Extending Investment Horizons: The Rise of Long/Short Beta-1 Strategies

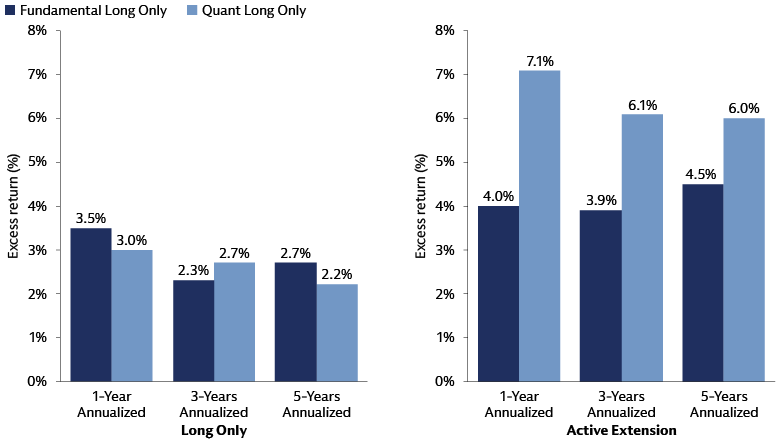

Long-only allocators have faced growing challenges in both passive and active implementations. Passive has become increasingly challenged, as lower return expectations imply allocators cannot solely rely on “beta” to achieve return objectives. An unprecedented degree of equity market concentration, coupled with higher correlations between equities and fixed income, has made traditional 60/40 investing riskier. Long/short beta-1 strategies, specifically extension managers, generated ~3x greater annualized excess return versus their respective benchmarks, compared to traditional long-only active managers. Additionally, long-only active management has proven to be insufficient for most, with the median equity manager underperforming and the top quartile barely outperforming.

Consequently, there is a growing interest in long/short beta-1 strategies—otherwise known as extension strategies and portable alpha—that enable allocators to potentially generate enhanced results in their long-only allocations. In this article, we address what they are, examine potential advantages and constraints of each relative to each other, and discuss key considerations to determine an optimal approach for investors.

What are Long/Short Beta-1 Strategies?

There are two primary forms of implementation to integrate long/short beta-1 strategies into a predominantly long-only investment framework:

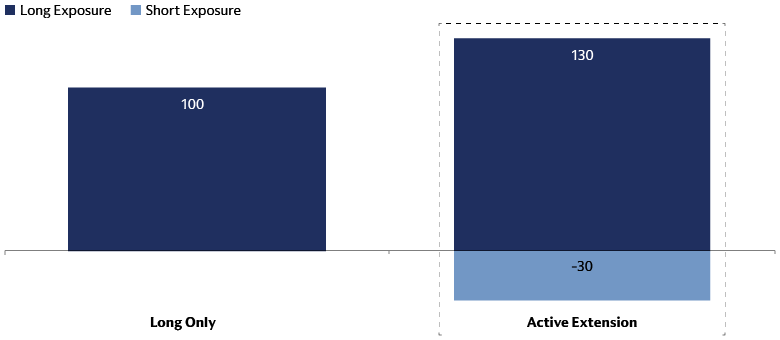

Extension Strategies (also known as Flex or 130/30):

This approach may enable investors to express active, alpha-oriented views on both the long and short side versus a given index, using a modest amount of leverage, to generate an improved excess return. These strategies can be accessed at varying leverage levels, tracking error, and focus (i.e., index). While 130% gross long and 30% gross short (130/30) is the most common leverage level, this may change depending on goals and index choice.

Source: Goldman Sachs Asset Management. As of October 2025

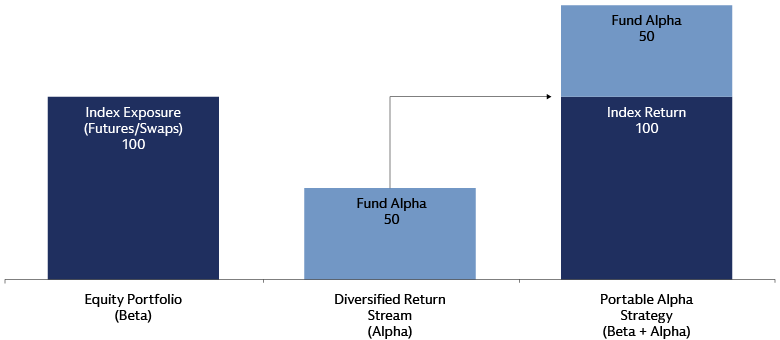

Portable Alpha Strategies

These strategies combine a desired market exposure (via a derivative) with a separate, uncorrelated source of alpha (hedge fund) to achieve improved risk-adjusted excess returns within a long-only allocation. This can provide incremental benefits versus extension, partially since the alpha opportunity set is wider, often outside of the chosen market index. However, the trade-off is higher complexity in the form of the need to manage the liquidity, collateral, and beta exposures over time and to select high quality, appropriate hedge fund managers (ideally those that are low net /uncorrelated, more liquid, more transparent). This may be more resource intensive but can be alleviated by a turnkey portable alpha solution or via a partnership.

