Asset Management Mid-Year Outlook 2025: A Halftime Reset—Not A Retreat

At the halfway point of 2025, we believe investors have a number of reasons to recalibrate their portfolios. These include the unfolding impacts of tariffs, US fiscal risks, unusual dollar dynamics, conflict escalation in the Middle East, and European fiscal initiatives. The rapid advance of artificial intelligence (AI) is adding another layer of disruption. We believe this evolving landscape demands a halftime reset—not a retreat. In our view, it’s important to stay invested, stay active, and diversify portfolio exposures across regions, sectors, and factors. Exploring ways to source income and returns, and hedge against tail risks, can help enhance portfolio resilience. In this Mid-Year Outlook, we highlight key investment themes and potential strategies to navigate heightened economic, geopolitical, and market uncertainties.

Broader Equity Horizons and Income Generation

We remain confident in our longstanding public market investment themes Broader Equity Horizons and Income Generation.

- Equities: Keep on broadening: We see potential opportunities in the equity markets across geographies and sectors—including Europe and small caps, among others—and favor data-driven insights underpinned by fundamental analysis to capture them. Globally, companies with key differentiators and pricing power may have enhanced appeal in a world of higher tariffs. We continue to believe the broader tech landscape offers extensive opportunities, especially with the rise of Agentic AI. AI is also becoming an increasingly important tool for investors to systematically extract information from the large, complex, and unstructured datasets.

- Bonds: Unlocking income and returns: We continue to see value in landing on bonds for their income and return potential, as well as their potential ability to diversify multi-asset portfolios amid equity market volatility and growth concerns. However, with spreads tight in what is an uncertain environment, investors may need to explore opportunities across the fixed income universe, including securitized sectors. Systematic strategies based on disaggregated drivers of asset prices and returns can be considered. Importantly, such drivers do not depend on specific macro, market, or policy outcomes. This approach has been increasingly relevant throughout the 2020s, when the only certainty has been uncertainty.

Alternative Routes to Resilience

Private markets, hedge funds, and tail-risk hedging strategies can provide Alternative Routes to Resilience, along with exposure to persistent and accelerating growth themes.

- Versatile alternatives: In private markets, we continue to expect strong investor demand for private credit, driven by its historically attractive risk-adjusted returns and diversification benefits. Flexible financing solutions, such as hybrid capital, can help companies with strong fundamentals optimize their capital structures. For investors in need of liquidity or looking to rebalance their portfolios, ongoing innovations in secondary markets are providing new optionality. We also believe the current environment will continue to favor alpha generation for hedge funds while strengthening the value of diversification these investments have historically provided.

- Megatrends and disruption: In an unpredictable macro environment, we see opportunities to invest in persistent and accelerating growth themes. Increased spending on defense and infrastructure across developed markets reinforces the durability of economic security, despite recent near-term volatility in equity markets. AI, clean energy transition, and industrial reshoring continue to drive strong increases in demand for power and electricity. We believe increased climate transition-oriented private credit will be needed to scale energy solutions across countries and use cases.

