Commercial Real Estate: Into the Headwinds

Commercial real estate (CRE), the third-largest asset class after fixed income and equities, is under pressure. An aggressive rate tightening cycle by the US Federal Reserve (Fed) and other major central banks over the past year has fuelled concerns about the potential impact on the sector, given its reliance on debt and bank financing. This has been compounded by the prospect of further tightening in credit conditions resulting from recent stress among US regional banks, which are a key source of lending to owners.

The office market faces the greatest headwinds, underscored by several high profile CRE loan defaults hitting the headlines.1 Owners of office buildings are contending with structural challenges led by fundamental changes in the way we work since the pandemic. With more people working from home or on hybrid schedules, many companies are reducing their office space. In the US, this shift has contributed to a steady rise in office vacancy rates, particularly in central business districts. Owners of older buildings that lack amenities and sustainability credentials are finding it even harder to attract tenants.

Outside of office properties, however, the outlook for CRE is less downbeat. Industrial properties such as warehouses and logistics facilities have posted the strongest rent increases in the sector in recent years, though net operating income (NOI) growth may slow along with the economy. We believe that pockets of resilience can still be found in CRE despite the current challenges facing the sector, thanks in part to its diversity. In this article, we review the headwinds facing the US CRE market, examine where opportunities may be found and discuss key factors to consider when making investment decisions.

Stress is Building

The pressure on CRE has been created by a convergence of factors, including a sharp increase in interest rates, rising costs and reduced operating margins, income pressure, tighter financing needs and a wall of debt maturing over the next 18 months. These headwinds have put downward pressure on asset valuations and while the performance across CRE sectors is uneven, the oversupplied office market is presenting the most acute challenges.

Rate Sensitivity

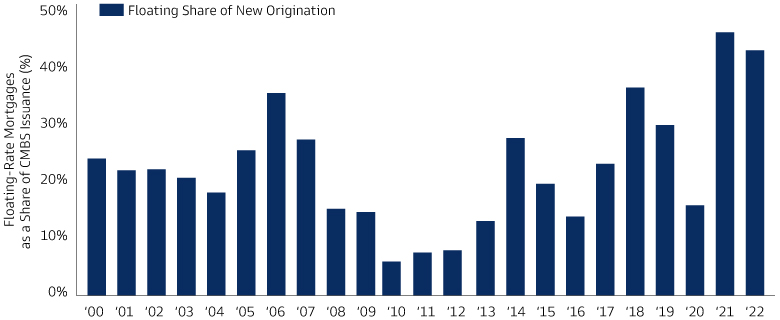

The US CRE sector has become increasingly reliant in recent years on floating-rate debt, which has become more expensive following benchmark interest rate hikes by central banks. By contrast, the residential real estate market is comprised mostly of 30-year fixed-rate mortgages. Lenders often require floating-rate loans to be paired with interest rate caps tied to a benchmark such as the Secured Overnight Financing Rate (SOFR), although this still exposes borrowers to rate increases up to the strike rate. While most of these floating-rate loans are hedged to protect against rising rates, the duration of rate caps is generally shorter than the fully extended mortgage term. These hedges therefore need to be reset in order to exercise extension options, exposing borrowers to large capital outlays to reset the hedge, or the need to seek out refinancing in the current constrained environment.

Source: Trepp, Goldman Sachs Global Investment Research. As of April 10, 2023.

