Triple A to Triple Threat: US Debt Sustainability, Serviceability, and Geopolitical Risks

How We Got Here

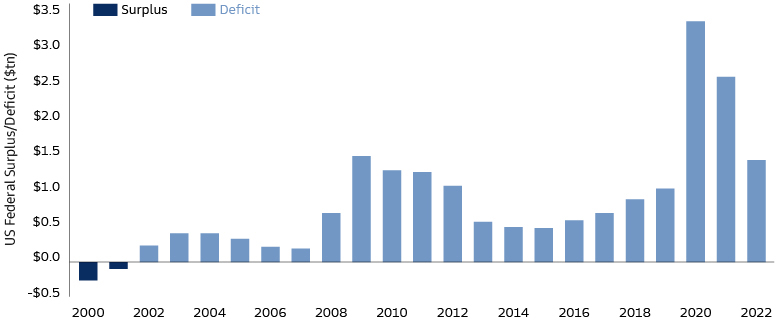

US debt sustainability is garnering concern once again as growing projected deficits risk driving the level of debt higher while rising interest rates pose a challenge to serviceability. US national debt has ballooned to its highest level on record, now totaling over $33 trillion as of October 2023. Naturally, one might ask how the Federal debt level became so large in the first place. This question gives rise to a mathematically simple finding: the US has experienced a budget deficit every year for the past 22 years and a budget surplus only five times in the last 50 years. Year after year, deficits, caused by government spending outpacing revenues, have contributed to an increasing debt level. But not all fiscal-year deficits are created equal, and some leave a more lasting impact on the sustainability of debt than others. In fiscal years 2020 and 2021 for example, the government deficit was, on average, four times larger than that of the prior 15 years due to several relief bills that were enacted in response to COVID-19, which included funds for stimulus payments, forgivable loans to small businesses, and increased unemployment benefits. Budget gaps will likely only worsen moving forward, as the Congressional Budget Office projects deficits to grow from 5.8% to 10% of Gross Domestic Product (GDP) over the next 30 years.

Source: Federal Reserve Economic Data. As of December 1, 2022.

Recent years of swelling fiscal deficits have commanded the attention of the public, investors, and perhaps most obvious in 2023, members of Congress and the White House. Elevated debt levels in the past have spurred questions among these groups as to whether they should be allowed to continue to grow or be capped. While the latter might not truly be a feasible option, its prospect does afford government officials the ability to debate both the level and priorities of government spending, thereby introducing debt ceiling standoffs, as we experienced earlier this year. This time around Republicans and Democrats came together to pass the Fiscal Responsibility Act, which suspended the debt limit until 2025. But the standoff came with other consequences, namely a downgrade to the US sovereign rating from AAA to AA+ by Fitch. The downgrade may not have presented new fiscal information to investors, which is why we believe the impact to Treasury markets was manageable, but it did provide reasonable insight to the current and future state of the US’ financial health. We share concern for the three primary rationales behind the downgrade:

- a high and growing general government debt burden,

- the erosion of governance relative to 'AA' and 'AAA' rated peers and

- the expected fiscal deterioration over the next three years.

High government debt levels, low odds that a sustained surplus is maintained, and political partisanship will all be growing challenges in the years to come. With that said, we turn our attention to the future health of the US’ fiscal position and the level of ease with which debt can be serviced.

Challenges on the Path to Debt Sustainability

Why does debt sustainability matter? Just like a corporation, the more debt a country carries, the more funds are directed to the payment of interest rather than productive growth investment. Confronting the growing debt challenge is therefore crucial to the welfare of the US because of the nation’s funding priorities which include spending on infrastructure, healthcare, education, social security, and national security. Unproductive allocation of funds could just be the beginning. While not our base case, what if the unthinkable prospect of a US default occurs? US Secretary of the Treasury Janet Yellen stated it best: “failure to meet the government’s obligations would cause irreparable harm to the US economy, the livelihoods of all Americans and global financial stability.”1 A failure from Washington to pay its debt could impair the government’s ability to finance operations, drive interest rates higher, negatively impact consumer and investor sentiment, and usher in a recession. Moreover, excessively high debt levels themselves, absent a default, can lead to an erosion of economic power, posing several risks to the US’ geopolitical standing. While the backing of the “full faith and credit” of the US government affords the ability to take on additional debt to meet funding priorities, is there an unspoken debt limit above which the integrity of “full faith and credit” becomes compromised?

