Private Equity’s New Math – Part 2: Value Creation in Today’s Market

Surveys have shown that investors continue to view private equity as a critical component of their portfolios.1 The asset class can offer an important route for accessing long-term economic growth opportunities via a vast universe of companies that are outside the publicly traded markets. Private equity can also help to drive innovation and evolution in the way companies operate – effecting corporate transformation that many companies may need to undergo to thrive in new technological, sustainability, geopolitical, and macroeconomic regimes.

However, given challenges to topline real growth, margin compression, and a structurally higher cost of capital, investment should be predicated on an understanding of the potential return profile for the strategy in the current environment. We believe that private equity can continue to create attractive value for investors, but that the future path for creating value will be different than in the past.

In Part 1 of this series, we discussed the evolution of private equity value creation strategies, using a simplified buyout model that breaks down value creation into four categories: topline growth, margin expansion, multiple expansion, and leverage/financial structuring. We showed how the contributions from each of these evolved over time based on the broader market context in which buyout managers operated. In this, the second paper in the series, we discuss the math for the next era of private equity, once again turning to our simplified model. We also discuss factors that we believe should be key to success in this environment.

New Math for a New Era

Most investors agree that in an era of structurally higher interest rates and elevated valuations, leverage and multiple expansion are unlikely to add much to private equity value creation. Instead, operational value creation levers are poised to become the main determinants of success in the new regime.

Our LBO model can offer clues to quantify ways for a GP (General Partner) to achieve success for transactions undertaken in this new era of private equity. We define “success” here as achieving a 2.5x gross TVPI (Total Value to Paid-In Capital). This outcome translates to around 2.0x net TVPI – doubling the investor’s initial contribution, a result that over the past 20 years has translated to second-quartile performance. In our model, we assume an entry debt level of 5x EBITDA—reflecting ~2x interest coverage (industry data suggests that default rates are around 2-5% among borrowers with interest coverage at 2x or more, but spike above 11% for borrowers with interest coverage below 2x).2

We assume an overall entry multiple of 10x—reflective of the general industry consensus of multiple contraction from recent levels. This implies a 50/50 debt/equity ratio at entry—an assumption we believe is reflective of capital structures in normalized financing conditions. We further assume zero multiple change from entry to exit, intentionally setting a conservative assumption. Historically, buyouts have exited deals at a higher multiple than they entered them, in any given year – a dynamic we attribute to fundamental company improvement from entry to exit and carefully considered exit strategies – as described in more detail in our first paper in this series.

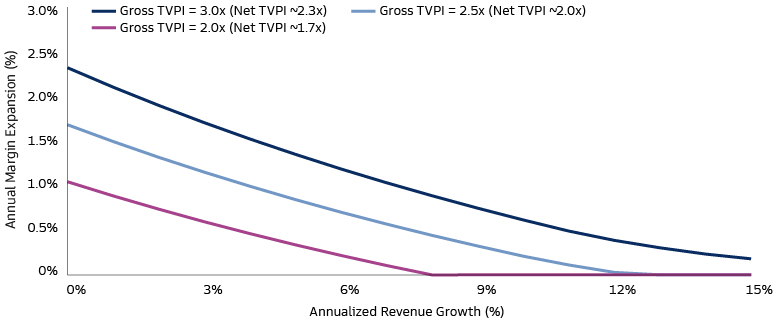

Using these assumptions, our analysis suggests that generating a 2.5x gross TVPI would call for an annualized EBITDA growth rate in the low-double-digits. This is somewhat higher than what had been achieved in the decade prior to COVID-19-driven disruptions, when the median buyout company generated upper-single-digit year-over-year EBITDA growth. The exhibit below shows different combinations of revenue growth and margin expansion that can achieve this target return, highlighting that the two levers are not equal. Value creation is more sensitive to margin expansion than revenue growth: a 1x TVPI increase can be achieved with annual margin expansion of ~1.3% (assuming no revenue growth) or an annualized ~10% extra revenue growth (assuming no margin expansion).

