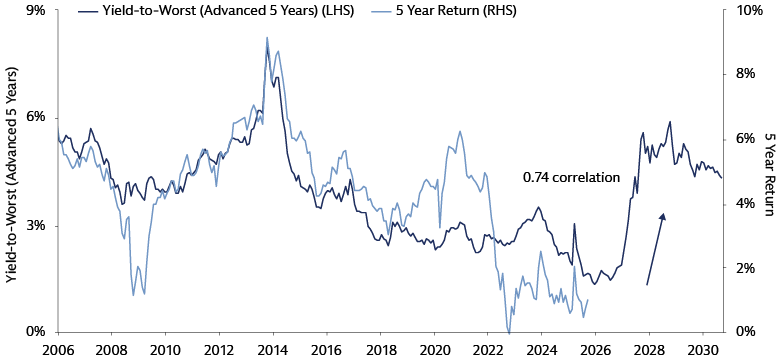

High Carry, High Return

IG bonds stand out as an option for enhancing portfolio returns going into year-end, in our view, striking a balance between earning income and managing risks. Specifically, the resilience of IG credit in downside growth scenarios and capital preservation in market phases characterized by higher growth volatility are especially relevant in the current market environment. While spreads are tight, we believe the income potential of IG credit looks attractive. Historically, the Global Aggregate Corporate Index3 yield has shown a strong correlation with future returns. Given current yield levels, this relationship suggests mid-single digit annualized returns in the next five years, a performance not seen in over a decade.

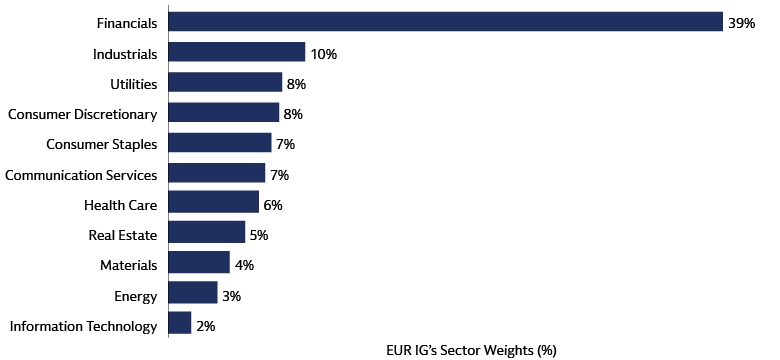

Europe’s Moment

Within credit, we see compelling reasons to focus on European investment-grade credit (EUR IG), particularly given its sectoral composition. Financials, which make up a significant portion of the index and tend to be more domestically oriented, are well-positioned to benefit from the current environment of still-elevated rates and steeper curves. With IG credit duration falling to ~4.5 years in the Euro area and ~6.6 years in the US, the impact of rising fiscal stimulus, particularly in Europe, on duration risk appears manageable. Moreover, the improved growth outlook in Europe and easy monetary conditions are likely to offset any negative effects stemming from renewed fiscal concerns, in our view. We believe that EUR IG offers a balanced mix of defensiveness and return potential going into next year, making it an attractive allocation within credit in the current macro environment.

SOLUTIONS

Source: Bloomberg and Goldman Sachs Asset Management. As of September 30, 2025. The chart shows the Global Aggregate Corporate Index hedged. Past correlations are not indicative of future correlations, which may vary. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.

Source: Bloomberg and Goldman Sachs Asset Management. As of September 30, 2025.