First Half Reflections: A Look Back to Look Ahead

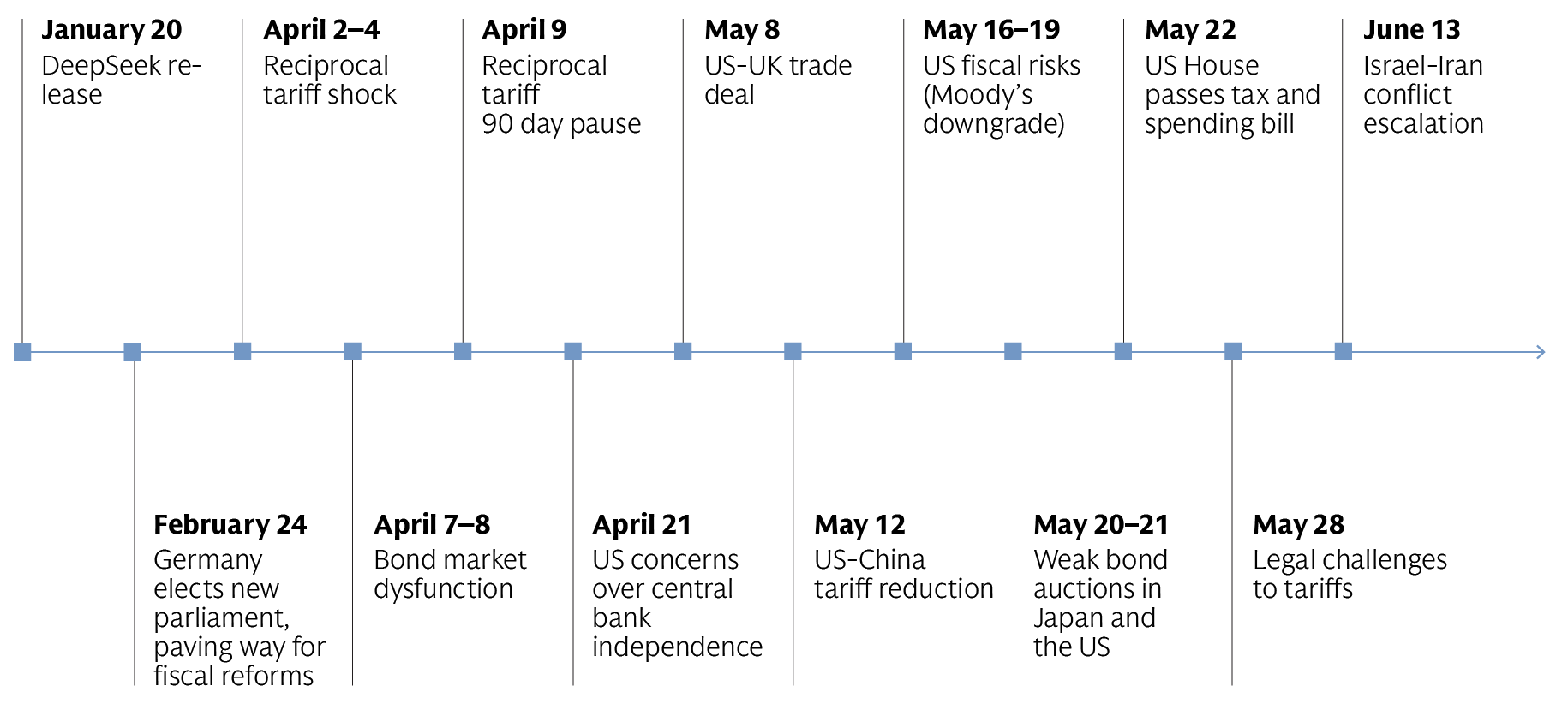

Before exploring these themes in depth, we reflect on the timeline of multiple market drivers in the first half of 2025, assess how our initial investment expectations have fared against the realities that have unfolded, and consider key questions on the investment backdrop as we head into the second half of the year.

Source: Goldman Sachs Asset Management. As of June 2025. For illustrative purposes only.

Key Questions on the Investment Backdrop

Which policy choices will matter most?

The biggest US trade war in 100 years and unpredictable White House policies unsettled the markets in the first half of 2025. Since April, positive trade-related developments, including a 90-day pause on reciprocal tariff being introduced, trade negotiations, and pushback from a court order,1 suggest that trade policy uncertainty may have peaked in April. However, the outlook after the July 9 reciprocal tariff pause deadline remains uncertain. While the US administration appears to have adopted a more pragmatic approach to tariffs, in part influenced by bond market selloffs, tariffs remain a central component of the US policy agenda. The US administration has various avenues to pursue tariffs, and sectoral tariffs still appear likely.