Source: Goldman Sachs Asset Management. As of October 2025.

The Case for Long/Short Beta-1 Strategies

Enhanced Flexibility and Return Potential Within a Long Only Allocation

The current investment environment presents significant hurdles for long-only allocators, requiring a more dynamic approach. The "passive is now too aggressive" problem stems from lower beta return expectations, increased correlations between equities and fixed income, and heightened market concentration, making it challenging to rely solely on beta for return objectives. Simultaneously, the "long-only active approach is now insufficient" problem persists, with the average active manager underperforming most indices and even top-quartile managers generating insufficient long-term alpha.

Against this backdrop, long/short beta-1 strategies offer a compelling solution, enabling allocators to potentially generate better results within their long-only allocations through a more active and less constrained framework.

These strategies provide both greater flexibility and enhanced performance potential. At the manager level, the ability to express views through both long and short positions, combined with judicious use of leverage, allows for more unconstrained and capital-efficient idea generation, enhancing potential returns. For allocators, long/short beta-1 implementations effectively introduce hedge fund-like exposure into traditional long-only portfolios.

Moreover, by alleviating the binding constraints of long-only mandates, these strategies benefit from a higher “Transfer Coefficient” (TC) in their investment views which may lead to a higher Information Ratio (IR). Quantitative extension strategies, specifically, can achieve higher risk levels while maintaining diversification, further boosting their IR. Historical data, as illustrated below, indicates that active extension strategies have delivered an annualized excess return of 4.0% over long-only active managers across a decade.1 While portable alpha strategies exhibit a similar dynamic, their diverse implementation methods make precise quantification more complex. We believe this outperformance potential may grow even greater in the future for both, given an improved environment for active management characterized by higher volatility and dispersion of returns in the post-QE world.

Source: Performance data from Goldman Sachs Marquee Connect, investor letters shared with the GS Capital Introduction team, With Intelligence, eVestment; analysis conducted by the Prime Insights & Analytics team. Only includes LO and active extension products from hedge funds (i.e., portable alpha is not included). All data through December 31, 2024, unless otherwise noted. Past performance does not predict future returns and does not guarantee future results, which may vary.

Evolution & Implementation Process

Extension Strategies

Active extension strategies were a popular allocator strategy in the 1990s, but interest diminished on the back of the Global Financial Crisis (GFC) given the sharp drawdowns in global equity markets and underperformance compared to long-only active managers. Underperformance relative to long only managers was expected as extension strategies inherently run with higher tracking errors/leverage, therefore they will suffer larger losses. Interest in these strategies has historically been cyclical depending largely on market return expectations. As mentioned previously, we believe today’s volatile environment presents a constructive opportunity for active investing, specifically for less constrained solutions.

The extension marketplace has long been dominated by quantitative managers rather than fundamental due to their scalability and access to greater risk controls. The trend is still in place today as roughly 70% of funds in space, or 90% of AUM, are quantitative.

Implementation Process

1. Choose desired index: The index of choice depends on the universe an allocator is seeking exposure to. Most products are benchmarked to a global equity index, though there are many other versions across regions and market cap and asset classes including fixed income.

2. Determine active risk: A higher tracking error suggests greater deviations from the benchmark and potentially higher active returns but also increased risk of underperformance. This ratio reflects the proportion of your portfolio allocated to long and short positions. Common ratios are 130/30 (130% long, 30% short) and 150/50 (150% long, 50% short). Leverage is often a function of desired risk targets.

3. Select a manager: Manager selection has become ever more important as the dispersion between top and bottom managers has grown wider and many of the better ones no longer have capacity.

Portable Alpha

Portable alpha was first introduced via the Capital Asset Pricing Model (CAPM) model in the 1960s with the concept of creating independent return streams for both alpha and beta. Similar to extension strategies, it became widely embraced in the late 1990s but subsequently fell out of favor in the GFC and subsequent period of QE due to negative returns, limited dispersion (consequently alpha), and breakdown in diversification benefits. This was particularly painful for institutions with significant leverage profiles as they were forced to meet margin calls on their equity exposure, coinciding with a time when some hedge funds suspended redemptions.

Over the past few years, we have seen a meaningful resurgence in portable alpha interest across all types of allocators. We attribute this to the shift in the macro market backdrop that has made problems regarding passive being “too aggressive” and active long-only being “insufficient” more acute and hedge fund tailwinds more meaningful. This has also led to a wave of talent within the long-only space to move over to hedge funds given their more flexible approach. With lessons learned, allocators are more focused than ever on managing counterparty risk, liquidity risk, and independence of alpha and beta - all paramount to how portable alpha strategies are built today.

