Climate Metrics 2.0: Measuring What Matters for Real Economy Climate Progress

In recent years, many investors have pursued various approaches to Net Zero in their portfolios under the broad idea that they could contribute to global climate progress and/or generate return from that journey by decarbonizing their portfolios. This led to asset owners and managers rallying to set portfolio carbon reduction targets, currently representing $72 trillion in AUM,1 an impressive achievement and critical step towards Net Zero. Now that we are a few years into the journey, we believe it is time to reflect on what we have learned from this approach and assess what further evolution is needed. Through the management of net zero target of our own financing portfolios and analysis of client portfolios’ carbon footprints, we have a vantage point to assess different measurement approaches, the results they achieve, and some of the lessons learned. This article is an effort to synthesize some of these observations and highlight learnings from our own initial work and as we partner with our clients to offer thoughts on flavors of what a climate metrics 2.0 approach could look like.

Climate Metrics 1.0: Unintended Consequences of Carbon Reduction Targets

Many asset owners and managers initially set headline Net Zero targets with the intent of reducing the carbon emission exposure of their aggregate holdings. We point to three learnings that we have observed that can demonstrate the unintended consequences of a portfolio carbon reduction approach.

Learning 1: Too Easy to Achieve “Decarbonization on Paper”

Portfolio-level carbon reduction approach was a logical first step in pursuing Net Zero targets, but it is often easy to achieve via divestment or sector tilts, particularly in public markets.

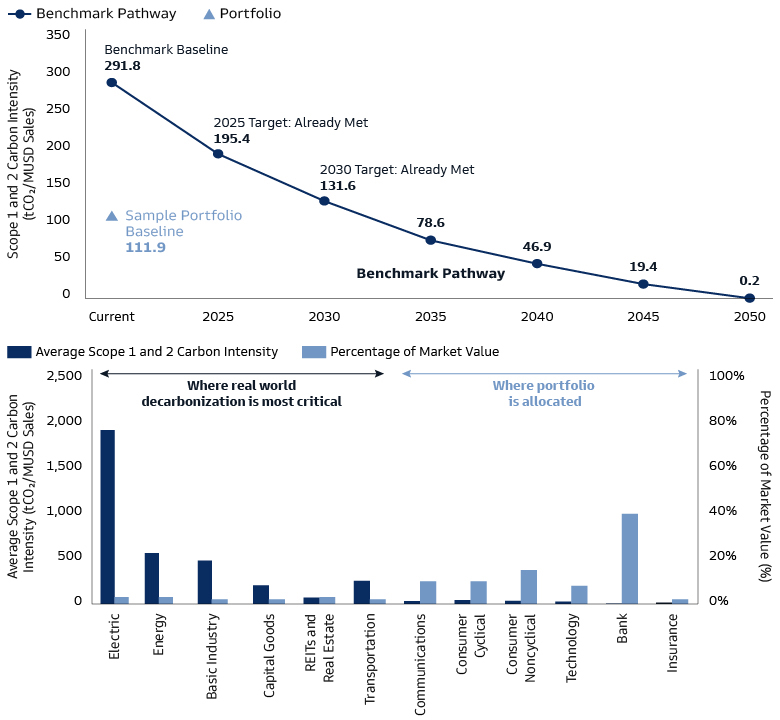

Goldman Sachs Asset Management. As of September 2023. Based on an illustrative portfolio. Includes Scope 1 and 2 emissions. For illustrative purposes only.

In our experience, carbon emissions are often concentrated in a few sectors—or even a few high-emitting names within sectors. As a result, portfolio carbon reduction targets can be relatively easily achieved by increasing exposure to low-carbon sectors or decreasing exposure to high-carbon sectors. However, by doing that, no actual carbon has been avoided or removed from the atmosphere. By simply measuring historical carbon footprints and setting portfolio-level emission goals, investors may miss the opportunities to access the harder but necessary innovations and transformations driving real world carbon reductions in the years ahead.

Learning 2: Supporting Real World Decarbonization

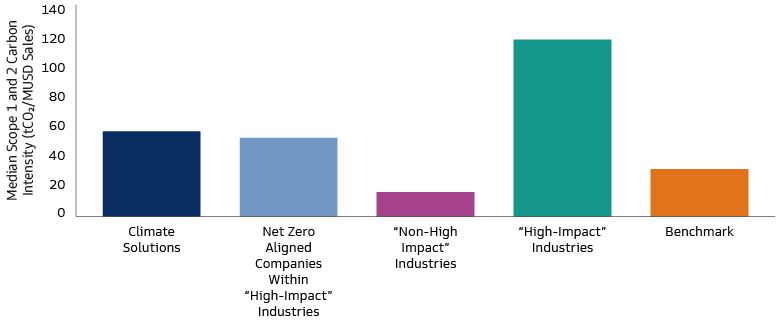

Not only is it easy to achieve “decarbonization on paper” with a pure carbon reduction approach based on historical data, but it counterintuitively can be at odds with the actions required to achieve real world impact. Indeed, the highest-emitting geographies, sectors, and companies also present the greatest opportunity for carbon reduction. The hard-to-abate areas are responsible for majority of global emissions and their successful decarbonization would represent a significant step towards achieving real world emission reduction impact, but this requires investors to endure higher carbon levels at the onset. To decarbonize in the real economy, we believe investment is needed in climate transition and solutions, which often tend to have higher emissions intensity, as we show in chart below. By setting portfolio-level carbon reduction targets that penalize investment into these industries, investors risk not supporting sectors that truly need to decarbonize.