Refinancing Needs

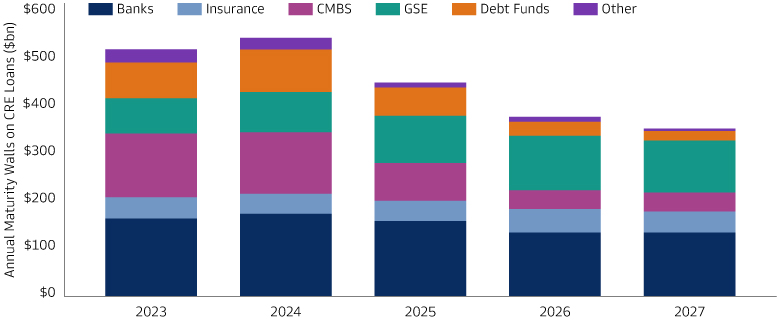

The imminent refinancing needs of CRE owners are another source of stress in the sector, with nearly $1.1 trillion worth of commercial mortgage loans expected to mature before the end of 2024, according to Goldman Sachs Global Investment Research. Given the balloon maturities common in commercial mortgages, many borrowers will have to refinance their existing loans at higher rates—assuming there is no dovish pivot by the Fed during this period.

Sources: RCA, Goldman Sachs Global Investment Research. As of April 10, 2023.

Tighter Credit

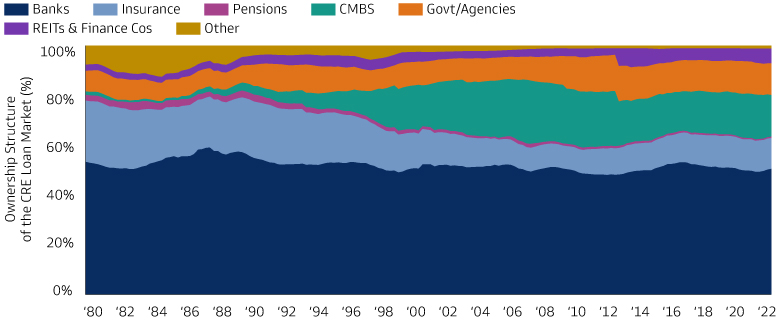

Deposits at small US banks—the dominant lenders to CRE—have decreased by nearly $250 billion since January 2023. This pressure will likely lead to a pullback in lending among some banks, including to the CRE market, reinforcing existing headwinds on the sector. Outside of banks, the securitization market has also slowed, with new issuance of commercial mortgage-backed securities (CMBS) falling sharply. The supply of conduit CMBS is down by 72% in the year to date compared with the same period in 2022. Single-asset/single-borrower CMBS have fallen by 85% and CRE collateralized loan obligations are down by 92%.2

Income Pressure

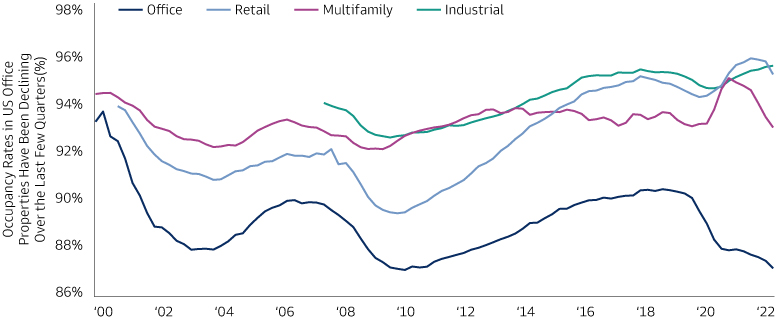

Downward pressure on net operating income (NOI) from declining rent growth, higher labor and materials costs and, in some sectors, rising vacancy rates, is a fourth source of stress for CRE. These issues are particularly acute in the office sector, while some other property types, such as industrial, are driven by more favorable fundamental dynamics. Overall, CRE borrowers have become exposed to a higher risk of a payment2 shock on their liabilities than households and non-financial corporations.

The office sector faces uncertain long-term demand due to the continued popularity of remote and hybrid work among employees. US office utilization is down by 51% nationwide compared with the pre-pandemic period. Further, tenant demand has shifted toward newer buildings with better amenities and sustainability features. More than two-thirds of US offices were built before 1990 and the required repurposing and capital expenditure will weigh on NOI, at least in the near term.

Source: CoStar, Goldman Sachs Global Investment Research. As of April 10, 2023.

