Earning Credit: How Investment Grade Can Deliver in Times of Uncertainty

Investment Grade Corporate Credit: Why Now?

High Yields Offer Higher Total Return Potential

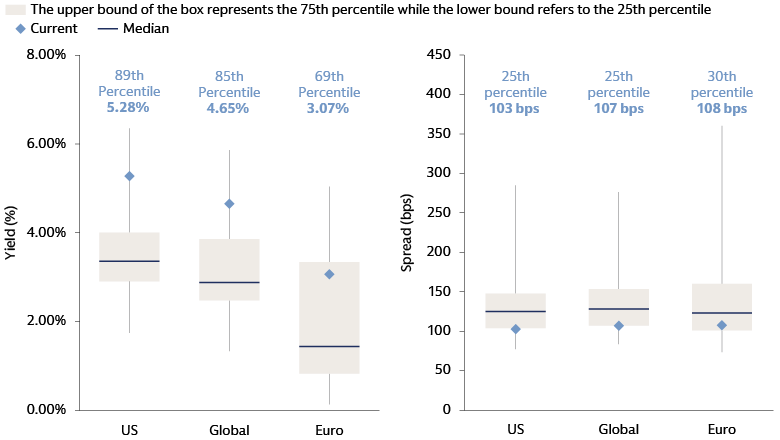

Current market conditions present a compelling opportunity to secure higher yields in IG corporate credit, in our view. Recent market volatility has pushed IG corporate credit yields upward. This increase stems from two primary factors: a reset higher in US interest rates, partly driven by concerns about diminished foreign investor demand for US assets, and a widening of credit spreads from their tightest levels earlier in the year.

Global IG corporate credit yields—currently exceeding 4.5%—have only been higher 15% of the time over the past 15 years.1 We believe these elevated carry levels offer a buffer against potential spread widening. Furthermore, improved valuations compared to the beginning of 2025 provide us, as active investors, with opportunities to increase exposure to high-conviction ideas if we find risk premiums to be attractive, while remaining vigilant regarding risks from tariffs and slower economic growth.

Source: Goldman Sachs Asset Management. As of April 24, 2025. Both charts show Bloomberg US Aggregate Corporate Index. Bloomberg Euro Aggregate Corporate Index. Left side: Based on option-adjusted spread to worst over Sovereigns. Displays current percentile based on historic time horizon of 15 years. The upper bound of the box represents the 75th percentile while the lower bound refers to the 25th percentile. Right side: The yield shown is the yield to worst. Bloomberg Global Aggregate Corporate Index. Displays current percentile based on historic time horizon of 15 years. The upper bound of the box represents the 75th percentile while the lower bound refers to the 25th percentile.

Strong Fundamentals Suggest Continued Resilience

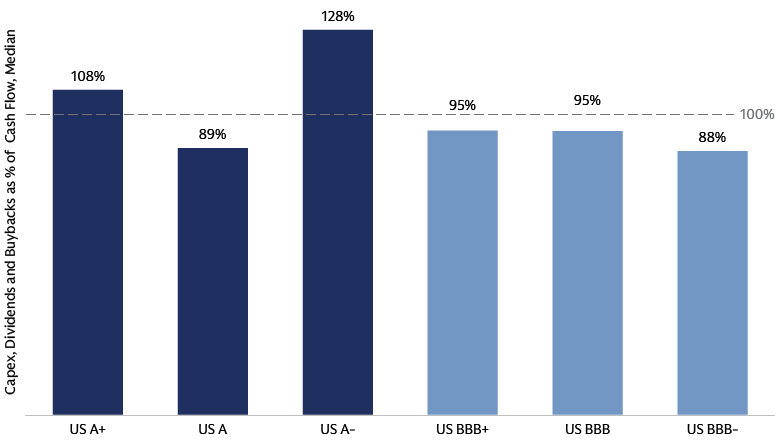

IG-rated companies entered the current environment of higher tariffs and ensuing uncertainty with strong credit fundamentals. Key credit metrics such as leverage, debt servicing capacity, and liquidity positions were robust as of the end of 2024. We expect that continued resilience – for instance, many BBB-rated companies were already retaining cash flow - could provide a cushion against downside risks. With regards to assessing the potential impact of tariffs, we are mindful of headwinds to economic and earnings growth in both the US and Europe. That said, we also note that elevated trade policy uncertainty may temper capital investment, buybacks, and mergers and acquisitions (M&A) activity. This can be beneficial for credit investors, allowing companies to preserve liquidity, and assuming it leads to a reduction in debt-funded capital markets activity. We believe that particularly BBB-rated companies will continue to manage their balance sheets conservatively. Data from 2024 show that companies in this rating cohort spent less than 100% of their operating cash flow for capital expenditures (capex), dividends, and share buybacks.