Importantly, although tariffs are lower than April 2, they are not low. The same can be said for growth risks, with the sharp rise in the US effective tariff rate relative to the end of 2024, combined with policy uncertainty, expected to weigh on real income, consumer spending, and business investment. We anticipate global growth to decelerate in the coming months due to headwinds from US tariffs and weaker US growth. Outside the US, we anticipate weaker global trade and growth will likely reinforce dovish monetary policy actions in Europe (even though the ECB has expressed confidence in the resilience of the Eurozone economy to the trade shock) and many emerging market economies. In China, government stimulus measures will only partially counteract the growth hit from US tariffs, in our view, with ongoing headwinds from property sector weakness.

In the US, a key question for investors is whether fiscal support in the House Republican tax and spending package,2 which still needs to be passed by the Senate and reconciled by both chambers, will help counteract the negative impacts of tariffs later this year and entering 2026. This package extends expiring tax cuts, enacts new tax cuts, and reduces spending. It is important to note that the Republican package is expected to increase the fiscal deficit and keep federal debt as a share of GDP on an upward trajectory, which could reignite concerns about fiscal sustainability. The continued upward pressure on long-term US rates could create tension for risk assets. Overall, we believe the stimulative effects of tax cuts on consumption and investment are unlikely to materialize before early 2026. In contrast, the inflationary impact of tariffs—through higher consumer prices—may be felt sooner, posing ongoing downside risks to consumer spending and US growth in the near term. Beyond the US, we believe Europe's fiscal expansion plans represent a significant step forward for the region’s future growth potential, with long-term investment opportunities in areas such as defense, energy and infrastructure. However, we do not expect the economic effects of German fiscal spending to be felt until 2026 and beyond and are mindful of implementation risks.

A shift in US policy focus from tariffs, immigration controls, and federal government efficiency towards fiscal easing and regulatory relief has the potential to improve investor sentiment in the second half of the year. Deregulation paired with tax incentives support the return of manufacturing to the US, especially in heavy industry, semiconductors, and electric vehicle production. These sectors are power-intensive and infrastructure-dependent, increasing demand for grid capacity, power generation, and natural gas. On energy, the administration's rhetoric includes "drill baby drill,” an ambitious oil production target, and lower energy prices.3 Financials are potentially in line for US regulatory rollbacks, with implications for banks’ capital costs and balance sheet flexibility.

Will US economic and earnings growth hold up?