Sources of Resilience

Credit Quality

Stringent lending standards over the past two decades suggest that the credit quality of CRE loans today is stronger than in the period preceding the savings and loan crisis of the 1980s and 1990s, and the global financial crisis of 2007-2008. Many loans that will mature in the next few years were originated at loan-to-value levels of 50% to 65%.3 This significant equity cushion suggests that the impact of lower valuations will be mostly felt by equity sponsors rather than holders of CRE debt including banks, insurers and investors in CMBS.

CRE is highly diverse, comprising everything from offices in major cities to data centers and industrial warehouses in rural areas. The office sector faces headwinds, as discussed above, but it accounts for less than a third of all CRE. Elsewhere, the fundamentals are more encouraging. Rents for multifamily properties have come down, for example, but significant growth in the NOI of apartment buildings over the past two years has raised the bar for defaults. Industrial properties including warehouses and logistics facilities have seen strong rent growth in recent years, though the sector is cyclical so NOI growth may slow along with the economy.

Brick-and-mortar retail stores have been suffering for years from the rise of e-commerce, which accounted for 14.7% of total US retail sales in the fourth quarter of 2022, down from the peak reached in the early stages of the pandemic, but still a significant increase from the level of 5.4% in the same period a decade earlier.4 The default cycle has largely materialized, however, particularly for regional shopping malls. The lodging industry was hard hit by lockdown measures during the pandemic, and although business-oriented hotels have yet to fully recover, tourism-oriented hotels have benefited from a steady recovery in demand.

Overall, the fundamental strength of credit quality in CRE has kept delinquency rates in check. Given the sharp rise in interest rates over the past year and slowing economic growth, we expect delinquencies to trend higher from current low levels, but we believe the rise to remain largely concentrated in the office sector, while other sectors remain relatively resilient.

Loss Rates

The experience of the past two decades suggests that losses on CRE loans tend to materialize over a multi-year period, allowing investors to adapt and lowering the prospect of widespread defaults in the near term. Even after a recession, loss rates only tend to pick up after five to seven years. This lag is the result of several factors. First, the process between a default—when a borrower stops repaying debt—and the liquidation of collateral tends to be lengthy. Second, borrowers and lenders are incentivized to amend and extend loans, postponing the potential realization of losses. Finally, loan maturities and property leases are both spread out over several years. As a result, we believe the prospect of a large percentage of leases being rolled over (or not renewed) and loans maturing (or refinanced at higher rates) at the same time is limited. In the office sector, for example, multi-year leases are commonplace and firms cannot typically terminate leases early just because more of their staff are working remotely.

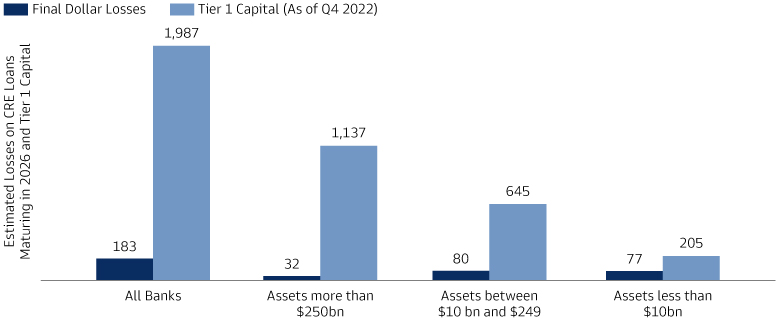

Even if CRE defaults reach the scale seen during the global financial crisis—which is not our base-case expectation—we believe US regional banks and the broader financial sector should be able to absorb the losses provided the US economy holds steady. According to our bottom-up analysis, the total losses for US banks should amount to less than 10% of current Tier 1 capital and accumulate over four years.

Source: Federal Reserve, Autonomous, and Multi-Asset Solutions Goldman Sachs Asset Management. As of March 31, 2023.

