Making Biodiversity Investing Actionable

Biodiversity has risen up the sustainable investing agenda. However, investors are grappling with how to integrate this theme into their investment process and to understand what it means, what tools are available, and where to invest. At Goldman Sachs Asset Management, we have been working with clients to clarify their objectives and expand their analytical toolkits related to biodiversity to allow for more targeted investment integration. In this article, we share our observations on the initial wave of investor activities and considerations for those who are starting to factor biodiversity-related risks and opportunities into their investment process. In subsequent articles, we will explore applications for specific asset classes.

Building Market Momentum

Investor interest in biodiversity has increased in recent years, though the market remains in the early stages of development. New biodiversity equity funds have been launched, enjoying significant growth in flows, albeit from a low base.1 In fixed income, momentum can be seen in the share of labeled bonds (green, social and sustainability) listing biodiversity conservation as a use of proceeds, which rose to 16% in 2023 from 5% three years earlier.2

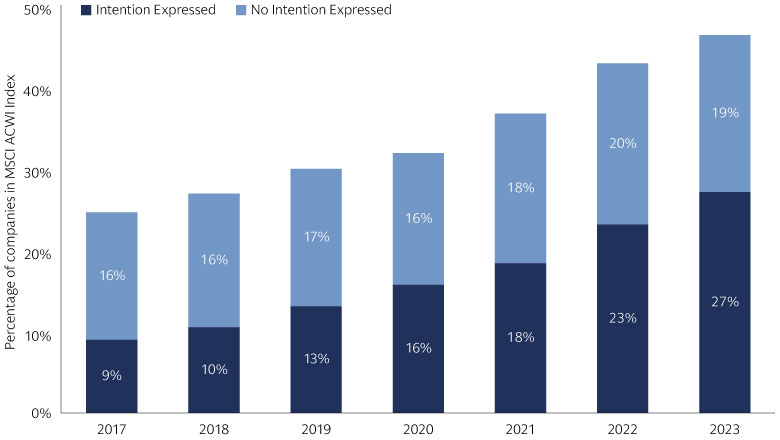

Companies are also talking more about biodiversity. Analysis by our Sustainable Investing Platform using NLP shows that 46% of companies in the MSCI ACWI Index discussed biodiversity-related topics in their annual reports in 2023, with more than half of those reporting an intention to take action related to biodiversity – a commitment, pledge, target or policy – or steps already taken.3

Source: Goldman Sachs Asset Management Sustainable Investing Platform, MSCI. As of December 31, 2023. Based on analysis of annual reports from companies in the MSCI ACWI Index.

Evidence of increased attention to biodiversity from companies and investors can also be found by analyzing earnings calls, both in presentations by management and from investors in question-and-answer sessions using NLP. Our analysis shows that at the end of 2017, biodiversity-related topics were discussed on the earnings calls of just 1.6% of the companies in the MSCI ACWI Index. In the first quarter of 2024, that number stood at 10%.4

This rising investor interest is driven by a diverse set of factors, including:

- Evidence of the destruction of ecosystems is mounting, with the global wildlife population reduced by 69% since 1970.5

- Understanding of the economic importance of nature has increased, with companies’ business models having direct and indirect financial exposure to nature loss. For example, a widely cited report from the World Economic Forum showed that more than half of the world’s total economic value generation is “moderately or highly dependent” on nature.6

- In response, policymakers have taken action to accelerate regulations on mitigating nature loss, from local legislation to global conservation targets.7

With these factors, awareness is growing of the urgent need for increased investment in biodiversity to reduce a financing shortfall estimated at $700 billion a year.8 Yet deciding where and how to invest can be a challenge, even for those familiar with the climate-investing market.

Biodiversity Growing Pains

Despite the increasing flow of investment into companies and projects focused on biodiversity, we believe expanded adoption is still constrained by key issues associated with a fledgling market.