Trade Finance

OUTLOOK

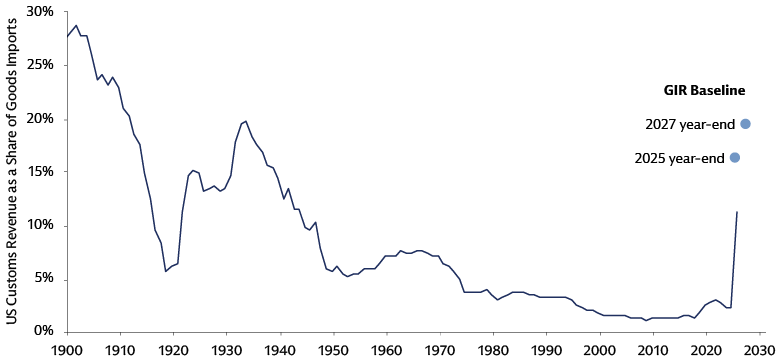

Reshoring and Onshoring Redraw Global Supply Chains

The long-term decline in the US effective tariff rate, from nearly 30% in the early 1900s to under 5% post-1970s4, reflects decades of globalization and trade liberalization. Recent geopolitical shifts have reversed this trend, prompting a resurgence in protectionist policies. The sharp uptick in tariffs post-2020 signals a focus toward onshoring and reshoring of supply chains, echoed by rising corporate mentions during earnings calls. While tariffs disrupt trade by fragmenting supply chains, we believe that the reconfiguration of global trade routes, via transshipment and rerouting, may lift demand for financing. Trade reshuffling is key in a fragmented world and reconfiguration occurs not only between regions and across supply chains, but also in how trade is financed, underscoring the growing importance of trade finance.

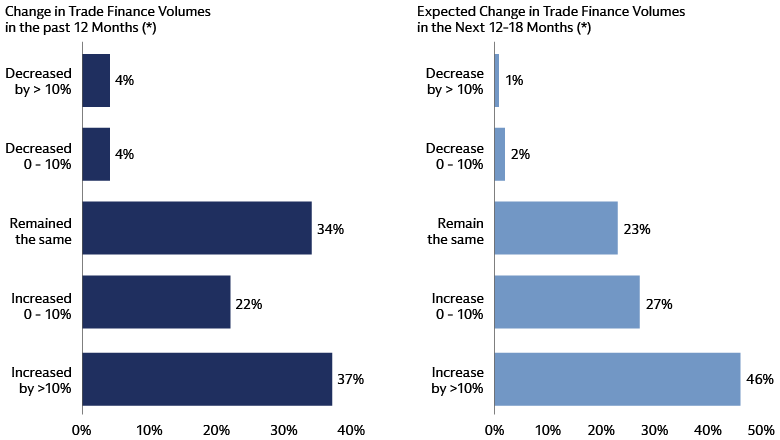

Taking Advantage of A Fragmented World

According to Euromoney’s 2025 Trade Finance Survey5, about 60% of firms reported higher trade finance volumes over the past year and roughly 73% expect trade finance volumes to increase over the next 12-18 months. This optimism reflects persistent supply chain disruptions, accelerating digitization and regional diversification even as geopolitical instability, inflation and higher interest rates complicate execution for corporates. Global trade flows have expanded from ~$6.5 trillion in 2000 to ~$24.1 trillion in 2024, growth boosted by various trade finance tools that enable importers and exporters to transact more confidently across borders. Looking ahead, we expect global trade volumes to keep rising as transshipment and rerouting intensify in response to higher tariffs, lengthening routes and increasing working‑capital needs.

SOLUTIONS

Source: USITC, Goldman Sachs Global Investment Research and Goldman Sachs Asset Management. As of September 30, 2025. GIR Baseline is for an overall increase in the effective tariff rate of around 14pp by the end of 2025, rising to a 17pp increase by early 2027. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.

Source: Euromoney Trade Finance Survey 2025 and Goldman Sachs Asset Management. As of September 30, 2025. *Please see additional disclosures on page 15 of this document.

1Goldman Sachs Global Investment Research. As of June 27, 2025.

2Goldman Sachs Global Investment Research. As of June 27, 2025.

3Bloomberg Global Aggregate Corporate Index hedged

4USITC and Goldman Sachs Asset Management. US effective tariff rate refers to US customs revenue as a share of goods imports

5Euromoney Trade Finance Survey. As of September 8, 2025.