No Time For Corporate Pension Complacency: An Interview with Michael Moran

Defined Benefit (DB) plans have been helped by the rising interest rate environment, which has bolstered funded ratios, but sponsors still face pressure to effectively manage these plans given the potential financial risks they may impose. We recently sat down with Michael Moran, CFA, Senior Pension Strategist, to provide an overview of the corporate pension landscape, the effects of the recent market cycle, and what may be on the mind of sponsors.

Let’s begin with a look back on 2022. How did the tumult of last year affect US corporate pension plans’ returns?

Michael Moran: It was a wild ride in 2022, as equities in the US and around the world suffered drawdowns in a bear market, interest rates rose, credit spreads widened, and the US Treasury yield curve experienced its largest inversion in over four decades. The median return for a corporate DB plan in 2022 was a decline of 18% and some plans posted losses as high as almost 25%.1 Yet from a funded ratio standpoint, corporate pensions began 2023 in the best shape in 15 years, having benefited from falling liability values due to higher interest rates.

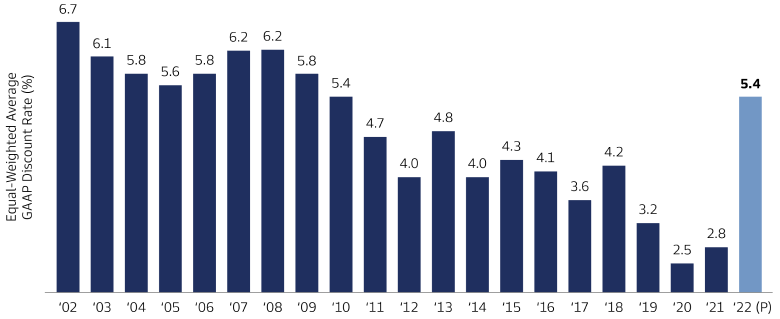

The biggest headwind for pension plan funded status over the past two decades has been steadily declining interest rates. Since pension obligations are valued for Generally Accepted Accounting Principles (GAAP) accounting purposes based on the yields of high-quality corporate bonds on the last day of a company’s fiscal year, falling interest rates contributed to a notable decrease in discount rates and therefore an increase in gross pension obligations. For example, if the duration of a plan’s pension liabilities was 12 years, a 100 basis point (bp) decline in discount rates would have increased a plan’s gross pension obligations by around 12%, holding all else constant. In 2022, this reversed. US Treasury yields rose and credit spreads widened. While historically high inflation was a source of much angst for all investors in 2022, higher interest rates allowed corporate DB plans to use higher discount rates to value their pension obligations at the end of 2022. The average discount rate increased about 245 bps in 2022, with many plans consequently seeing their liabilities fall by about 25%.2

Source: Goldman Sachs Asset Management and company reports. As of December 2022. Based upon all the US (when specified) defined benefit plans of S&P 500 companies. For illustrative purposes only. The 2022 (P) figure is estimated and unaudited as of March 2, 2023 and is subject to potentially significant revisions over time. Discount rate assumptions above represent the average of those indicated by defined benefit plans found within the S&P 500 index with December fiscal year-ends. If any assumptions used do not prove to be true, results may vary substantially. Past performance does not guarantee future results, which may vary.

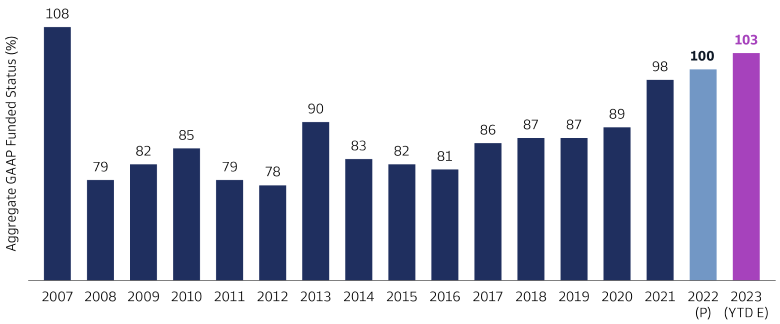

In Goldman Sachs Asset Management’s 21st annual report on US corporate pensions, the 2022 Pension Review First Take, we reviewed the 50 largest US DB pension plans of S&P 500 companies based on their 10-K reports with the Securities and Exchange Commission. Our analysis indicated that system-wide funded status rose to 100% in 2022, the first time it was fully funded or overfunded since before the 2008 global financial crisis. Rising interest rates and widening credit spreads have allowed plans to use accounting discount rates in excess of 5% at the end of 2022, the highest in over 10 years.

Source: Goldman Sachs Asset Management and company reports. As of March 2023. Based upon all the US (when specified) defined benefit plans of S&P 500 companies. 2022 (P) figure based on 50 plan First Take sample. For illustrative purposes only. The 2022 (P) and 2023 (YTD E) figures are estimated and unaudited as of March 2, 2023, respectively, and are subject to potentially significant revisions over time.