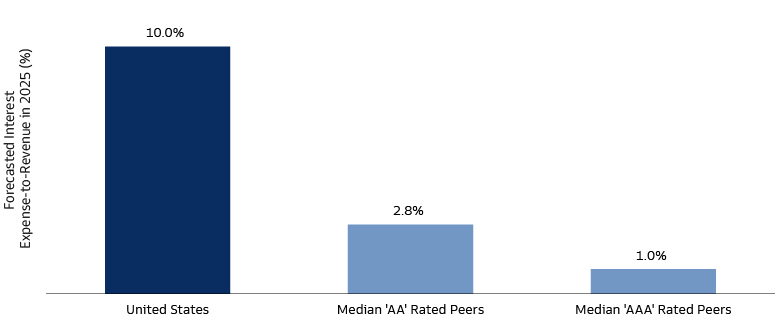

Goldman Sachs Global Investment Research (GIR) expects continued fiscal deficits to raise the federal debt-to-GDP ratio over the next decade to nearly 120%, topping the peak immediately following WWII of 106%. Perhaps ironically, the servicing of already existing debt will likely be the most influential driver of additional future debt issuance, as interest expense becomes more burdensome in a structurally higher interest rate regime. GIR also expects interest expense to reach 3.8% of GDP by FY2028, well above the post-war average of 1.8%. This, alongside increasing Medicare and Social Security costs that come with an aging US population, set the stage for larger future spending deficits, and in turn higher debt levels. But one cannot consider cash outflows without also considering cash inflows and unfortunately, this side of the ledger likely will not provide much relief. The interest-to-revenue ratio in the US is expected to reach 10% by 2025, compared to just 2.8% for the median ‘AA’ rated country and 1% for the median ‘AAA’ rated country.

Source: Fitch Ratings. As of July 31, 2023. The economic and market forecasts presented herein are for informational purposes as of the date of this presentation. There can be no assurance that the forecasts will be achieved. Please see additional disclosures at the end of this presentation.

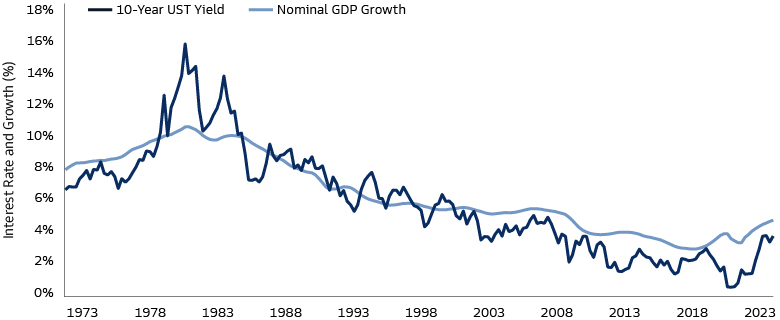

With high debt levels and challenged serviceability, how can this trajectory be sustainable? While there is no single definition of fiscal sustainability, a common focus is whether current or future policies will be sufficient to avoid a situation where debt rises without limit or fails to return to some prior level. As previously discussed, the trajectory of debt-to-GDP levels does not appear to fit this definition of sustainability. Two key determinants of a path toward sustainability will be: 1) GDP growth relative to interest levels and 2) fiscal responsibility. Related to the former, the US has historically benefitted from an average borrowing cost lower than the nominal growth rate, a trend we expect to continue. This low borrowing cost is supported by the fact that US Treasury markets are the most liquid in the world and have served as a safe haven for investors during times of stress and instability. GIR believes the Treasury will continue to benefit from a favorable tradeoff between GDP growth and interest rates, with the 10-Year US Treasury yield settling around 0.5 percentage points below the nominal growth over the longer run.

