How Active ETFs Can Help Investors Fine-Tune Portfolio Construction

Actively managed exchange-traded funds are on the rise. In the short time since their debut in 2008, active ETFs have already topped $1 trillion in assets under management.1 This expansion has been driven by demand from investors attracted by active ETFs’ fusion of active management with the benefits of the ETF wrapper, which makes these funds a powerful portfolio-management tool.

The “active” in active ETF means these funds are managed by investment professionals with specific goals, which can include outperforming a benchmark, generating income and targeting a specific investment theme. The “ETF” tells you they offer the same advantages as all exchange-traded funds. They can be bought and sold at a known price on an exchange, just like stocks. They can be cost-effective and offer greater transparency on holdings.

This combination of attributes can make active ETFs a valuable addition to an investment portfolio. They offer investors an efficient, flexible way to gain exposure to equity and fixed income markets, including corners of these markets where structural inefficiencies make specialist research and rigorous bottom-up security selection essential, in our view. Innovative products such as derivative-income and buffer ETFs can allow investors to manage volatility while generating income.

We believe the active ETF market will continue to expand in the years ahead, and that the active component of these funds will be critical in driving market growth. The focus on delivering specific investment outcomes will intensify. This will result in a broadening range of targeted products offering access to new markets and asset classes and providing investors with increasingly sophisticated tools for portfolio construction and management.

The Rise of Active ETFs

Active ETFs grew slowly in the years following the first fund launch 17 years ago, but that changed in 2019, when the US Securities and Exchange Commission streamlined the process for bringing new ETFs to market.2 Among other changes, the so-called ETF Rule allowed for the use of custom baskets of assets. This gave managers greater flexibility to manage a fund’s underlying portfolio and liquidity, a crucial change that facilitated the development of active ETFs.

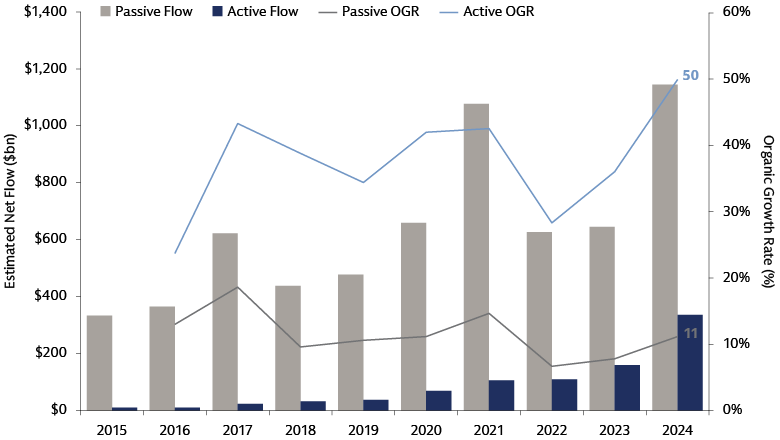

ETFs have been around for more than three decades, and during most of that time they have been associated primarily with passive investing and index-tracking funds. That is changing. Active ETFs accounted for just 7.8% of all ETF assets at the end of 2024, but they grew almost five times faster than their passive peers, fueled by a surge in global net inflows to $339 billion.3

Source: Morningstar, Goldman Sachs Asset Management. As of December 31, 2024.

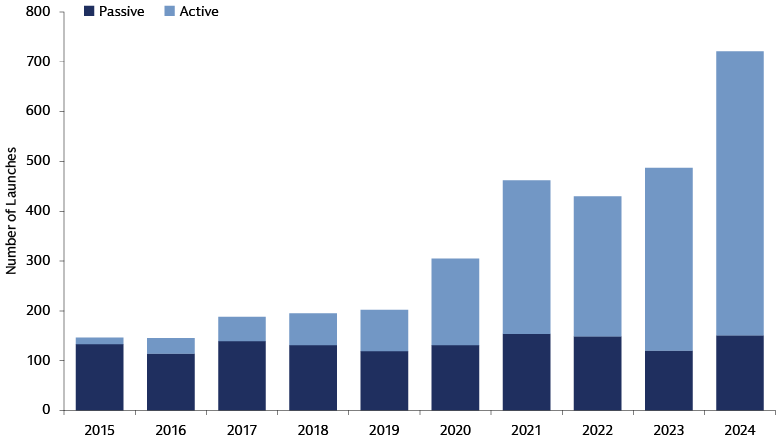

The rapid expansion of active ETFs relative to their passive counterparts is also reflected in the number of new funds launched in recent years. As the following chart shows, active ETFs have been the primary source of product growth for the past five years, and their numbers took off in 2024.

Source: Morningstar, Goldman Sachs Asset Management. As of December 31, 2024.

Within the active ETF market, one recent source of growth has been options-based products such as derivative-income and buffer funds. These funds incorporate options into their investment strategies and can offer regular income or a measure of downside protection. This has made them increasingly popular with investors looking for a hedge against market volatility. For US-domiciled funds, the derivative-income category took in more than $28 billion of net new money in 2024. Defined-outcome ETFs, which include buffer funds, had inflows of nearly $11 billion.4 The market for these funds is currently concentrated in the US, though we expect them to make inroads in other regions in the years ahead. These fund types will be examined in greater detail in subsequent sections of this article.