Investment Opportunities

Private Credit

For private credit investors, the roughly $1.1 trillion of CRE loans due to mature before the end of 2024 creates immediate capital deployment opportunities. While demand for debt is growing, increased volatility and uncertainty have significantly reduced the supply of available credit from traditional lenders and public financing providers. As public markets have pulled back, the resulting supply-demand shift has created an opportunity for private lenders to negotiate higher pricing and more favorable structural protections with borrowers, as well as finance higher-quality assets that would have previously been capitalized by the public markets. Funding gaps between current levels of debt and what lenders are willing to refinance may also drive opportunities in structured financing as owners look for options to retain upside in performing assets.

Securitized Credit

CMBS typically consist of a pool of fixed-rate loans with terms of 5-10 years that are securitized and sold in the secondary market. The market in private-label CMBS stood at $729 billion outstanding at the end of 2022, and conduit CMBS made up about half of that total.5 Single-asset, single-borrower (SASB) conduit loans provide another opportunity for CRE exposure. These consist of a single large loan for a single property that is securitized and sold in the secondary market. SASB CMBS accounted for a third of the market at end-2022, with the remainder in collateralized loan obligations (CLOs). The office sector accounted for 28% of conduit CMBS, 24% of SASB CMBS and 15% of CRE CLOs. The underlying loans in CRE CLOs tend to have a floating rate and are typically linked to “transitional properties” such as multi-family assets under redevelopment/ re-tenanting to stabilize the asset. These assets tend to entail more active management, because loans can be added or removed during a specific reinvestment period, and CRE CLO managers tend to have more familiarity with underlying properties.

We expect many CRE borrowers to extend and modify existing loans to avoid stress. We are also reassured by improved credit quality in the CMBS asset class since the global financial crisis thanks to tighter underwriting standards, a tougher regulatory environment that introduced risk retention rules for CMBS issuers and affiliated parties, lower loan-to-value ratios, and higher interest coverage ratios. We are nevertheless alert to the ongoing pressure on NOI that could diminish borrowers’ willingness and ability to refinance or extend loans, particularly in stressed segments of the CRE market such as low-to mid-tier offices and brick-and-mortar retail properties. As a result, we favor risk in senior parts of the capital structure and exposure to high-quality property types. We expect CMBS transaction volumes to remain subdued overall and we anticipate some pockets of stress, but we think better credit standards since the global financial crisis combined with loan modification options will help to contain spillovers to the broader market beyond the structurally challenged office sector.

Corporate Credit

Banks are among the largest holders of US CRE debt, and investors have understandably grown mindful of potential losses on CRE loan exposure, particularly for the regional banks. Historically, banks have not disclosed property type exposure within their CRE loan portfolio, but in response to investor concerns, many provided more detail in Q1 2023 earnings reports. While certain regional banks may be exposed to losses on CRE loans (particularly in the office sector), we think the risk of widespread losses is curbed by relatively healthier fundamentals in other CRE property types and strong capital positions among larger banks. Further, we are reassured by the fact that all banks have access to Fed funding facilities, usage of which has recently moderated.

Source: Federal Reserve, Goldman Sachs Global Investment Research. As of April 10, 2023.

Looking ahead, while we are alert to the risk of renewed banking sector stress, we also believe extraordinary policy interventions could limit contagion risk. That said, alongside the effects of a slowing economy we are closely monitoring the impact on bank profitability from rising deposit rates.6 During the last US hiking cycle, the increase in deposit rates relative to the rise in policy rates—also known as the deposit beta—was modest. Today, deposit rates remain low but are increasing at a faster pace than they did in the last cycle. This likely reflects the speed and scale of the hiking cycle which has made short-term money instruments and other interest-bearing assets more attractive relative to deposits. The ease with which deposits can move around at the tap of a smartphone app has also likely contributed to the stiffer competition faced by banks for deposits. Overall, a larger-than-expected increase in deposit betas could weigh on bank profitability, as higher deposit rates erode the margin between interest expenses and interest income, making this a key dynamic to monitor to assess the outlook for the sector.

Real Estate Investment Trusts

Market dislocation has increased dispersion of returns across property types, with public REITs trading at historic discounts to private market valuations. While the full effects of the US banking stress on real estate is still uncertain, we believe there remains some insulated pockets of opportunities for investors to gain exposure to REIT sectors where fundamentals remain strong, secular trends are supportive, and existing valuation discounts reflect attractive entry points.