Without the equalizers of cheap leverage and market-wide multiple expansion, we believe dispersion in company and fund outcomes will widen. To get a sense for the magnitude of potential dispersion, we consider additional return outcomes: 3.0x and 2.0x gross TVPI (on a net-of-fee basis, these returns translate to approximately 2.3x and 1.7x TVPI, respectively – putting the funds into the first and third quartile of managers historically).3 The upside scenario could be achieved with EBITDA growth in the mid-teens, while the downside scenario corresponds to EBITDA growth in the mid-single digits.

Goldman Sachs Asset Management. As of December 2023. For illustrative purposes only. This chart illustrates the combinations of annualized revenue growth and margin expansion that can help an investment achieve gross TVPI targets of 2.0x, 2.5x and 3.0x respectively, assuming no multiple expansion from deal entry to exit, a 10x entry multiple, a 50/50 debt/equity initial capital structure, and financing at rates with baseline (SOFR) of 5%.

Ultimately, the combination of growth and margin will vary by the underlying company, based on the nature of the business, the growth of the industry that the company is operating in, and varied company-specific factors. It may be that companies need to flip the value creation playbook, if the less-used historical lever is more likely to generate future marginal benefits. For instance, companies in high-growth areas may now need to focus on margins as economic tailwinds abate, while investments in traditional sectors may need to generate topline growth as an environment of structurally higher inflation may impede margin expansion. These types of initiatives require different areas of expertise, so operating teams may need to expand their execution skillsets beyond those they’ve relied on in the past. The value of an experienced and knowledgeable investment partner, with both extensive operational networks to support management teams and the financial resources for the upfront costs of driving impactful transformation, should become increasingly apparent.

Revenue Growth: Going Organic

As discussed in our last article, over the past two decades GPs have honed their skills in growing revenues in their portfolio companies. Some of this growth was achieved with M&A and add-on activity. In 2022, add-ons accounted for over three-quarters of US buyout transactions.4

There are a number of benefits to such platform strategies, including a lower aggregate entry multiple, intuitive integration theses, and, more recently, greater ease of obtaining financing compared to large deals. We anticipate that add-ons will continue to be an important strategy for value creation, even once financing markets normalize. However, we also believe that going forward, relying solely on inorganic growth will no longer be sufficient. Growing anti-trust regulatory scrutiny may limit rollup opportunities in some sectors – especially for larger companies that are more likely to draw regulatory attention.

Furthermore, business integration is challenging and costly to execute. Integrating disparate businesses and achieving targeted synergies means integrating systems, processes, operations, and different technology solutions. Success is predicated on successfully combining potentially disparate corporate cultures and recruiting and retaining the right talent – something that challenges most integrations. According to a 2023 study by Bain, 80% of integrations address culture at or before the start of the diligence process – yet 75% of integrations still have cultural issues that lead to program delays, personnel changes, or worse.5 The study also notes that too often, acquirers’ initial estimates of major diligence areas are meaningfully inaccurate, leading to failed acquisitions. Over 40% of transactions in their study rated their initial estimates of overall integration roadmaps and revenue synergies / go to market estimates as 4 or 5 on a scale of 1 (almost never inaccurate) to 5 (almost always inaccurate).6 This can mean that success takes some time to achieve. However, in an environment in which capital is more expensive and higher discount rates put greater emphasis on near-term success rather than future promises, realizing value from M&A will necessitate showing tangible success sooner – a higher bar.