Source: Bloomberg. As of June 30, 2023.

Related to the latter, there is little that Congress or the White House can do about the Treasury’s borrowing cost or the stock of existing debt, but they can influence the primary deficit. Both sides of the aisle agree that the path to sustainable debt doesn’t involve a reduction in entitlements spending, despite Social Security and Medicare spending projected to rise to 6.0% and 4.1% of GDP in 2033, respectively.2 As such, fiscal discipline around defense spending, expiring tax provisions, green subsidies, and health spending may be key components to lower deficits, and therefore, a path to a more debt-sustainable future. In the interim, we believe the US’ fiscal position will be supported by high demand for US debt and dollar-denominated assets from both foreign and domestic investors.

Politics Could Undermine the Credibility of US Assets

The US government’s institutional capacity to repay debt remains intact, so the risk of default is small. However, the lack of political will to resolve debt challenges expeditiously increases left tail risk. Throughout history, opposing parties have utilized debt negotiations to influence government spending in their favor. Increased political polarization in Washington is crippling Congress' ability to accomplish their stated fiscal priorities and repeated brinkmanship is reducing the credibility of US investment opportunities. Left unchecked, this could adversely impact US’ creditworthiness and drive investors to allocate capital to different geographies.

Greater Vulnerability to Geopolitical Shocks

With respect to rising geopolitical tensions, US indebtedness and economic weakness is worrisome because a large share of US debt is financed by foreign investors. If skepticism over the government’s ability to repay its debt grows, the desire to invest in US capital markets may be adversely affected. The more indebted the US becomes, the more credit risk will be priced into its investment assets, albeit from strong starting points. Simultaneously, as geopolitical tensions escalate, the US’ ability to borrow additional capital could diminish, putting its ability to meet financial obligations and support strategic alliances at risk. A weakening economic standing could thus pose increased national security threats and increase the US’ vulnerability to geopolitical shocks.

De-dollarization Concerns

The US Dollar’s unique role as the global reserve currency allows for extraordinary fiscal flexibility. Deep capital markets in the US solidify the US dollar’s reputation and longevity, allowing foreign central banks to reliably invest their reserves at scale in US government debt, all of which enhances the US dollar’s appeal as a safe-haven currency. This significant level of built-in demand for US Treasury debt affords the US the ability to borrow at lower costs and employ the dollar as a tool of diplomacy. At this stage, it’s unlikely that the US dollar will be stripped of its reserve currency status as there is no one currency, or basket of currencies, that currently serve as a viable alternative. In our view, there remains little risk of a changing global currency order in the foreseeable future, though we acknowledge that it may be a part of a decades-long trend. Until then, we believe de-dollarization will remain a popular headline but an unlikely story.

Credit Where It’s Due

US national debt has reached historic levels. Despite reasonable grounds and risk assessments behind these growing concerns, we believe that the current state of US debt sustainability is not an immediate, nor a guaranteed, long-term threat. The strength of the US as a global economic power reinforces its credibility and ultimate promise to pay off debt, which widens the financing flexibility for meeting its funding priorities and taking on additional debt. US assets therefore prevail as both desirable and investable in spite of its debt challenges. Although the path to sustainability will not be easy, ample access to capital provides the US government a buffer in its search for fiscal discipline, allowing it to balance a plethora of spending responsibilities with its effort in deflating a ballooning sovereign debt level.

1Janet Yellen, Debt Limit Letter to Congress. US Department of Treasury. January 13, 2023.

2US Congressional Budget Office 10-Year Budget Projections. As of May 2023.