Income Generation: Seeking Steady Streams in Unstable Times

When uncertainty is high, we believe it’s important to find ways to build resilience and return consistency into portfolios. Steady streams of income can help investors achieve balance through turbulent market cycles. Once captured, income can be reinvested in the next new opportunity, making income a powerful form of diversification in its own right. We believe the appeal of stable income is heightened in an uncertain world where macroeconomic and policy uncertainty could drive dispersion and market volatility. Rather than simply “chasing yield” or attempting to time the market, we believe nuanced and nimble strategies that capture diversified public market income may help deliver positive outcomes.

Capturing Income in Fixed Income

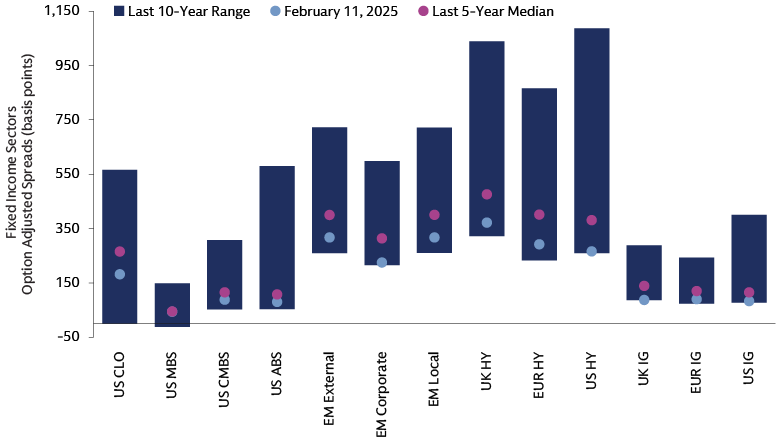

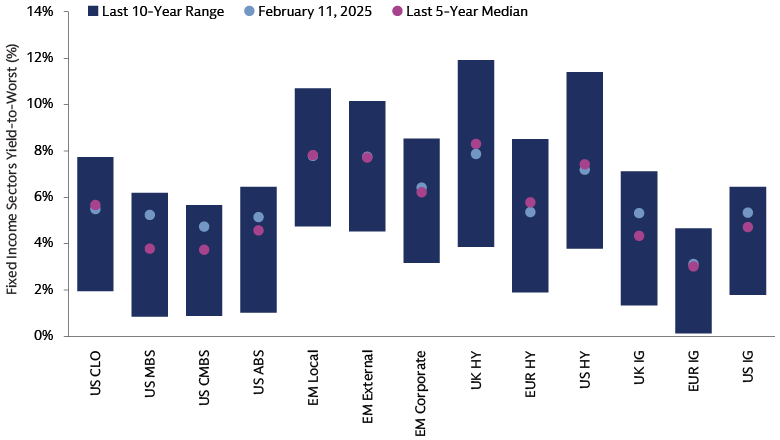

Income is a key strategic advantage of incorporating bonds into investment portfolios, alongside diversification and stability. These attributes stand out during periods of market volatility driven by equity market declines, such as sharp corrections in US AI-related names in January, or growth-driven bearish episodes like August 2024. Corporate and securitized credit continue to offer attractive income potential underpinned by strong credit fundamentals. We believe active security selection will be key to income generation as an uncertain year unfolds.

Corporate Credit

High yields offer historically attractive income potential across corporate credit, but tight spreads are the elephant in the room. The narrow levels of extra yield received for lending to corporates over government bonds suggests investors should be selective. However, today’s tight spread environment also reflects healthy credit fundamentals. A broad-based, sustained spread widening would require a significant shift in credit fundamentals or a sudden, sharp economic downturn, which our analysis suggests is unlikely in the near-term. Given most of the income from corporate bonds today comes from high interest rates rather than credit spreads, this may help mitigate downside risks that arise from market equity market volatility or a deterioration in economic growth.

Source: Macrobond, Goldman Sachs Asset Management. As of February 11, 2025. The returns are based on the respective indices and does not represent performance of any Goldman Sachs product. It is not possible to invest in unmanaged indices. Past performance does not predict future returns and does not guarantee future results, which may vary.

Source: Macrobond, Goldman Sachs Asset Management. As of February 11, 2025. The returns are based on the respective indices and does not represent performance of any Goldman Sachs product. It is not possible to invest in unmanaged indices. Past performance does not predict future returns and does not guarantee future results, which may vary.

Risk appetite remains firm for investment grade (IG) credit, particularly for US dollar IG bonds, evidenced by low new issue concessions, near-record low spreads, strong mutual fund inflows, and continued net foreign demand.1 We find that IG corporate fundamentals remain healthy in aggregate with key credit metrics such as leverage, debt servicing capacity, profitability, and liquidity positions generally robust. Even so, we believe it remains crucial to separate companies that are financially sound or on an improving trajectory versus those on a weakening path via bottom-up security selection.

