Adapting to Change: How Hedge Funds May Benefit in a New Volatility Regime

In mid-2022, few outside the artificial intelligence (AI) community had heard of a chatbot called ChatGPT. However, by January 2023—only two months after its November 2022 release by OpenAI—ChatGPT was estimated to have reached 100 million monthly active users, making it the fastest-growing consumer application in history.1 This set off a proverbial AI gold rush; application developers, venture capital-backed startups, and some of the world’s largest corporations are all now scrambling to assess the possibilities of a world heavily influenced by generative AI tools.2

While many hedge fund managers are also incorporating AI into their processes, many are more focused on capitalizing on what is widely viewed as a new and more volatile market regime. As of July 2023, the US Federal Reserve had raised the Federal Funds Rate at 11 out of the last 12 meetings—including four straight 0.75% hikes—marking the fastest and most aggressive pace of rate increases since the early 1980s.3 With the Fed Funds rate jumping roughly 500bps in only 16 months (March 2022 - July 2023), hedge fund managers may also be experiencing a similar strategy-altering evolution of the economic environment.

The new and evolving macroeconomic environment plays to the advantage of most hedge fund strategies, and we expect it will lead to materially greater expected returns with similar—and potentially lower—levels of risk over the medium term.

A Market Environment of Higher Volatility

Following the Global Financial Crisis (GFC) of 2008-2009, both low inflation and meagre economic growth led to dovish global monetary policies and generous fiscal policies. As a result of easy money and ultra-low interest rates, volatility was dampened in most asset classes. Since early 2022, there has been a material increase in inflation that has led to a mostly coordinated attempt by central banks to remove market liquidity and raise interest rates, which has had the expected effect of increasing volatility in most asset classes. While rates and volatility are certainly higher now than in the decade following the GFC, they are reasonable when measured against longer timeframes. Furthermore, despite many economists and market participants believing that the shift to tightening monetary and fiscal policy may ultimately lead to recession, the jobs markets and risk asset performance to date have remained strong. However, despite debate around if and when the economy will have a soft landing or recession, there appears to be market consensus for a prolonged period of elevated macro volatility.4

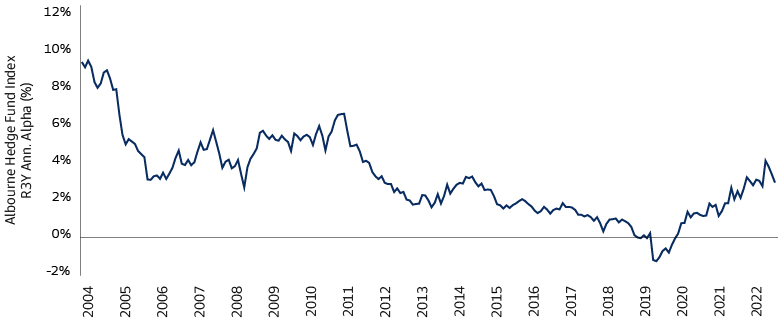

For most of the past decade, the hedge fund industry faced headwinds to generate alpha as subdued volatility led to fewer trading opportunities and a near-zero interest rate environment hindered the asset price discovery process. Following the tightening of monetary policies, we now have a new macro regime characterized by greater volatility—which should also lead to better investing opportunities for hedge funds. Historically, when equity and fixed income volatility has increased, hedge fund alpha generation has also improved; this scenario occurred as recently as the second half of 2022.

Albourne. As of June 30, 2023

In the mid-2000s, hedge fund alpha generation was about 5%—similar to the average Fed Funds Rate during the period. Hedge fund alpha remained strong during the depths of the GFC and the period immediately following; nimble, opportunistic investors were able to find profitable trades in dislocated markets around the globe. It was the long subsequent period of low rates and low volatility that caused and supported an environment in which there was little economic uncertainty, resulting in low dispersion within asset classes from which hedged investors could profit. There are few ways for hedge fund strategies to generate alpha when all securities trade in sync, equity and bond markets trend based on monetary policy, and volatility remains low.

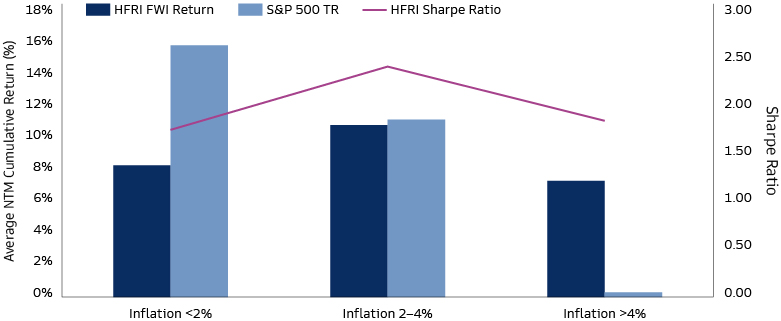

Historically, the hedge fund industry has displayed a strong positive relationship between higher inflation and higher interest rate regimes and better hedge fund performance.5 In periods marked by low inflation,6 hedge funds have generated absolute returns that are approximately half (52%) of those available to equity investors; in periods of high inflation,7 hedge funds have materially exceeded US equity market returns. When inflation has been close to the Fed's long term target of 2%, we see that hedge fund returns were roughly in-line with equities; however, hedge funds have generated these returns with significantly lower volatility due to the relative value orientation of many hedge fund strategies, resulting in a Sharpe ratio greater than 1.0, as illustrated in the chart below.