For instance, life sciences office has been more insulated than traditional office space from work-from-home trends given the need for scientists to collaborate in person on the research and development of new drugs. Although higher financing costs have led to a slowdown in venture capital funding for life science companies and consequently lower absorption of space relative to the strong levels of the prior two years, we expect rents to remain relatively stable within most major life science clusters. Cell towers and data centers are also in strong positions and benefitting from the digitization of activities in many areas of the economy, with increasing demand for broadband connectivity and cloud data storage. Access to this property type is primarily through the public markets. As an example, more than 90% of cell towers in the US are owned by public tower REITs. The rollout of 5G and AI applications, as well as the internet of things (IoT) are two key tailwinds for these property types, which historically have enjoyed high barriers of entry.

Finally, we remain constructive on rent growth for the industrial sector over the next year, especially in gateway markets. We forecast strong demand for industrial real estate space will continue, which is supported by growing e-commerce penetration and an undersupply in logistics real estate in many of the key distribution hubs.

It is important to note that not all publicly traded REIT sectors will benefit from increased secular demand drivers. REITs that own standard commodity offices, as opposed to amenity-rich specialty office buildings, will be more impacted by the secular decline in demand due to disruption trends and refinancing headwinds, compared to the sectors mentioned above.

What We’re Watching

Non-Bank Lending and Spillovers to the Broader Economy

For almost two decades, loans to US businesses from non-bank lenders such as hedge funds, pension funds and insurance companies have exceeded loans from banks. As of the fourth quarter of 2022, about 40% of all non-corporate business loans were bank loans, down from a peak of 70% in 1983.7 If we assume that losses on CRE loans cause only banks to tighten lending standards, the impact on the US economy should be manageable and recession would likely be avoided. Given the increased dependence on non-bank lenders, however, we also need to consider the potential impact if they also tighten lending standards. For example, CRE loans account for about 11% of investments made by insurance companies.8 Losses on those loans relative to capital could be sizeable and lead insurers to scale back investments elsewhere. In a bearish scenario, where CRE sector stress also leads to tighter credit standards in non-bank lending, we think a recession is highly likely. More broadly, we continue to monitor spillovers to the broader economy from tighter standards for lending to CRE borrowers and are tracking data across stress in the broader financial sector, as well as monitoring financial conditions, consumer spending and confidence.

Headwinds are building for the CRE market. A challenging environment is set to persist in the year ahead, with most pressure likely to apply to the office sector. However, investors should be mindful that CRE remains a diverse asset class. Not all property is created equal, and some segments are better placed to navigate a difficult backdrop than others. To protect portfolios and capitalize on opportunities, we believe it will be vital for investors to monitor near-term risks and identify pockets of resilience where they can be found.

1Goldman Sachs Global Investment Research: Guide to CRE Office Debt: Mapping exposures and analyzing property performance. As of April 17, 2023.

2Goldman Sachs Global Investment Research. CRE: Will This Time Be Different?” Goldman Sachs Global Investment Research. As of April 10, 2023.

3CMBS Weekly: Deconstructing and Demystifying US CRE Exposure,” BofA Global Research. As of April 21, 2023.

4 “Quarterly Retail E-Commerce Sales, 4th Quarter 2012,” U.S. Census Bureau press release. As of February 15, 2013.

5 “CMBS Weekly: Deconstructing and Demystifying US CRE Exposure,” BofA Global Research. As of April 21, 2023.

6 Goldman Sachs Global Investment Research, “Global Economics Analyst The Lending and Growth Hit From Higher Deposit Rates”. As of April 5, 2023.

7Goldman Sachs Global Investment Research, “US Economics Analyst: Small Banks, Small Business, and the Geography of Lending,”. As of April 10, 2023.

8US Federal Reserve, Autonomous and Goldman Sachs Asset Management Multi-Asset Solutions. As of March 31, 2023.