The potential for a more relaxed US regulatory environment under Trump 2.0 may increase debt-funded M&A activity, potentially challenging corporate issuers' financial standing. However, M&A can also be financed with equity or cash. It can also lead to long-term improvements in operating performance and credit fundamentals. We favor earning income on BBB-rated industrial IG credit bonds in sectors like consumer non-cyclical, capital goods, and technology, where management teams seek to maintain IG ratings and improving balance sheet health.

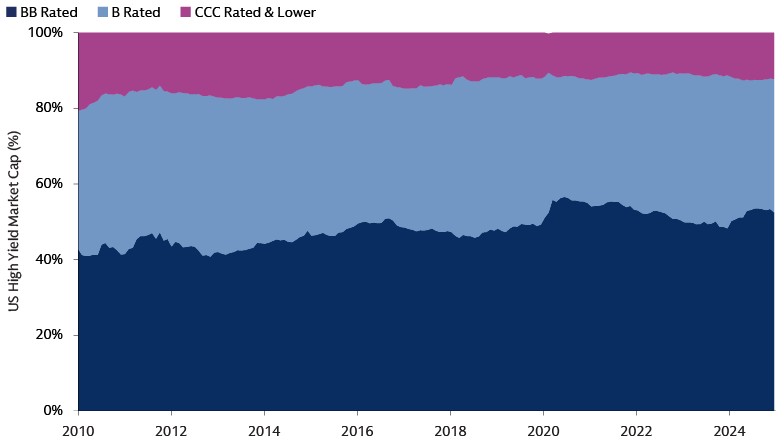

Like IG credit, leveraged credit spreads are tight, especially US high yield (HY). Some investors may consider compressed spreads a potential reason to avoid the asset class. We disagree. In our view, lower-than-average spreads, in isolation, are not necessarily a danger sign and should be analyzed in the context of the overall market including absolute yield levels, credit fundamentals and underwriting trends. Encouragingly, we see limited evidence of a decline in underwriting standards. Reflecting improved credit quality, the share of BB-rated debt, the highest high yield rating cohort, has increased from 35% in 2013 to 50% today.2

Source: Macrobond, ICE BofA US High Yield Constrained Index Market Capitalization. As of January 2025.

While recent headlines have highlighted a rise in corporate bankruptcies, we believe the reality is more reassuring. The recent uptick in bankruptcies reflects a return to normal levels rather than a concerning trend, as the annual rate remains below the 2015-2019 average.3 Our analysis suggests that default rates in the high yield and leveraged loan markets will remain contained in 2025. For context, our team estimated US defaults at 1% in 2024, close to the realized 1.3% rate versus industry estimates exceeding 3%.4 In our view, this demonstrates the value of bottom-up company analysis.

Securitized Credit

Securitized credit comes in a variety of forms, typically with relatively low correlations and higher yields than similarly-rated corporate bonds.5 Two categories we favor are collateralized loan obligations (CLOs)—which often comprise a diversified pool of non-investment grade, senior-secured corporate loans—and commercial mortgage-backed securities (CMBS) backed by commercial real estate (CRE).

During the global financial crisis (GFC), securitized defaults were mainly in subprime residential mortgages and complex structured products. Securitization structures are now simpler and more transparent, with tighter lending standards. However, the asset class still demands thorough due diligence and expertise. We believe identifying dislocations and leveraging structural inefficiencies are crucial for helping to capture income and manage risk. In our view, this also requires a disciplined investment process, and deep analysis of collateral pools and deal structures.

We see attractive income potential in high-quality CLOs. The floating rate nature of CLOs means that today's elevated base rates provide attractive income levels. At each rating level, CLOs have historically offered higher yields than similarly-rated corporate bonds and loans. A key feature of CLOs is that the collateral is managed by a CLO manager. In a world where credit selection is crucial, we favor managers who effectively manage their collateral pools and actively seek managers with minimal overlap of collateral to ensure diversification across exposures.

Source: Goldman Sachs Global Investment Research The Structured Credit Trader as of February 20, 2025. J.P.Morgan US CLOIE AAA Index as of February 27, 2025. S&P 500 Default, Transition, and Recovery: 2023 Annual Global Leveraged Loan CLO Default And Rating Transition Study, as of June 2024. Past performance does not predict future returns and does not guarantee future results, which may vary.

