Forces of Change - Investing in a World of Cyclical and Structural Drivers

Cyclical fluctuations and structural forces are changing the shape of economies, markets, and the way we invest. At this year’s Jackson Hole symposium, European Central Bank (ECB) president Christine Lagarde pointed out that elements of clarity, flexibility, and humility are required for robust policy making in an age of shifts and breaks.1 We believe these principles also hold the key to prudent investment management in a highly dynamic world. Longer-term paradigm shifts, such as structurally higher interest rates and disruptive megatrends, may call for a re-assessment of portfolio themes and asset allocation mix. Shorter-term fluctuations along the business cycle may require nimble actions to capture opportunities. Identifying these forces can give investors important reference points to guide their decisions and position for success.

Cyclical, Structural, and the Long Term Outlook

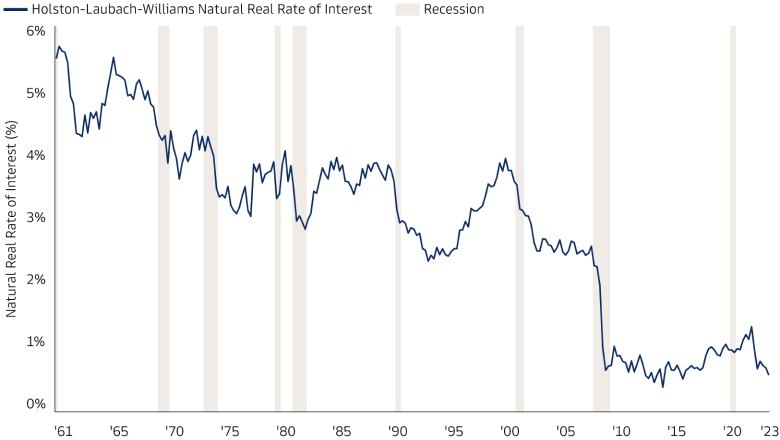

A potential starting point for investors is to consider the outlook for monetary policy. It is viewed as “neutral” and therefore neither stimulating nor restraining the economy, if the policy rate is aligned with the sum of inflation target and the so-called “r-star,” the natural real rate of interest. The US r-star rate is currently estimated to be around 0.5%, compared to nearly 4% in 2000 and even higher in the 1960s, according to the Federal Reserve Bank of New York’s Holston-Laubach-Williams model. Other studies have also found a similar downward trend over past decades.2 This may have been driven by structural factors such as demographic aging, a global savings glut, productivity declines, and so on. While it is difficult to state where r-star is heading, we believe some shifts in these factors are worth noting.

We expect higher fiscal deficits and government debt, including US national debt, to result in an increased demand for savings and potentially higher interest rates. The digitization of more activities across industries and the emergence of generative artificial intelligence (AI) may also have the potential to lift productivity. When coupled with deglobalization trends, this creates a different dynamic for central banks to deal with than past decades. These structural changes suggest that it is possible for the mean level of interest rates to shift higher through the next number of business cycles, which has potential implications for equity and bond portfolios.

Source: Federal Reserve Bank of New York, Haver Analytics. Data from 1Q 1961 to 2Q 2023. The shaded areas indicate periods designated as recessions by the National Bureau of Economic Research.

Structurally higher interest rates, negative effects of persistent inflation and higher debt levels could weigh on US economic growth over the long-run. Additionally, academic studies presented at the Jackson Hole meeting suggest that factors which may have contributed to growth in past decades, such as a higher rate of investment in ideas and substantial increases in educational attainment, could be difficult to keep up.3 This suggests that growth rates may slow in the future. On the other hand, underlying changes in sector composition (e.g., more services, less manufacturing) and a high share of fixed-rate debt in the US housing market implies that the US economy may have become more resilient to higher interest rates. Furthermore, cyclical factors such as the easing of supply chain pressure and inventory de-stocking have been part of the re-normalization after the pandemic. These developments may contribute to an increase in activities and prolong the current late economic cycle. This makes the outlook for growth even more uncertain as cyclical and structural factors partially offset each other, at least in the short term.

Japan shows that structural trends do not always need to be global. The country finds itself on the cusp of a new economic dawn characterized by an unfamiliar yet desirable cycle of rising prices and wage growth. Japan’s shrinking and aging population may have the potential to cause either inflation or deflation in the years ahead. The outcome should depend on the country’s ability to improve labor force participation, and the interaction of demographics with other structural forces such as deglobalization and digitization. We also expect corporate governance reforms in Japan to create long-term winners and losers as some firms use it as a channel to achieve growth, while others fail to keep up. We believe investors that focus on secular growth winners committed to reforms may end up on the right side of change.

Decarbonization is another structural trend affecting not only economies and industries, but the future health of the planet. Sustainable transformation creates both new risks and opportunities for investors. The US Inflation Reduction Act’s (US IRA) clean-energy incentives have encouraged companies to announce a wide variety of investments, with more set to come.4 Across the Atlantic, the European Union’s RePowerEU plan is helping to catalyze clean energy investments and diversify the bloc’s energy supplies. Other markets, such as China and India, may strengthen existing climate incentives in the future. A less predictable but more competitive geopolitical environment may also require a focus on any short-term fluctuations in climate policies globally and potential impacts on commodity prices.

Investment Implications

A world of potentially higher rates and slower growth may require long-term capital market assumptions to be re-evaluated, which could potentially lead to shifts in long-term asset allocation. The evolution toward a new structural paradigm is unlikely to be a straight line. For instance, with rates rising, concerns over the sustainability of fiscal paths forward have continued to build. Companies face higher cost of capital, making businesses with weaker balance sheets potentially more vulnerable to defaults. Opportunities for alpha generation in public markets may not only become more global but also more bottom-up and determined by profitability. Structurally higher interest rates have the potential to alter private market dynamics, too. Private credit yields have been increasingly attractive and private equity is evolving, with operational value creation levers poised to potentially become the main determinants of success in the new regime.

As investors recalibrate portfolios to a structurally higher interest rate environment, we believe being positioned on the right side of powerful megatrends may prove to be rewarding in the long run. However, capturing the best opportunities may require an understanding of the complexities associated with secular growth themes and certain industries, such as AI’s potentially transformative impacts on healthcare and life sciences. A focus on nuances in specific markets and countries may also uncover long-term opportunities. For instance, we expect Japan’s revitalized economy and corporate governance reforms will create winners and losers in the years ahead. Other opportunities may emerge in commercial real estate with some assets positioned to potentially capitalize on shifting demographics and sustainability trends, while others miss out.

In an uncertain world of cyclical and structural changes, it may be time for investment playbooks to change too. An environment of deviation, differentiation, and volatility may require a more active and diversified investment approach across public and private markets, in our view. Long-term success may depend on a mix of creativity and courage to look beyond convention, but also deep experience gained through previous market cycles. We can relate to Federal Reserve Chair Jerome Powell’s analogy of “navigating by the stars under cloudy skies”.5 Predicting precisely what lies ahead is unrealistic in a dynamic world. It’s important to contemplate a wide range of future scenarios and build up an expanded set of instruments and tools to help manage risks and capture opportunities.

1 European Central Bank. As of August 25, 2023.

2 International Monetary Fund. World Economic Outlook. As of April 11, 2023.

3 The Outlook for Long-Term Economic Growth, Charles I. Jones. As of August 29, 2023.

4 US Department of the Treasury. The Inflation Reduction Act (IRA) is designed to mobilize private capital to achieve US climate goals and strengthen long-term growth. As of August 16, 2023

5 US Federal Reserve. As of August 25, 2023.