How to optimise your portfolio for second half of 2024?

As originally published by the Straits Times

Investors enjoyed a strong start to 2024. In the first half of the year, global equities gained more than 10 per cent with US equities leading the charge.

Bond investors benefited from tighter credit spreads – a narrowing difference between the yields on corporate bonds and risk-free government bonds – while returns from cash investments continued to be attractive.

“While it has been a good backdrop for investing, we have been telling investors it may not be as smooth-sailing as we head towards the last two quarters,” says Mr Shoqat Bunglawala, head of Multi-Asset Solutions in Europe, Middle East, and Africa and Asia-Pacific at Goldman Sachs Asset Management (GSAM).

Indeed, the global stock market rout that unfolded in early August highlights that volatility can happen swiftly.

According to Mr Bunglawala, the significant correction in stock prices was an overreaction triggered by a series of weak economic data, a hawkish pivot from the Bank of Japan and some disappointment with corporate earnings.

He is also monitoring risks closely and is watchful of the US labour market. “The job market has slowed and this is a positive development to reduce inflation. However, this recent weakness warrants close monitoring. It is important to be flexible – adding to or moving away from risk assets and adjusting our portfolios as the data improves or weakens from here.”

Stay diversified and lean-in to income

Stay diversified with multi-asset investments and lean-in to income to help cushion portfolios from some of the market volatility, advises Mr Bunglawala.

“In our multi-asset income strategy, we look for consistent, quality income streams. We invest across the globe and in different yield-producing assets to reduce the reliance on any one income source,” he says.

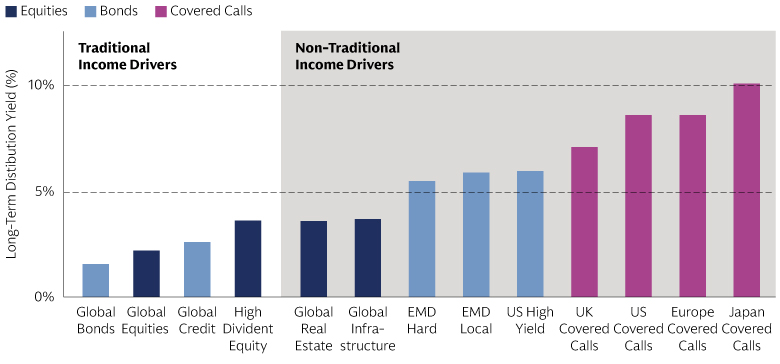

In addition to traditional sources like government bonds, corporate credits, high yield debt and dividend-paying stocks, Mr Bunglawala and his team also sell covered call options as part of their unique approach.

A covered call is a two-part strategy, in which equities are bought and call options are sold on equities simultaneously. The call-option seller receives the premium (cash flow) from the sale but loses some of the potential upside on the equities. When expected market volatility increases, such as amidst the stock price correction in early August, the potential premium received may typically increase.

“The call option strategy can provide added attractive cash flow. It’s important to remain nimble in how to manage this and we rely on a seasoned, expert team that has managed option-based strategies since 2005 to execute this.”

Mr Bunglawala elaborates that some of the risk-mitigating features for the call-option strategy include taking a diversified approach – the portfolio sells equity options globally on US, Europe, Japan and the UK indices, not single stocks.

“It’s important to note that we are selling equity index, not single stock, options. The premium income from the latter is typically higher but equity index options are relatively less risky,” he explains.

“The GSAM multi-asset income strategy is typically diversified over 10 sources of income, but it’s not all about income.”

Source: Multi-Asset Strategy Team

Why it is important to have a total return approach

This multi-asset strategy team does not believe in going all out for yield.

“We want to deliver income alongside capital growth, not at the expense of growth. This total return approach is a key tenet which guides both our top-down asset allocation and how we select individual stocks and bonds,” says Mr Bunglawala.

For example, a stock may have a high dividend yield today, but low earnings growth. Such companies would not provide long-term income growth and may also lose their value over time leading to an erosion of portfolio value.

For the near term, Mr Bunglawala’s team continues to be positive on global equities, given a supportive growth backdrop, healthy earnings growth and expected central bank cuts.

Within equities, the team has been looking at opportunities to broaden its exposure to artificial intelligence (AI) beyond the largest names. There is a new strata of AI beneficiaries that can complement the current incumbents – these companies can enhance the power of AI by harnessing the power of data. As investing in AI grows, investors will need to stay diligent on selecting the right stocks.

Elections, especially those in the US, are also very much in focus. Mr Bunglawala shares that the team at GSAM thinks a lot about election risk. Policies will likely evolve and there could be increased levels of trade wars and trade dynamics which could cause inflation to spike again.

It is important to have different hedges in the portfolio to account for the range of outcomes – from economic slowdown to unfavourable policies. This is where the safe haven properties of bonds become critical, as this asset class can add resilience and help navigate uncertainty in portfolios.

The other key aspect to managing risk is to be dynamic in asset allocation. Mr Bunglawala explains that the GSAM team has always been actively anticipating changing conditions and rotating across assets to account for this.

“Our global multi-asset team conducts macroeconomic research and evaluates opportunities and risks continuously. We also rely on our broader Goldman Sachs network to understand geopolitical undercurrents.”

“There are many factors to capture in an asset allocation process and we adopt the same thorough approach to how we manage money across portfolios – for sovereign investors, corporate pensions, family offices and individual investors.”

Find out how you can lean into multi-asset income investing with Goldman Sachs Asset Management.

1 As of 30th June 2024. Diversification does not protect an investor from market risk and does not ensure a profit. Past performance does not predict future returns and does not guarantee future results, which may vary. Inception: 18/3/2014. Longer term distribution yield based on the 10-year median asset class yields.