Emerging Markets, Global Impact: Driving Sustainable Growth

Emerging markets (EMs) are home to 86% of the world’s population,1 account for 60% of global GDP and are responsible for approximately 75% of global carbon emissions.2 Their central role in the global economy highlights a crucial reality: achieving global sustainability goals is unattainable without the active participation of emerging economies. A diverse set of developing countries—spanning Africa, Asia, Europe, Latin America, the Middle East—and companies residing in these regions will therefore need to mobilize significant capital while balancing economic growth, decarbonization, and meeting the health, education, and financial needs of their respective populations. Capital markets will play a vital role in this journey. Within public equity and fixed income markets, we see investment opportunities to support emerging economies in multiple areas—from the rollout of renewables and climate transition solutions, to biodiversity conservation and social advancement of EM communities.

The Green Leap Forward

Decoupling Economic Growth from Carbon Emissions

The economic viability of clean energy technologies continues to improve, driven by the growing affordability and greater efficiency of solar power and battery storage. These dynamics suggest emerging economies can continue to grow as they decarbonize, with renewables the ultimate route to sustainable power generation. In emerging economies (excluding China), renewables accounted for approximately 75% of new power generation in 2022, up from 25% in the previous decade.3 Agriculture and reforestation initiatives in many EMs also highlight new avenues for economic growth that are simultaneously designed to reduce carbon footprints. EMs are gradually shifting towards renewable energy, but coal, along with oil and gas, still constitutes a significant portion of their energy mix. While progress is being made, this indicates that there is a considerable journey ahead in the transition to greener energy sources.

Meeting Rising Energy Needs Through Renewables

As global GDP accounted for by emerging economies continues to rise, and EM incomes converge towards developed market (DM) levels over time, providing essential services to underserved populations—775 million people are without electricity and 2 billion lack clean cooking solutions—poses a significant challenge.4 EMs are also industrializing, modernizing agriculture, and developing urban housing. In addition, despite their lower per capita emissions relative to DMs, EMs are more vulnerable to physical climate risks, particularly in low-income regions, necessitating a reinforcement of their climate resilience strategies. Meeting rising energy demands with renewables is key to the climate future of emerging economies and global sustainability efforts. Clean energy investments are vital for climate action as well as broader sustainability goals, including affordable housing, clean water, sanitation, and healthcare access. Transitioning to renewables can also bolster economic resilience, reducing reliance on fossil fuel imports, improving current account balances, and lessening external financing vulnerabilities.

Closing the Capital Gap

Sustainable growth in EM economies requires a collaborative effort and significant capital investment from governments, corporations, and investors. In 2022, clean energy investments in EMs reached approximately $770 billion, with China contributing two-thirds of this amount.5 To align with the Paris Agreement6 and growing energy needs, investments must broaden and increase to $2.2-$2.8 trillion annually by the 2030s. Private sector financial institutions are crucial, with 60% of clean energy financing outside of China expected from institutional investors, banks and other private entities set to rise from $135 billion today to $0.9-$1.1 trillion annually by the early 2030s.7 Asia shows notable potential for private sector-led sustainability investment, given today’s high reliance on governments and public development banks for nascent clean energy investment. India's power sector alone presents a $650 billion investment opportunity to meet its 450 GW renewable target by 2030,8 while Vietnam may need $8-$10 billion annually for its renewable goals.9

Financing Climate Transition

Almost none of the $2.5 trillion in environmental, social, and governance (ESG) funds is invested in EMs, highlighting vast potential for sustainable investment growth in these areas.10 Public equity and fixed income markets offer multiple routes for investors to align their portfolios with positive environmental impact without sacrificing potential returns. Investors can tap into EM decarbonization themes, like renewable energy supplies and green buildings, or sectors in which emissions are notoriously difficult to reduce.

In the equity market, over half of the companies listed on the MSCI EM index have committed to achieving net-zero emissions. This trend is mirrored in the EM corporate bond market, where numerous companies have made similar pledges. This creates opportunities for investors to allocate capital toward 'enablers' who drive climate transition through innovation, and 'improvers' who adopt cleaner technologies to reduce their carbon footprint. We see examples of EM businesses providing carbon reduction technologies to high-emitting industries, such as aluminum and cement.

