Market Pulse August: Turning Tides

Macro Views

In the US, we remain keenly attuned to the next phase of labor rebalancing. July employment report was weak across the board with the unemployment rate rising 0.2pp to 4.3% raising concerns of a more meaningful deterioration ahead. That said, the current level of job openings and still healthy pace of final demand indicate still resilient labor dynamics reducing downside risk, in our view. In Europe, we remain cautiously optimistic about the economic recovery, with political gridlock in France and trade policy uncertainty in the Euro area more broadly serving as key risks.

The Bank of Japan (BoJ) surprised the market by hiking rates by 15bp to 0.25% in July. It also announced the reduction of its JGB purchases to about JPY 3tn in Q1 2026 as the Bank judged activity and prices had been developing in line with its outlook. In the US, the Fed left its policy rate unchanged while noting that a cut could be on the table in September. GIR now expects 3 consecutive 25bp rate cuts in September, November, and December.

By the end of 2024, more voters will have gone to the polls to express their sentiment on leadership and ideology than in any other calendar year on record. So far, mixed results have failed to provide any consistent ideological migration. What does appear clear are stinging rebukes of incumbents and highly binary nationalistic sentiment. Additionally, the US Democratic switch from Biden to Harris atop the ticket has reset prediction markets to very competitive pre-debate levels.

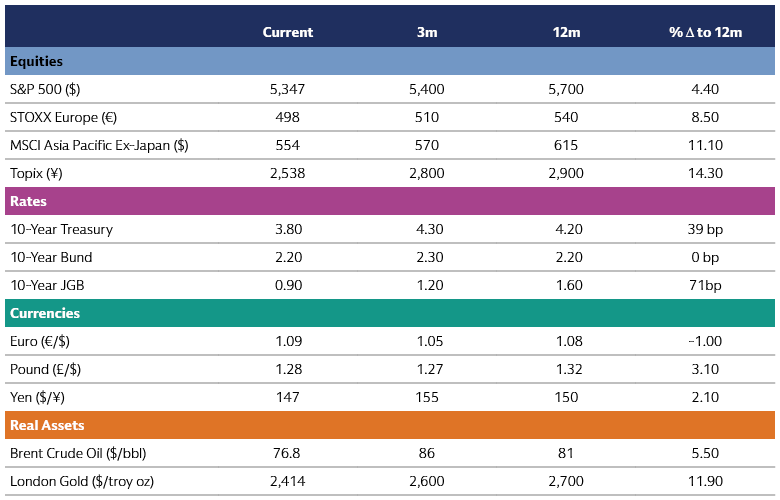

Source: Bloomberg and Goldman Sachs Asset Management. As of August 1, 2024. Past performance does not guarantee future results, which may vary.

Market Views

Weaker US macro data and the BoJ’s surprise hike led to a spike in volatility across markets with the VIX crossing above 50, the highest since the COVID-19 crisis in March 2020. While risk assets have been hit globally, Japanese equities have been hit especially hard, experiencing their largest daily decline in almost 4 decades with the TOPIX index falling by more than -12% on Monday 5th of August. The overall risk-off sentiment and the rapid Yen appreciation following the BoJ’s rate hike have been two key contributors to the recent price action.

Disinflation and cooling US labor demand should soon rationalize an interest rate cut from the Fed, in our view. As the market-priced probability for a September rate cut moved from 58% at the beginning of July to 100% in early August, the Russell 2000 outperformed the S&P 500 by 9.5pp. Absent a more meaningful weakening in labor data, the relief to smaller companies’ debt burdens via lower rates should provide staying power to the recent small-cap rally, in our view.

Following the recent rally in global yields, we expect rate volatility to stabilize from here as further macro deterioration should remain limited. In the US, the curve may be set to steepen as both sides of the Fed’s mandate have moved into better balance and a September cut now appears likely.

The USD/JPY experienced a sharp move lower following the BoJ’s rate hike and the increased odds of a Fed’s rate cut in September. That said, we do not expect further major downside from here as markets become less concerned about US growth and rates stabilize near current levels.

Source: Price targets of major asset classes are provided by Goldman Sachs Global Investment Research. Source: “Global equities lost 2%; Momentum underperformed” – August 5, 2024. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation. These examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially.

Investment Solutions: Turning Tides

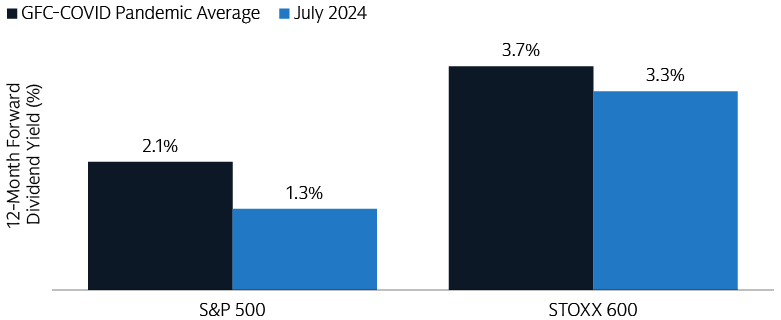

Amid market volatility, global investors may want to focus on their strategic asset allocation and revisit their regional equity exposure. Investors often rationalize their underweight DM ex US equity positions by their underperformance relative to US counterparts for 11 of the last 15 calendar years. With that said, we don’t believe past underperformance is a factor which governs future return prospects. Instead, fundamental drivers such as earnings, interest rates, and dividends are of higher consideration and when analyzing these factors. We find that the tides that have supported recent US dominance may be turning.

Source: Bloomberg and Goldman Sachs Asset Management.

Source: Bloomberg and Goldman Sachs Asset Management.

Source: Bloomberg and Goldman Sachs Asset Management.

“We/Our” refers to Goldman Sachs Asset Management. “Earnings” Section Notes: Source: Bloomberg and Goldman Sachs Asset Management. As of June 28, 2024. GFC refers to Global Financial Crisis. The period between the Global Financial Crisis and COVID Pandemic references trailing twelve-month earnings growth between January 2008 and February. The period between the COVID Pandemic onward references trailing twelve-month earnings growth between February 2020 to June 2024. “Interest Rates” Section Notes: Source: Bloomberg and Goldman Sachs Asset Management. As of June 28, 2024. “Dividends” Section notes: Source: Bloomberg and Goldman Sachs Asset Management. As of July 30, 2024. The economic and market forecasts presented herein are for informational purposes as of the date of this document. There is no guarantee that objectives will be met. There can be no assurance that forecasts will be achieved. Please see additional disclosures at the end of this document. Past performance does not guarantee future results, which may vary.