Plans that were less well-hedged benefited more in 2022, but better-hedged plans have experienced less funded status volatility over the past several years and, in our opinion, generally are in a stronger position today to preserve recent improvements.

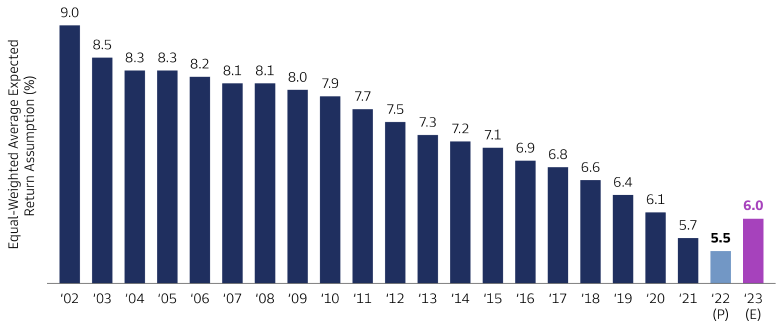

Expected Return on Asset (EROA) assumptions are a key byproduct of setting investment strategies for DB plans. After two decades of decline, they are poised to rise in 2023. What does this mean for sponsors?

Moran: The plan’s EROA reflects the sponsor’s long-term prospective average return for its entire portfolio. Setting an EROA is a necessary task for plan sponsors each year, and a large shift in the plan’s strategic asset allocation or a meaningful change in return expectations by asset class would likely require a change in EROA. We have seen many sponsors upwardly adjust their EROA assumptions for 2023, driven by the rise in US Treasury yields and the sell-off in risk assets, which has reset long-term return assumptions for many individual asset classes. At its most basic level, a higher EROA assumption means that sponsors expect higher returns going forward, in contrast to recent years. For corporate pensions, a higher EROA assumption may have a positive impact on its income statement in the current fiscal year. But a higher hurdle rate could also mean a greater chance of future shortfalls relative to the EROA, which would have negative income statement implications in the future. In addition, if a sponsor increased its EROA due to shifting its asset allocation to more return-seeking assets like public equities, it could increase the plan’s funded status volatility.

Conversely, a higher allocation to long duration fixed income at the expense of public equities leads to a lower EROA assumption (and higher pension expense) but may also result in fewer negative surprises relative to EROA and lower funded status volatility. Therefore, it is important that plan sponsors reviewing the various trade-offs manage them appropriately, taking into account their obligations as plan fiduciaries.

Source: Goldman Sachs Asset Management and company reports. As of March 2023. Based upon all the US (when specified) defined benefit plans of S&P 500 companies. For illustrative purposes only. The 2022 (P) and 2023 (E) figures are estimated and unaudited as of March 2, 2023 and are subject to potentially significant revisions over time. These examples are for illustrative purposes only and are not actual results. If any assumptions used do not prove to be true, results may vary substantially. Expected returns are estimates of hypothetical average returns of economic asset classes derived from statistical models. There can be no assurance that these returns can be achieved. Actual returns are likely to vary. Please see additional disclosures.

With many plans being well-funded or overfunded in 2022, what actions can plan sponsors consider to potentially maintain their funded ratios?

Moran: The ultimate goal of DB plan sponsors is to make sure that plan assets are sufficient to pay benefits and maintain liquidity. Hence, sponsors should consider their asset allocation strategy for the short and long term while also understanding how their plan liabilities change based on interest rate fluctuations.