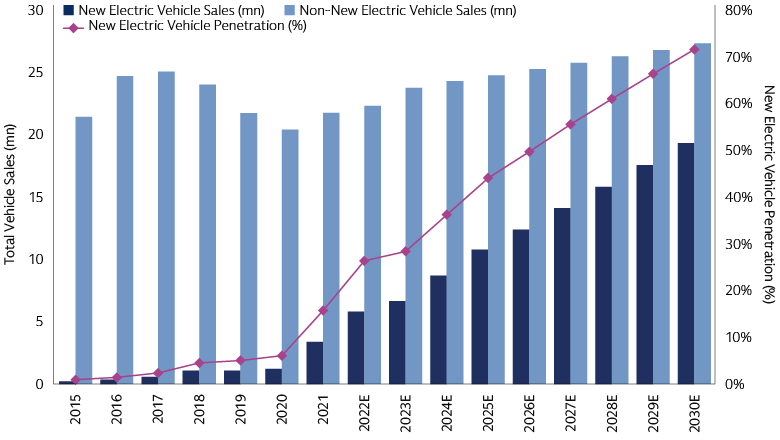

EMs contain some of world’s largest providers of green energy, such as hydroelectric and solar power production. Some EMs have already overtaken early adopters of transport electrification technology from developed countries—more than half of the electric vehicles (EVs) on roads globally are now in China.11 The Chinese EV market continues to grow at elevated rates, with local car producers surpassing established industry players to become the world’s largest by sales.

Source: China Association of Automobile Manufacturers, Morgan Stanley Research. Estimates based on Morgan Stanley Forecasts. Growth rate represented by 10-year compound annual growth rate (CAGR) from 2020 to 2030 and a 28% compound annual growth rate forecast. As of June 2022.

Elsewhere, companies are developing highly innovative technologies to power their automotive industries—most passenger cars sold in Brazil can now run on a mixture of petrol and ethanol,12 a biofuel derived from sugarcane, which significantly lowers direct carbon emissions. Furthermore, countries like Mexico and South Korea stand to benefit from US companies nearshoring their supply chains in the push towards reliable energy sources—a trend accelerated by subsidies in the Inflation Reduction Act and the CHIPS and Science Act. For investors able to navigate current challenges, investment opportunities can be found in EM economies with strong economic momentum, such as India, as well as countries experiencing temporary headwinds, like China.

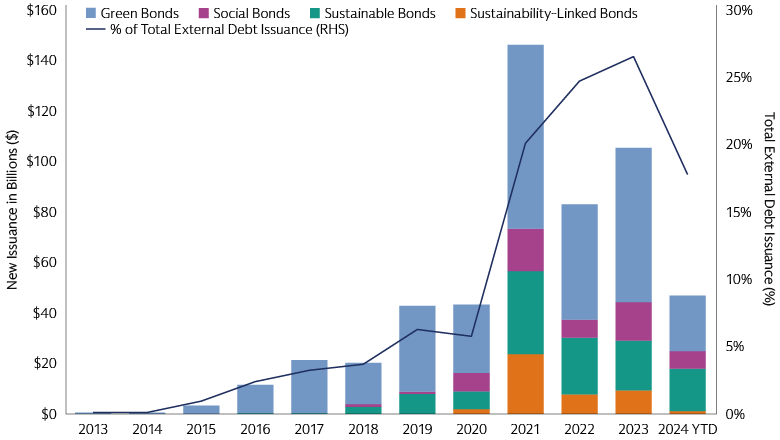

For fixed income investors, the EM green, social, and sustainable (GSS) bond market provides a major pathway to support EM climate transition efforts. GSS bonds have the same credit risk as conventional bonds from the same issuer and offer transparency in fund allocation. Investors can monitor and evaluate the impact of projects funded by these bonds through detailed reports and engage with issuers on sustainability frameworks. However, access to quality data can be challenging within EM investment landscapes. In 2023, the market for external currency GSS bonds in EMs grew by $94 billion to $270 billion.13 The EM local GSS bond market, though smaller, is also growing, with India, Thailand, Hong Kong, and Chile leading in local currency issuances.

Source: Bond Radar, Bloomberg, Morgan Stanley Research. Reflects sovereign, corporate and quasi-sovereign external debt issuance. As of May 20, 2024. Sustainability-linked bonds (SLBs) often entail vague use-of-proceeds and limited sustainability performance indicators at the issuer level, making it difficult to assess the issuer's sustainability profile and the bond's environmental or social impact. In addition, SLBs can initially benefit issuers with lower coupons without a guaranteed sustainable impact and the penalties for not meeting sustainability targets are usually minor, providing insufficient motivation for achieving these goals. These factors contribute to our preference for green and social bonds over SLBs.

GSS bonds provide EM issuers, such as sovereigns and companies, with several key advantages. For instance, they can help secure funding for crucial emission-reduction projects, which might otherwise be overlooked due to competing financial priorities. Green transportation is a key focus for the use of proceeds from GSS bonds among EM issuers. Notable examples include Indonesia's green sukuk bond, which dedicates funds to sustainable transportation initiatives, and Egypt's green bond that supports the Cairo monorail project. Additionally, EM GSS bonds attract sustainability-focused global investors, thereby enabling EM companies and sovereigns to diversify their sources of funding. Issuance of GSS bonds also demonstrates a commitment to sustainability, which may open the door to funding opportunities from programs like Next Generation EU grants or the IMF's Resilience and Sustainability Facility.