Prior cycles have demonstrated that spending activities of companies that exceed their operating cash flow led to downgrades and financial distress in IG credit sectors, such as the energy sector in 2016 or the telecommunications sector during the dot-com bubble in the early 2000s. Companies spending more than 100% of operating cash flow are primarily in the higher-quality (single-A) part of the IG market, and most industries are spending less than 100% of their cash flow on capital investment.

Source: Goldman Sachs Asset Management. As of 4Q 2024. Median US IG Non-Financial Issuer: Percentage of operating cash spent on capital expenditures, dividends, and share buybacks, last twelve months.

Entering 2025, we anticipated limited downgrades and defaults. We forecast that 1.3% of the US IG index par value (approximately $100 billion in corporate bonds) and 0.8% of the European IG market (around €25 billion) had a 30% chance of migrating to high yield. This reflects challenges faced by some companies due to slower growth or secular challenges to their business models. In a recession scenario, we think these figures could rise to around 2% and 1.2% in the US and European markets, respectively. Even then, this would be lower than the peak rating migrations seen in the US market during the pandemic (3.2% of par value), the 2016 energy crisis (2.2%), and the global financial crisis (6.2%).

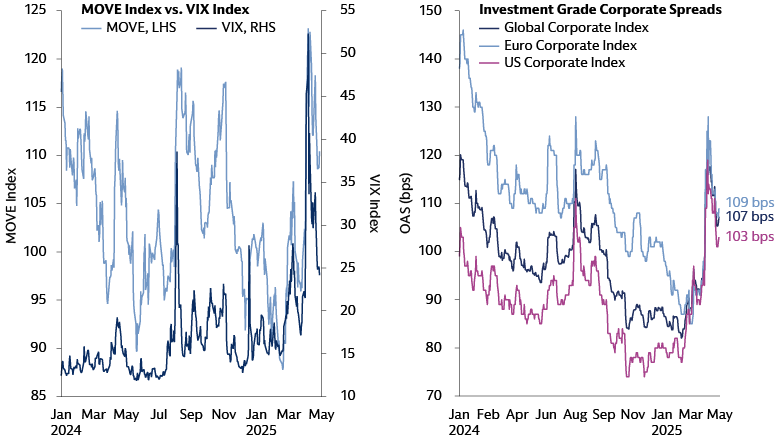

Source: Macrobond, Goldman Sachs Asset Management. As of April 30, 2025

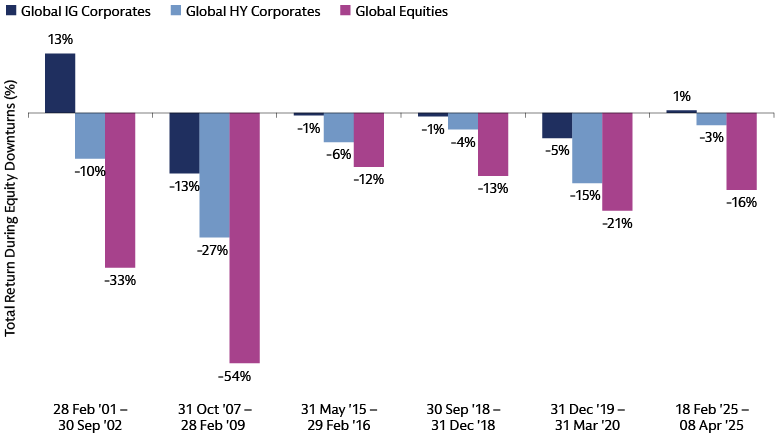

Markets have reacted to increased uncertainty and a weaker outlook, which could negatively affect credit quality and raise downgrade potential. However, we believe it is important to recognize that even amid the elevated uncertainty and recent market volatility, global IG corporate credit has proved more resilient than global equities and global high yield corporate credit. This resilience is consistent with the relative performance observed in credit markets over the past 25 years, where global IG corporate credit has outperformed during equity market downturns of more than 10%.