Enhancing Portfolio Diversity and Efficiency

For investors who are familiar with active investing through mutual funds, active ETFs deliver many of the same potential benefits, such as in-depth research and dynamic management with the goal of outperforming a benchmark. In addition, they offer the advantages of the ETF vehicle, including intraday trading, portfolio diversification and the potential for lower costs.

For investors who are familiar with ETFs as a passive strategy through index-tracking and rules-based funds, active ETFs offer access to the alpha potential, robust security selection and engagement with portfolio companies that an active manager can bring, without sacrificing the benefits of the ETF vehicle.

Thanks to this unique combination of attributes, active ETFs can provide an efficient complement to existing allocations that allows investors to diversify their portfolios. The solutions they offer may help investors who are seeking to manage market volatility and also outperform the market. Active security selection can allow investors to avoid the concentration issues facing many passive investment products that track indices whose performance is driven by a small percentage of stocks.

The ease of buying and selling an active ETF makes these products efficient tools for short-term and tactical investments. This could benefit an investor who has committed to a private equity investment, for example. While they wait for their capital to be called and deployed, the investor could put it to work through an active ETF and sell the exposure quickly when their capital is called.

Active ETFs could also be a versatile component of a model portfolio, which provides a framework for pursuing an investor’s objectives as they evolve over time. As part of a diversified asset allocation that balances risk and return, active ETFs may also be used to expand an investor’s investment options. For example, derivative-income ETFs provide the potential to generate income from equity markets that is independent of the interest-rate movements that impact yield in fixed income.

The Case for Derivative-Income ETFs

Derivative-income ETFs, also known as covered-call or buy-write strategies, are designed to generate income from a portfolio of assets with the use of options contracts. These products are gaining in popularity, with 39 US-domiciled launches in 2024 taking the total number of US funds to 105. Assets under management approached $100 billion at the end of last year.5

No two derivative-income strategies are the same, but the approach typically involves holding a diversified basket of securities (the “buy” in “buy-write”) and selling a call option against it that requires the fund to sell the securities if the price rises to a pre-defined level called the strike price (the “write”). In this way, the call option limits exposure to market gains beyond the strike price. If the price of the underlying securities declines, however, the call option would not be exercised. The fund would retain the securities as well as premium income that could offset some losses in a downturn. As a result, derivative-income strategies tend to produce higher lows and lower highs.

Many investors turn to fixed income ETFs to capture monthly income. Equity derivative-income strategies offer an alternative to fixed income, providing a source of yield that is not tied to interest rates. They can help investors increase and stabilize income generation and reduce portfolio volatility while maintaining equity market exposure. Investors in these products can choose to forgo some equity upside in exchange for enhanced income above and beyond equity dividends generated by pure equity exposures.

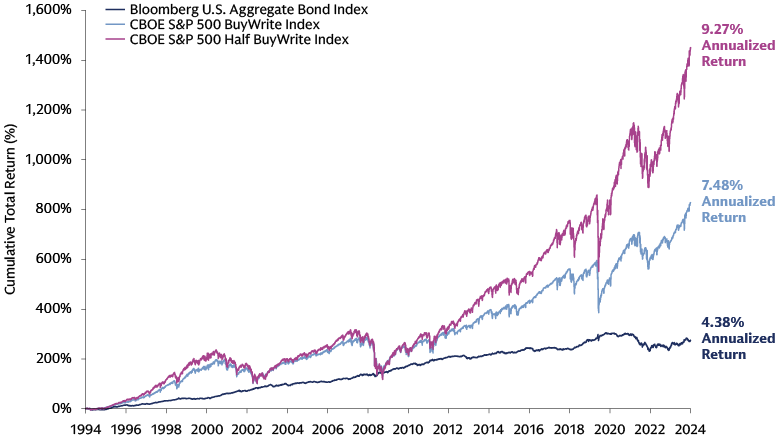

To increase a fund’s upside potential, managers can write call options on part of the portfolio (the “covered” portion), leaving the uncovered portion available to participate in further price increases. The potential benefits of this strategy can be seen in the following chart, which shows how both full and partial covered-call equity approaches have outperformed traditional fixed income in aggregate over the past three decades.6

Source: Bloomberg, Goldman Sachs Asset Management. As of December 2, 2024. See glossary for additional information on indices.

Past performance does not predict future returns and does not guarantee future results, which may vary.