As such, we believe organic growth will become more important for value creation in the years ahead. This growth could potentially be achieved by fixing broken business models or by super-charging growth in healthy, but slower-growing, businesses and industries. Organic growth can be accomplished by gaining market share in existing areas through better products, services or customer experiences; expanding into new markets by launching new products, entering new geographies, and targeting new client segments; and/or having a more analytical, data-driven pricing strategy to optimize revenues from each transaction. This will require more finely-honed capabilities and talent around brand building and communication, sales channel optimization, and market research. It will likely mean more technology capex and R&D spend to create new products and optimize existing ones. It will also require having a macro viewpoint on growth differentials by region and customer base, acknowledging the dynamics around aging populations, the rise of the millennial consumer, and a recognition of environmental and social impact of many business models. It will also, increasingly, require a viewpoint on the trajectory of geopolitics, given increasing impacts from conflicts on the trajectories for individual companies. Geopolitical power realignment is reshaping the economy and trade flows, and introducing uncertainty that can translate to volatility. This volatility extends not only to securities markets but also to consumer and CEO confidence—and, therefore, can impact spending and capex investment strategies. Resilience is coming into greater focus.

Expanding at the Margin: A Renewed Focus on Operational Efficiency

Over the past several years, many private equity-owned companies have been able to expand their margins over time, with median EBITDA growth outstripping revenue growth in the period from 2013 to 2020.7 In 2022 and first half of 2023, this trend reversed,8 driven by inflationary pressures. With continued elevated (though moderating) inflation and labor cost pressures continuing to be in the forefront of macro-economic statistics, margin expansion is receiving increased attention.

Margin expansion can be an impactful value creation lever, and with the right approach, can become a more meaningful contributor to value creation than was the case in the past. For some GPs, a focus on margins may represent a shift in mindset from prioritizing growth to now focusing on efficiency as the cost of capital has risen.

Margin enhancement is likely to rely on optimizing processes, enhancing supply chains, and rationalizing the workforce to be prepared for technological challenges and opportunities. GPs will need to question everything—from raw material procurement to marketing budgets, to structure and focus of sales organizations—in order to understand the most efficient ways to drive growth, customer acquisition costs and unit economics. This effort will likely need more systems, processes, and technology to accurately understand costs, quantify their impact, and identify prudent ways of reducing expenses without hurting topline growth.

Traditional capex-heavy areas, such as industrials and manufacturing, will need to think more holistically about how capex investment outside of the core business may be able to drive efficiency gains. For companies in asset-light categories, such as healthcare and IT services, where there is little capex to cut, efficiency gains will need to be achieved by reducing operating expenses—which in many cases translates to SG&A. While the labor market has proven resilient in the face of rising rates and inflation, technology companies have stood out for reducing head count—a potential harbinger of the ability for AI and other technologies to allow for greater levels of operational efficiency. Successful GPs will be those that find a way to adapt, although the means may vary.

Technology: Time to Upgrade

Fortunately, today’s environment also offers tools for transformation that were not available in the last decade. Data science, AI, robotics, and automation continue to mature and accelerate. They are increasingly in a position to drive revenue growth and enhance efficiency in ways not possible before. As such, they are providing opportunities to effect large-scale business transformation while forcing a re-imagining of the characteristics of successful businesses. This may be especially valuable for businesses and industries that are already performing well but below potential. Technology can assist in evaluating marketing approaches and analyzing sales data to determine which products are resonating, enabling rapid adjustments to the product mix. Robust data analytics platforms can offer more accurate customer segmentation analyses and evaluate willingness to pay, while innovations such as digital menus are enabling more real-time price adjustments – enabling greater pricing flexibility. Artificial Intelligence is increasingly being integrated into numerous products to enhance customer service and user interfaces. Technology can help optimize processes, to enable more efficient operations. As such, management teams have a heightened focus on AI and automation as levers to grow revenues and margins. Capex in recent years has largely shifted away from tangible physical assets (especially real estate) and towards R&D, technology, and IP—a trend which Goldman Sachs Global Investment Research expects to continue.9

