Fixed Income Outlook 4Q 2024

Fixed Income Front and Center

Central banks have shifted from inflation control to conventional business-cycle management. Global monetary easing strengthens the case for rotating from cash into fixed income assets. The Federal Reserve’s (Fed) 0.5% rate cut in September signals responsiveness to labor market weaknesses, with the aim of securing a soft landing. This proactive easing has encouraged other central banks, including those in emerging markets (EM), to resume or initiate rate cuts. China has also introduced stimulative policies to stabilize the property sector and revive domestic demand.

While central banks are returning to traditional business cycle management, the investment environment remains unconventional due to heightened trade policy uncertainty and geopolitical tensions that may cause energy price volatility. Despite potential volatility from elections, data releases, or other risk-off events, the strategic value of core bonds, such as investment-grade credit and securitized sectors, remains strong. These bonds offer attractive income for healthy fundamentals, especially as growth risks dominate inflation risks, and central banks appear willing to accelerate easing into growth weakness. The protective power of bonds was evident during early-August and early-September growth scares and amid concerns about contagion from US regional banking stress in 2023.

Opportunistic investors can explore high yield (HY) credit, which offers attractive yields and benefits from global policy support with healthy liquidity. Additionally, the combination of the Fed’s easing and China’s stimulus creates a supportive backdrop for emerging market (EM) assets, including external, corporate, and local bond markets. For active investors, market volatility presents opportunities to increase high-conviction exposures at attractive valuations.

Understanding the context and intricacies of each fixed income market segment is crucial. Fixed income sector spreads are tight compared to the post-financial crisis era, reflecting a supportive fundamental and technical backdrop. However, yields are at their highest level in a decade, offering attractive potential for income-driven returns. Improvements in credit quality in sectors like HY credit and emerging market debt (EMD), along with changes in sector composition, suggest that certain bond spreads may narrow further. These dynamics highlight the importance of bottom-up security selection to identify issuers well-positioned for both cyclical and structural trends.

As we progress through the final quarter of the year, we recognize the value in extending duration for protection, capitalizing on income opportunities from fixed income spread sectors like corporate bonds and securitized credit, and exploring global opportunities to access the full spectrum of fixed income investments.

Key Investment Themes

- Dial Up Duration: Extending duration can protect against growth risks and capture potential upside in sovereign bonds amid global monetary easing. Central banks, including the Fed, appear willing to accelerate easing during growth weakness, making bonds an attractive hedge against downside risks. This also supports positioning for steeper yield curves. The return of yield relative to the last cycle and the re-emergence of the negative bond-equity correlation further strengthen the case for increasing duration in portfolios.

- Earn Income Amid Ongoing Expansion: We continue to see value in fixed income spread sectors like corporate bonds and securitized credit to generate income. Despite rising downside growth risks, consumer spending remains healthy, corporates are in good financial health, and central banks are easing to elongate the expansion. This environment preserves the opportunity to earn income in EM and DM corporate bonds and securitized sectors. In our view, tight spreads are justified by firm demand for yield and robust credit fundamentals, but active security selection is essential.

- Go Global: Central bank actions vary in pace and likely destinations, creating relative value opportunities across developed market (DM) interest rates. We also see value in EM local bonds that closely track US rates, particularly in countries where policy rates are high and restrictive. In certain markets, potential dovish actions by central banks are underpriced, offering attractive income and potential for total return as easing measures are implemented. EM external debt remains an attractive asset class for earning income, with potential for further spread compression and total returns in some HY issuers. However, astute security selection is mandatory. A resolution of US election uncertainty and China stimulus could add to the positive sentiment surrounding EM debt, though we remain alert to potential tail risks from broad-based tariffs. Additionally, we see growing opportunities in the green bond market as issuers from more sectors and countries access the market for financing. The diminishing green premium means investors no longer need to compromise on income or return potential by going green.