Goldman Sachs Asset Management based on MSCI ACWI Investable Market Index universe. As of September 2023. For illustrative purposes only. High-impact industries are those that meet any of the three criteria – scope 1, 2, 3 /enterprise value including cash (EVIC) intensity in the top 25%, fossil-fuel related revenues>5%, and for companies where greenhouse gas (GHG) emissions are material. Climate Solutions are companies whose green revenue exposure is more than 50%. Net Zero Aligned companies are those that are assessed as aligned based on Goldman Sachs Asset Management’s proprietary framework of net-zero alignment based on ambition, target, disclosure, decarbonization strategy and capital allocation strategy.

Learning 3: “Perils of Aggregation” – Noise Drowns Out Signal

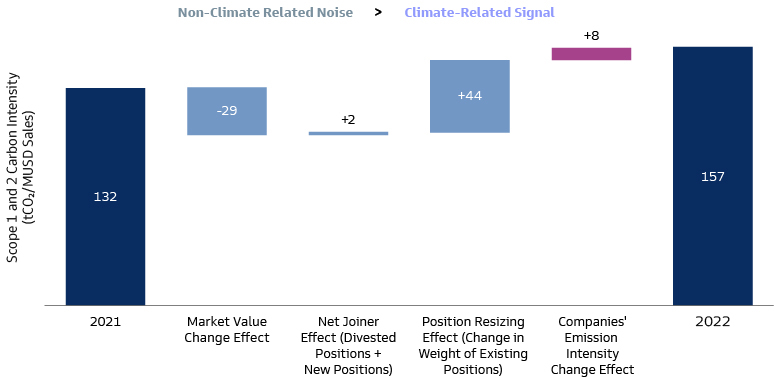

When data is aggregated across one or many portfolios, the noise often obfuscates true changes in the desired outcome of improving companies’ carbon performance. When sources of portfolio emission are disaggregated, we find that most of the change across periods comes from non-climate related noise, such as shifts in market value and portfolio selection decisions (e.g., divesting, adding new positions, reweighting). The noise can drown out the signal that investors care about, which is actual change in the carbon efficiency of companies.

Goldman Sachs Asset Management based on S&P 500 Index. As of October 2023. For illustrative purposes only. Black bars represent portfolio intensity in 2021 and 2022. The bars in between explain the sources of change from 2021 to 2022. Includes Scope 1 and 2 emissions.

Climate Metrics 2.0: An Approach that Aligns with Real World Climate Progress

Given the challenges of the climate metrics 1.0 approach, what are approaches investors can consider? We have seen several attempts by the investment community to move towards a climate metrics 2.0 approach that may alleviate the unintended consequences of anchoring on a purely portfolio emission reduction approach and does not penalize investing in the real economy. Below, we offer thoughts on what a climate metrics 2.0 approach could look like.

Strip Out Noise from the Signal and Track Progress Bottom-up

When we assess portfolio-level carbon emission progress, we have found it more effective and decision-useful to report on whether underlying investments are actually becoming more carbon efficient, rather than aggregated portfolio metrics as we illustrate in the chart above. We believe this more disaggregated attribution approach may help investors more easily identify and track desired changes in the portfolio. This shift away from headline percentage reduction requires more granular bottom-up work to track progress at the most granular level, assessing progress company by company.

Adopt Measurement Approaches that Support Real World Decarbonization, Not Penalize it

The use of more holistic metrics to assess company strategy and actions is required to understand where companies are going in their decarbonization journey, in addition to where they have been. Through a holistic assessment of intent, credibility of plan, and indicators of real investment, we believe investors can better assess potential transition winners. We have developed our own proprietary tool to provide a forward-looking assessment of portfolios’ Net Zero transition alignment including: long-term climate ambitions, medium- to short-term targets, revenue from lower-carbon products and services, capital allocation strategy aligned with the decarbonization plan, and actual capex going into low-carbon areas; with both point-in-time and momentum-focused metrics. These metrics that combine transparency and performance help us assess transition readiness of high-impact sectors and provide investors concrete action items for engagement.