However, we believe technology as a standalone thesis is not sufficient to drive returns. Success is predicated on strategy and execution – implementing the right processes, structures, and frameworks to harness the technology efficiently within the organization and integrating it into the transformation initiative. Cautionary tales abound of companies that spent heavily on technology without reaping the full benefits due to organizational frictions. As more companies lean into similar technological theses, the use of technology will cease to become a key differentiator. Over time, what are now novel technologies (including AI) will become a requirement rather than a competitive advantage. GPs need to not only work to create first-mover advantage and build a defensible moat, but also form a realistic view on the ability of technology to expand or create new markets – which may vary by technology and product/service type. These efforts will require ongoing innovation and a focus on both customer acquisition and retention, in a way that leverages the company’s core competencies and strengths. Both growth and margin enhancement efforts will require management team attention and, in many cases, additional capex spend, centered on increasingly commercially viable technologies in areas including automation, data science, and AI. Funding for these initiatives has become more expensive as the cost of capital has increased. Knowing how to make effective prioritization decisions is an important part of utilizing technology wisely.

Capital Solutions for Capital Problems

A common theme is that value creation plans are likely to become more complex and costly to execute. The costs of transformation tend to be front-loaded while the benefits accrue over time. In order to continue generating compelling returns, fund managers may look to find ways to reap the benefits of transformation faster. Execution timelines may need to speed up – with more of the work done in the diligence and underwriting phase than the post-acquisition phase, requiring closer collaboration between the GP’s investment and operating teams. Demand can also grow for innovative capital structures spanning the spectrum from senior credit to preferred and traditional equity, with the mix potentially evolving over the life of the deal.

Hold periods for individual assets may need to extend in order to realize the same TVPIs as in the past. Since extended hold times dampen internal rates of return, GPs may seek out capital solutions to expedite some distributions to mitigate the impact. Growth in continuation vehicle transactions is one potential result. The use of NAV borrowing has been another recent technique to expedite distributions amidst a challenging exit environment. While expediting distributions in this manner can help amplify IRRs, LPs (Limited Partner) should be mindful that these transactions represent financial engineering, rather than true operational value-add. In evaluating managers, it behooves LPs to distinguish the sources of returns.

Why Take the Hard Road?

The challenges outlined in this article are not unique to private equity. All companies, regardless of ownership structure, will likely face higher capital costs, headwinds for multiple expansion and a more challenging operating environment. It is likely, however, that private equity is advantaged relative to public markets in effecting large-scale company transformation. Its long-term time horizon and control-oriented governance structure can facilitate making resource allocation decisions with high upfront costs but a longer-term payoff. It can allow for mid-journey pivots and adjustments as necessary, supported by additional resources that the GP can potentially deploy over time. These factors may prove a decisive advantage in weathering a challenging environment. To the extent that new value-creation skills and competencies need to be developed, private equity GPs can amortize them over a broader capital base – a portfolio of companies, rather than an individual company. While a higher cost of capital will have a larger impact on more-levered companies, the difference in leverage levels between public and private companies has decreased over time.10

So while challenges abound, we continue to believe that private equity, with the right partner, should present attractive opportunities for investor portfolios. However, dynamics of the new environment will have implications for how GPs may think about their competitive advantages and how LPs approach manager selection.

In the final article of this series, we will dig deeper into critical ingredients for GPs to succeed in the new era, and aspects for LPs to consider in identifying GPs well positioned for the years ahead.

1 See, for instance, Goldman Sachs Asset Management, “Staying the Course in Private Markets: 2023 Private Markets Diagnostic Survey.” As of September 25, 2023.

2 LCD Default Review. As of March 30, 2023.

3 Based on historical quartile information for buyout funds of vintages 2008-2018. Source: Cambridge Associates. As of 4Q 2022.

4 PitchBook 2Q 2023 Private Equity Breakdown. As of June 30, 2023.

5 Bain 2023 global M&A report. As of June 2023.

6 Bain 2023 global M&A report. As of June 2023.

7 Burgiss. As of 2Q 2023.

8 Burgiss. As of 2Q 2023.

9 Goldman Sachs Global Investment Research. US Daily: The Capex Outlook: Slowing but Still Growing. As of November 7, 2022.

10 For a more in-depth discussion, please see Murphy, Daniel, James Gelfer and Juliana Hadas, “Private Equity’s New Math - Part 1: A Brief History of Private Equity Value Creation.” As of September 28, 2023.