Biodiversity—A Key Ally Against Climate Change

Biodiversity conservation is essential for environmental and economic health. Oceans and rainforests, mainly located in EMs, are key for carbon sequestration.14 By 2030, ecosystem preservation could yield $10.1 trillion in business revenue opportunities and 305 million jobs.15 EM sovereign bonds that support biodiversity can offer a more immediate path to environmental benefits and sustainable growth than corporate or government climate initiatives. For instance, proceeds from Barbados' blue bonds aim to protect 4 million square kilometers of ocean, 13% of the world's coral reefs, and positively impact 43 million people.16 While the blue bond's issuance size was small, it inspired similar initiatives in the Seychelles and Fiji, highlighting the potential for substantial environmental and economic gains. Biodiversity efforts can also drive environmental protection and economic recovery, as demonstrated by Belize's 2020 blue bond for coral reef conservation, integrating ESG factors into sovereign debt restructuring to promote economic recovery and climate resilience.

In equity markets, business models that support the circular economy, energy transition, and resource efficiency are crucial for combating biodiversity loss due to climate change, pollution, and resource exploitation. These business models also represent potential investment opportunities given the rapid growth of EMs and concerted efforts to tackle environmental issues. For instance, EMs are major suppliers of metals, with China being the leading producer of aluminum, an essential commodity for green technologies but also highly energy-intensive and polluting. Investing in a greener aluminum industry is vital for global decarbonization goals and China's ambitions to reduce pollution and optimize resource use. However, measuring progress in natural capital and biodiversity for equity or bond issuers is complex without a unified metric like greenhouse gas emissions for climate change. The Taskforce on Nature-related Financial Disclosures provides a framework to help businesses and investors incorporate biodiversity into their decision making and conservation efforts.

Financing Inclusive Growth

The goal of inclusive growth seeks opportunities for all, including those in emerging economies. Investors can promote social sustainability by supporting companies that focus on essential services like affordable housing, clean water, and clean energy. Investments in firms that provide access to finance and innovative education is also critical. The increased issuance of social bonds in EMs reflects a commitment to social objectives, making them an attractive option for socially-conscious fixed income portfolios.

The Links Between Digital and Financial Inclusion

Of the 2.9 billion people worldwide without internet access, an estimated 96% reside in EMs.17 The development and operation of telecommunications infrastructure is crucial for enhancing digital inclusion. This, in turn, facilitates access to mobile banking and a broad spectrum of financial services to support the unbanked and underbanked in EMs. Approximately 1.4 billion individuals worldwide do not have access to formal financial services and often resort to costly informal financing methods that exacerbate financial difficulties.18 Digital accounts encourage efficient savings and affordable borrowing and are often the first step in being able to finance education and healthcare. Digital financial services also broaden choices for low-income individuals, promoting financial independence and resilience.

Realizing EM Womenomics

Womenomics refers to the empowerment of women to fully participate in the economy and society, which is essential for economic growth. Financial inclusion is a critical aspect of this, particularly for women entrepreneurs in EMs who often encounter financing challenges. Financial independence enables women to make better choices for their families, such as purchasing nutritious food, medicines, and investing in education, thereby enhancing their quality of life, and contributing to the wider economic and social advancement of their communities. Yet many women remain underbanked, with some regions reporting up to two-thirds of women without access to formal financial services. Obstacles include strict collateral requirements, often with assets not registered in their names, intricate application processes, and elevated interest rates. Investors can promote social sustainability and tap into the economic potential of women by supporting EM financial companies that cater to women. For instance, in Latin America, a financial services firm focused on serving microentrepreneurs reports that nearly 90% of its clients are women. Cash flow-based digital lending can also enhance credit access for women entrepreneurs by bypassing traditional collateral requirements that frequently exclude women.

Supporting Entrepreneurship

Micro, small, and medium enterprises (MSMEs) form the backbone of many economies, accounting for about 90% of global businesses.19 In EMs, MSMEs contribute up to 40% of national income.20 However, nearly half of MSMEs in EMs face financing challenges, with a collective annual shortfall of $5.2 trillion.21 Supporting these entrepreneurs, including the 23% that are women-owned businesses—accounting for 32% of the MSME finance gap—can significantly advance gender equality and financial inclusion. Fintech companies, banks, and insurers serving EMs have the potential to tap into large, underserved, and growing markets. Investment opportunities exist in EM equities and social and sustainability bonds that aim to close the financing gap. Examples include companies in Indonesia and India providing working capital loans for MSMEs. Overall, investors have numerous avenues to promote inclusive growth. They can support companies that improve internet and financial access, invest in fintech firms that bridge the digital financial inclusion divide, and assist MSMEs. Addressing digital and financial gaps is also a strategic move to reduce gender disparities, contributing to a more inclusive economy.