First, the theory of change for climate/net zero is not directly translatable to biodiversity. To rally effort for climate progress, there is a clear theory of change – to limit global warming to no more than 1.5 degrees Celsius, we need to reach net zero emission by 2050. We can debate whether a 1.5-degree world is still attainable, but having one global target that everyone can measure their performance against means we can directly link individual investor/company action with global targets. Every portfolio can be measured by its temperature alignment pathways or warming potential. While we have our reservations on approaches grounded in portfolio decarbonization as outlined in Climate Metrics 2.0, being able to link investor effort with one measurable global target was very effective at motivating investor actions.

This is possible because carbon is fundamentally fungible; a ton of CO2 is the same no matter where it’s measured,9 Biodiversity, by contrast, is inherently local. Water may be the most significant issue in one place and forestry in another, and the way we think about water stress differs from region to region. The expectation that the climate-change playbook can be adapted to biodiversity creates challenges at a foundational time because when that proves to be difficult, the gap between expectation and reality widens.

The need for thoughtful approaches that balance simplicity and nuance is hard but critical, especially during the early stages of market development. As the metrics landscape evolves, it is encouraging to see financial institutions being careful and prudent around adoption of one standardized unit of measurement for nature impact comparable to greenhouse gas emissions.

Second , the wide variety of terminology and approaches in the biodiversity market can also make it difficult for investors to navigate.10 We think recent progress in developing global frameworks and regulations will help clear up this confusion by bringing greater clarity and transparency. The landmark Kunming-Montreal Global Biodiversity Framework lays out concrete targets and measures, including conservation of 30% of land, sea and inland waters and restoration of 30% of degraded systems. Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) has devised a list of five drivers of nature loss: changes in land and sea use, climate change, pollution, direct exploitation of natural resources and invasive species.11 These are emerging as a common guide that allows for alignment across global agreements and organizations on biodiversity. This interoperability could facilitate disclosure by investors and companies and help direct financial flows into nature-positive investments.

There are growing disclosure expectations regulations and guidelines such as Taskforce on Nature-related Financial Disclosures (TNFD), Corporate Sustainability Reporting Directive (CSRD), and Article 29 of the French Law on Energy and Climate, with certain regulations having material financial consequences. One example is the European Union’s Regulation on Deforestation-free Products, which carries a potential fine of up to 4% of EU-wide turnover for operators or traders that violate its provisions.12 However, we also recognize the challenges of requirements such as detailed geolocation data and operators’ current state of preparedness, with the recently proposed 12-month delay of implementation to December 2025.13 On the incentive side, we are also seeing new market developments like Australia’s Nature Repair Market, which is starting to stir interest in biodiversity investment and align carbon and biodiversity credit markets.

Three Considerations for Investors

Global investors are starting to take concrete actions on biodiversity, spurred by the clearer evidence of economic dependencies, the strong link between biodiversity and climate, fast-developing data and tools, and development of viable investment opportunities. We offer three initial considerations.

1. Clarify the objective

For investors who are starting to integrate biodiversity into their investment process, common approaches typically include materiality analysis, heatmapping, and engagement on specific topics such as deforestation. As we develop our own approach and engage with investors who are doing the same, one important lesson we have learned is to clarify the investment objective before deploying specific data and tools.

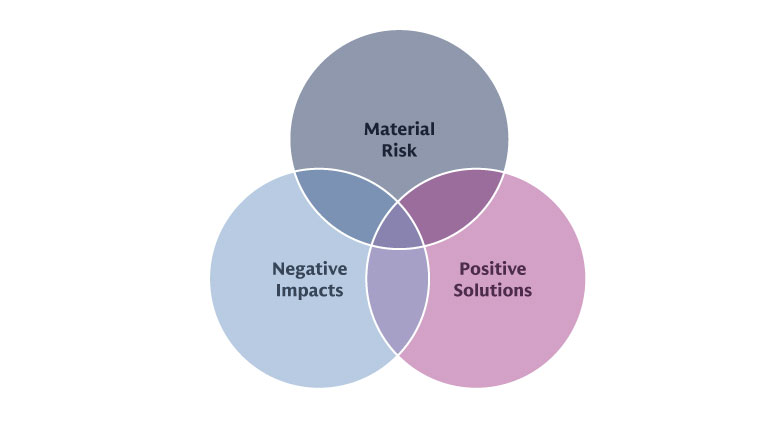

Source: Goldman Sachs Asset Management. For illustrative purposes.