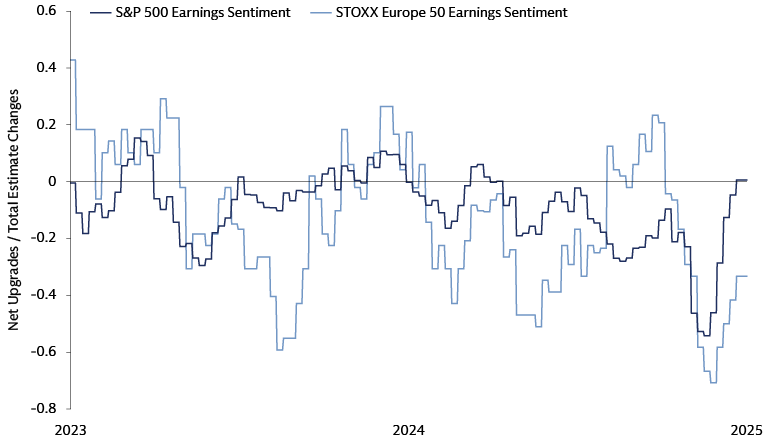

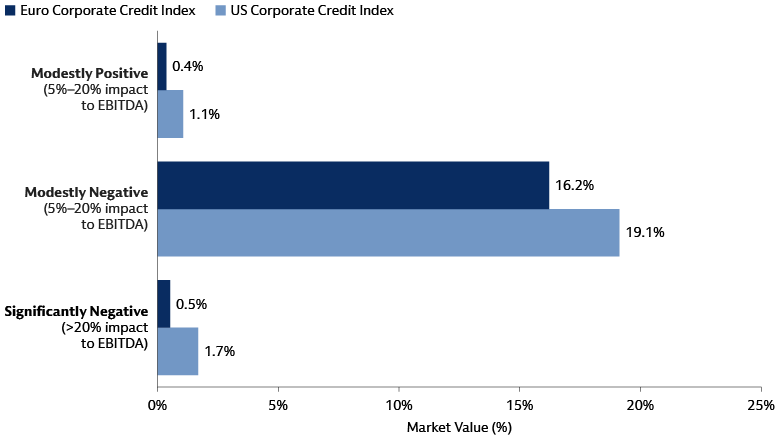

Financial markets so far this year have been largely influenced by sentiment, uncertainty, and headlines, rather than any significant changes in economic or credit fundamentals. As we move into the second half of the year, our focus shifts to the tangible impacts of tariffs and elevated policy uncertainty on key economic indicators such as employment, consumer spending, business investment, and corporate earnings, which remained strong in the first quarter. Fixed income investors have found reassurance in the continued resilience of corporate credit fundamentals, while equity investors have welcomed better earnings per share (EPS) growth. More broadly, consumer and corporate balance sheets across major advanced economies remain relatively healthy. Additionally, despite a significant gap between weak soft survey data and resilient hard data, we have observed signs of stabilization in soft survey data, including in the US Conference Board Consumer Confidence Index and the Philadelphia Fed Manufacturing Index.4

Source: IBES, LSEG DataStream. Number of analysts upgrades – downgrades. As of June 9, 2025.

Source: Goldman Sachs Asset Management. As of May 2025.

Looking ahead, we anticipate that growth is likely to decelerate due to the impact of tariffs. For the 2Q earnings season, it will be crucial to determine whether the strong performance in 1Q was a result of pulled-forward activity or genuine resilience. We also need to assess whether Corporate America will pass higher costs onto consumers or absorb the costs, leading to lower margins. Notably, earnings forward guidance trends continue to reflect a high level of uncertainty. The key question is whether markets can overlook any emerging weaknesses in hard data, viewing them as backward-looking, provided that soft data continues to improve. However, evidence of trade tensions affecting hiring and causing a rise in unemployment could pose downside risks to consumer spending, potentially reigniting recession fears and weighing on risk assets.

How might the evolving narrative around US exceptionalism impact markets?

Some investors have begun to question the concept of US exceptionalism. While we do not anticipate a complete collapse of US dominance in global investor portfolios, shifting preferences may have implications for global investment flows and in turn US financial asset valuations. High global allocations to US assets, driven by strong returns and perceived safety, are now being reconsidered. Improving prospects in other regions, considering China's AI advancements and European fiscal stimulus, coupled with concerns about US trade policy, fiscal trajectory, and institutional integrity, are prompting investors to diversify.

This diversification, however, is not a wholesale rejection of US assets, in our view. While foreign investors are likely to increase their regional diversification, the superior liquidity, earnings growth prospects, and potential of the AI sector in US equities will likely maintain significant foreign investment. Similarly, US Treasuries, despite fiscal concerns and upward pressure on long-term yields, will continue to offer diversification benefits, particularly during periods of rising downside growth risks. The depth and breadth of US credit markets will also likely sustain foreign demand, although the prospect of credit spreads reaching new historical lows may be diminished. Furthermore, the decline in the US dollar's dominance as the global reserve currency is not expected to be linear or dramatic. While diversification pressures exist, no other currency matches the US dollar's scale and liquidity. The US retains significant advantages, in our view, providing a deep investment opportunity set for investors. However, careful monitoring of investment flow trends is crucial.

Explore our Mid-Year Outlook investment themes Broader Equity Horizons and Income Generation and Alternative Routes to Resilience, and the potential sources of attractive returns they could create.

1 US Court of International Trade. As of May 28, 2025.

2 US Congress. As of May 21, 2025.

3 White House. Inaugural Address. As of January 20, 2025.

4 The Conference Board, Federal Reserve Bank of Philadelphia. As of May 27, 2025.