The Case for Buffer ETFs

Buffer or defined-outcome ETFs also make use of options, but with a different objective than derivative-income funds. Buffer ETFs seek to deliver a pre-defined range of outcomes over a set period. To accomplish this, they provide a buffer against market losses in exchange for a cap on market gains. This strategy has grown steadily in the US with annual inflows of more than $10 billion over the past three years and 124 new funds launched in 2024, taking the total to 338. Assets under management stood at more than $48 billion at the end of last year.7

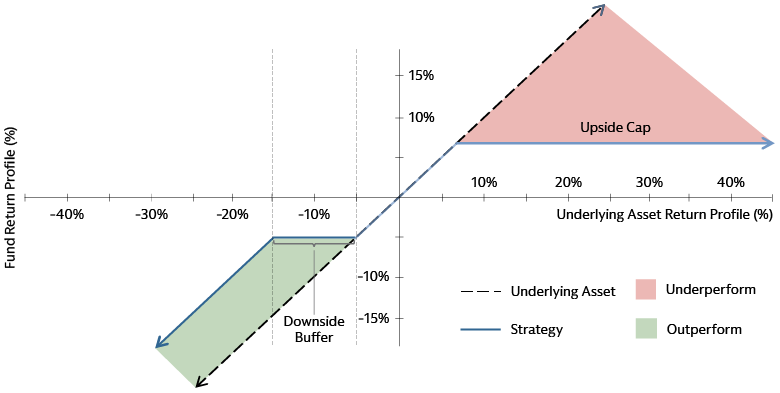

The structure of a buffer ETF typically begins with long exposure to a reference asset, often an underlying ETF, for the defined outcome period. The next step is to install the downside buffer. This is done by buying a put option at the top of the protected range, for example when the price declines by 5%. This gives the fund the right to sell the underlying asset at this predetermined price. The bottom of the protected range is set by selling a put option, for example at -15%. Between these limits, the investor is shielded from further losses. With the downside buffer in place, the fund sets an upside cap by selling a call option, which determines the maximum gain the fund can earn over the full outcome period. Selling the lower put option and the call option generates premium income that can offset the cost of buying the higher put option.

Source: Goldman Sachs Asset Management. As of February 4, 2024. For illustrative purposes only.

The cap and buffer are provided for a pre-defined term. This is typically a year, though some funds reduce this with the goal of increasing upside potential through a more dynamic, adaptive approach. Investors should be aware that defined outcomes are set at the beginning of the specific period and only apply when it ends. Trading the funds during this period could significantly affect performance.

Buffer ETFs offer a range of benefits in portfolio construction. They benefit from gains in the price of the reference asset up to a pre-set limit, while the buffer provides protection against equity market drawdowns. They also contribute to portfolio diversification during equity drawdowns, when diversification is most useful. Their unique alternative return profile can complement fixed income, particularly in those environments when stocks and bonds are highly correlated.

Industry Trends to Watch

We expect ETFs to build on a record-setting 2024, when flows, assets under management and fund launches all posted significant gains. We anticipate these trends may continue in the years ahead as ETFs become the pooled vehicle of choice for many investors thanks to their ease of trading, transparency and cost-effectiveness.

We are watching three key trends that investors should be aware of. Active ETFs have become the fastest-growing part of the industry, and we see further expansion ahead. The market is dominated by US-listed funds, though investor demand in the rest of the world is increasing.8 In Europe, assets in active ETFs rose sharply last year to $56.7 billion.9

We think solutions-oriented ETFs, such as derivative-income funds that aim to deliver consistent income and buffer funds that provide defined outcomes, are particularly well positioned for further development. We also expect to see the increased incorporation of ETFs, especially active ETFs, in model portfolios that many investors rely on to provide a road map toward their chosen investing destination.

The Importance of Active Management

Our 2025 Outlook highlighted a dynamic environment. Some macroeconomic imbalances have receded, but new uncertainties have arisen around inflation, growth and international trade. In our view, this environment provides reasons for investors to recalibrate their portfolios, and an active investment approach, diversification and sound risk management will be essential. The rise of active ETFs offers investors a flexible and efficient tool to diversify their portfolios and prepare them to take advantage of the potential opportunities that lie ahead.

1 Global assets under management in active ETFs rose to $1.075 trillion at end-2024 from $669 billion a year earlier. See “Global ETF Flows 2025,” Morningstar. Data as of December 31, 2024.

2 “SEC Adopts New Rule to Modernize Regulation of Exchange-Traded Funds,” SEC press release. As of September 26, 2019.

3 “Global ETF Flows 2025,” Morningstar. Data as of December 31, 2024.

4 Simfund, Strategic Insights and Morningstar. Data as of December 31, 2024. Excludes funds of funds.

5 Simfund, Strategic Insights and Morningstar. Assets under management stood at $97.4 billion as of December 31, 2024. Excludes funds of funds.

6 Bloomberg, Goldman Sachs Asset Management. As of December 2, 2024.

7 Simfund, Strategic Insights and Morningstar. Assets under management stood at $48.4 billion as of December 31, 2024. Excludes funds of funds.

8 “Global ETF Flows 2025,” Morningstar. Data as of December 31, 2024.

9 European ETF & ETC Asset Flows: Q4 2024,” Morningstar Manager Research. Data as of December 31, 2024. The USD figure given here is a conversion of EUR 54.4 billion in the Morningstar report as of December 31, 2024.