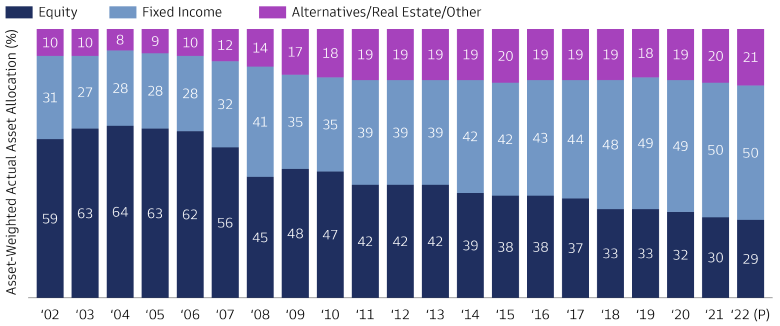

Despite a strong improvement in funding ratios, now is not the time for plan sponsors to be complacent, as they must walk a tightrope of managing competing forces and priorities. Some plan sponsors’ asset allocations still maintain a significant mismatch between plan assets and liabilities, exposing the plan and the sponsor to a substantial amount of risk. We believe one of the greatest dangers these plans face is lower interest rates, a real possibility as the US economy slows and recession risk is still elevated relative to historical conditions. We encourage plan sponsors not to try and time interest rates or the equity markets, but to consider prudent risk management actions. Accordingly, they may wish to consider reallocating capital away from equities and other growth-seeking assets into liability-hedging fixed income today to lock in the improvement in funded levels that have occurred over the past two years. Sponsors may want to limit the potential distribution of outcomes, since at a certain point taking too much risk could result in a notable drawdown in funded status. Furthermore, upside and downside risk around funding ratios are not symmetrical. When a plan experiences a funding deficit, the sponsor is responsible for that deficit, including paying Pension Benefit Guaranty Corporation (PBGC) variable-rate premiums. However, when a plan experiences a surplus, the sponsor does not enjoy its use freely. Surplus can typically be used only in limited circumstances, for example, to pay for ongoing service costs, using the surplus for underfunded plans acquired in an acquisition or transferring to a retiree healthcare plan to fund those liabilities. As such, plans may want to avoid a strategy that can result in a large surplus that is not able to be utilized in an economic manner while risking a meaningful drawdown.

Our review of 2022 results indicated that a number of plans effectuated changes to increase the target allocation to fixed income as part of their strategic asset allocation in line with glide path strategies. We expect more such changes to occur in 2023, and over the next several years there could be around $400 billion of incremental demand for high quality fixed income from this investor segment as corporate DB plans continue to move down their glide paths and increase their asset/liability matching.3

Source: Goldman Sachs Asset Management and company reports. Based upon the US (when specified) defined benefit plans of S&P 500 companies. For illustrative purposes only. The 2022 (P) figures are preliminary and unaudited as of March 2, 2023. Actual returns may vary significantly from the performance information presented above. Illustrations reflect one possible outcome and reflect a number of assumptions which are disclosed therein. Goldman Sachs is not providing actuarial services in connection with providing the information contained therein. Past performance does not guarantee future results, which may vary.

What are some other actions that sponsors can take toward de-risking their portfolios?

Moran: Higher interest rates, and therefore higher funded levels, have made it easier for sponsors to effectuate a pension risk transfer. This is because, in many cases, an incremental contribution may not be needed to complete the transaction. Some sponsors aspire to shrink their plans or get completely out of the pension business, and higher interest rates and funded levels make it easier for them to effectuate those transactions. We saw a record year for pension risk transfer activity in 2022 and expect 2023 to be another robust year. For plans that are frozen and overfunded, the limited ability to use surplus for anything other than pension or other retiree-related benefits provides further incentive to either fully immunize the plan or execute a risk transfer.

We’ve seen law-making play an important role in shaping rules for retirement. Could you please expand on how recent legislation has affected corporate pensions?

Moran: The pension risk transfer activity I mentioned has garnered increased interest from the US Senate, in particular, private equity-backed insurers engaging in these transactions. For example, at the September 8, 2022 US Senate Banking Committee hearing, Senator Sherrod Brown (D-OH) and Senator Elizabeth Warren (D-MA) expressed concern around the riskier investment strategies of PE-controlled insurers and the impact on participants from pension risk transfer. However, at the same hearing, outgoing Senator Patrick J. Toomey (R-PA) came to the industry’s defense, stating that pensioners are well-protected by state insurance regulators after pension risk transfer transactions, noting that private-equity owned insurers are subject to rigorous state regulations similar to other insurers.

SECURE Act 2.0, which was part of the 2022 omnibus bill, requires the Department of Labor (DOL) to review the interpretative bulletin governing pension risk transfers and determine if any amendments are needed. The DOL must report its findings to Congress within one year, including an assessment of any risks to participants. Sponsors potentially looking to explore these transactions in 2023 or beyond may want to monitor these developments.

What do you see as other upcoming changes for the DB landscape?

Moran: Demand for Outsourced Chief Investment Officer (OCIO) services has increased in recent years and has been moving up market, a trend that we do not see slowing down in 2023. Some companies had previously closed their DB plan to new entrants or frozen the accrual of any new benefits. As such, many view the pension obligation as a legacy liability and not something they want to devote significant internal resources to manage. Engaging an OCIO partner can ease the burden of managing the plan while also providing the sponsor with the expertise to navigate any stage of the plan’s life cycle, such as hibernation, partial pension risk transfer, or complete plan termination.

Finally, as sponsors take actions to reduce the risk of their DB plans, many are turning greater attention to their defined contribution programs. As an increasing number of employees are no longer covered by DB plans, some sponsors are reexamining their DC plan design, including investment line-ups and financial wellness offerings, in order to further enhance participants’ ability to save for and prepare for retirement. This is especially true in today’s world when many competing financial priorities can crowd out retirement savings. We expect sponsors in 2023 to explore ways to provide participants with more help in developing their retirement strategy, including ways to turn their defined contribution assets into a retirement income stream.

1Goldman Sachs Asset Management and company reports. As of December 2022. Based upon all the US (when specified) defined benefit plans of S&P 500 companies.

2Goldman Sachs Asset Management and company reports. As of December 2022. Based upon all the US (when specified) defined benefit plans of S&P 500 companies.

3Goldman Sachs Asset Management and company reports. As of December 2022.