The Case for Mid-Market Infrastructure

The infrastructure asset class has scaled significantly over the past 20 years, with a number of managers responding to this growth by raising infrastructure mega-funds. As a result, many GPs have now gradually migrated away from the mid-market.

Tavis Cannell, global head of infrastructure at Goldman Sachs Alternatives, explains how this dynamic has created a widening opportunity set for today’s mid-market infrastructure investors.

How has the size stratification of the infrastructure asset class evolved, and how do you define the mid-market today?

Infrastructure GPs managed around $50 billion of assets immediately prior to the global financial crisis, but that figure has since increased to around $1.4 trillion. The bulk of that growth has taken place in the large-cap space. As a result, the investment landscape that exists today is very different to that which existed at the end of the past decade, opening up a whole new set of opportunities in the mid-market.

In today’s environment, investors define the mid-market in a range of different ways, but broadly we think of the space as companies with enterprise values of between $400 million and $2 billion. The one caveat is that we do see interesting opportunities to selectively acquire smaller businesses and grow them quickly, particularly around the energy transition sector. As a result, we do sometimes acquire companies with enterprise values below that $400 million threshold if there is a real opportunity to scale.

Why does the mid-market represent such an attractive investment opportunity today?

We have been consistently focused on the mid-market, value-add space for the past 15 years, operating globally but with a primary focus on Western Europe and North America, and diversified across sectors. The first reason why we believe this is the place to be is the favourable competitive dynamics, as the supply of capital relative to the number of investment opportunities in the mid-market is attractive.

If you look at Infrastructure Investor statistics, well over 50 percent of the cumulative capital raised last year went into funds that ultimately raised north of $9 billion. A large proportion of the capital formation that has been taking place is investing in that large-cap segment. Conversely, when you look at deal-making statistics, the mid-market accounts for just under half of transaction value and approximately 75 percent of the number of deals completed. The total infrastructure mid-market universe equates to around $1 trillion in market value. In other words, the potential opportunity set is huge.

The second key appeal of the mid-market is the scope for value creation. As a value-add investor, this is at the heart of what we do, and we see more opportunities to generate that value in mid-cap companies than in the large-cap space. These businesses simply have more room to grow and can disproportionally benefit from the power of our network. As our track record shows, there is real scope to raise the calibre of management teams and boards, to implement operational efficiencies, to elevate sustainability programmes, and to drive better commercial performance by harnessing data.

Another advantage is the optionality that exists at exit in the mid-market. When we make an investment, we always consider what the ultimate exit is likely to be, in the context that IPO markets can frequently be closed for extended periods. There are always multiple exit routes that we can take. There may be strategic buyers. If the strategy is build-to-core, then core infrastructure buyers may be an obvious choice, and if the company has been scaled significantly, then larger-cap GPs may be interested in the acquisition as well. Having multiple routes to exit is particularly important in the kind of dislocated market that we find ourselves in right now.

How are investors thinking about their infrastructure allocations, particularly regarding mid-market exposure?

A lot of investors started out on their infrastructure journeys by making commitments to large-cap funds. After all, a significant proportion of investors only formed their infrastructure programmes within the past five to six years. What we are seeing now, however, is that these investors are looking to diversify by complementing those commitments with exposure to the mid-market.

It is also worth noting that the mid-market often offers increased access to co-investment opportunities and strong partnerships with managers. The ability to have that increased level of interaction, share insights, and gain exposure to a mid-market manager’s wider network is something that, in my experience, really appeals to investors.

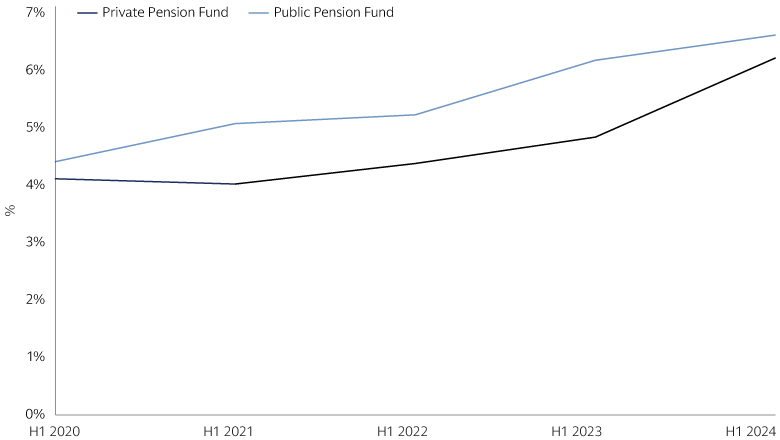

Source: Infrastructure Investor Investor Report H1 2024

Where are you seeing attractive investment propositions in terms of sector and investment theme?