Bureau of Labor Statistics, Bloomberg, HFRI. Analysis from 1990-2022.

How Hedge Funds May Benefit from Higher Volatility

There are both structural and environmental reasons for the performance pattern of hedge funds in a higher inflation and higher interest rate environment. From a structural perspective, many hedge fund strategies maintain high levels of unencumbered cash. Managers typically seek leverage by using financial derivatives that have low margin requirements. Hedge fund strategies such as trend following, global macro, and fixed income relative value (among other strategies), often have cash levels in excess of 50% of the funds’ net asset values. As a result, when short-term cash instruments (e.g., money market funds, short term T-bills etc.) offer materially higher interest rates, it creates a total return tailwind for these investment managers. Additionally, equity long/short managers benefit from the increased interest on the proceeds from shorting stocks (i.e., short rebate). For example, a market neutral hedged equity manager running a 100% long and 100% short portfolio is now able to harvest an annualized positive carry of approximately 5%, compared to near 0% in the prior decade.8

Interest rate normalization increases the value add of security selection. Over the last decade, we observed a one-way multiple expansion as the S&P 500 price-to-earnings multiple doubled from 11x to 22x from 2010 to 2021. In this environment, alpha generation from security selection was difficult as stocks all rose together. In our current higher rate environment, we have already seen contraction in price-to-earnings multiples, which will increase the importance of security selection.

The evolving market backdrop has increased the opportunity set not only for equity strategies, but also for credit managers. With liquidity being removed from markets and companies refinancing into a higher interest rate environment, corporate defaults are already on the rise. We expect this increase to continue as more companies’ bonds mature and some firms are unable to refinance at the new, higher rates on offer.

Finally, the new macroeconomic regime has been a significant tailwind in the trading environment for tactical trading managers. Trend following and directional macro managers benefited from the coordinated rise in interest rates during 2022 to post one of their strongest return years on record due to the performance of the fixed income portions of their portfolios (for reference, for calendar year 2022, HFRI Macro Index returned 8.8% and SG CTA Index returned 20.15% vs MSCI World -18.5% and Barclays Agg -13%).9 Fixed income relative value managers were able to profit not just from the higher level of interest rates, but also from the increased volatility in fixed income markets allowing them to meet their return objectives at lower levels of leverage and risk. We expect the environment to remain attractive for tactical trading funds in the medium term, particularly for global macro managers who may be able to profit from divergence in the monetary and fiscal policies of both developed and emerging economies as inflation normalizes in certain countries while remaining high and problematic in others.

Manager Selection in a Higher Volatility Environment

While a higher volatility market backdrop may benefit a number of hedge strategy types, selecting high-quality hedge fund managers remains the most critical feature of a successful hedge fund program. Unlike traditional long-only equity and fixed-income fund managers who typically risk manage their tracking error versus a benchmark, hedge fund managers are mostly absolute return focused and benchmark agnostic. If one were to place investment managers on a passive-to-active spectrum, hedge fund managers sit on the most active side of the spectrum. As a result, the performance dispersion amongst hedge fund strategies, even across those running similar strategies, is widely distributed.

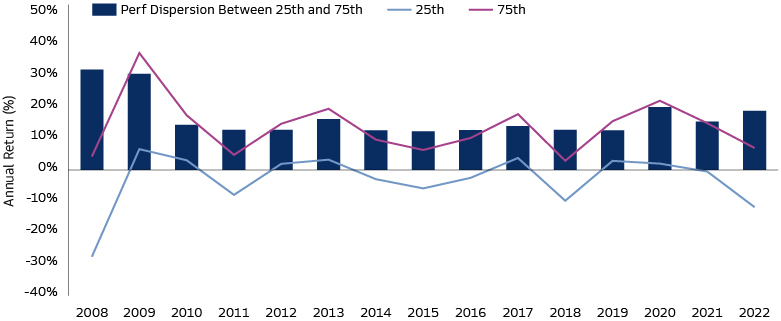

When looking at our hedge fund database since 2008, which is comprised of more than 8,000 hedge fund strategies, we found a persistent dispersion of greater than 10% return between the 25th percentile and 75th percentile hedge fund managers. This dispersion increased during more volatile market environments (i.e., 2008, 2009, 2020, and 2022), averaging an annual return dispersion of over 20%, as shown in the chart below. Interestingly, when analyzing the sub-strategy level performance on a beta-adjusted basis (e.g., a measure of the skill-based return, or alpha of managers), the Information Ratio dispersion is notably wide across strategies and across various time horizons.

Goldman Sachs Asset Management XIG Hedge Fund Database. As of 2022.

