Adjusting for Volatility

A financial service and insurance provider looking to hedge against volatility.

Manage our client’s portfolio against volatility adjustment-discounted liabilities under Solvency II, the European regulatory framework for the insurance industry.

- Find a solution to manage assets and liabilities despite a complicated discount rate.

- Outline how the client should be thinking about liabilities in mark-to-market terms and how best to align the asset allocation.

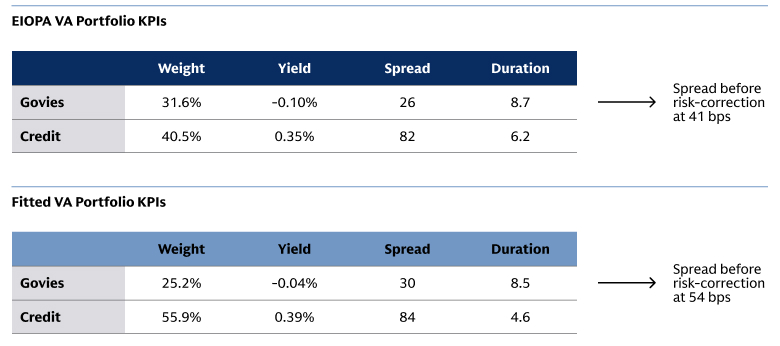

We first started by building a liability replicating portfolio by calculating the sensitivities of the Best Estimate Liability to various market shocks under Volatility Adjustment discounting, and constructing a basket of public market instruments matching these sensitivities. However, this liability replicating portfolio had the drawback of not being investable because of investment and capital restrictions. We then ran a strategic asset allocation (SAA) against the non-investable benchmark that incorporated the investment and capital restrictions, in order to propose a number of target allocations that are investable and could serve as a benchmark to portfolio managers.

Source: Goldman Sachs Asset Management as of September 2020. For illustrative purposes only. Performance results vary depending on the client’s investment goals, objectives, and constraints. There can be no assurance that the same or similar results to those presented above can or will be achieved.

We created an investable benchmark for the asset portfolio that reflected the dynamics of the liabilities discounted under Volatility Adjustment. We updated the analysis on a regular basis to inform the client’s need to adjust the benchmark.

Our approach allowed the client to choose among a set of benchmarks that are consistent with their objective to mitigate the asset-liability volatility and can be invested by our portfolio manager. This approach offers the benefit that the mandate can now fit in the client’s mandate monitoring framework and they can use the same metrics as other mandates (e.g. tracking error, excess return, VaR (Value at Risk) etc). Given the balance-sheet oriented aspect of the benchmark construction, the benchmark may need to be revised on a regular basis, in particular if the liability profile changes significantly or if the risk profile of the rest of the portfolio evolves meaningfully.

The cited case studies represent examples of how we have partnered with various institutional clients on a broad range of services and offerings. The experiences outlined in the case studies may not be representative of the experience of other clients. The case studies have not been selected based on portfolio performance and are not indicative of future performance or success. This is not a testimonial for Goldman Sachs Asset Management’s advisory services.