The office CRE sector has faced challenges in recent years from higher interest rates and remote and hybrid work trends. However, we believe not all CRE is equal. The asset class can offer diversified exposure to a range of underlying CRE with steady cash flows. Many CMBS deals also have credit enhancement features like subordination and overcollateralization, and reserve accounts. We believe active investors are best placed to capitalize on potential opportunities, including in some office-related CMBS, where many pre-COVID leases are set to expire, potentially providing clarity around supply-demand balance.

We are monitoring the new US administration's potential impact on securitized sectors. Pro-growth policies combined with lower rates and a steadier supply-demand balance could improve the prospects for office CRE, while looser regulations could boost M&A and leveraged buy-out (LBO) activity, leading to a potentially strong year for leveraged loans and new CLO supply.

Equity Income Essentials

Dividends to Drive Returns?

Expensive valuations are not limited to tight corporate bond spreads. The US equity market has seen an extraordinary rise in value since the GFC, more recently driven by large capitalization technology stocks. This has taken the US country weight in the MSCI World Index up to 74% compared to 53% in 2000.6 The expansion of price-to-earnings ratios means the broad US equity market is still trading at close to record valuations, even when excluding the major tech companies.7

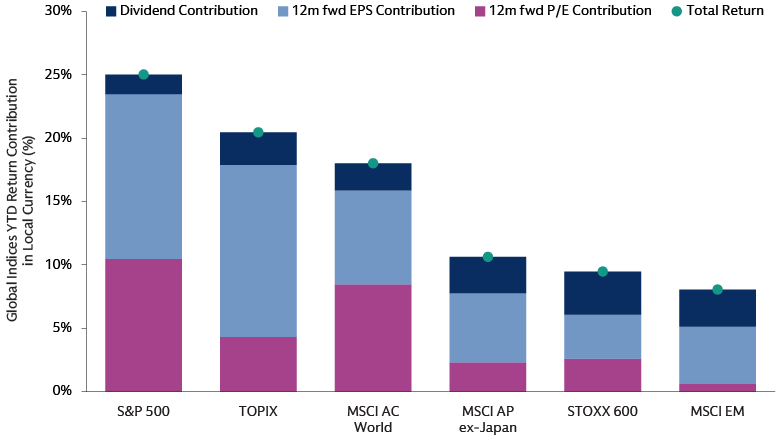

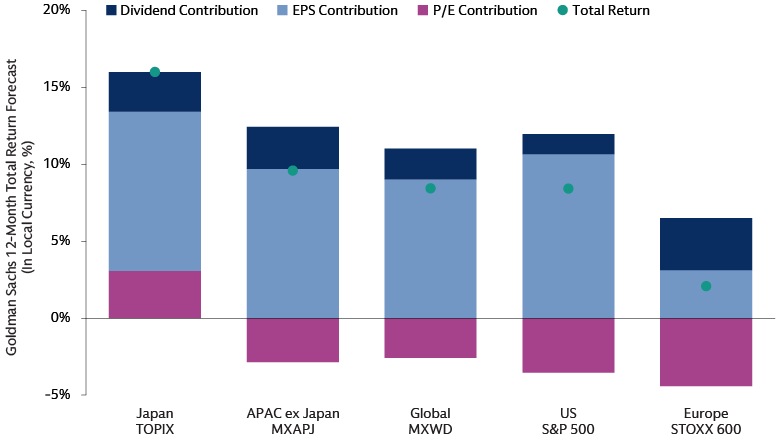

While valuation expansion drove most equity returns globally in 2024, estimates suggest that earnings and dividends will become greater drivers of index returns in 2025.8 We expect the return structure of the stock market to broaden beyond the largest US mega cap names. Given high concentration in the US with the Magnificent 7 and disruption in tech driven by AI, we believe that diversifying into other regions and sectors may provide potential opportunities for active investors. A focus on companies with strong fundamentals and financially sustainable dividend yields may help to manage against large market corrections. Such sectors as financials, utilities and consumer staples are historically less cyclical than US growth stocks and tend to provide a steady income stream through dividends, enhancing overall portfolio resilience.

Companies in international markets, specifically in Europe and Japan, have historically exhibited stronger commitment to paying dividends to shareholders. The MSCI EAFE (Europe, Australasia, Far East) Index has seen dividends account for 70% of its cumulative total returns in the last 20 years. We believe the emerging market universe also offers compelling income opportunities. Post-GFC, more EM companies have been paying dividends than their developed market peers and over 50% of stocks in emerging markets pay a dividend yield of more than 3%.9 We believe an active approach can help to identify companies that demonstrate dividend growth and yield sustainability.

Source: Goldman Sachs Global Investment Research Global indices in 2024 return contribution in local currency. As of December 18, 2024. For illustrative purposes only. It is not possible to invest in unmanaged indices. Past performance does not predict future returns and does not guarantee future results, which may vary.