Source: Bloomberg. As of April 2025. Equity downturn periods defined by a 10% decline in the MSCI World Index. “Global IG Corporates” refers to the Bloomberg Global Aggregate Corporate Index; “Global HY Corporates” refers to the Bloomberg Global High Yield Index.

Given healthy starting fundamentals, we anticipate IG corporate credit total returns will remain resilient compared to other risk assets. High interest rates, rather than tight credit spreads, are now the primary driver of income for corporate bonds. This suggests that a negative correlation between rates and spreads could protect total returns. While we are aware of inflation risks from tariffs and rising Treasury yields (linked to potential reductions of foreign demand for US debt), we still believe the Federal Reserve would respond to labor market weakness, allowing the duration of IG corporate credit to help protect returns.

As we progress through the 1Q 2025 earnings season, our focus is on signals regarding the outlook. We are closely monitoring profitability trends and whether companies choose to absorb tariff costs to maintain sales volumes rather than passing them onto consumers. Existing inventory levels may mitigate some near-term pressure on profitability, and certain companies could benefit from a front-loading of demand ahead of the July 9 deadline for reciprocal tariffs. We are also watching if management teams elect to reduce spending on capex and buybacks, if they are able to shift supply chains in the near-term, and whether they look to reduce costs (including headcount reductions).

Prioritizing Active Alpha Generation Versus Passive Beta Exposures

Trade policy uncertainty will likely keep markets volatile and create performance differences among companies based on tariff sensitivity. In our view, active security selection is key to finding opportunities and managing risk. The large, diverse global IG corporate credit market offers diversification across sectors and geographies. Active investors have opportunities to build diversified portfolios that can display resilience to market volatility and exogenous shocks like tariffs. We focus on distinguishing companies with sound fundamentals from those on a deteriorating path to effectively navigate headwinds.

Source: Goldman Sachs Asset Management. As of April 2025. As measured by the Bloomberg Global Aggregate Corporate index.

In dedicated IG corporate credit portfolios, we are moderately overweight credit risk. Given the fast-moving investment environment, we are closely assessing our exposures which are highly dynamic. As the starting point of fundamentals has been sound, we may add exposure to segments of the market if risk premiums are attractive, while staying alert to risks from tariffs and slower growth. We are monitoring country-, sector-, and company-specific impacts and will adjust our positioning accordingly.

Currently, key themes in the US market include an overweight position in front-end versus longer-dated bonds to capture attractive carry and roll potential, and a preference for BBB-rated bonds. Although we have recently reduced our exposure to BBB-rated bonds and anticipate an increase in fallen angel activity from IG to high yield, we expect the volume of fallen angels to remain below the levels observed during COVID. This is due to companies continuing to demonstrate financial discipline as described above. However, we are closely monitoring the outlook for companies at the lower end of the BBB-rating cohort. Elsewhere, we are constructive on banks in both the US and European markets due to the attractive spread premium they provide relative to comparable A-rated industrial companies and their healthy credit fundamentals. We also see value in non-cyclical companies that can demonstrate resilience even as growth slows, including US and European food and beverage companies with a global footprint, diversified product offerings, and strong brand recognition. Conversely, we are cautious on the global auto sector due to slowing demand, declining profit margins, and tariff headwinds. We also remain cautious on US utilities, where investments required for the energy transition may lead to a deterioration in key credit metrics.

Staying Risk Aware and Return Ready

With the economic and policy impact remaining unclear, we are facing a world of higher uncertainty than initially expected at the beginning of the year. In this environment, we believe IG corporate credit provides advantages for navigating today's complex market. As we highlighted in our 2Q 2025 Fixed Income Outlook, we are closely watching US trade policy, company earnings, and overall market trends and will actively adjust our positions based on new risks and opportunities.

1 Goldman Sachs Asset Management. As of April 24, 2025.