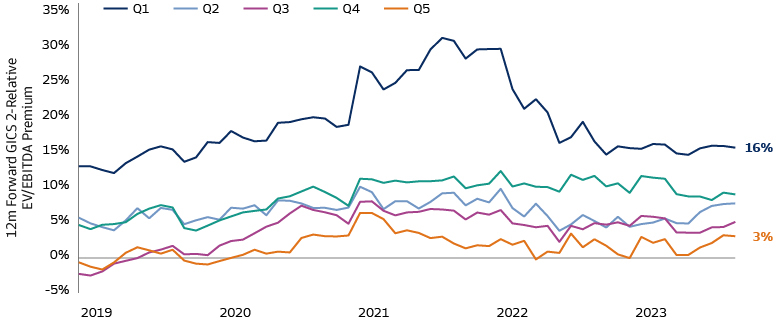

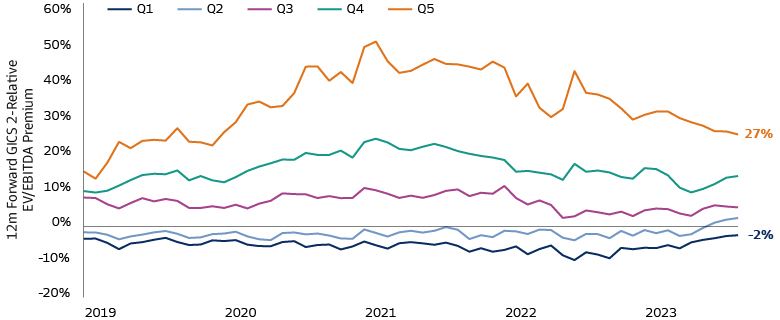

Companies demonstrating concrete actions in climate transition are receiving valuation premiums, while the reverse is true for those who simply disclose more. This demonstrates that tangible, performance-driven actions and outcomes are being rewarded much more than disclosures alone.2

Factset, Goldman Sachs Global Investment Research. Trimmed mean 12m-fwd GICS2 sector-relative EV/EBITDA premiums, ex-Financials, of companies in the respective Quintile (Q1 is best) on Performance Ranking (as shown above), MSCI ACWI, Jan 2019 to Sep 2023. Our Performance Rank is sector-relative to GS Sustain Environmental & Social sector peers in the MSCI ACWI.

Factset, Goldman Sachs Global Investment Research. Trimmed mean 12m-fwd GICS2 sector-relative EV/EBITDA premiums, ex-Financials, of companies in the respective Quintile (Q1 is best) on Transparency Ranking, MSCI ACWI, Jan 2019 to Sep 2023. Our Transparency Rank is sector-agnostic and ranked relative to all global companies in the MSCI ACWI.

In addition to using more holistic metrics combining historical with forward-looking, point-in-time, and momentum-focused data, we have seen investors modify how they count emissions to not penalize investing in decarbonization transition and solutions. For example, some investors carve out their transition and solutions-focused portfolios to track separately. Some apply a carbon emission discount for companies that meet investor requirements to be designated as climate solutions or transition-ready assets. We see some investors take these approaches as an interim practical mechanism to accommodate the dual need to monitor portfolio-level emissions but also not penalize investing in decarbonization. Ultimately, new measurement approaches need to be advanced to help investors evaluate the climate upside of transition and solutions focused assets.

Fork in the Road: A Three-Pronged Approach to Net Zero

To achieve real world climate progress, we believe investment is needed in three areas:

Transition

The road to net zero will be long, and while technological breakthroughs may provide some shortcuts, certain historically high-emitting areas will be necessary for a time before new technologies scale to become cost effective such as we have seen in both solar power generation and lithium batteries. And regardless of pathway, all of this will take more capital investment. Investors may find the greatest opportunities to drive carbon performance and unlock financial value come from investing where the carbon is – accelerating the transition of high emitting companies that are better positioned to be transition winners.

Efficiency

Research shows that companies that are more efficient have the potential to outperform their less efficient peers.3 We believe this will become increasingly true as consumers, corporate buyers and investors continue to focus more on the carbon footprint of companies. Governments are looking to increase disclosure requirements, and policymakers are incentivizing low carbon solutions (e.g., tax incentives through the U.S. Inflation Reduction Act), which has the potential to further widen earnings and margins of higher efficiency companies.

Solution

In the long run, we believe new solutions will be required that deliver cleaner energy and help to decarbonize others. Growing revenue, profit, and market capitalization will accrue to climate solutions that decarbonize other parts of the economy. Private markets may be well-positioned to finance these long-term structural trends, given the closed-end nature of the fund model and insulation from the quarterly reporting cycle of public markets. Public market companies are another good source of climate solutions providers both as smaller/mid-sized pure plays and in larger companies expanding revenue opportunities by providing new business lines.

For investors who want to help drive progress both for their portfolios and the real world, the metrics and methodologies they adopt to measure portfolio performance need to align with transition of high-emitters, improved efficiency economy wide, and catalytic solutions that decarbonize others to achieve climate progress.

1 Goldman Sachs Global Investment Research, “GS Sustain: The Net Zero Guide”. As of July 27, 2022.

2 Goldman Sachs Global Investment Research, “GS Sustain: Net Zero Guide; Climate Transition Tool 2.0: Bridging gaps, enhancing sectoral scope, highlighting performance links”. As of September 20, 2023

3 Goldman Sachs Global Investment Research, “GS Sustain: Green Capex; Accelerating the Energy Transition”. As of October 13, 2022.