There are many reasons for investors to consider biodiversity in their investment process. We have identified three relevant lenses:

- Understanding and managing material financial risks in their portfolios where there are companies with high dependency on certain ecosystem resources, such as a beverage company that is highly dependent on reliable diversified sources of fresh water.

- Mitigating potential negative biodiversity impact from a value/stakeholder concern/regulatory perspective, such as for companies with deforestation-linked commodity products.

- Increasing exposure to companies providing positive solutions, such as sustainable forestry and land/ocean management businesses that help natural habitats and maintain carbon sinks through regeneration and replanting, water treatment and plastics recycling services.

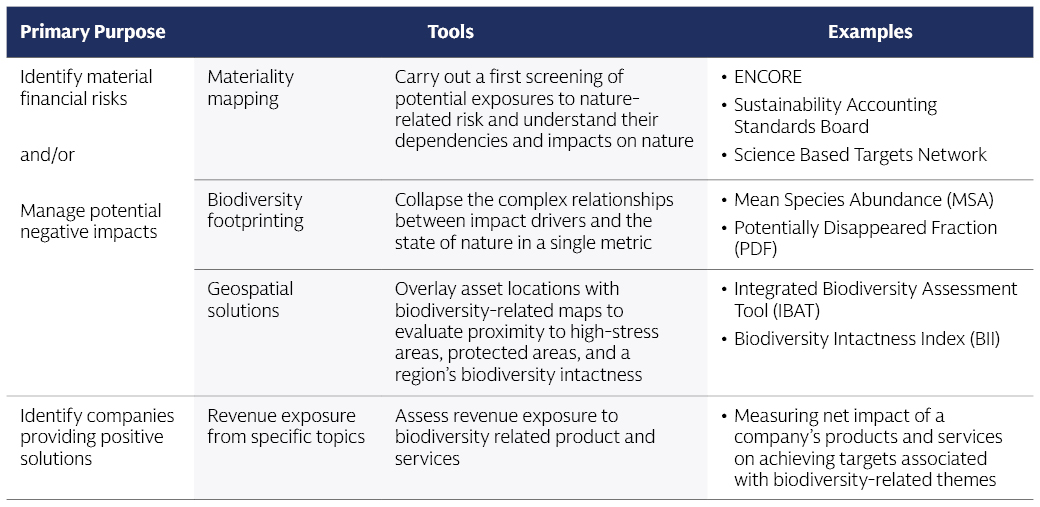

Once investors identify their objectives, they can select the most appropriate tools.14 We see clusters of tools emerging. To assess financially material risks and mitigate negative impacts, we have found materiality mapping and geospatial solutions to be practical starting points. To assess exposure to positive solutions, topic-specific analysis of revenue exposures offers a good first step. In the following table, goals are matched with tools and examples showing how this can be put into practice.

Source: Goldman Sachs Asset Management. The above proposed approaches are not an exhaustive list.

2. Build targeted investment toolkits for incremental insights

A first step investors often take to understand how their portfolios interact with nature is heatmapping. This approach leverages established materiality frameworks to assess sector- and industry-level impacts and dependencies on various drivers of biodiversity loss and ecosystem services.