To identify high-quality managers, a robust manager selection and comprehensive diligence process is required. Hedge fund strategies are more complex than traditional long-only equity and fixed income managers. Relative to traditional investment strategies, hedge fund managers will utilize higher balance sheet leverage, make extensive use of derivatives and complex trade structures, add illiquid investments, and typically have more frequent trading tendencies. Hedge fund businesses can also be challenging to assess. Hedge fund managers are generally smaller and less diversified than established traditional asset managers—which introduces an elevated level of organizational risk.

In addition to the challenges of underwriting managers, turnover is high in the hedge fund industry. New fund launches and fund closures amongst a universe of >8,000 hedge funds present a dizzying array of options for investors to track. Based on our analysis, we estimate that on average since 2009, more than 10% of hedge fund strategies exited the industry each year. We estimate new entrants to be approximately 10% per year on average as well representing total industry turnover of approximately 20% in any given year.10

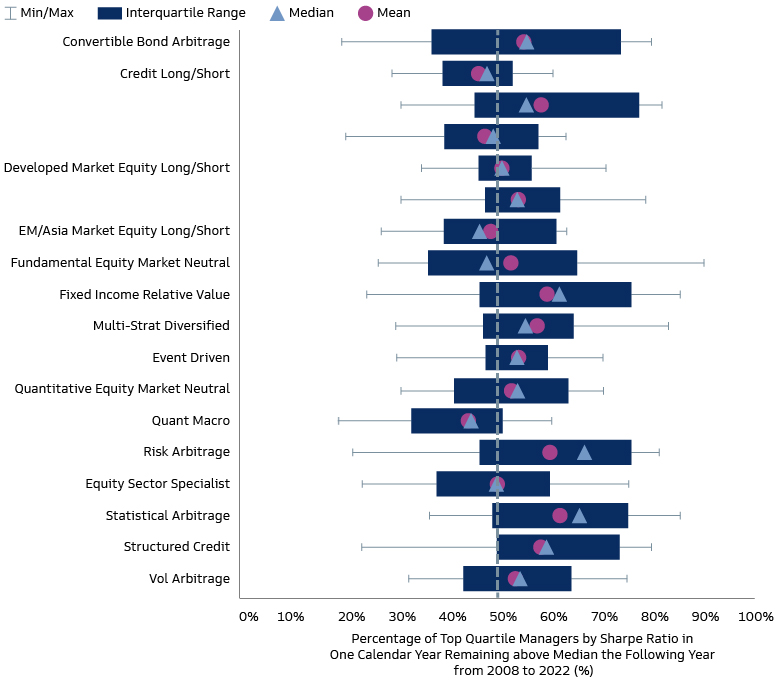

While underwriting a strategy and assessing the ever-changing hedge fund universe may be difficult, the ability to identify skill can help to compound returns over time. We have historically observed that skill may adapt, and skill may persist. For example, using risk-adjusted returns as a proxy for skill, a manager that achieves a top quartile Sharpe Ratio ranking in one year is likely to be above the median manager the following year as well, as shown in the chart below. Although it is ill-suited to evaluate a hedge fund based on a single year’s performance, it is notable that this persistence of skill is consistent across strategy types, with credit long/short and quant macro the lone exceptions. In the world of hedge fund investing, we believe the persistence of skill translates to alpha. And alpha translates to returns that are diversifying and can meaningfully enhance the risk-adjusted returns of an overall portfolio.

Goldman Sachs Asset Management XIG Hedge Fund Database. As of 2022.

The Only Constant is Change

The adaptability of hedge fund managers is key to survival given the Darwinian nature of financial markets. In fact, adaptability is one of four key criteria we assess when evaluating managers.11 We like to think of a down escalator as a metaphor for the continually changing and highly competitive investment landscape for a skill-based manager: if the manager is standing still on the escalator and not continuously adapting, the manager will likely be taken down. A manager that can successfully adapt is not only able to keep pace with the escalator, but also stays one step ahead. Like the technology companies now seeking to capitalize on the promise of generative AI to upend traditional processes, skill-based managers are also adapting to a new and more volatile market regime.

1Reuters, “ChatGPT sets record for fastest-growing user base - analyst note.” As of February 2, 2023.

2MIT Technology Review, “ChatGPT is about to revolutionize the economy. We need to decide what that looks like.” As of March 25, 2023.

3World Economic Forum, “The pace of US interest rate hikes is faster than at any time in recent history. Is this creating a risk of recession?” As of October 12, 2022

4Goldman Sachs Global Investment Research, “First to the Finish: Early Hikers and the Rate Cut Outlook.” As of July 27, 2023.

5Bureau of Labor Statistics, Bloomberg, HFRI. Analysis from 1990-2022.

6Defined as inflation less than 2%.

7Defined as inflation greater than 4%.

8Goldman Sachs Prime Services, Prime Insights, May 2023.

9MSCI, See additional disclosures.

10Goldman Sachs Asset Management XIG Hedge Fund Database. As of 2022.

11The other three criteria as part of the XIG process are Governance, Infrastructure, and Process.