Portfolio Perspectives

To effectively unlock sustainable investment opportunities in EMs, it's crucial to adopt active management, recognize the challenges and opportunities presented by data gaps, and understand the local context that reveals unique opportunities. Acknowledging these factors helps investors navigate risks and capitalize on the distinctive potential of EMs for sustainable development and impact.

Adopt an Active Approach

Investors should apply the same rigor as traditional investing to sustainable investing in EMs. Awareness of heightened risks, such as financial risks in power distribution, land acquisition challenges, and country-specific risks in EMs, is crucial. For EM GSS bonds, it's essential to evaluate the issuer's sustainability profile and the use of proceeds to ensure tangible outcomes. This analysis should parallel the depth of traditional credit risk assessments. It is also important to consider alignment with standards like the International Capital Market Association’s (ICMA) Green Bond Principles and detailed analysis of the use of proceeds, allocation timeframe, and management. Continuous reporting on the allocation of proceeds until bond maturity and seeking external verification and second party opinions are also best practices. Collaborating with asset managers experienced in both EMs and sustainable investing can reveal impactful investment solutions addressing climate, nature, and social issues.

Seek to Fill in the Data Gaps

EM entities may lack the resources for comprehensive sustainability data disclosures. These data gaps can lead to perceptions of high investment risk. Investors can overcome these challenges by focusing on fundamental metrics and actively engaging with company management teams and policymakers. Gathering data on emissions and companies' transition plans can also lower barriers to investment. Some Southeast Asian countries are already moving towards mandatory greenhouse gas emission disclosure for publicly traded companies. As sustainability investing becomes more data-driven, measuring both environmental and social impacts is critical for investors in both emerging and developed markets.

Understand Local Context

EM economies are at varying stages of development and offer unique opportunities. Standard ESG ratings may not fully capture the specific risks and opportunities present in EMs, potentially leading to capital misallocation. Tailoring analysis to the local context, such as GDP per capita, and focusing on forward-looking sustainability plans can help mitigate income bias that often directs capital towards wealthier countries. While DM companies may lead in sustainability, EMs present distinct investment opportunities not found in DMs. For instance, recognizing local customs like the financial impact of expensive funerals in Africa can uncover social impact opportunities in companies offering funeral financing options to low-income individuals, along with financial education. By understanding these nuances, investors can support inclusive growth.

EMs are crucial to the global sustainability agenda. Strategic capital allocation across public equity and fixed income markets is essential for EMs to sustainably meet growing energy demands, contribute to global sustainability goals, and achieve economic resilience. While EMs pose certain risks, they also offer substantial investment opportunities for global investors focused on driving climate transition and inclusive growth within EM economies, and by extension, the global economy.

1International Monetary Fund. As of April 2024.

2Brookings. As of April 2023. For context, DM economies have far higher carbon emissions per capita relative to EM peers.

3Bloomberg. As of December 2023.

4International Energy Agency (IEA). As of April 2023.

5IEA. As of June 2023.

6The Paris Agreement is an international treaty signed by 196 parties in 2015, aiming to reduce greenhouse gas emissions and limit global warming this century to well below 2°C, preferably 1.5°C, compared to pre-industrial levels.

7IEA. As of June 2023.

8Climate Finance Leadership Initiative. As of April 2024.

9United States Agency for International Development. As of September 2020. 10IEA. As of June 2023.

11IEA. As of April 2023.

12Financial Times. As of May 26, 2024

13Bond Radar, Bloomberg, Morgan Stanley Research. As of May 13, 2024.

14A "carbon sink" refers to a natural or artificial reservoir that accumulates and stores carbon-containing chemical compounds for an indefinite period. The ocean absorbs about 25% of all CO2 emissions, significantly reducing the impact of greenhouse gases on the climate. Carbon sequestration is the process of capturing and storing atmospheric carbon dioxide. It is a method used to reduce the amount of CO2 in the atmosphere with the goal of mitigating global climate change.

15World Economic Forum. As of July 2020.

16US International Development Finance Corporation. As of August 2019.

17International Telecommunication Union. As of November 2021.

18World Bank. As of September 2022.

19World Bank. As of October 2019. MSME contribution to national income is likely higher when considering the informal sector.

20World Bank. As of October 2019.

21World Bank. As of January 2017.