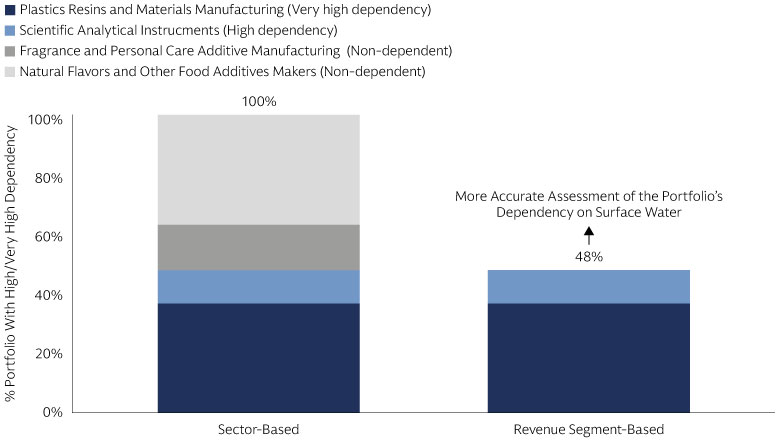

While heatmapping can help identify sectors and industries that face greater risk from regulatory impact and higher potential for positive impact, investors may find that it is just a starting point. Companies often have multiple business lines and operations that span several industries, so assigning them to a single sector may be too simplistic. We believe we need to build toolkits that facilitate bottom-up company-level analysis to obtain more targeted, actionable and accurate insights.

To illustrate this point, consider a hypothetical portfolio with a single holding, a healthcare company. We want to assess the portfolio’s dependency on surface water. Using a sector-based methodology, we find that the entire healthcare company has high dependency on surface water, resulting in 100% of the portfolio being dependent on water. If we drill down, however, and consider only the dependence of the company’s relevant business segment on surface-water ecosystem services, we only estimate a 48% portfolio dependency. This approach yields a more nuanced assessment of a portfolio’s dependency by considering only relevant business operations.

Source: Goldman Sachs Asset Management Sustainable Investing Platform. As of December 31, 2023. For illustrative purposes only. The illustrative portfolio provided herein has certain limitations. These results are based on hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under-or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown.

3. Unlocking opportunities for potential positive solution investment

Climate-related themes such as clean energy have a large universe of investable companies. The climate conversation is shifting in part from a largely risk-focused approach to one also focused on opportunities in technology innovation and areas driven by significant green capital expenditure . Increasing capital flow into biodiversity, in our view, will require demonstrating the attractiveness of biodiversity as an opportunity play.

One approach in our view is to start with sub-asset classes where the impact on biodiversity is more direct, facilitating the task of demonstrating additionality and intentionality. Examples include nature-based solutions (NBS) focused on investments that restore, help protect, and manage landscapes to sequester carbon, sustainably produce timber and agricultural products, help to improve biodiversity, and seek to generate economic benefits for local communities.

One example is investments in a reforestation strategy in the Cerrado region of Brazil alongside BTG Pactual Timerland Investment Group (TIG). The Cerrado region is the biologically richest savanna in the world, which contains 11,000 plant species, half of which are endemic to the region. TIG’s two-part strategy seeks to conserve and restore native ecosystems on half of their properties, and establish commercial tree farms that produce long-lived, renewable wood products, and sequester carbon on the other half. As of December 31, 2023, we have invested in a 35,000-hectare portfolio of properties with TIG and other investors.15 Biodiversity baseline assessments indicate the portfolio supports over 319 species of animals and plants.

For public markets, we believe a key step is to develop a clear framework for identifying companies that are aligned with an investor’s definition of a biodiversity solution, with tailored applications across asset classes. In listed equities, for example, investors could assess the alignment of a company’s products and services with the Sustainable Development Goals (SDG), for example SDG 12 (Responsible Consumption and Production) or SDG 15 (Life on Land). In fixed income, a thematic approach could include labeled bonds with biodiversity-related use-of-proceeds categories, e.g. a paper and pulp company that allocate use of proceeds towards investments related to terrestrial biodiversity activities such as investments related to restoration and conservation of existing native forests. It could also include conventional bonds from issuers with leading biodiversity profiles, e.g. a packaging company that focuses on sustainable packaging solutions from majority recycled materials, and remaining non-recycled materials sourced from sustainably managed forests. This combination of labeled bonds and vanilla bonds that meet respective biodiversity criteria would provide exposure to a wider universe and allow investors who may consider seeking to build a portfolio with a better risk-return profile.