Implementation Process

Once allocators select desired beta and alpha/risk objectives the implementation process includes:

1. Buying the exposure: Buying the desired beta exposure via a derivative/swap.

2. Investing the proceeds: Investing the proceeds (at desired leverage level) into an alpha engine being managed by a hedge fund. Ideally this is done with low net exposure and better liquidity and transparency versus the average hedge fund, which has become more challenging.

3. Managing the model: Managing the liquidity, collateral, and beta exposures over time.

Allocators can implement the above in two ways:

- Direct (“DIY”): Allocator selects and manages the entirety of the program (beta, alpha, collateral and liquidity management components) in-house. This is a more resource intensive approach and can come with numerous complexities and increased costs.

- Partnership: Allocator outsources the alpha implementation to an external partner to make it less resource intensive, but may influence the degree of capital efficiency depending on how it's implemented.

What to Consider When Implementing Long/Short Beta-1 Strategies

Long/short beta-1 strategies, while offering enhanced return potential, present several inherent complexities that allocators must carefully consider. We outline these considerations below.

These strategies typically offer a higher tracking error and volatility, though with the expectation of greater excess return. The use of leverage and shorting may lead to a greater tracking error and may be challenging for allocators to fit within traditional long-only mandates (could require board/IC approval).

Long/short beta-1 strategies are more complex than long-only active ones. Portable alpha strategies are especially intricate as they require beta, leverage, and liquidity management. Hedge fund selection is also crucial given the need for high-quality managers that are low net (uncorrelated), more liquid, and more transparent – qualities that are harder to find against today’s industry backdrop, especially given the majority of best-in-class managers are closed to new capital.

In the case of portable alpha, simultaneous drawdowns in both the alpha and beta sleeves could lead to outsized losses making it crucial that the alpha source is uncorrelated to the associated beta.

Long/short beta-1 strategies are likely to be more capacity-constrained than long-only products due to the inclusion of short positions.

From an allocator’s perspective, long/short beta-1 strategies are more expensive than traditional long-only products given the higher return potential and implementation complexity. Fee structures tend to vary significantly, that correlate to degree of active risk and quality of manager, often in the form of both management and performance fee.

Implementing these strategies via an SMA requires a prime brokerage agreement and other potential operational burdens for the LP. Otherwise, LPs can implement via a commingled fund or fund-of-1 structure.

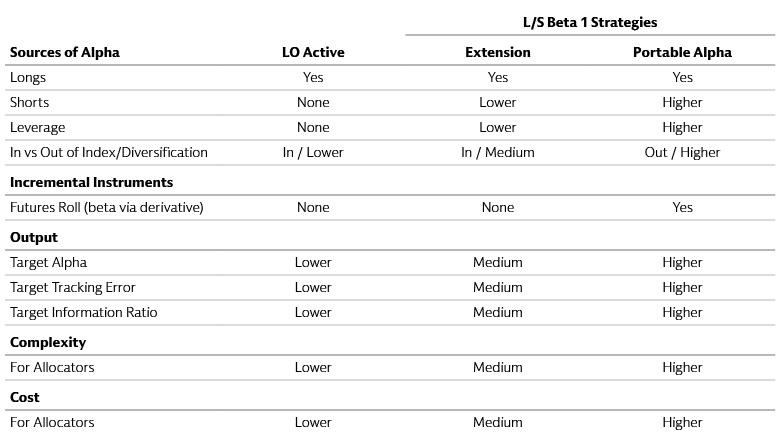

Choosing between Long/Short Beta-1 Strategies

Choosing between portable alpha and active extension strategies depends on the allocator’s objectives, liquidity preferences, risk objectives, and degree of in-house resources. This choice can vary by allocator as some are constrained within a market. For instance, an allocator constrained to strictly developed markets can utilize portable alpha to allow them to get more return from that asset class by dipping into other markets, often less efficient ones.

Portable alpha typically employs higher leverage levels, increased shorting and use of derivatives, and pulls from a wider alpha source resulting in a higher alpha, tracking error, and information ratio. While these are benefits, it does come with a higher degree of complexity.

Extension, on the other hand, utilizes lower leverage levels and less shorts and use of derivatives, and pulls from a narrower alpha source (within the chosen index only) generally resulting in a slightly lower alpha, tracking error, and information ratio. However, extension strategies typically present lower complexity for allocators.

Ultimately, the choice between these strategies should align with the investor's overall investment philosophy and risk appetite.

Source: Goldman Sachs Asset Management. As of September 2025.

Traditional Thinking Extended

Long/short beta-1 strategies offer a compelling value proposition for allocators looking to generate improved excess returns in a long-only allocation via greater capital efficiency, increased flexibility, and improved diversification. These strategies not only provide a more efficient use of capital but also allow for greater adaptability in response to market changes. We believe long/short beta-1 strategies can lead to more consistent returns, making them an attractive option for those seeking to optimize their investment outcomes. As the landscape of traditional active equity investing continues to face challenges, now is the time for allocators to consider long/short beta-1 strategies.

1 Goldman Sachs Prime Brokerage. As of June 2025.