I would start off by saying that we see relatively more actionable investment opportunities in sustainable and innovation-focused sectors in the mid-market than we do in the large-cap space.

Some of the areas that we are focused on currently include renewable gases, battery storage, the circular economy and specialised logistics. Interestingly, we are also increasingly seeing attractive mid-market opportunities in the traditional renewable energy space, where risk/return profiles have adjusted in light of movements around capex, financing costs and regulatory developments. While pricing can be challenging, some areas of digital infrastructure are also quite interesting. We have exposure across all of these segments within our portfolio.

I would add that a core part of our strategy centres on accelerating the growth of our portfolio companies in a sustainable manner. That is how we generate returns for our investors, as opposed to using financial engineering, as history has taught us to remain conservative there. We buy established companies but then deploy significant capex to grow the business over time.

As you look to grow these mid-market companies, are there particular value creation levers that you find effective in the current environment?

An important part of value creation actually takes place on the buy, in the sense that the majority of the acquisitions that we look at are away from competitive auction situations. We have completed a number of public-to-private deals, for example. We have also executed on a number of platform builds, particularly around the energy transition, as well as corporate carve-outs.

The first element of value creation is therefore having the insight and ability to identify and execute in a differentiated manner, rather than simply accepting the lowest returns.

Then, of course, it comes down to the value creation that takes place through the ownership period. That is about pursuing operational excellence. We do that in a number of different ways. For instance, we have a deep bench of seasoned operational experts organised by domain, who partner with our deal teams on specific value creation initiatives. During the due diligence phase, we will identify upfront a number of key value creation drivers as part of the business plan. That almost always includes talent and organisational structure. It may also involve data science, operations or sustainability, for example.

In addition, we look to activate our network in order to attract best-in-class talent to management teams. The management teams that are in place when we make an acquisition are typically good. But a team that works for a $500 million enterprise value business does not necessarily have the strength or depth to allow that business to become a $2 billion enterprise value company. Leveraging our network to bolster management teams and fill out boards with seasoned executives can really help with that.

The last thing that I would highlight is capital markets expertise, which is critical to optimising the capital structure of a company and to supporting the exit process. Financial markets have been through a lot of ups and downs over the past three to four years. Having strong insight and capabilities here is imperative when it comes to exits, but this is an area where there has historically not been a great deal of focus within the infrastructure industry. Given that DPI has become the new IRR for a lot of investors, I think that is something that needs to change.

How would you describe LP appetite for infrastructure against the backdrop of a very challenging environment for private markets fundraising overall?

Investor sentiment around infrastructure is positive. The majority of investors are still increasing their percentage allocation to the asset class, which means infrastructure is getting a bigger piece of the pie. The question then becomes whether that overall pie is growing. I think that depends on which type of investor you are talking to and where they are based.

The good news is that if you look at the performance of infrastructure over the past three years during this period of high inflation, a challenging geopolitical and regulatory environment and elevated financing costs, the asset class has outperformed private credit, private equity and real estate. The challenge, of course, is that many investors are significantly more capital-constrained than they were a few years ago, particularly given the lower distributions coming through across private markets in general and infrastructure specifically.

What does the future hold for the mid-market infrastructure space?

I think that mid-market infrastructure will remain front of mind for the majority of investors as the segment continues to produce consistent and attractive returns, as well as some of the most interesting investing opportunities in the broader infrastructure market. I anticipate allocations to mid-market infrastructure will therefore increase on a relative basis as investors that have been through the first couple of chapters of their infrastructure story look to further build out and diversify their infrastructure programmes.

Originally published in Infrastructure Investor