As global frameworks on biodiversity risk, dependencies and impact consolidate, it also provides a potential opportunity to leverage the power of stewardship to engage with key companies to understand their approach to managing biodiversity and nature-related risks, and to promote accountability and transparency. This could involve disclosure such as plastic-packaging usage for Fast-Moving Consumer Goods companies, deforestation reduction plans for commodities companies, more detailed deforestation risk-exposure analysis, and impact and progress reporting. See Goldman Sachs Asset Management’s latest Stewardship Report for more details on how we engage on biodiversity and nature.

A Fresh Approach

Helping to protect biodiversity and nature is a critical part of advancing the transition to a sustainable economy. Awareness of the importance of biodiversity is growing, and investment is on the rise, yet the need for increased capital is urgent. As investors begin to explore nature-related risks and opportunities, many find that techniques applied in climate investing do not translate directly to the nascent biodiversity market, and that a new, targeted approach is needed. Based on our own experience and engagement with investors, we think investors should begin by clarifying their objectives and then select tools that are fit for the purpose of assessing companies and identifying investment opportunities.

Our approach to sustainability is founded on two intersecting areas of impact: helping to accelerate the climate transition and advancing inclusive growth. These are the areas where we believe we can have the most impact. Learn more on Climate Transition and Inclusive Growth.

1See “Investing in Biodiversity: A Multi-Asset Guide,” GS SUSTAIN. As of October 5, 2023. Net assets in 20 European funds and one US-domiciled fund amounted to about $3.4 billion according to the report, based on the latest data then available.

2 “Biodiversity in ESG: State of the Sustainable Finance Market,” Sustainable Fitch. As of October 9, 2023.

3Goldman Sachs Asset Management, MSCI. Based on analysis of annual reports from companies in the MSCI ACWI Index. As of December 31, 2023. The MSCI ACWI Index is MSCI’s flagship global equity index.

4Goldman Sachs Asset Management, MSCI. Based on analysis of annual reports from companies in the MSCI ACWI Index. As of December 31, 2023.

5“Living Planet Report 2022,” WWF. As of October 2022.

6“Nature Risk Rising: Why the Crisis Engulfing Nature Matters for Business and the Economy,” World Economic Forum in collaboration with PwC. As of January 19, 2020.

7For example, the Kunming-Montreal Global Biodiversity Framework, an international agreement reached in 2022, set a range of targets for 2030, including cutting global food waste by half and ensuring effective conservation of at least 30% of the world’s lands, inland waters, coastal areas and oceans. See “Kunming-Montreal Global Biodiversity Framework,” Convention on Biological Diversity. As of December 19, 2022.

8Kunming-Montreal Global Biodiversity Framework, Convention on Biological Diversity. As of December 19, 2022.

9https://www.un.org/en/climatechange/net-zero-coalition

10For example, MSCI researchers identified 15 funds globally bearing the term “biodiversity” in their name as of the third quarter of 2023, whereas the number of funds with names and objectives thematically related to biodiversity, such as environment and circular economy, was far larger at 134. See “Biodiversity Funds: Welcome to the Jungle,” MSCI. As of September 20, 2023.

11“Five Drivers of the Nature Crisis,” United Nations Environment Programme website. As of August 21, 2024. IPBES stands for Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services.

12“Regulation (EU) 2023/1115 of the European Parliament and of the Council,” Official Journal of the European Union. As of May 31, 2023.

13"EU Proposes to Delay Landmark Anti-Deforestation Law by 12 Months," Reuters. As of October 2, 2024.

14For investors who care about all three lenses, individual metrics or frameworks will likely not provide a complete picture and a combination may be required.

15“We” refers to the Goldman Sachs Asset Management Imprint team.