Source: Goldman Sachs Global Investment Research.12-month total return forecast in local currency. As of December 18, 2024. For illustrative purposes only. It is not possible to invest in unmanaged indices. Past performance does not predict future returns and does not guarantee future results, which may vary.

Historically, dividend paying stocks have outperformed in periods of lower growth and persistent inflation. In these environments, strategies that target companies with higher potential for dividend growth tend to outperform those that target the absolute highest dividend payers in the universe. We believe active management can help avoid disrupted, highly levered, high-dividend payers, in favor of quality companies with strong fundamentals and financially sustainable dividend yields and stocks showing potential for capital appreciation as well.

Buyback Bonanza?

In addition to dividends, share buybacks are growing outside the US as a source of shareholder returns. Historically, buybacks in Europe have tended to be small and infrequent, especially when compared with the US.10 However, buybacks have increased and buyback yield has become a greater component of total European stock returns. Companies in the STOXX Europe 600 Index announced share buyback programmes of around €290 billion last year11—making 2024 the third-highest buyback volume year ever. Buybacks generated a 1.9% yield for the STOXX 600 and contributed to 40% of the total shareholder yield. Energy, financials and consumer discretionary companies were the main actors on the buyback scene, although the buyback phenomenon is not concentrated exclusively in value sectors. We believe increased capital returns reflect robust corporate fundamentals.

Share buybacks also appear to help manage downside stock market pressure: companies with high buyback volumes have generally experienced smaller drawdowns.We expect strong buyback activity to continue in 2025 and deliver alpha for investors against a subdued European macro backdrop and uncertainty around trade policies of the Trump administration in the US.

Diversifying Your Income Streams

We see potential opportunities to complement traditional income generation across stock and bond markets through dynamic active fixed income approaches and equity buy-write strategies.

Dynamic Fixed Income

We believe unconstrained or dynamic bond strategies allow for flexibility to invest across a wide range of fixed income securities without being tied to a specific benchmark. In our view, this approach can help pinpoint the most compelling risk-adjusted returns across fixed income spread sectors, including IG and HY credit, as well as emerging market debt and securitized credit. We believe geopolitical uncertainty as well as structural shifts, such as digitization and decarbonization, combined with the potential for a new post-election policy paradigm, provide additional reasons to dynamically adjust sector, rating, and duration allocations. We favor agile strategies with seamless sector, geographical, and issuer rotation in response to market opportunities, underpinned by fundamental and quantitative research.

Considering All Options

To potentially capture additional income and manage downside risk in 2025, we see ways to combine core equity index exposure (i.e., S&P 500, Nasdaq) with actively managed options. Buy-write ETFs, also known as covered-call funds, are designed for this purpose and seek to provide a more defensive, muted-volatility return profile versus long-only exposures. In other words, by allocating to buy-writes, investors choose to forego some equity upside in exchange for lower volatility and income above and beyond equity dividends. This approach may help to deliver diversified sources of income to maximize upside potential while preserving capital appreciation over the long run.

A Year for Income

In a volatile market environment, we believe capturing steady income streams from stocks and bonds is crucial for maintaining portfolio stability. Active security selection and dynamic investment approaches may help investors find opportunities in corporate and securitized credit, which offer diversification and attractive income potential. Additionally, focusing on stocks with sustainable dividend and buyback profiles can enhance return stability and provide downside risk management. Diversifying income sources through dynamic fixed income strategies and equity buy-write approaches could further optimize risk-adjusted returns. Ultimately, a well-rounded income strategy may help investors navigate market uncertainties while paying dividends over the long run.

1 Goldman Sachs Global Investment Research. As of January 23, 2025

2 JP Morgan. As of December 1, 2024.

3 Macrobond, Goldman Sachs Asset Management. Based on Total Bankruptcy Filings reported by The American Bankruptcy Institute. Latest data released as of January 3, 2025.

4 Goldman Sachs Asset Management. As of December 31, 2024. Released default rate source: J.P.Morgan. As of November 2024.

5 Goldman Sachs Asset Management, Credit Suisse, JP Morgan, Bloomberg, CRTx. Data as of December 31, 2024.

6 MSCI. As of December 31, 2024.

7 Goldman Sachs Global Investment Research. As of November 18. 2024.

8 Goldman Sachs Global Investment Research. As of December 18, 2025.

9 Goldman Sachs Asset Management, MSCI. Five-year cumulative returns for MSCI EM Index as of April 2024. Past performance does not predict future returns and does not guarantee future results, which may vary.

10 Goldman Sachs Global Investment Research. As of April 23, 2024.

11 Barclays Buyback Monitor. As of January 9, 2025.