What We’re Watching

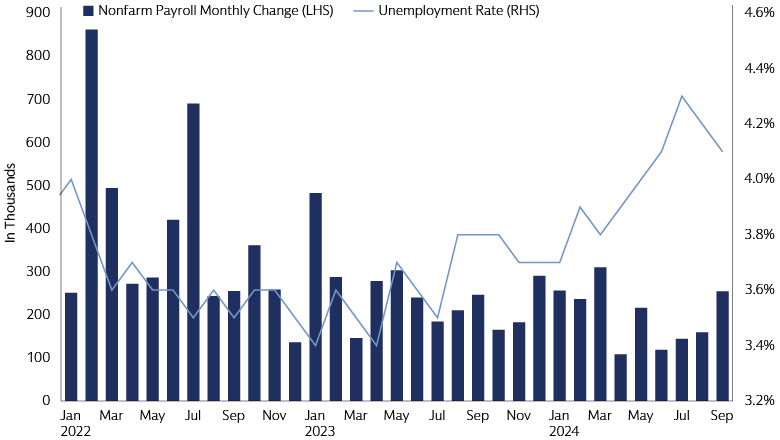

Labor Markets & Consumer Spending

Consumer spending is a key driver of growth in major economies, and a healthy labor market is essential for sustaining it. Currently, consumers benefit from high employment, healthy household balance sheets, normalizing delinquencies, and recovering consumer confidence. Falling headline inflation and high employment also support real income growth. However, there are variations across countries. Debt service ratios remain low in Japan, the US, and the Euro area but have increased in Australia, Canada, and the UK due to a higher share of shorter-fixation mortgages.1 Lower-income consumers face challenges, although central bank rate cuts offer some relief. Overall, consumers are still spending but are becoming more selective. In Europe, higher precautionary savings are leading to lower spending habits compared to the US. In China, rising unemployment and negative wealth effects, especially in top-tier cities, are weighing on spending.

Source: Macrobond. As of September 2024.

Politics & Policies

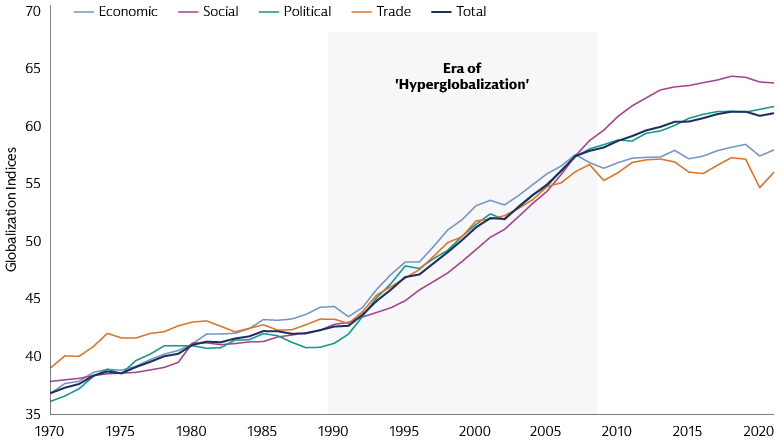

The outcome of the US election and the subsequent policy agenda are highly uncertain. If Republicans win the White House, tariff escalation is likely due to executive authority over trade policy, consistent campaign messaging, and past actions in 2018-19. Tariffs could pose growth headwinds. The inflationary effects would be swift but short-lived, potentially slowing Fed easing in the near term but accelerating it once the growth impact becomes clear. High trade policy uncertainty is currently stalling investment plans, but investment may resume post-election. There is limited risk premium in markets linked to the election, potentially offering opportunities to add to high-conviction views if markets sell off due to election uncertainty. However, broad-based tariffs could have a significant and lasting impact on global growth.

Geopolitical Tensions

Ongoing conflicts around the world pose tragic human consequences, and our thoughts are with everyone affected, including our clients and colleagues. These conflicts may also present significant economic costs that could impact financial markets. Although oil prices have recently risen due to increased geopolitical risk in the Middle East, they remain near yearly lows due to high spare capacity and limited production disruptions, thus limiting economic consequences for now. However, we are focused on tail risks that could drive oil prices higher, including potential declines in Iranian supply, additional reductions in Red Sea oil flows, and an interruption of trade through the Strait of Hormuz. The latter scenario could lead to a significant spike in oil prices with substantial economic implications, including a spike in headline inflation, an income shock for consumers and oil-importing economies, and sharp tightening in financial conditions due to risk-off market sentiment.

Source: Macrobond. As of 2021. Based on the annual KOF Globalization Index released December 2023. Economic globalization is composed of trade globalization and financial globalization, equally weighted. Social globalization consists of personal contact, information flows and cultural proximity where each contributes one third. Economic, social, and political globalization are aggregated to the Globalization Index using again equal weights.

1 Source: Goldman Sachs Global Investment Research G10 Consumer Dashboard. As of October 1, 2024.